The Central Government in exercise of its powers conferred by Section 1, sub-section (2) of the Finance Act, 2019, hereby declares that on 1st day of September 2020, the provisions of section 100 of the Finance Act, 2019 shall come into force. Section 100 of a Finance Act, 2019 have inserted the proviso to Section 50 of the GST Act to clarify the fact that Interest levied on Net Tax Liability for the delayed GST payment from Sep 1, 2020.

Finance Act, 2019 contains the following in section 100

Section 100 of the Finance Act, 2019, has been notified on Aug 25, 2020, vide Notification no. 63/2020-Central Tax amendment. In section 50 of the CGST Act, in sub-section (1), the following proviso will be inserted:-

- It has been provided that the interest on tax payable in respect of supplies made during a tax period and declared in return for the said period furnished after the due date in accordance with the provisions of section 39.

- The exception is where such return is furnished after the commencement of any proceedings under section 73 or section 74 in respect of the said period. It will be levied on that portion of the tax paid by debiting the electronic cash ledger.

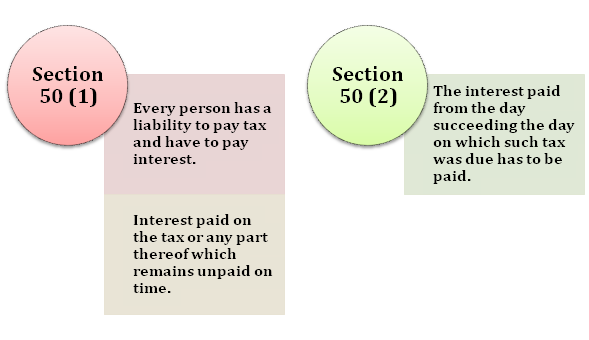

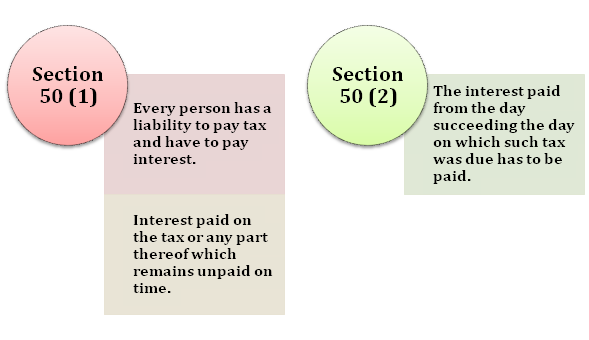

Sections 50 (1) and 50 (2) of the CGST Act, 2017

The description of Sections 50 (1) and 50 (2) of the CGST Act, 2017 were inserted as below:-

- Section-50 (1) – Every person has a liability to pay tax in accordance with the provisions of the Act or the rules made there-under. However, if he fails to pay the tax or any part thereof to the Government within the period prescribed, must have to pay interest tax or any part thereof which remains unpaid. The interest at such a rate must not exceed 18% as may be notified by the Government on a Council’s recommendations.

- Section-50 (2) The interest under sub-section (1) must be calculated in such manner as may be prescribed, from the day succeeding the day on which such tax was due has to be paid.

Interpretation of section 50 (1) of the CGST Act, 2017

The interpretations of the aforesaid section 50 (1) views that it does not specify an amount on which interest is to be levied. Hence, it has been opined that the section does not specify the principal amount. It is not a substantial provision.

Under this sub-section, it has been also interpreted that the interest is leviable on the GST’s gross amount. Some people have opined that section 50 (1) cannot be made effective until the ‘manner of calculation,’ as mentioned in section 50 (2), as prescribed.

The interest is compensatory in nature, and it can only be levied on the actual unpaid amount. Till Dec 22, 2018, common people were of the view that interest under Goods and services tax. Even if chargeable, it will be charged on the net amount cash liability.

Read our article:Get Your New GST Registration in Just One Step

Issue Observed by a Law Committee

The issue was deliberated and observed by a Law Committee in its meeting held on Dec 15, 2018. The Committee has been observed that the proposal to charge interest has applied only on the taxpayer’s net liability. Moreover, only after taking into account the admissible credit, it can be accepted in principle. Accordingly, an interest would be charged on the delayed payment of the amount payable by an electronic cash ledger.

However, where invoices and debit notes have been uploaded in the earlier statements, hereby the interest will be calculated on the amount of tax pre-arranged on the taxable value calculated from the date on which the tax on such invoices was due.

After 31st meeting of a GST Council, it was published on Dec 22, 2018, that a council has principally approved an amendment to section 50 of CGST Act. The observation of the Interest levied on Net Tax Liability of the taxpayer, after taking into account the admissible input tax credit. Also, the interest would be leviable only on the amount payable through the electronic cash ledger.

Amendment by Hon’ble GST Councils Recommendation

The Hon’ble GST Councils recommendation was regarding the suggested amendment’s prospective or retrospective effect in section 50 (1). The amendment, as produced in the bill, was also silent on its retrospective effect. Once the bill was passed, it has been notified after more than 12 months from the date of assent of India’s president.

39th Meeting of the GST Council

The 39th GST Council meeting declared that interest in delayed GST payments would be applicable only to net cash tax liability after deducting the available input tax credits. The interest on the delayed GST payment will no longer be charged based on gross tax liability, but it will charge on net-tax liability.

Conclusion

The council has approved to amend section 50 of the CGST Act[1] to provide that interest levied on net tax liability of the taxpayer, after taking into account the admissible input tax credit that means the interest would be leviable only on the amount payable through the electronic cash ledger.

Read our article:How To Obtain GST Registration in India?