From 1st April 2021, the businesses whose turnover is well above Rs 100 cr would have to opt for the GST E-Invoicing system without an exception. The government has taken this decision in the direction of ease of doing business.

The implementation of the system will let the government repair the revenue leakage which is quite prominent with the existing invoicing system. During the announcement of this system on 8 October 2020, the honorable finance minister ensures that with this system in place, the defaulter will find it difficult to perform the GST evasion activities and it would also ease out the compliances for the corporate.

Applicability of GST E-Invoicing System

The GST E-invoicing system is not only available to business with Rs 500 cr annual revenue, but it will expand to cover more taxpayers under its ambit. As per the government plan, the system will also make available to taxpayers having GST registration generating more than 100 cr of revenue per year. The system would be available to the said taxpayer by 1st January 2021.

In the setup, the systems of the companies are connected with the GSTIN portal. The invoices issued by the companies will be uploaded to the portal within twenty-four hours. The GST e-invoicing system will soon supersede the e-way billing system as well as physical invoicing. The system is capable of rendering real-time data on invoices accessible to both sellers and buyers.

In the presence of a GST e-voicing system, banks can get rid of innumerable documents for the validation process. The system is likely to improve the payment circle for the industries as well. Therefore; this system will provide plenty of advantages to businesses and tax administration in one way for another.

Read our article:Things you must know about GSTR-5 Filing: How to go about it?

Progress of E-invoicing

According to the Finance Secretary, the government has been constantly investigating the progress of the system and some positive sign have been discovered in this regard. On the date of the launch, System manages to generate about over 8.40 lakhs Invoice Reference Numbers (IRNs), which was an overwhelming response by all means. And by the end of the first week of October, nearly 70 lakhs IRNs have been generated in the new system.

Mechanics of e-Invoicing

The invoicing system seeks a unique identification number known as Invoice Reference Number (IRN) against each invoice. GSTN allows the taxpayer to avail of IRN through various methods.

As soon as the taxpayers avail the IRN from the portal, the invoice detail & IRN need to be submitted to the pre-notified authority in the real-time scenario. After successful verification of the given credentials, the agency will then provide a digitally signed e-invoice to the supplier. The aforesaid agency can also transfer the invoice details to GSTN w.r.t auto-population of returns. To ensure immediate confirmation, the invoice details would be accessible to the buyer on a real-time basis on the GST portal.

The invoice without an Invoice Reference Number would be deemed invalid for GST purposes. On a whole, the GST e-invoicing system is giving an implication of an extended version of the e-way bill (EWB) system. As of now, it is essential for every business owners to analyze. As of now, it is important for industry stakeholders to examine the consultation paper released by GSTN along with the draft e-invoice format.

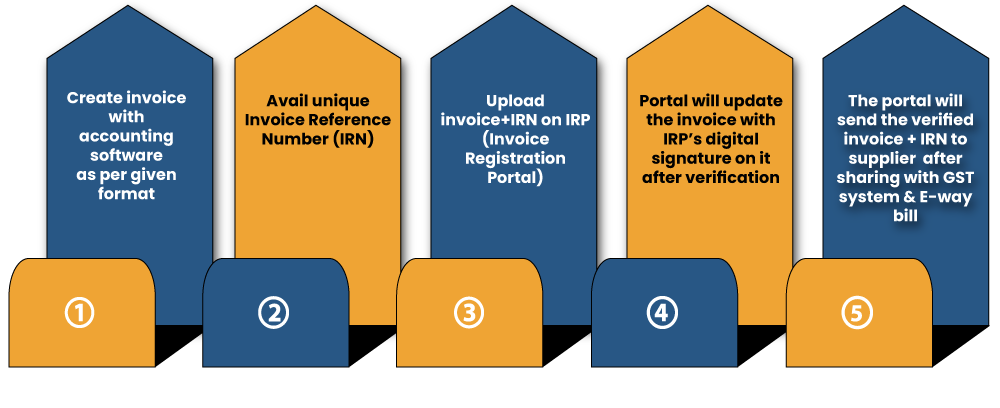

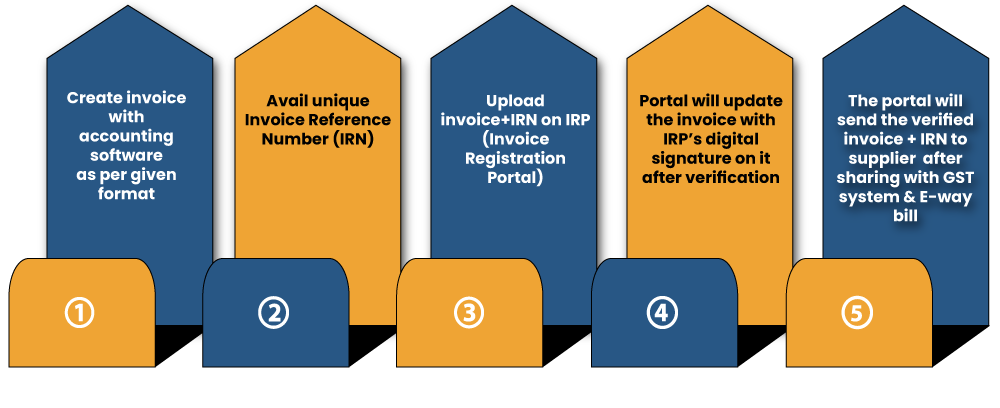

Procedure to Generate e-invoice in GST

Following steps would help you generate e-invoice in GST

- An invoice is created with the help of accounting and billing software as per the given format for E-invoicing.

- A supplier[1] can take advantage of a standard hash-generation algorithm to generate a unique Invoice Reference Number (IRN). In case of unavailability of IRN, the IRP system would generate the same.

- JSON file for each business to business invoice (created via third party software or accounting program) in addition to IRN, is uploaded on the IRP (Invoice Registration Portal).

- The Invoice Registration Portal will authenticate the generated IRN linked with JSON uploaded by the supplier. The portal might also generate IRN and validate the file against the registry of GST for any replication. The IRN will act as a unique identity for the e-voice for the given financial year.

- After the successful verification, the portal will update the invoice with IRP’s digital signature on it and a QR code will be attached to the JSON file.

- The same data will be communicated with the GST system & E-way bill, which further utilized for the auto-population of GST Return.

- The portal will forward the IRN as well as the JSON file to the supplier. The same will also be shared with the relevant buyer via registered email id.

Key Benefits of GST E-Invoicing

- GST e-invoicing helps to overcome the requirement of multiple reporting for the GST return filing. With this system in place, one-time reporting would be enough.

- Reduce the chance of invoice mismatching while reconciliation.

- Being robust in nature, the GST e-invoicing system would be able to coordinate with multiple softwares seamlessly.

- The supplier will be able to track the invoices in real-time.

- Low manual intervention in the return filing process due to the presence of auto filing.

- ITC’s claim process would turn out more subtle and easy.

Conclusion

The new system is expected to ease out the invoicing complication for a lot of companies. The presence of the system will eliminate the need for generating separate e-waybills. Also, it is proposed to increase the invoice lending for the small companies registered under MSME. Apart from that, it would also allow businesses to prevent irrelevant paperwork and documentation regarding invoicing which in turn increases their efficacy.

Read our article:Interest on the Late GST Payment would imposed on Net Cash Tax Liability

Circular_Refund_143_11_2020-GST-E-invoicing