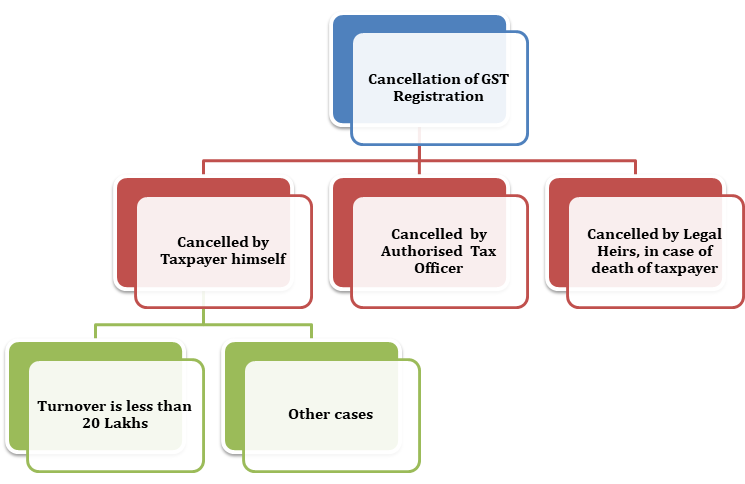

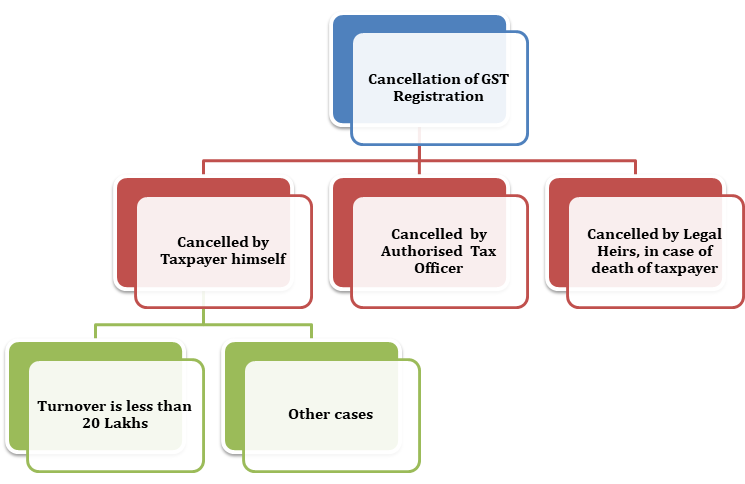

The GST registration granted under the GST Act can be cancelled for any of the specified reasons. The cancellation can either be initiated by a department on their motion or by the registered person who can cancel their registration.

In case of the death of the registered person, the legal heirs can apply for cancellation of registration. In case the GST registration has been cancelled by the department, there is a provision for revocation of cancellation of GST registration. On cancellation of registration the person has to file a return, which is called the final return.

Reasons for cancellation of GST registration

The GST registration can be cancelled for any of the following reasons:

- A person gets registered under any existing laws, but who was not liable to be registered under the GST Act.

- The business that has been discontinued, transferred fully for any reason including death of a proprietor, amalgamated with the other legal entity, demerged or otherwise disposed off.

- In case there are changes in the constitution of a business.

- Any taxable person other than the person who voluntarily taken the registration under the sub-section (3) of section 25 of CGST Act, 2017) must no longer liable to get registered.

- A registered person has contravened any such provisions of the Act or rules made.

- A person who has paid tax under Composition levy if not furnished returns for 3 consecutive tax periods.

- Any of the registered person, other than the person paying tax under Composition levy has not furnished any returns for the continuous period of 6 months.

- Any person who takes voluntary registration under sub-section (3) of section 25 has not commenced business within 6 months from date of registration.

- If registration has been obtained by means of fraud, willful misstatement or suppression of facts.

Read our article: Latest: GSTN Advisory issues on GSTR (1&3B) Forms

Procedure for Revocation of Cancellation of GST Registration

- When the GST registration has been cancelled by a Proper Officer (Superintendent of Central Tax) by his motion and not based on the application, the registered person, whose registration has been cancelled, can submit an application for a revocation of cancellation of GST registration. It is made in FORM GST REG-21, to a Proper Officer (Assistant or Deputy Commissioners of Central Tax), within a period of 30 days from date of the service of the order of cancellation of GST registration at a common portal, either directly or through a Facilitation Centre notified by a Commissioner.

- However, if a registration has been cancelled for failure to furnish returns, application for revocation must be filed only after the returns are furnished and the amount due as tax. In terms of such returns, it must be paid along with the amount payable towards interest, late fee, and penalty in respect to said returns.

- On examination of an application if the Officer (Assistant or Deputy Commissioners of Central Tax) is satisfied, then reasons to be recorded in writing, that there are sufficient grounds for revocation of cancellation of GST registration, then he must revoke the cancellation of registration by an order in the FORM GST REG-22 within a period of 30 days from the date of the receipt of an application and communicate the same to an applicant.

- However, if on the examination of an application for revocation, if the Officer (Deputy Commissioners of Central Tax) is not satisfied, then he must issue the notice in FORM GST REG–23 requiring an applicant to show cause as why an application submitted for revocation must not be rejected. The applicant must furnish the reply within a period of 7 working days from a date of the service of a notice in FORM GST REG24.

- Upon receipt of information or clarification in FORM GST REG-24, the Officer (Assistant or Deputy Commissioners of Central Tax) must dispose of an application within a period of 30 days from the date of receipt such information or clarification from the applicant. In case any information or clarification provided is satisfactory, the Officer (Assistant or Deputy Commissioners of Central Tax) must dispose of the application.

- In case it is not satisfactory an applicant will be mandatorily given an opportunity of being heard, after which the Officer (Assistant or Deputy Commissioners of Central Tax) after recording the reasons in writing can by an order in FORM GST REG- 05, reject an application for revocation of cancellation of GST registration and communicate the same to the applicant.

- The revocation of cancellation of GST registration under State Goods and Services Tax Act or Union Territory Goods and Services Tax Act must be deemed to be a revocation of cancellation of registration under CGST Act.

Conclusion

Application for the revocation cannot be filed if the GST registration has been cancelled because of any failure to file returns. Such returns have to be furnished first, along with payment of all dues amounts of tax, interest & penalty. In the case of voluntary registrations made under GST, application for cancellation can be made only after one year from the date of GST registration.

We at Corpbiz makes the legal process simple and easy for individuals and businesses. We have started out as a Web portal to help fix appointments with lawyers across India, quickly pivoted to providing services.

Read our article: GST online Registration Process: A Complete Guide