Form GST ITC-03 is the form which is submitted by registered taxpayers in exceptional circumstances where an input tax credit availed has to be reversed. Where the taxpayer opts for composition scheme or where his supplies become exempt, he must file a declaration to intimate ITC reversal and payment of tax on inputs held in the stock. Here, we will discuss the provisions concerning Form GST ITC-03 and the collateral information which is required to be furnished therein.

What is the Form GST ITC-03?

Form GST ITC-03 is the form which is to be furnished to pay an amount by the common portal, either by debiting in electronic credit ledger or by electronic cash ledger. The amount is equivalent to the credit availed by a taxpayer in respect of:

- Inputs held in stock

- Inputs contained in the semi-finished goods or finished goods held in stock

- Capital goods held in stock

Here, taxpayer refers to one who opts for composition scheme requires to shift from normal tax regime to composition scheme or where goods and services has become wholly exempted.

Who is required to file the Form GST ITC-03?

Form GST ITC-03 has to be furnished by a Registered Taxpayer

- Who has availed input tax credit (ITC)

- Who opts for a composition scheme

- Where goods or services supplied and rendered by him become wholly exempted from the tax.

Read our article:How to Use SMS Facility for the GSTR-3B Filing?

What are Things Declared in Form GST ITC-03?

Form GST ITC-03 entails details of stock, as on the date immediately preceding date on which the composition right is exercised or on the date of exemption, in respect of the inputs kept in stock, the inputs found in finished or semi-finished goods held in stock and capital goods, on which an input tax credit has been availed. The same will be reversed or paid if used complying with the section 18(4) of CGST Act, 2017.

Since the taxpayer shifting from normal tax regime to composition tax scheme would breach ‘GST and input tax’ chain, he will not avail any ITC. However, suppose he has already claimed the ITC on goods lying in his stock as on a date immediately preceding the Financial Year from which composition scheme is applicable. In that case, he needs to reverse the ITC and intimate via Form ITC-03. Similarly where goods or services supplied by a taxpayer become wholly exempt, then in that case also, an input credit claimed earlier also needs to be reversed.

Are there any Pre-Conditions for Filing of Form GST ITC-03?

The following prerequisites have been checked before a filing of Form GST ITC-03:

- In form GST CMP-02, the taxpayer has filed an intimation to opt for a composition scheme.

- The Government[1] has issued notifications relating to an exemption of goods and services supplied by the taxpayers which become completely exempt.

- ITC has been used and availed by the taxpayers for inputs held in stock & inputs contained in finished goods or semi-finished goods in stock and on capital goods in stock.

When does Filing of GST ITC-03 is opted to Pay Tax under Composition?

According to GST law, in the event that intimation has been filed in the Form GST CMP-02 before 31st March a taxpayer has to furnish GST ITC-03 within 180 days from the day when the tax under composition begins to be paid. However, in event that intimation in Form GST CMP-02 is filed after 31st March the taxpayer has to furnish GST ITC-03 within 60 days of the beginning of the financial year for which the option of paying of compositional tax has been exercised.

In the time of the Covid-19 relaxation in due dates notified by CBIC, it has been provided that if the taxpayer can opts for composition scheme for the 2020-21 financial year, he must file for a reversal of input tax credit, by filing of Form GST ITC-03 was till 31st July 2020. In case if a taxpayer submits the form GST ITC-03, the exemption of products or services can be provided. The date has been extended also for GST return filing.

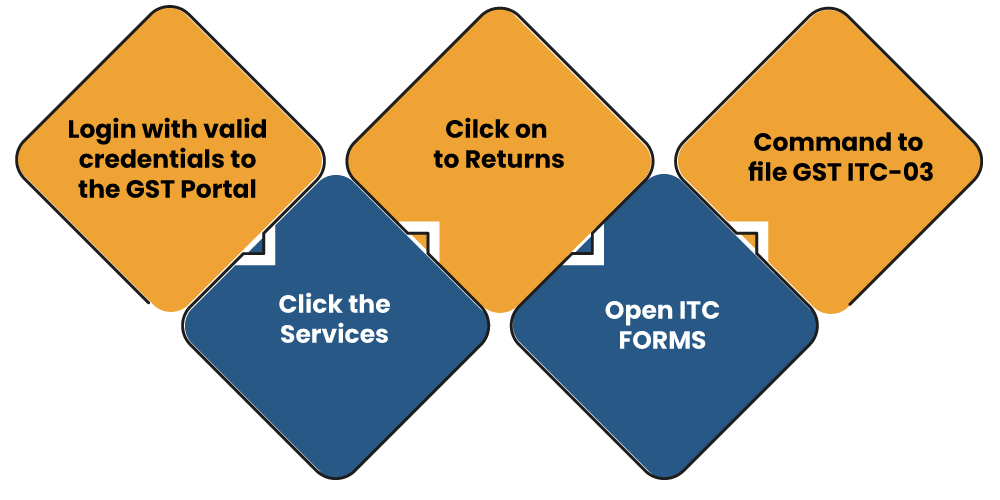

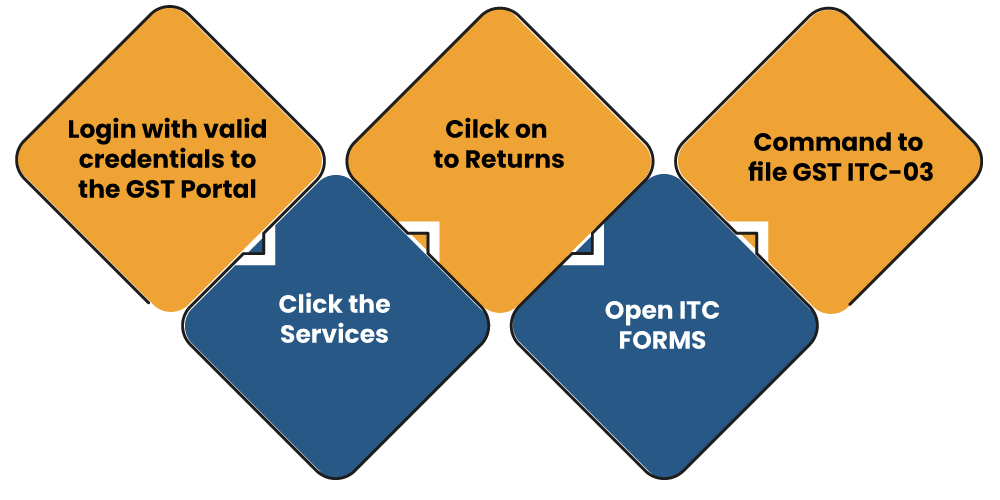

How to File Form GST ITC-03?

What Details are given in Form GST ITC-03?

The information concerning quantity and value of inputs held in stock, inputs contained in finished or semi-finished goods held in stock, & capital goods must be provided separately where invoices are available and where invoices are not available with the taxpayers.

In addition, the details are required to be given as follows:

- GSTIN, Legal name and Trade name

- Details of the application filed to opt for composition scheme.

- Date from which an exemption is effective

- Details of the ITC claimed on inputs held in stock (where an invoice is available)

- Details of the ITC claimed on inputs contained in semi-finished and finished goods held in stock (where an invoice is available)

- Details of the ITC claimed on capital goods held in stock (where the invoice is available)

- Details of the ITC claimed on inputs held in stock as contained in finished and semi- finished goods held in stock (where an invoice is unavailable)

- Details of the ITC claimed on capital goods held in stock (where the invoice is not available)

- The total liability of the ITC payable and being paid off after setting off the balance available in an Electronic Credit Ledger or Electronic Cash Ledger

- The balance of credit lying in Electronic Credit Ledger will lapse on filing of this form, after the ITC reversal/payment of tax, in case of the option being exercised for composition scheme.

What Value is adopted for Filling Input details where invoices are not available?

It is provided under CGST Act that where there are no invoices available to calculate the value of ITC availed, a registered individual has to estimate the sum based on the prevailing market price of the products on an effective date of the occurrence of any of the events which required the filing of the Form GST ITC-03. Such details furnished must be duly certified by a practicing-chartered accountant or cost accountant. The certificate to this effect needs to be uploaded with Form GST ITC-03 before filing the form.

Conclusion

Form GST ITC-03 must be filled in by those taxpayers who will choose the composition scheme or where goods and services provided by a taxpayer have become completely exempt. The form is to be filed by taxpayers to pay an amount equivalent to credit availed in respect of inputs held in stock, by way of paying debit in an electronic cash ledger or electronic credit ledger.

Read our article:Things you must know about GSTR-5 Filing: How to go about it?