The Central Board of Indirect Taxes has made available the new functionalities for Tax Collection at Source (TCS) and Composition Taxpayers. The Central Board of Indirect Taxes has also enabled the filing Form GSTR-4 Annual Return by Composition Taxpayers on Goods and Services tax Portal.

Provision to amend Form GSTR-8

- Earlier, the TCS (e-commerce operators) could amend the details only once. Based on requests received from the stakeholders[1], the restriction of amending the transaction details only once, in Form GSTR-8, has now been removed.

- As a result, in Form GSTR-8, now can be amended multiple times, e-commerce operators liable to collect the tax at source under section 52, while filing Form GSTR-8.

TCS (Tax Collection at Source) facility has extended to composition taxpayers

- The taxpayers under the composition scheme are permitted to make supplies through E-Commerce Operators.

- E-commerce operators will now be able to add GSTIN of such composition suppliers, in Form GSTR-8.

- The amount of a tax collected at source (TCS), is reported by E-Commerce Operators in Form GSTR-8. Now it will be mentioned in TDS and ‘TCS credit received’ Form of the respective composition taxpayers.

- The amount that is reported by e-commerce operators will now be available to respective composition taxpayers, for accepting or rejecting the same in TDS and TCS credit received’ Form.

- For accepted transactions, the amount will be credited to the cash ledger of composition taxpayers, after the successful filing of TDS/ TCS Credit received Form.

- For any rejected transactions, the amount will be shown to e-commerce operators for correction.

Read our article:Know the Provisions for availing 2 GST Registration on One PAN Card

What is Form GSTR-4 Annual Return?

All the Composition Taxpayers are required to file Form GSTR-4 Annual Return, for each financial year, on an annual basis, with effect from April 1st 2019.

Who has to file Form GSTR-4 Annual Return?

All the registered taxpayers have opted for composition scheme under GST, for any period during a financial year, starting from 1st April 2019. They need to file Form GSTR-4 Annual Return, annually.

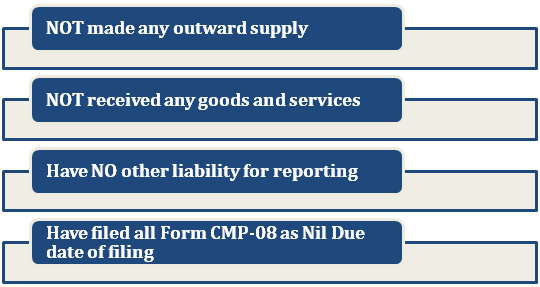

Who requires to file NIL Form GSTR-4 Annual Return?

A Nil Form GSTR-4 Annual Return can be filed for the financial year, if:

Other Important Highlights

- Form GSTR 4 can be filed when all applicable quarterly statements in Form CMP 08 of the financial year, have been filed.

- Form GSTR-4 Annual Return, can’t be revised if once filed.

- After successfully filing, the ARN will be generated and intimated via email and SMS

- Currently, online filing has been enabled on the portal. After some time, an offline filing of Form GSTR-4 Annual Return will be made available.

- Is it different from Form GSTR-4 Quarterly Return? The Form GSTR-4 Annual Return is different from the Form GSTR-4 Quarterly Return as follows.

- Form GSTR-4 Quarterly Return is applicable, for composition taxpayers, up to the tax period ending on 31st March 2019.

- Composition Taxpayers have to file Form GSTR-4 Quarterly Return (which is also available on the GST portal), for tax periods till the quarter ending March 2019.

Conclusion

The provision for TCS (e-commerce operators) which earlier could be altered only once has now been removed. Hence, filing in Form GSTR-8 now can be altered multiple times, and e-commerce operators liable to collect the tax at source under section 52, while filing Form GSTR-8.

Read our article:CBIC directs to clear pending GST registration under special drive