Are you having issues in conventionally filing the GSTR-3B? Well, you can now use the SMS facility to serve the same purpose. This blog would enable you to perform a successful filing procedure in easy steps. But before we dive straight into the new method, let begin with some basic things.

What is Nil GSTR-3B?

A Nil GSTR-3B is filed when suppliers have no details regarding supplies for declaration. In the absence of outward supplies, the tax implication in such a scenario is equivalent to nil. The taxpayer can follow the given checklist in case of the filing of a Nil GSTR-3B for a specific month:

- No supply of goods as well as services including non-GST supplies.

- No late fee or interest is payable.

- No supplies on which tax liabilities need to be addressed under RCM.

- No other liability is to be addressed.

Read our article:GSTN Allows Generation of System Computed Liability for GSTR-3B

How was the Nil return filing done before?

Those who seek the filling of both Nil GSTR-3B and Nil GSTR-1 were required to utilize the return dashboard on the GST portal. The taxpayer shall come across the set of questions before form GSTR-3B that for deciding what tables are to be made available for the declaration of the details.

Next, the taxpayer needs to select “Yes” under the section” Do you want to file a Nil return to initiate the filing process. The process of filing the Nil GSTR-3B and Nil GSTR-1 was complicated due to the involvement of numerous steps.

Eligibility Criteria

The following guidelines need to be met by taxpayers to file Nil GSTR-3B for a specific tax period via SMS:-

- The taxpayer should be a Normal taxpayer/ SEZ Unit / Casual taxpayer/ SEZ Developer

- The taxpayer should have a legit GSTIN under the possession.

- The authorized signatory must be registered on the GST Portal.

- As mentioned earlier, GSTR-3B is for the NIL filing so there is no point in mentioning the outward supply of any kind.

- No inward supplies in regards to reverse charge or non-GST, nil rated.

- Should not avail income tax credit or reversal of ITC.

- No liability is left on the part of the interest or late fee.

- No tax liability left on the part of Form GSTR-1

- No liability for previous tax periods.

- All previous GSTR-3B returns must not be due.

- No data should not be in the saved form in GSTR-3B form on the GST Portal

To ease the process of GST return filing, the Government of India has started the facility of SMS services via which NIL GST returns can be filed without even opening the GST portal. The facility for GSTR-3B has been already in existence since 08/06/2020 and the facility for GSTR-1 has been made available from the 1st week of July 2020.

What are the Steps to file NIL GSTR-3B?

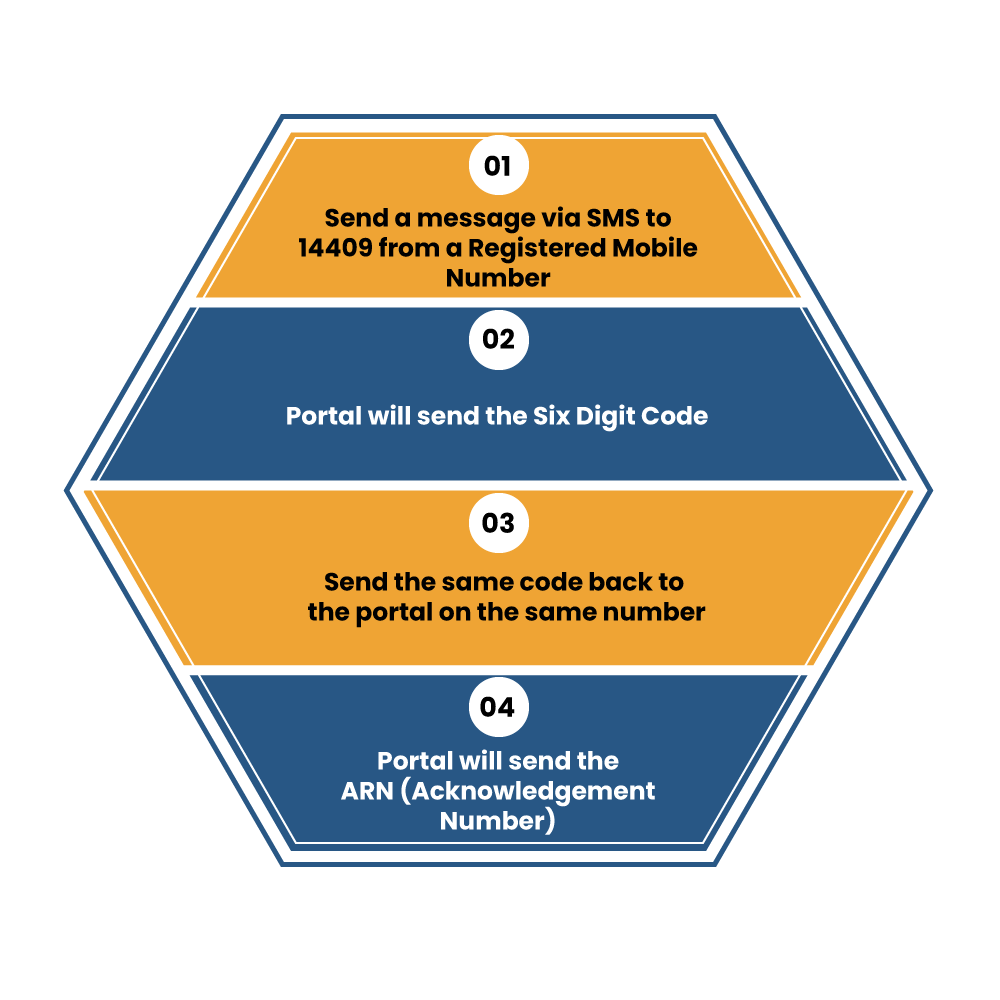

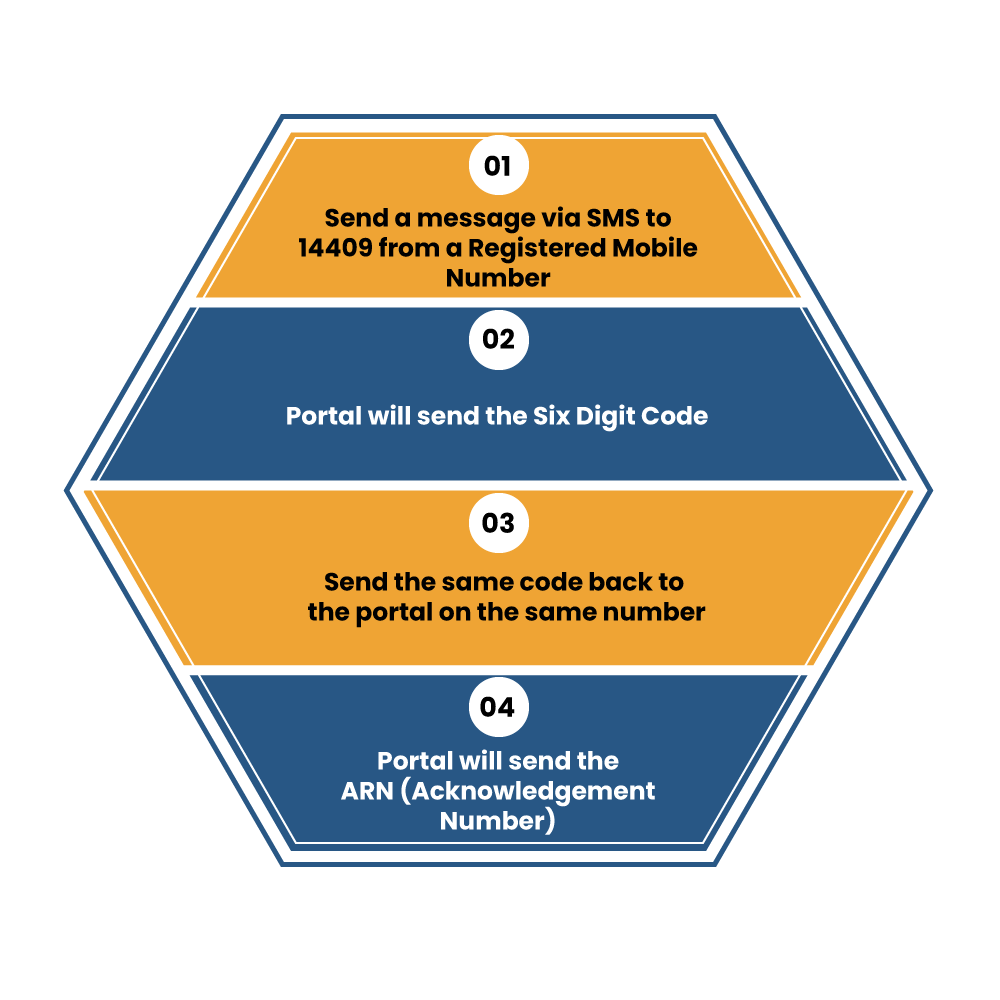

To get started with the Nil filing, send a message via SMS to 14409 from a phone number registered with the tax authority in the given way:

NIL<space>3B<space>GSTIN<space>Tax period

Next, the portal will send the six-digit code to the taxpayer which would remain activated for thirty minutes.

Now a taxpayer is required to send the above code to the same number for purpose of confirmation w.r.t filing of Nil GSTR-3B return. Use the given format to do the same.

CNF<space>3B<space>CODE to 14409

Upon successful validation of the code, the ARN (Acknowledgement number) will be prompted on the taxpayer’s phone number, confirming the successful filing of Nil GSTR-3B.

How to Track the Status regarding the filed Nil GSTR-3B return?

To track the real-time status of the Nil GSTR-3B return, follow the given steps:-

- Log in to the GST portal.

- Head over to the Services and then select Return

- The next thing you need to do is to tap on the option called “Track Return”.

- The above option will let access the real-time status of the Nil GSTR-3B return.

- Apart from that, the taxpayer can also take advantage of ARN to avail of the same information.

Changes made by GSTN to Simplify GSTR 3B Filing

GSTN has made some crucial changes in GSTR-3B return filing form, those are as follows:-

Tax Payment

In the updated iteration of the form, the public can determine whether the tax liability is being addressed via cash or credit in tax liability, before submitting the form. Previously, the individual was liable to submit the return to confirm the tax liability amount. Post submission, no modification was permitted.

Draft Return Download Facility

Previously, the downloading option was not present to save details for offline re-checking. But now the new option has been incorporated for the public convenience where users can download the draft return regardless of the stage to determine the saved detail offline.

Challan Generation:

At present, challan can be prepared with the cash needed to the furnished after considering the balance available in cash ledger and suggested the ITC utilization in the table with a tap of a cursor. Previously, manual intervention was required to file the challan against the amount to be paid in cash. But, the taxpayer is allowed to edit the credit amount to be used filled by the system.

Auto-filling of Tax Amount

This step generally is taken to reduce time consumption and lower down the error as taxpayers now either have to fill SGCT/UTGCT or CGST, another tax amount will be auto-filled.

Conclusion

This is an imperative measure on the part of the Central Government[1] and GST portal, particularly in the ongoing crisis. This facility is nothing short of relief for the individuals when the GST portal fails to respond properly. Now, the taxpayer having nil details in a specific tax period can also gives the GSTR-3B through SMS service in the absence of the portal services.

Read our article:GST Return Filing Procedure – Types of GST Returns, Due Date and Penalty