Central Board of Indirect Taxes and Customs (CBIC) advised on Friday to clear all the pending GST registrations under a ‘special drive’ by 30th July 2020. The Panel has issued the circular in respect to clear the pending GST registrations to help in giving out of a strip of pending submissions for GST (Goods and Service) registration.

The move to fast track the process follows that of a complete slowdown as the government had definite against surrendering any deemed supports for GST registrations since 25th March, i.e., the commencement of the lockdown to secure the spread of COVID-19, for fear of probable chance of misusing during the period wherever central or state tax offices were either closed or functioning with emaciated staff.

Requests that will then take three working days to be administered were held up for months, as the government extends the lockdown for over two months till 1st June, after which offices reopened. The Board has asked GST Network to offer a list of registration applications that was supposed to be approved during the lockdown period – because of technical glitches to jurisdictional officers to conduct corporal verification of business premises wherever required.

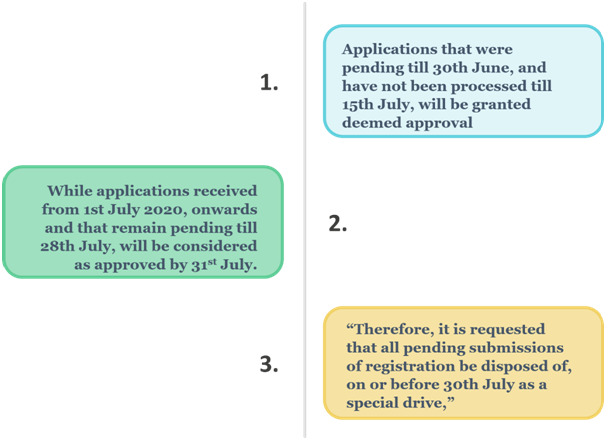

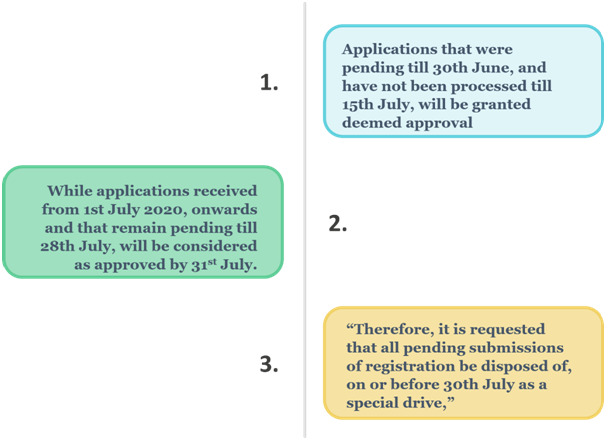

Applications that were pending till 30th June, and have not been processed till 15th July, will be granted deemed approval, while applications received from 1st July 2020, onwards and that remain pending till 28th July, will be considered as approved by 31st July.

The Board in the announcement to all principal commissioners and commissioners across various jurisdictions said that the three days considered an endorsement of the application of process would be resumed from 1st August 2020.“Therefore, it is requested that all pending submissions of registration be disposed of, on or before 30th July as a special drive,” the letter added.

According to Section 25(10) of the CGST Act read with Rule 9 of CGST Rules, offers for estimated approval of the application of registration after 3 working days, if the appropriate officer fail to take any deed on the said application within the said period of three working days.CBIC vide its letter No. 20/06/11/2020-GST/1137 dated July 17, 2020, has, because of the COVID lockdown period, conveyed the following decisions regarding deemed approval of the application for GST registration.

Read our article:How to apply for GST registration certificate online?

Deemed registration held up from 25.03.2020

It has been definite that the estimated approval of the application of registration will not be approved on the portal with effect from 25th March 2020. Accordingly, considered adoptions had been held up.

However, it has been stated that during the pandemic situation also, a few registration submissions have been considered approved on the portal because of technical glitches, GSTN has been demanded to forward the list of such GSTIN who got considered to be approved during the lockdown to the jurisdiction officers. In such cases, where ever required, the proper officer may get the physical verification of business premises done.

Deemed approval of registrations granted for applications pending as on 30.06.2020 not processed till 15.07.2020

Subsequently, the lockdown is over in most of the places and offices are open from 1st June 2020, as conversed in the video conference by Member of GST on 26th June 2020, estimated approvals have been approved for all those submissions pending as on 30th June, which had not been processed till 15th of July 2020.

Applications received from 01.07.2020 and pending on 28.07.2020 shall be deemed approved on 31.07.2020

The CBIC has conveyed that It has been further decided that the applications received after that which remains pending as on 28th June, shall be deemed approved on 31.07.2020. Accordingly, It has been requested by CBIC[1] that all the pending applications of registration be disposed of, on or before 30th July’2020, as an exclusive drive.

Deemed approval of the application of registration to be resumed from 01.08.2020

CBIC has conveyed its decision that three days deemed approval of the application of registration as mandated under sub-section (10) of section 25 of the CGST Act, 2017 read with rule 9 of CGST Rules, 2017 would be resumed from 01st August 2020

What is the work of the Special Drive?

The communication of the GST policy wing was sent by the Board to all principal commissioners and commissioners across various jurisdictions on 17th July 2020. The Board has asked GSTN to share a list of registration applications that got deemed approval during the lockdown period since 25th March 2020 due to any technical glitches. Accordingly, the jurisdictional officers can conduct physical verification of business premises where it is required.

The CBIC has also stated that the three-day window for deemed approval of the registration application would be resumed from 1st August 2020. Due to lockdown and limited staffing, government operations were almost stopped since March 2020. It had also suspended granting of any deemed approvals for GST registration due to the possibility of misuse or unverified approvals.

In one of the clarifications by CBIC in early March 2020 to taxpayers undergoing CIRP, the IRP/RPs had to obtain fresh GST registrations for such companies mandatorily. Delay in granting registration certificate due to lockdown restrained the IRP/RP’s appointed under the IBC law, stalling the revival process for these debt-laden companies.

Several GST compliances including the filing of refund applications and assessments by officers was pushed up to 30th June and recently was further extended up to 31st August 2020. It is relevant to note that the government had not notified any extension in the time limit to apply for GST registration where it becomes mandatory for a person under the GST law. Due to this imposition, people had to still apply for GST registrations online, while its processing got stuck due to insufficient staffing by the CBIC.

The decision made by the GST policy wing and being implemented by the CBIC is a welcome move as it will help in encouraging businesses to begin their operations since the unlock phase of lockdown has already started.

Conclusion

The CBIC has also stated that the three-day window for deemed approval of the registration application would be resumed from 1st August 2020. Due to lockdown and limited staffing, government operations were almost stopped since March 2020. It had also suspended granting of any deemed approvals for GST registration due to the possibility of misuse or unverified approvals.

Our Corpbiz group intend to be at your disposal if you seek expert advice on any aspect related with GST Registration along with complete compliance. We will help you to make sure full compliance concerning all the requirements based on your anticipated activities, ensuring the productive and well-timed completion of your expectation.

Read our article:GST online Registration Process: A Complete Guide