The implementation of GST was one of the most prevalent changes that India’s taxation system has undergone in past years. The Indian Government now allows companies to take advantage of their GST return to avail the high-value GST business loan.

These loans are easily accessible and can help businesses cater to urgent financial needs. In this write-up, we will look at how GST business loans work and how a business owner can obtain them.

What is a GST Business Loan?

A GST business loan is practically a collateral-free loan. The business owners can avail it without mortgage any property as collateral. Financial institutions evaluate the borrowing capacity of credit seekers by analyzing their previous tax returns.

Based on the past tax returns, the banks or other financial lenders approve a suitable GST loan, leading to swift loan approval & credit availability. GST business loan averts the requirement of furnishing tons of approval for the approval process. Various banks or other financial lenders have their threshold limit for the credit amount.

Who are Eligible to Obtain GST Business Loan?

Several private & public sector banks provide GST loans to credit seekers. Therefore, selecting the right business loan can be a perplexing affair. Also, all banks don’t have a standard credit threshold limit. The Government of India has capped the business loan at Rs 1 crore.

Business sectors from all verticals will benefit from the advent of this new system. The following entities are eligible to obtain GST business loan under the new scheme;

- Public Limited Companies

- Private Limited Companies

- Partnership Firms

- Sole Proprietorships

Additionally, manufacturers, service providers, retailers, traders, and wholesalers can also apply for a GST business loan. In most cases, small & medium firms will receive such credit through the seamless validation process, a rarity with the conventional lending system. Therefore, business entities working as an MSME are eligible to obtain GST business loans without any hassles.

Read our article:GST Exemption on Satellite launches for Encouraging the Domestic Launch

59-minute Government Portal- Automating the Approval Process

The Indian Government has set up a new portal known as 59-minute to provides financial services to MSMEs. The portal has an extensive portfolio of loan amounts ranging from 10 lakhs to INR 1 crore. This portal’s approval process be complete within an hour, rendering businesses access to prompt and seamless funding. The GST loan approval process is completely contactless and automated.

The rate of interest on GST loan starts from 8% against no collateral whatsoever. The disbursement of such loans is connected to the CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) Scheme. Upon successful approval, the loan amount will be disbursed in about a week.

This portal leverage advanced algorithms to keep fraudulent activities at bay and to verify all the information furnished by the applicants. The portal has connectivity with several financial avenues, including banks, helping prevent in-person meetings or visits. The GST loan is provided by the Small Industries Development Bank of India as well as public sector banks, including;

- State Bank of India

- Punjab National Bank

- Bank of Baroda

- Indian Overseas Bank

- Vijaya Bank

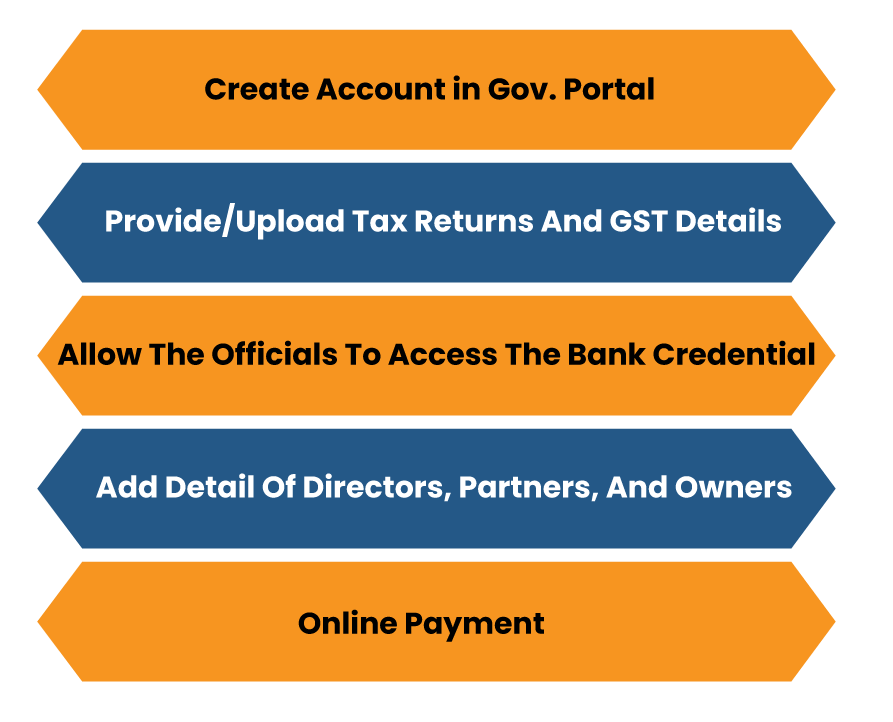

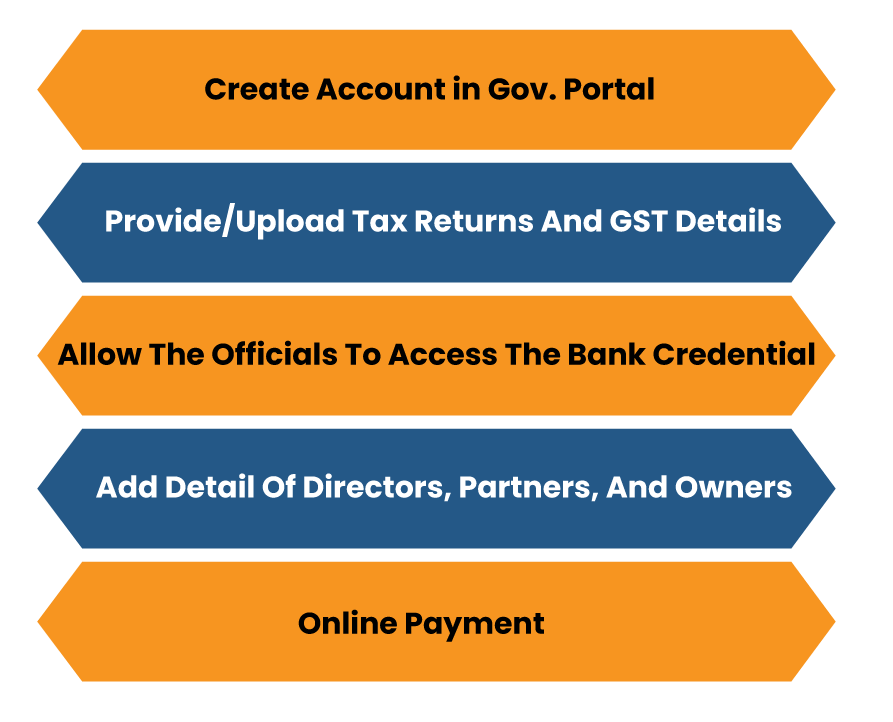

What is the Online Procedure to Avail GST Business Loan?

- First, visit the government portal and complete the registration formality by providing credentials such as email ID, phone no, and name.

- Next, log in to the portal and furnish the Tax information and GST details as required,

- Upload the XML version of tax returns and other financial documents. Note: the applicant can log in via their PAN and Incorporation date.

- Next, either login or upload via bank credential to allow officials to access the bank statements.

- Renders the information related to the directors, partners, and owners of the firm. Also, add the business detail and reason for obtaining the loan and a past track record for the same.

- Lastly, the applicant must opt for the suitable kinder, pay the requested fees and download the approval letter’s copy once the processing is complete.

The only criteria for availing loan from this portal is that the business[1] must be a year old and have monthly sales of not less than Rs 2,00,000.

What are the Documents Required for GST Business Loan?

- PAN card

- Residential address proof: driving license/ rent agreement/ voter’s ID/ Aadhaar card / ration card/ passport

- Bank account statements (last 6 months)

- GST registration certificate/ shops and establishment certificate/ company incorporation certificate /business PAN/ trade license

- Business owners seeking loans more than INR 20 Lakhs ought to furnish the following documents:-

- Audited financial statements (last two years)

- ITR detail of the last two years

- GST Returns (last six months).

Conclusion

India has a significant financial hub outfitted with thousands of financial institutions, including private lenders. But even their presence can’t ensure that every business can obtain the loans according to their needs. Also, tons of paperwork and tedious verification process makes the business more reluctant to approach banks or other avenues to get loans.

GST business loan, on the other hand, has mitigated all such requirements. The 59-minute government portal allows the applicant to verify their credential within an hour. After the successful verification process, the loan will be disbursed in their account within a week.

GST Business loans can have a remarkable impact on the lending business in India. The credit facilitation services in our country lack widespread reach. Most of the businesses fail to obtain the required funding from financial institutions due to Red Tapism. With such adversity escalating every passing day, the introduction of GST business loans is nothing short of relief for credit seekers across this county.

Read our article:Key Highlights of GST Updates 2021