Having a registered office, which serves as the company’s proof of address, is one of the essential conditions for creating a business. Before opening a business in a rented space, it is typical for start-ups to have a registered office at the promoter’s home. Due to shifting business locations based on demand and cash outflow, enables the organisation to maintain the same address. As a result, the actual location of the firm is distinct from the registered office address because this is where all business operations are carried out. Similar to books of accounts, books of accounts are kept somewhere other than the registered office for various reasons. In this article, the author has discussed Form AOC-5 and how it relates to a company’s books of accounts.

What Do We Mean By Books Of Accounts?

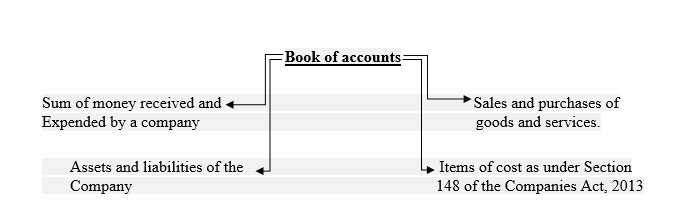

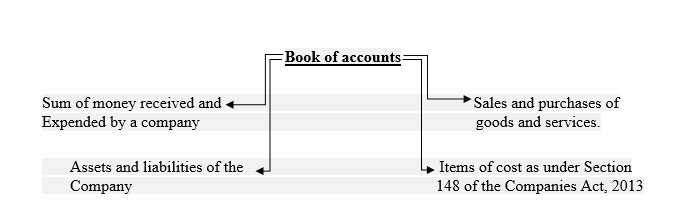

According to Section 2(13) of the Companies Act of 2013, “Books of Accounts” refers to records kept regarding:

What Are The Essentials Of AOC-5?

The following details or papers must be included with Form AOC-5 in order for it to be appropriately filed. The following information is needed for Form AOC-5:

- The company’s Corporate Identification Number (CIN).

- The date on which the BODs or Board of Directors made its decision regarding the location where the books of account are to be kept.

- The new address where the accounting records must be kept.

- Details or specifics about the police station that has jurisdiction over the location where the accounting records must be kept.

- The Registrar of Companies would approve Form AOC-5 because it is on the Non-STP Mode.

- The Company’s Director, Manager, CEO, CFO, and Company Secretary must digitally sign Form AOC-5.

- No professional qualification is needed for Form AOC-5.

Laws Pertaining To Maintaining Books of Accounts

Following are the laws pertaining to maintaining books of accounts:

- Section 128 of the Companies Act of 2013

Every company will establish and maintain “books of account” for its registered office, as well as any additional related books and papers, such as a financial statement for each fiscal year that provides a correct view of the cases of the company as well as any branch office(s) that may exist. The registered office and its branches will elaborate on the transactions made, and these books will be maintained on an accrual basis as per the double-entry system of accounting.

All or any of the former books of account and additional related papers may be kept at another other place since the board of directors may decide where the decision would be made, so within a period of seven (7) days, the company will provide the registrar with a written notice identifying the location of the other place:

The corporation may maintain these account books or any additional related documents electronically using the way that may be determined.

In accordance with Section 128 of the 2013 Companies Act and the 2014 Companies (Accounts) Regulations, as modified from time to time:

- A firm must only maintain its financial statements, pertinent books and documents, and accounting records at its registered office.

- Books must be kept using the double entry method of accounting and accrual basis.

- Both hard copy and electronic formats are available.

- In the event of electronic records, the company must annually submit a financial statement together with information about the service provider, including name, IP address, location, and address.

- The Board of Directors may also elect to keep any or all of these accounting documents elsewhere in India. However, in this situation, e-Form AOC-5 must be submitted within seven (7) days of the Board resolution being passed, indicating the entire address of the location.

- Books can only be held at the branch office for branches (in or outside of India) if summarised returns are forwarded to the registered office on a regular basis (Every quarter in case of Foreign Branches based outside India)

- Books and vouchers must be retained in good condition for the eight years immediately prior to the applicable year.

- Rule – 2A, Companies (Accounts) Rules of 2014

The notice for the address at which the books of account may be maintained will be in Form AOC-5, in order to achieve the purpose of the first proviso to sub-section (I) of section 128.

- Section 2(13) of the Companies Act of 2013

- The “Books of Accounts” consists of records that are kept about all sums of money that the company has received and spent, as well as the instances that the payments and expenditures relate to.

- All transactions, purchases of products and services made through the business.

- Assets and liabilities of corporations.

- The price of the item as it may be specified under Section 148 in the case of a company that belongs to any of the types of firms listed therein.

Penalty for Non-Compliance of Section 128 Companies Act

When a company’s managing director, whole-time director, chief financial officer, or other responsible person violates a section’s provisions, they face the following penalties from the board:

- A term that may last up to one year;

- A fine that must not be less than 50,000 rupees but might reach 5,000,00,000 rupees;

- Or both

That is one of those provisions that many businesses may wind up breaking without even realising it. Thus, the Company shall immediately take any of the following actions if its Books of Accounts are not at its registered office:

Recent development

The Companies (Accounts) Amendment Rules, 2023 have been changed by the MCA as of January 23, 2023, making it necessary to submit Form AOC-5 electronically along with evidence of address, copies of utility bills, and a photo of the registered office showing at least one director (Notice of address at which books of account are to be Maintained)

The Companies (Accounts) Amendment Rules of 2023 have been made public by the MCA[1]. The E-Form AOC-5 (Notice of Address at Which Books of Account Are to Be Kept) has been changed in accordance with the updated standards. It is now required to include Form AOC-5 with evidence of address, copies of the utility bill, and a picture of the registered office with at least one director in it. Before, simply the board resolution was necessary to attach. The new rules will take effect on January 23, 2023.

Conclusion

As a result of our discussion of all the issues surrounding Form AOC-5, it is clear that every firm is obligated to keep its books of accounts and other paperwork at its registered office. If the board decides, these documents can only be maintained in the registered office. In this case, the registrar of companies is informed of the address using the Form AOC-5.

Every company is required to keep books of account and any other papers at the company’s registered office under the provisions of the Companies Act of 2013. But, if the board decides, these documents may be held anywhere other than the registered office. The Form AOC-5 is used in this circumstance to inform the Registrar of Companies (ROC) of the address (other than the register office) where the company’s books of account and other pertinent documents will be stored.

Read Our Article: Procedure Of Filing Annual Return: A Complete Guide