GST was implemented in the country to alter the complicated tax framework. India’s government rolled out this tax provision with a slogan of “One Nation One Tax” to make the compliance procedure more transparent, seamless, and intuitive. This article pays attention to GST’s brighter aspects and briefs you about the benefits it offers to Start-ups and Small Businesses.

Overview on GST

GST stands for Goods and Service Tax, and it is based on an indirect taxation system. This multi-stage and destination-based tax framework have supplanted several indirect taxes in the country, such as VAT, service tax, and excise duty. GST implementation is a shift from the old tax regime to the centralized tax framework that offers numerous benefits to the taxpayers. Unlike earlier tax regimes, GST is levied on all entities that create value through their product and services. Therefore, the GST tax regime[1] applies to every point of sale, making it a multi-stage tax structure. It’s important to note that all the inter-state sales are chargeable to State and Central GST.

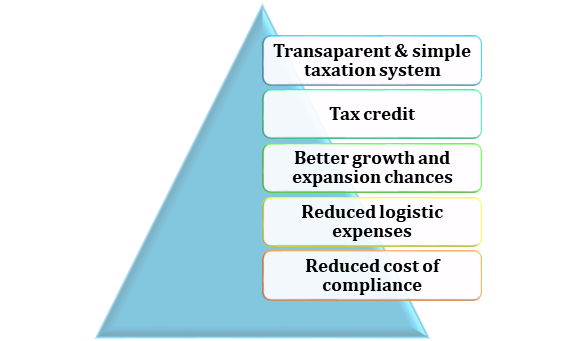

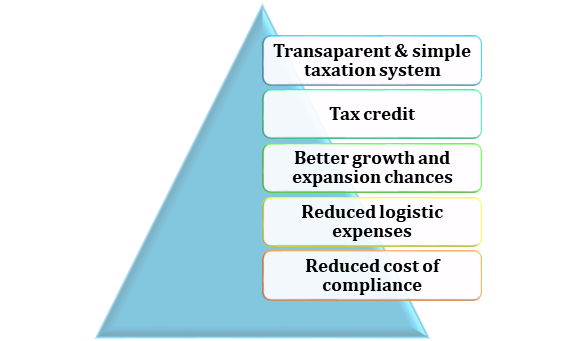

GST benefit for Start-up

Ease of Starting a Business in India under GST

With the implementation of GST in the country, the method for GST registration would be centralized and standardized identical to registration w.r.t service tax. Under this tax regime, a firm across the nation would never have to deal with VAT registrations. The method for obtaining GST registration would also be centralized, which will aid citizens in setup new firms with fewer tax complications.

Regulation of Un-organized sectors

Previously, industries like construction and textiles don’t work under the canopy of tax regulation. The arrival of GST ensures the comprehensive implementation of the tax reform across every sector. The revamped compliance and payment structures under GST have boosted these firms’ trading capabilities and make them accountable for the misconduct w.r.t tax liabilities. For example, the acceptance of input credit is not possible unless the supplier has accepted the amount.

Implementation of the composite scheme

The composition scheme is an essential part of GST that was rolled out to reduce taxes and other relevant compliances. The scheme aims to obtain taxes from the business owner on their turnover. Additionally, the scheme also seeks a quarterly return from these entities. The following points will show the regulations offered by the composition scheme.

- Small businesses with more than Rs 1.5 crore of turnovers are entitled to pay a flat GST and file a single return.

- Small firms with an annual turnover of more than Rs 50 lakh are accountable for paying 6% of GST.

Read our article: GST: Penalty, Offences and Appeals Under GST Act 2017

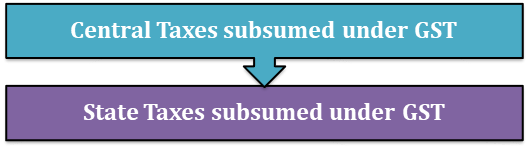

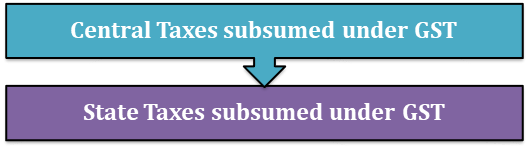

Subsuming Multiple Taxes in GST

The GST regime is the integration of all the taxes that exist in the old tax reform.

Central Taxes subsumed under GST

- Central cess & additional charges

- Service Tax

- Excise duty

- Custom duty

- Special additional duty of customs

State Taxes subsumed under GST

- Value Added Tax, aka (VAT)

- Central Sales Tax, aka (CST)

- Purchase Tax

- Octroi and Entry Tax

- State cesses and additional Taxes

- Luxury Tax

- Entertainment Taxes

- Taxes on lottery & betting

GST Exemption w.r.t Startups and Small Businesses

The government has waived off the requirement of GST registration for the firms whose annual turnover is less than Rs. 40 lacs. Many start-ups and small businesses across the country will be benefited from this provision. This will let them work seamlessly by averting GST related liabilities.

Simplification of Compliance Procedure under GST

Previously, businesses that are dealing with consumer appliances or restaurants need to take VAT and Service Tax guidelines into account. The businesses need to go through a hectic process of tax evaluation for different products and supplies. The advent of GST has eased out this difficulty by making compliance procedures simpler for the taxpayers. Due to a single tax proposition, organizations now need not be dealt with complex invoices anymore.

Online compliance processes

The online portal has made it easy for business owners to file their returns easily. With the centralized digital system onboard, business owners now don’t need to address different tax entities for registration purposes. Additionally, it also waived off the complexity w.r.t to the manual workflow, making GST return filling is a super easy process.

The Conclusion

Under the canopy of GST, the new start-ups and firms will flourish strongly and able to avoid unnecessary tax liabilities. GST implementation still seeks a crucial amendment that will unleash its full potential. On the whole, it still feels more practical and advantageous compared to previous tax reform. Therefore, we can conclude that GST is a catalyst for the growth of start-ups in India.

Read our article: GST Applicability on Works Contract for NCBS & Food Services for Exempted Institutions: AAR