The Indian government will continue to pay employee and employer contribution towards EPF account of employees for the month of August. The scheme has been rolled out for the benefits the enterprise holding up 100 employees, where 90% of the workforce avails the monthly salary less than INR 15,000/. The contribution rate is still poised at 12% for all the organization but in the case of NGO, this rate has been slashed down to 10%. This article would explain the procedure for EPF registration for employers.

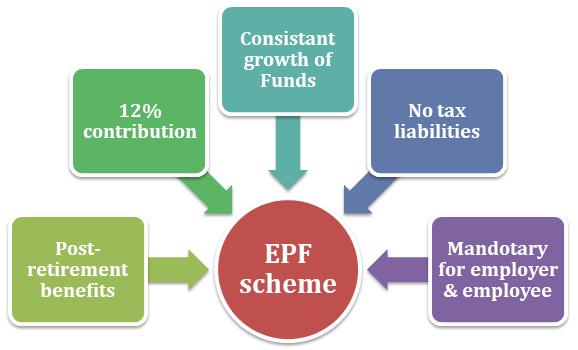

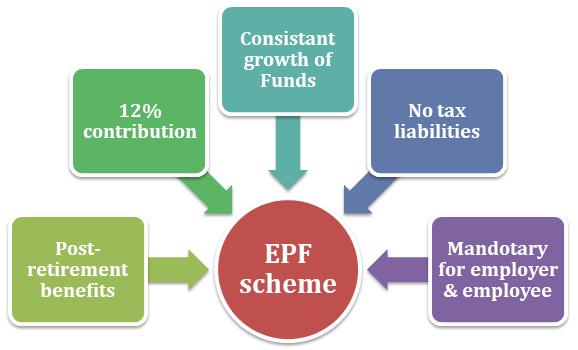

Employees Provident Fund [EPF] is a scheme launched by the Indian government under Employees’ Provident Funds and Miscellaneous Provisions Act, 1952[1], with an aim to benefits professionals reaping low salaries. The Employees’ Provident Fund Organization (EPFO) regulates the provident fund scheme undertaken by the employer across India. Basically, EPF is equivalent to long-term investment that benefits the working professional in their post-retirement phase.

EPF Registration Applicability

Before we look into the detail of the procedure of EPF Registration, let us discuss something about the applicability regarding EPF registration. An enterprise or firm having more than 20 employees should compulsorily opt for EPF Registration. There is also a provision for voluntary registration for entities employing less than 20 employees. Therefore, EPF Registration is mandatory for all the firms working with such a threshold of the employee regardless of the nature of their work. Contravention of provisions regarding such EPF registration attracts hefty penalties.

As soon as the employer attains the workforce of 20 employees, it becomes compulsory for them to avail of EPF registration within one month. The establishments operating with fewer employees can opt for EPF registration voluntarily. Soon after the registration, the employer must initiate the deduction of PF from the employee’s basic salary on a monthly basis. Any delay in this context could lead the employers toward hefty penalties.

The employer contribution toward the EPF scheme is poised at 12% of the basic salary and dearness allowance. The employee, on the other hand, is also accountable for making the same percentage of contribution. As per the EPFO guidelines, the organization having less than 20 employee has to make contribution at the rate of 10%. As per EPFO provisions, the contribution of the employer toward EPF is bifurcated into two parts which are as follows:

- 8.33% towards pension scheme of the employees

- 3.67% towards Employees’ Deposit Linked Insurance Scheme (EDLI)

Such contribution is only applicable if the employee’s basic salary is less than Rs 15000/month.

Read our article:Advantages of EPF Registration that worth your attention

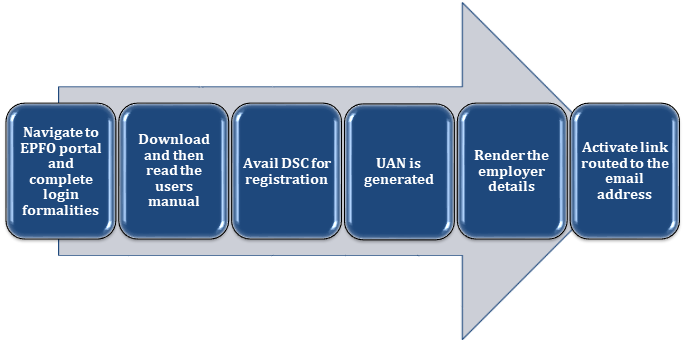

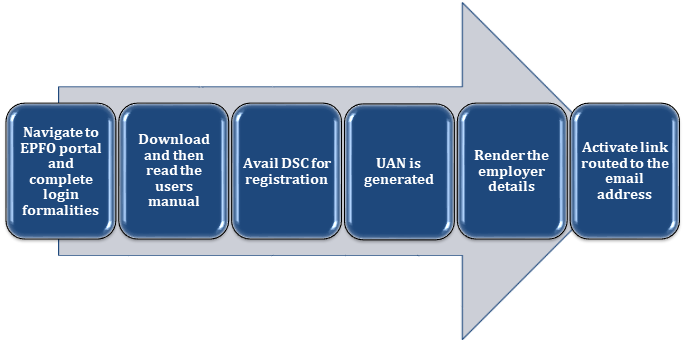

Procedure for EPF registration

Step 1- Firm registration with EPFO

Navigate to the EPFO online portal and click on the option called “ESTABLISHMENT REGISTRATION.”

Step 2: Go through the User Manual

As soon as you click the “ESTABLISHMENT REGISTRATION”, the new page will open that allows you to download the “INSTRUCTION MANUAL.” Make sure to go through every detail of the manual before proceeding further.

Step 3: Registration of DSC

The registered employers can log in to the portal with their account credentials. The instruction manual contains all the information regarding Employer registration as well as DSC registration of the employer. It’s worth noting that DSC registration is mandatory for the employer applying for ERF registration.

Step 4: Filled the mandatory Employer’s details

After reading the instructions, checkmark the option called “I have read the instruction manual.” Further, tap on the “REGISTER BUTTON,” and you will redirect to the page where you need the employer’s details.

Step 5: Fill the legitimate details in the given fields

First Name: Provide the name in the field as provided to the Income Tax department. The alternation in this context would raise the chance of the cancellation during verification.

Employer PAN: As you enter the PAN detail, a portal will prompt the message on your screen regarding your registration status. The PAN detail is crucial for the approval of the online application.

User Name: Now the portal will allow you to select the unique username through multiple suggestions.

Hint Question/ Answer: Now, to add an extra layer of protection to the account, the system will ask you to select a question. This would help you retrieve the account whenever you forget the login details. Next, complete the CAPTCHA verification process and tap on the GET PIN button to proceed further.

Mobile PIN: Now, the portal would generate the PIN and send it to your registered mobile number. Once you receive the PIN, select the option called “I agree to the above declaration.”

Activation of Email link: The portal would redirect an email link to your registered email address. As soon as you activate this link, the application for EPF registration automatically submits to the portal.

Documentation Required for EPF Registration

- Address and identification proof

- PAN card, as well as GSTIN details.

- The duplicate copy of MOA & AOA

- List of the members responsible for handling the company’s activities

- Legal documents stating compliance with the Income-tax act.

- Documentation illustrating the detail of existing workforce seeking EPF registration.

- Wages details of all the employees, along with their grade and destination.

- Canceled cheque of the applicant.

Conclusion

The EPF acts as a solid monetary backup, that provides financial and retirement benefits to the employee. Although EPF benefits don’t seem as luring as a short-term investment, it is arguably the most reliable source of investment for the individual seeking financial aid during post-retirement. Hopefully, by now, everything has been clear to you regarding the procedure for EPF registration. However, if still some doubt in this context, make sure to get technical assistance from CorpBiz’s experts.

Read our article:How to apply for EPF Registration online?