GSTR-5 is a return form for the individual who is not an Indian national but registered under GST. A summarized filing form, GSTR-5 is needed to be provided with detailing of outward and inward supplies along with transaction details of a specific business for a non-resident overseas taxpayer.

The overseas non-resident taxpayer is the individual who doesn’t have a business place in India but supplying products in India for a relatively small period.

In such a condition, the individual has to file a GSTR-5 form to address the tax liability. Section 5A under GSTR-5 allows the taxpayer to make changes in the details filed earlier. GSTR-5 encloses a summary of details regarding the taxpayers. Goods imported, changes in the detail of imported goods, b2b supplies, total tax paid, liabilities, etc.

What are the Attributes of GSTR-5 Form?

- The overseas taxpayers can be registered under GST via a temporary registration for a particular period.

- This form serves the non-resident person carrying out business activities in the country.

- The GSTR-5 form can be filed via a facilitation center or online portal.

- The details of outward and inward supplies shall be provided in a single form.

- The filing GSTR-5 is done on monthly basis along with tax (including fees, penalty, interest) by the 20th of the subsequent month for a specific tax period or within 7 days after the end of the validity period of registration

Who should file GSTR-5?

- The filing of the GSTR-5 return form is mandatory for the taxpayers who is not an Indian national but registered under GST and engaged in the supplies of OIDAR services (Online information & database access or retrieval services) from another country to non-taxable individual in India.

- Such an individual is free to obtain a temporary registration from the online GST portal and file returns for the supplies for a particular tax period. The taxpayer seeking GSTR5 should not have a business place in India.

Due Date for GSTR-5 Return filing

The due for GSTR-5 return filing is the 20th of the next succeeding month for a specific tax[1] period. Following is the rundown of the due date for filing GSTR-5 return:-

- October 2020 Return – 20th November 2020

- September 2020 Return – 20th October 2020

- August 2020 Return- 20th September 2020

- March – July 2020 Return- 31st August 2020

- February 2020 Return- 20th March 2020

Read our article:GSTN enables Download of ITC invoice details of Table 8A of Form GSTR-9

Interest on Late GST Payment and Penalty for Missing the GST Return Due Date

As per the GST council, in case of the late payment of tax, 18% charges would be imposed annually on the tax of GST. The aforesaid tax rate will be applicable from the due date until the tax has been paid to the fullest. The taxpayer fails to payout the GST taxes within the deadline will have to pay a calculative tax rate from the date on which the due date has begun.

In case if a person fails to file the return within the aforementioned deadline, he/she has to pay a fine of Rs 50/day (in case of tax liability) and Rs 20/day (in case of Nil liability from the date when the returns are filed.

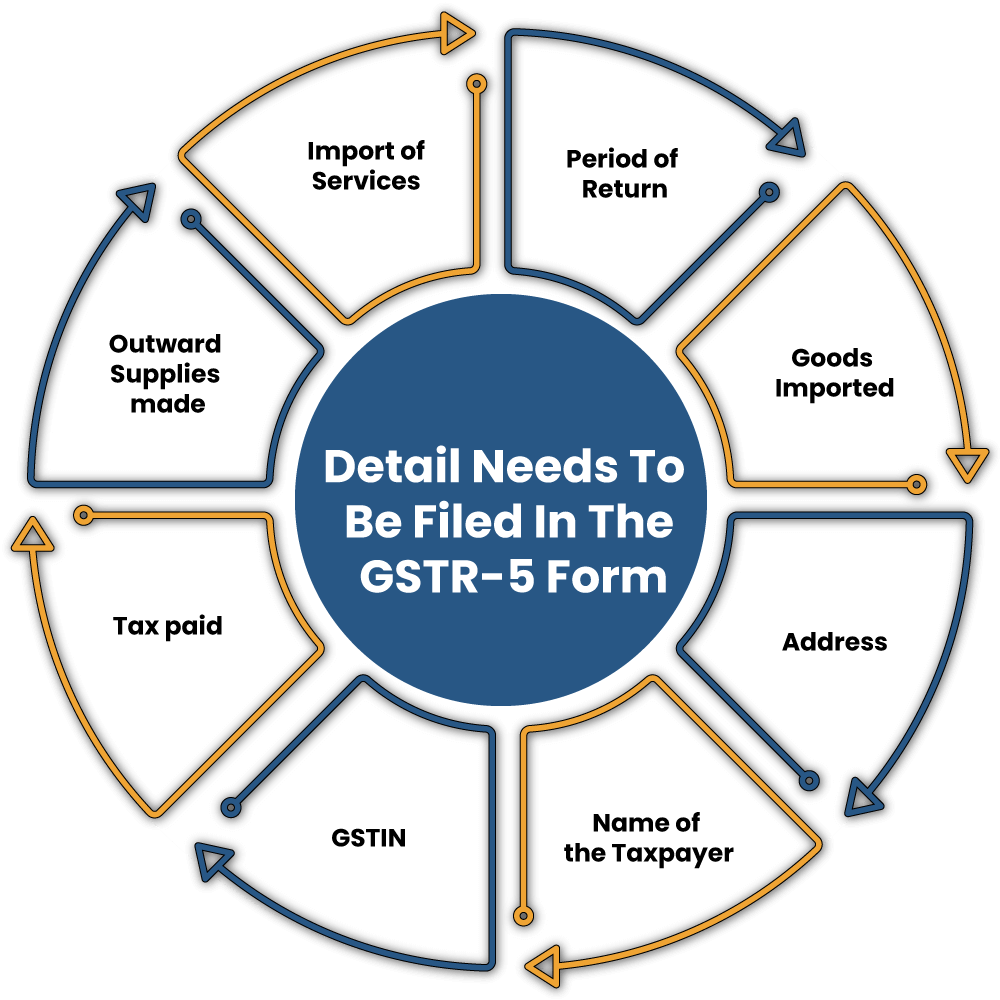

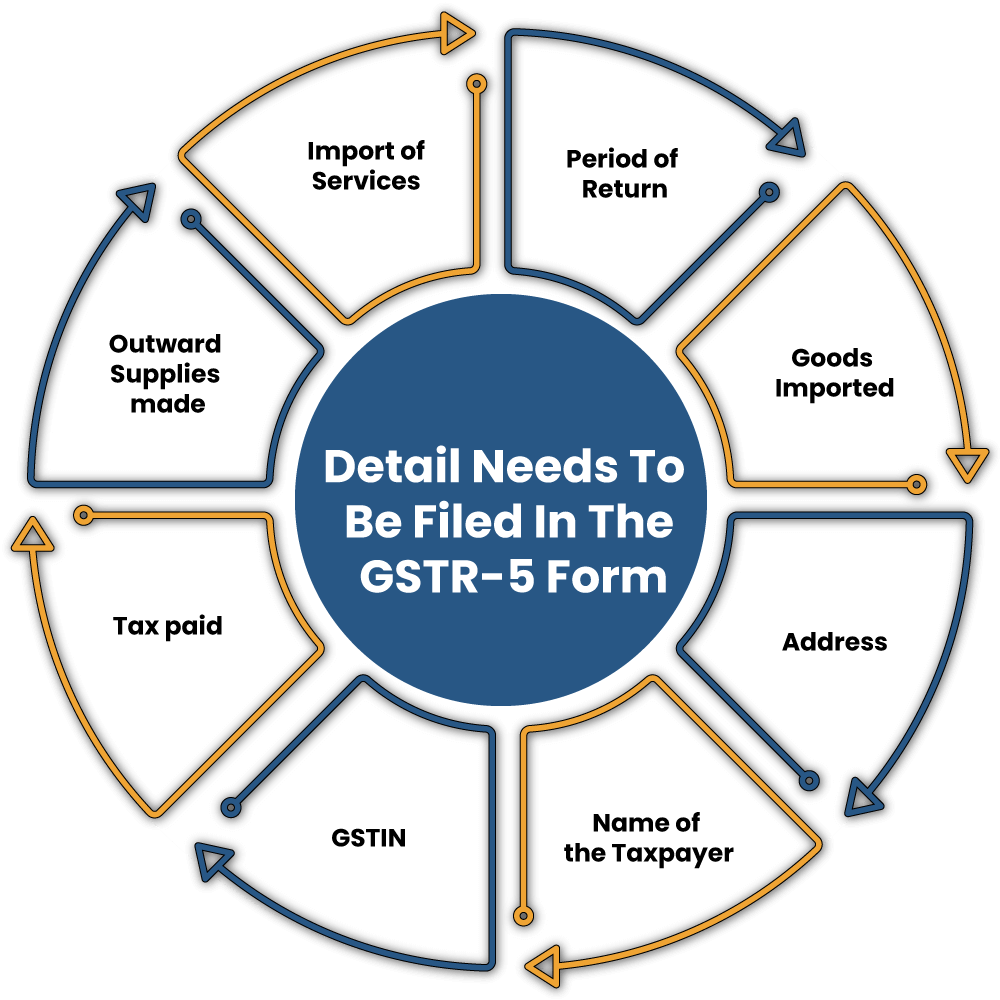

What Detail Needs To Be Filed In The GSTR-5 Form?

The GSTR-5 format encloses a variety of the details regarding the foreign taxpayer’s outward & inward supplies. These are as follows:

GSTIN

Here the taxpayers need to mention the PAN-based GSTIN number. GSTIN stands for Goods and Services Taxpayer Identification Number and it is a 15 digit code which is allotted to a individual under GST registration.

Name of the Taxpayer

This field includes the name of the taxpayers (who is also serving as an authorized signatory under the GST law.

Address

The section consolidates the information regarding the address that a taxpayer provided for the registration.

Period of Return

The period of Return shows the timeline for which the taxpayer is filing the GSTR-5.

Goods Imported

Here, the taxpayer needs to mention the detail of goods along with HSN codes that have been imported into India. Apart from these detail, the taxpayer may also require to enclose some additional information such as a bill of entry in this particular section.

Section 5A under GSTR-5

In the view of section 5A under GSTR-5, the taxpayer is allowed to make changes in the detail that was filed earlier. Taxpayers should attach the original copy of the document to authenticate the changes made to the details.

Import of Services

This section encloses the detail of services that were received by the taxpayers from the overseas suppliers who are taxable under GST. In Section 6A of the GSTR-5, the taxpayer is allowed to make changes in the detail of services imported during the tax periods.

Outward Supplies made

Here, the taxpayer needs to submit the details of sales and outward supplies that have been made during the period of this tax return. While addressing such a requirement, make sure to mention the details of the entire buyer having GSTINs. Also, the taxpayer needs to keep eyes on a different component of GST such as CGST, SGST, and IGST.

In section 7A of the GSTR-5, the taxpayer can make changes to the sale or outward supplies detail that has been previously filed.

Details of Credit/Debit Notes

Here, the taxpayer needs to enclose the details of all the credit and debit notes rose on account of business transactions that the taxpayer has carried out in India.

Section 8A of GSTR

Section 8A of GSTR allows the taxpayer to do modification in the detail of credit/debit notes filed previously.

Tax Paid

The section seeks the information regarding tax paid for the tax period as per different GST components such as CGST, SGST, and IGST. The tax owed by the taxpayer can be calculated by the data as per the above sections.

Closing Stock of Goods

Closing Stock is a price of unsold stock lying down in any business on a given date. In short, it’s the inventory which is still in your business coming up to be sold for a given period of time. Here, the taxpayer ought to mention the detail of the closing stock for the tax period.

Refund Claimed from Cash Ledger

The section consolidates the information of all refunds that a taxpayer received into the bank account via electronic cash ledger.

Conclusion

GSTR-5 form allows non-resident taxpayers to file a return on supplies made previously to the taxable person in India. The form is available on the GST portal in the downloadable format. With GSTR-5 form in place, that government can curb the tax evasion activities occur outside the boundaries of the country.

GST return filing procedure could be tedious at times and in that case you might need someone to avert complexities. At CorpBiz, we try our best to render best in class services to the client who are dealing with filing issues.

Read our article:GST Return Filing Procedure – Types of GST Returns, Due Date and Penalty