The Goods and Service Tax (GST) is a value-added tax imposed on the supply of non-exempted goods and services. GST was implemented with a moto- one nation one tax, as it replaces several indirect taxes such as CST, service tax, VAT, and so on. As per Section 25 (1) of the CGST Act, GST registration is mandatory to all the suppliers of non-exempted goods and services regardless of their business location. GSTIN portal is an online medium where the taxpayer can submit their application regarding GST registration.

The Income Tax Act of 1961 states that a PAN is an absolute necessity for business owners operating in India. The PAN helps the IT department to identify the financial loopholes triggered by the faulty or delayed transactions. Apart from filing the IT return, most companies use the PAN card to receive invoices and remittances. In a nutshell, no business entity can avail tax benefits in the absence of a PAN card.

GST registration and PAN card

GST is an indirect tax that accumulates all taxes under one umbrella, whether direct or indirect. GST registration number incorporates PAN details, which deals with direct taxes. For the time being, the GST Act won’t allow any taxpayer to avail two GST numbers against a single PAN card if the trading of non-exempted goods and services is limited to a single state or union territory. On the contrary, if the supplier is engaged with inter-state trading, then he/she can avail separate GST registration for both the states i.e., 2 GST registration on one PAN card.

There is another scenario when taxpayers can apply for 2 GST registration for one PAN card.

This is possible when a supplier is dealing with several business verticals in one state or UT. In such cases, a separate GST registration is mandatory for each of the business verticals. The taxpayer who wishes to secure separate registration regarding the place of business should mandatorily apply the Form GST REG-01.

Read our article:A Complete Guide on Eligibility Criteria for GST Registration

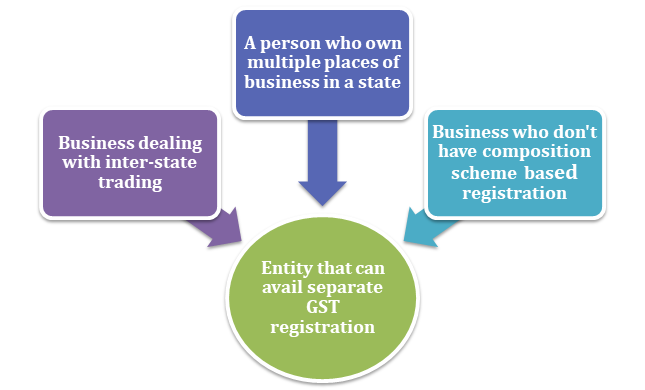

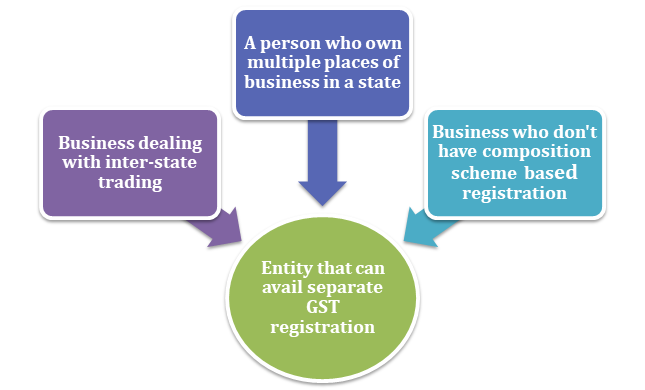

Conditions for acquiring 2 GST registration on one PAN card

- The taxpayers must be dealing with inter-state supply to avail separate GST registration.

- A person managing multiple places of business in a given territory shall be granted a separate registration.

- Any branch of the business is working under the composition scheme is not permitted to avail separate GST registration.

What is the business vertical?

As per section 2 (18) of the CGST Act, 2017, the term Business Vertical is referred to as a distinguishable component of an enterprise that provides deals with the supply of goods and services. The business component is vulnerable to possible risks that are different from the rest of the business’s verticals.The act further explains the following conditions taken into account for new vertical registration under GST.

- The type of production process

- The type of services or goods

- Type of customer-base reaping the services

- Type of distribution channel

- Type of regulatory or statutory environment supporting the business verticals

Rule 11- CGST Rules, 2017

There are a certain set of regulations that have been set by this law regarding the separate GST registration for business verticals operating in the same State or UT. Rule 11 (1) further add some guidelines w.r.t a new vertical. Those rules are as follows:-

- A person seeking separate registration should have multiple business verticals (precisely more than one) as per the provision of section 2 (18) of the act.

- An applicant cannot opt for registration under section 10 if the remaining business vertical of such an applicant already secured this registration.

- Section 9– The person operating with several business verticals needs to cater to tax liabilities under the act on the supply of goods or services provided to other verticals of business. The provision also stresses on the issuing of invoice in this context.

- Rule 8(1), CGST Act 2017 – A separate GST registration is mandatory for the taxpayer who wants its business unit to be identified outside the SEZ.

Important points regarding multiple GST registrations

- Your business should meet the criteria mentioned above if it wishes for multiple GST registrations

- Additionally, if one of the business verticals is not serving the GST provision, you cannot apply for composition scheme under GST for a specific business verticals

- The company must comply with the GST compliances on account of issuing the tax invoice or tax filling for the supply of goods and services within the business verticals.

Conclusion

The above information clearly indicates that the provision for 2 GST registration on one PAN card is 100% feasible and practical. Taxpayers who seek separate registration in case of the inter-state supplies or multiple businesses vertical, they need not to adopt different approaches for the approval. The registration process is more or less the same in this case as well. However, there is a specific provision that a taxpayer needs to fulfill to ensure conformity with the law. If you some of you having a tough time regarding separate registration, let the CorpBiz’s experts help you out. Our well-trained professionals can guide you through the hassles of the registration process through a holistic approach.

Read our article:How to apply for GST registration certificate online?