The GOI comes up with yet another set of measures to increase job creation and to provide financial aid to affected sectors. The scheme under which the stimulus has been launched is named Aatmanirbhar Bharat 3.0.

The economic stimulus is also likely to increase economic activity in the infrastructures and the housing areas. The recently launched Production Linked Incentives scheme is also part of Aatmanirbhar Bharat 3.0. Let unveil what this scheme offers and how it’s going to benefits the concerned entities.

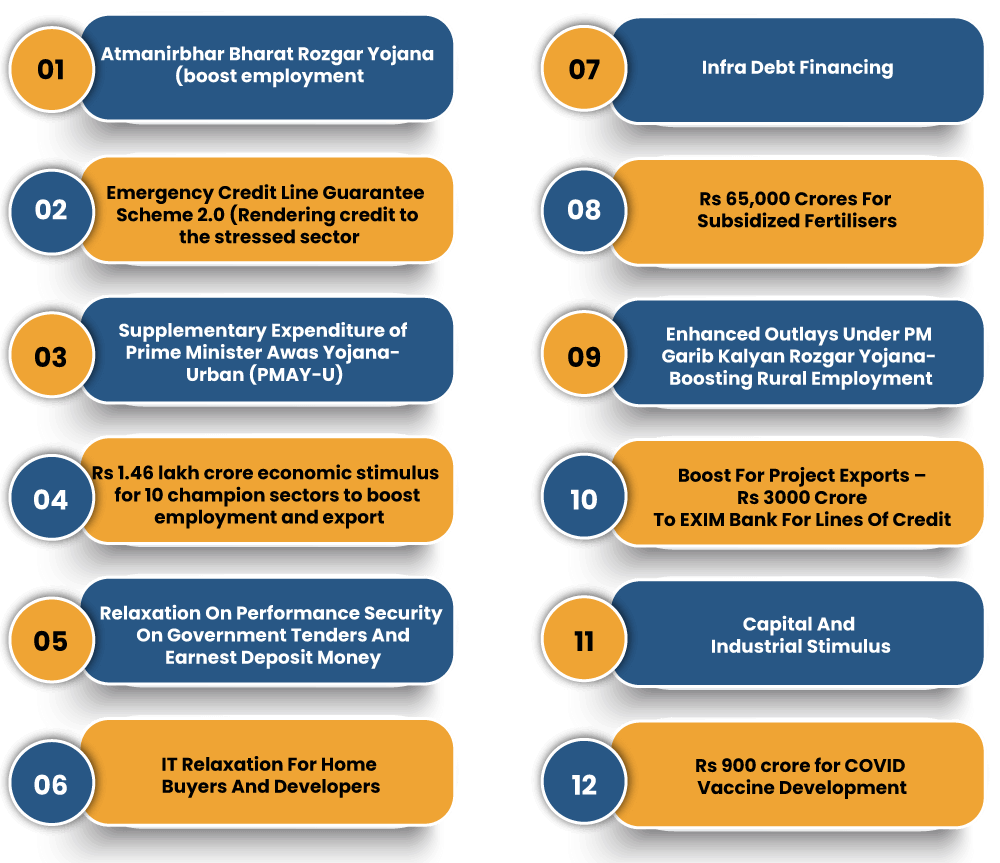

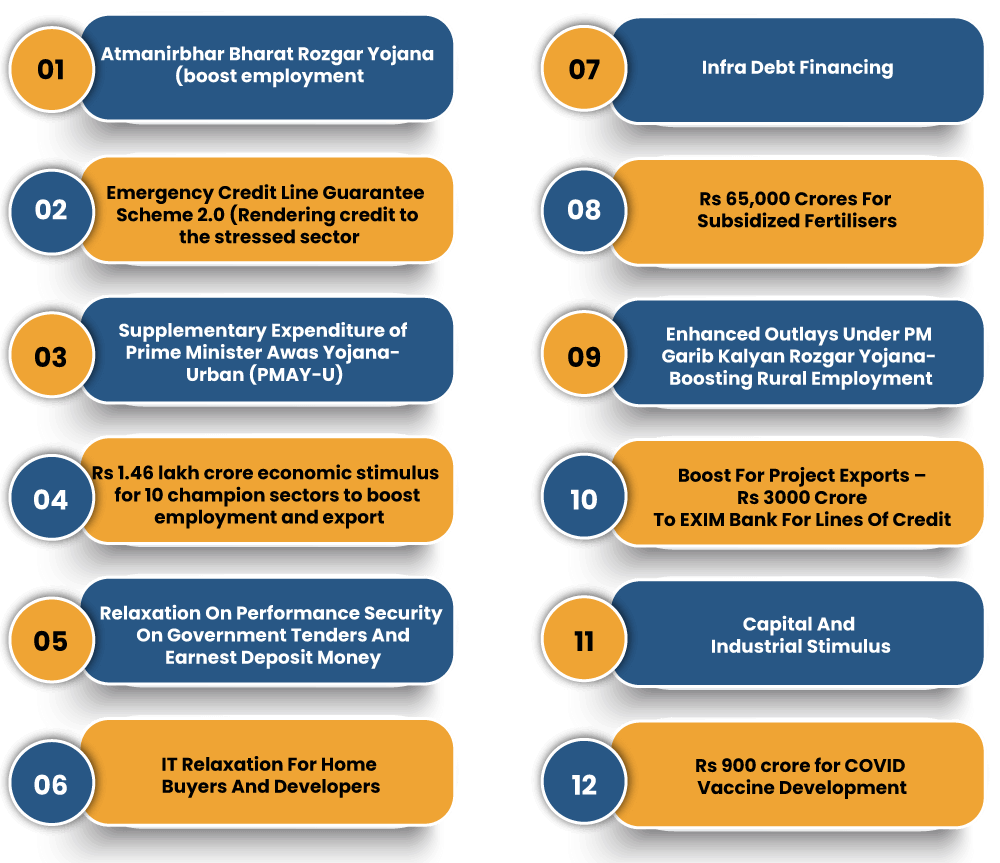

Atmanirbhar Bharat Rozgar Yojana (Boost Employment)

Prime Ministers Rozgar Protsahan Yojana was deployed in 31st March 2019 by the government to incentivize the new employment within the country. The said scheme has provided the aggregate benefits of Rs 8300 crore to the 1, 21, 69,960 Beneficiaries spanning over 1, 52,899 establishments

- A new scheme is being rolled out to prevent the deterioration of the employment during the recovery phase of the COVID 19.

Beneficiaries under Scheme

The new employees under EPFO registrations with monthly wages less than Rs.15000/ were eligible for the given scheme. The government through Aatmanirbhar Bharat 3.0 is trying to reincarnate the economy from the ground up by helping the needy ones through impactful incentives. The scheme is also accessible to those having monthly wages less than Rs.15000 who left the job within the duration from 01.03.2020 to 30.09.2020.

Eligibility criteria for Establishments

Every establishment registered under EPFO that hire new employees or employees who have been out of employment between 01.03.2020 to 30.09.2020 rejoin work, would be eligible to avail of the subsidy. Apart from that, the new candidates whose enrollment was done between 01.10.2020 to 30.06.2020 will avail of the benefits of the said scheme for two years. Establishments having less than fifty employees must hire a minimum of two new employees, and those having more than fifty employees must hire a minimum of 5 new employees.

Subsidy offered by the Central Government

For EPFO registered establishment having more than 1000 employees earning up to Rs 15,000/month, 12% of employee’s contribution & 12% from the employer would be borne by the central government. The subsidy support will be transferred to the EPFO account of the eligible employee.

Read our article:How to Activate UAN for Your EPF Registration?

Emergency Credit Line Guarantee Scheme 2.0 (Rendering credit to the Stressed Sector)

The Government of India rolled out the second iteration of the Emergency Credit Line Guarantee schemes to support the healthcare sector along with 26 stressed sectors identified by the RBI-driven committee named as KV Kamanth committee. The primary motive of this committee is to create a sectoral benchmark for the bank for determining the borrower’s eligibility to have debt restructured. Under the scheme, the bank promises to provide the guaranteed loans to the credit seekers without demanding any collateral. Considering the current situation of the entities, the government is trying their best to provide the best help via Aatmanirbhar Bharat 3.0 scheme

Establishments with credit outstanding ranging between 50 crore to 500 crore are eligible to avail of the benefits of the scheme. The scheme also allows the stressed entities to avail credit up to twenty percent of the outstanding credit for the duration of the five years. The scheme continues to serve till 31st March 2021.

Supplementary Expenditure of Prime Minister Awas Yojana- Urban (PMAY-U)

The government of India has taken various initiatives to improve the well-being of real-state sectors. The measures taken by the government proved to be quite beneficial for this sector. For the further improvement of this sector, the GOI has provided Rs 18000 crores under the PMAY-U scheme, out of which Rs 8000 crore has been already allocated. The package is projected to lay the foundation of 12 lakhs houses and creates substantial job opportunities for the unemployed sector of the economy. This would also boost the production of cement and steel. Through PMAY-U, the government aims to provide housing for everyone in the urban sector of the country.

Rs 1.46 lakh crore Economic Stimulus for 10 Champion Sectors to Boost Employment and Export

As per the financial ministry[1], the Production Linked Incentive scheme will encompasses ten more champion sectors. The said package is projected to paves the road map for the growth of domestic manufacturing as well as export. The package is also likely to create considerable amount of employment in upcoming five years. The fund will be allocated accordingly to the needy sectors as identified by the government.

Relaxation on Performance Security on Government Tenders and Earnest Deposit Money

Performance security deposit has been reduced to 3% which was previously capped at 5-10%. The EMD, on the other hand, will be not being needed anymore for the tenders and would be superseded by the Bid Security declaration. The relaxation is largely going to benefit the sector as it removes limitations on the capital so that contractors won’t grapple to continue their ongoing projects.

The relaxation under the scheme would remain accessible till 31.12.2020. Furthermore, the contractor is liable to deposit a sum with the owner for the protection of the owner’s interest in the case of untimely delivery of the project.

IT Relaxation for Home Buyers and Developers

The price of the housing unit has been decreasing ever since the economy was disrupted by the COVID 19 pandemic. The outage diminishes the purchasing power of the customers and deters the developers to continue with their ongoing project. The recent announcement permitted the developers to sell the housing unit at twenty percent lower than the circle rate by escalating the differential 10 to 20 percent as per section 43 CA of the Income Tax Act. Circle rate is referred to a price of land set by the state government. This measure will reduce the economic turbulence in the real estate sector and enables the developers to clear out the unsold inventory.

However, the said benefit would available only on the sale of residential units which cost up to two crore rupees. Furthermore, the same will come into effect from the announcement date and would remain activate till 30.06.2021. The consequential relief of 20% would be accessible to the buyer on account of section 56 (2) (x) of the Income Tax Act for the aforesaid period as well.

Infra Debt Financing

- Three NIIF has invested Rs 19,676 Cr. in the operating companies, platforms, and downstream funds.

- Debt platform has been built by the NIIF Strategic Opportunities Fund that consists of an NBFC Infra Finance Company and an NBFC Infra Debt Fund.

- The platform has a deal pipeline that worth around Rs 10,000 cr and a loan book of Rs 8000 cr.

- IFL having AAA rating and NIIF AIFL with AA rating will collectively raise Rs 95,000 crore debt from the market. The firms also try to raise project bonds during fundraising.

- By 2025, NIIF will roll out the credit of Rs. 1.1 Lakh Crore for an infrastructure project.

- The investment of Rs 2000 crore has been already made by NIIF in the equity of the platform.

- Government would also invest amounting to Rs 6000 crore as equity in the debt platform.

- Remaining equity would be raised from the private investors.

Rs 65,000 Crores for Subsidized Fertilisers

The surging fertilizer usages will be fueled by Rs 65,000 crore packages which are projected to assist 140 million farmers across the country. The package aims to boost the supply of fertilizers at subsidized rates which eventually improves agro-production.

Enhanced Outlays under PM Garib Kalyan Rozgar Yojana- Boosting Rural Employment

- Prime Minister Garib Kalyan Rozgar Yojana is in effect in 116 districts. Up till now, Rs 37,543 crores has been spent under the scheme.

- PMGKRY effectively syncs with other schemes such as PMGSY, MGNREGA, etc.

- A package worth Rs 61,500 crore is announced for MGNREGA for 2020-21.

- An additional package of Rs 40,000 crore has already been provided under Atma Nirbhar Bharat 1.0.

- As of now, Rs 73,504 crore has been rolled out under MGNREGA, and 251 crore person-days of employment have been generated.

- PMGKRY will be fueled by the supplementary expenditure of Rs 10,000 crores in the current financial year

- This will trigger the development of the rural economy.

Boost for Project Exports – Rs 3000 Crore to EXIM Bank For Lines Of Credit

- Exim banks have extended the line of credit on behalf of GOI to increase the export rate under the Indian Development & Economic Assistance (IDEAS) scheme.

- Promotes exporting activities by mandating recipient nations to import 75% value of the line of credit.

- Project that would be served by EXIM bank includes road and transport, Railways, sugar projects, transmission, and auto and auto components.

- As of now, LOC has been financed 811 export contracts amounting to 10 billion dollars

- GOI has allocated Rs 3,000 crore funds to the EXIM bank to boost the exporting activities via Lines of Credit as per the IDEAS scheme.

Capital and Industrial Stimulus

The GOI will be going to fuel the Capital and industrial expenditure with a fiscal package worth around Rs 10,200 crore. Companies working in the area of Domestic defense equipment and green energy would be a prominent beneficiary of the announced package. It is one of the proactive moves by the GOI under the Aatmanirbhar Bharat 3.0 scheme.

Rs 900 Crore for COVID Vaccine Development

The last and the most important announcement made by the finance ministry is the release of Rs 900 crore which has been made available to the Department of Biotechnology for the R&D of the COVID 19 vaccine. Government with Aatmanirbhar Bharat 3.0 strives to address every weak area of the economy.

Conclusion

It seems that the latest announcement revolves around the ideology of ‘fiscal conservatism’. Instead of relying on large cash transfer, GOI focused on creating a platform that helps domestic demand, encourages firms to create more jobs and improve the production volume, and simultaneously assist those confronting the tough times, be it individuals or firms.

The measures comprise of multi-facet elements which aim to create the jobs in the potential sector and incentivizes formalization of the manpower in the urban areas, broaden the extent of distress employment available in the rural areas, and providing easy credit to a stressed section of the economy. Aatmanirbhar Bharat 3.0 comes up with plenty of upgrades with previous initiatives and new schemes as well.

Read our article:Procedure for EPF Registration – A Step by Step Guide