All the taxpayers in India compulsory required PAN (Permanent Account Number). The companies incorporated in India or abroad mandatorily required PAN for establishing a business. The companies that have Indian origin but they are generating income outside the country also require to have PAN for several purposes in the country. The PAN is quoted during all the financial transactions of the company as well as in the invoices and other registrations. Hence, it mandatorily required to Apply for pan card for company.

Detailed Process to Apply PAN for Company

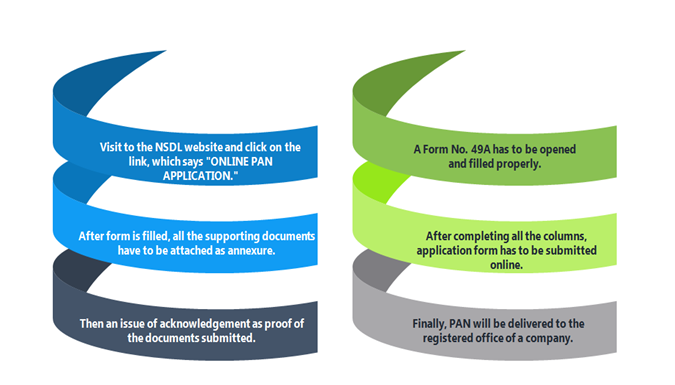

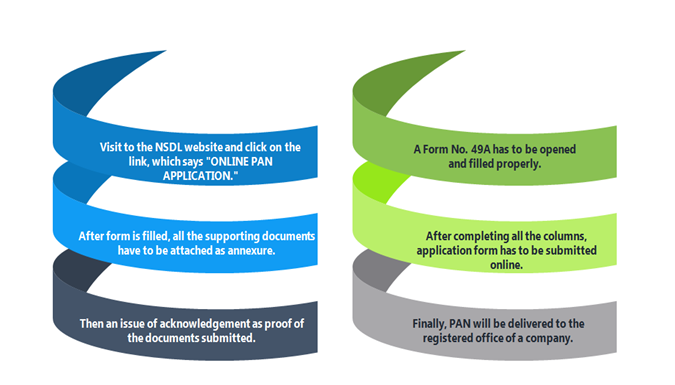

One can apply for PAN card for company as it can be easily obtained. To apply for the fresh PAN card for all the companies incorporated in India must be required to fill to Form 49-A.

- Step 1: Visit the section of Paperless PAN application on the NSDL website portal.

- Step 2: Select the Form 49A or 49AA from an ‘Application Type’ from the dropdown menu. Then select ‘category’ as ‘Company’ from the next dropdown menu.

- Step 3: Fill all the mandatory information such as name and details of the company (in the ‘Last Name’), company’s incorporation date, and registered email address of the company and the registered contact details and number. When all the information is filled, then enter the captcha code and further proceed. After that the token number will be generated, and the same will be sent on the company’s email address.

- Step 4: When the PAN application is applied for the company, the e-sign facility and the e-KYC facility is not available. The company’s name, the email address of a company and the contact number will be re-filled. One requires completing all the rest formalities, filling the registration number of a company. Then submit to proceed.

- Step 5: Here one must require mentioning all details regarding the source of income of a company. Select the options such as Income from Business or Profession from the menu. It is required to select a type of business. If there is a source of income is from Capital gains or house property or any other source, then all details must be mentioned.

- Step 6: Next, an applicant required to provide all details about a company’s registered office address which will be considered as the communication address of a company in the PAN database.

- Step 7: It is an important step where one is required to provide an Assessing Officer (AO) code which is designated according to the jurisdiction area of a company’s location. One can click on the option ‘Indian citizen’ and then select the particular ‘State’ and the ‘City’. There is an option to go on the NSDL website and select the ‘AO Code Search for PAN’ page.

- Step 8: Now, one can proceed to a documentation page.

- Step 9: In case of Companies, a Certificate of Registration is issued by the Registrar of Companies which can be used both in the form of identity proof and address proof.

- Step 10: The declaration required to be signed where an applicant will be asked about his relationship with a company. Either a Director or an Authorized signatory can apply for the Company’s PAN Card. After submitting the declaration, after then upload the scanned copies of the necessary documents.

- Step 11: Once the form is completed, the form will be applicable for review. Once an applicant reviewed all information mentioned is correct, he can proceed to submit the form.

- Step 12: Along with a form submission, an applicant is required to pay the fee of Rs 110 in case communication address is within India. Whereas a communication address is outside India, then Rs 1,020 is required to be paid. The payment can be made by Credit Card, Debit Card, Demand Draft, or by Net Banking. Only the director of a company can make the online payment Credit/Debit Card or by Net Banking.

- Step 13: An acknowledgement receipt shall be generated on successful payment of the fee. An acknowledgement number mentioned on the receipt can be used by an applicant to check the status of the PAN application of a company. A duly signed acknowledgement must be sent to the NSDL office, along with a copy of the registration certificate and a demand draft (if any).

Read our article:What is the Documents Required For Private Company Registration?

Briefly shown How to Apply for Pan Card for Company

Why do companies require applying for PAN card?

A PAN is beneficial for a company in many ways, such as –

- PAN is a company’s tax identity.

- PAN is used by an Income Tax Department to track all the financial transactions. Even if one does not fall in the tax bracket, then also it is required to possess PAN.

- If companies which are generating income do not have PAN, then it is considered as withholding of information from a government.

- PAN will primarily help the company in filing Income Tax Returns and in getting different types of remittance and invoices paid on time. PAN also serves as a reference number to track the financial transactions for an Income Tax Department. One shall require quoting the PAN number on all the transactions and also the number required on income tax document.

- In case if the company is not eligible to pay taxes, then also it is mandatory to have PAN.

- The Companies, whether registered in India or abroad, are required to pay tax to carried out businesses in the country. Without a PAN, the government can deduct a tax at the highest possible rate.

- Just as individuals, companies are also required to provide their (TRN) Tax Registration Number to whoever is paying them. The TRN can be obtained only when a company has the PAN number[1].

- In the case of foreign companies, it has been made mandatory under Section 206AA, as amended in 2009 in the Finance Act. According to this amendment, all foreign parties that provide or generate a payment to the counterpart in India must have to give their PAN. It includes individuals and also incorporations, companies, limited companies or any other form of entities.

- In an absence of PAN, the government will charge withholding tax which can be at the rate of more than 30% of the total invoiced payment.

Documents Required while applying for PAN Card for Company

- The copy issued by a Registrar of Companies of a Certificate of Incorporation for a Company is required.

- If a company does not have its office in India, then the Certificate of Incorporation required issued by the government, where the registered office of the company is situated. It shall be apostle by a resident country, or by the Indian Embassy or by the High Commission or the Consulate of a country where a registered office of the company is situated.

- The Address proof of the registered office of the company is required.

- A Bank draft for payment of the required Fees is to be given along with the application.

Conclusion

The PAN has been made mandatory by the government for all entities that are generating income in the country. It is important to apply for Pan card for company, an individual business, a partnership firm a trust, or a Hindu Undivided Family. Our team at Corpbiz not only helps in Company Registration but also help in obtaining fresh PAN card on behalf of the established company.

Read our article:Step By Step Process of One Person Company Registration