CBIC has amended the Central Goods & Services Tax Rules, 2017, in the exercise of the powers conferred by section 164 of the CGST Act, 2017[1]. The Central Government taking recommendations with the Council makes the Central Goods and Services Tax (Tenth Amendment) Rules. The amendment is regarding Aadhaar authentication for GST registration. This has come into force on the date of their publication in the Official Gazette.

Read our article:How to apply for GST registration certificate online?

Highlights of the Amendment

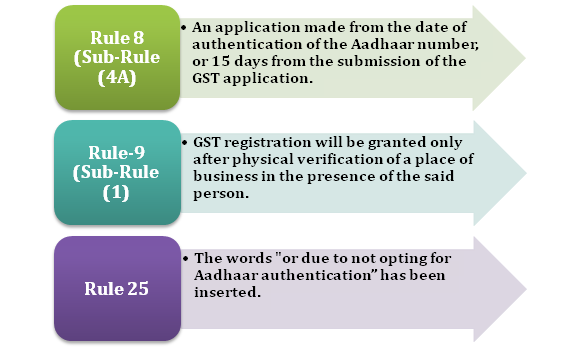

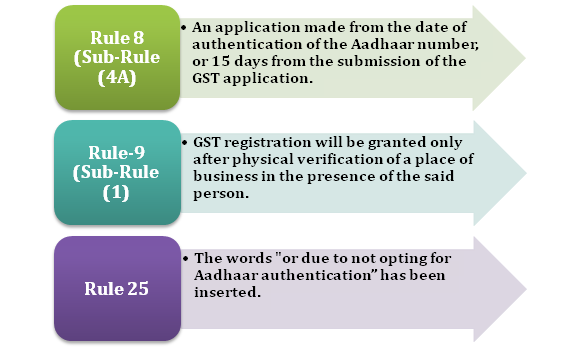

In CGST Rules, 2017, under rule 8, the sub-rule (4A), has been substituted with effect from 01st April 2020, is as follows: –

Rule-8 (Sub-Rule 4A)

Where an applicant, other than a person notified under sub-section (6D) of section 25, submits an application under sub-rule (4) have to opt for an Aadhaar authentication. It has came with effect from 21st August 2020, as now he has to undergo authentication of Aadhaar number. In these cases the date of submission of an application will be from date of authentication of the Aadhaar number, or 15 days from the submission of the application in Part B of FORM GST REG-01 under sub-rule (4), whichever is earlier.

In CGST Rules 2017, under rule 9, the following is substituted with effect from 21st August 2020. Those are as follows:-

Rule-9 (Sub-Rule (1)

The following proviso has been substitute :-

If a person fails to undergo Aadhar authentication of Aadhaar number as specified in sub-rule (4A) of rule 8 or does not opt for authentication of Aadhaar number, then registration will be granted only after physical verification of a place of business in the presence of the said person. It will be in the same manner provided under rule 25.

Provided further that the proper officer may record the reasons in writing and with approval of the officer not below the rank of Joint Commissioner, carry out the physical verification of the business’s place, and such documents as he may deem fit.

Rule-9 (Sub-Rule (2)

Before the Explanation, the following proviso has been inserted: –

Provided that when a person, fails to undergo Aadhaar authentication number as mentioned under sub-rule (4A) of rule 8 or does not opt for authentication of Aadhaar number, the notice can be issued in FORM GST REG-03 within 21 days from the date of submission of the application.

Rule-9 (Sub-Rule (4)

For the word “shall,” the word “may” has been substituted.

Rule-9 (Sub-Rule (5)

The following sub-rule has been substituted, if the proper officer fails to take any action:-

- Within a period of 3 working days from the date of submission of the application in cases where a person successfully undergoes authentication of Aadhaar number or is notified under subsection (6D) of section 25

- Within the prescribed time period under the proviso to sub-rule (2), in cases where a person, fails to undergo authentication of Aadhaar number as specified in sub-rule (4A) of rule 8 other than a person notified under subsection (6D) of section 25.

- Within the period of 21 days from the date of submission of the application in cases where a person does not opt for authentication of Aadhaar number

- Within the period of 7 working days from the date of the receipt of the clarification, information, or documents furnished by the applicant under sub-rule (2), the application for grant of registration shall be deemed to have been approved.

In CGST Rules, 2017, under rule 25, with effect from 21st August 2020, after the words “failure of Aadhaar authentication,” the words “or due to not opting for Aadhaar authentication” has been inserted.

Conclusion

CBIC notifies provision for Aadhar Authentication in GST Registration and physical verification of the place of business before GST Registration.

Read our article:CBIC directs to clear pending GST registration under special drive