With each day that passes, GST laws are becoming stringent instead of being simplified. That is why the department issues notifications from time to time to keep the interested people updated regarding the changes made by the authorities concerning various compliance procedures, Introduction of QRMP scheme, E-invoicing, tax rates, and related matters.

Here, we will discuss in a summarized form all the notifications and GST updates issued by the department. Here the recent GST updates of 2021, but before that we will have a look at the background of the GST-

An Overview on the Background of GST

Goods and Service Tax was introduced to-

- Remove the cascading of taxes,

- Remove the situation of collecting multiple taxes on every level of production.

Multiple taxes are also collected at every level of production under GST, but the manufacturer is refunded back on further levels. GST is a destination-based tax; it is levied at the point of consumption not at the place of manufacturing. Every state had a different set of regulation under GST.

GST Updates-Latest Notification 2021

Latest updates on the GST are given below for your understanding, which are as follows-

GST Update as on 1st January 2021

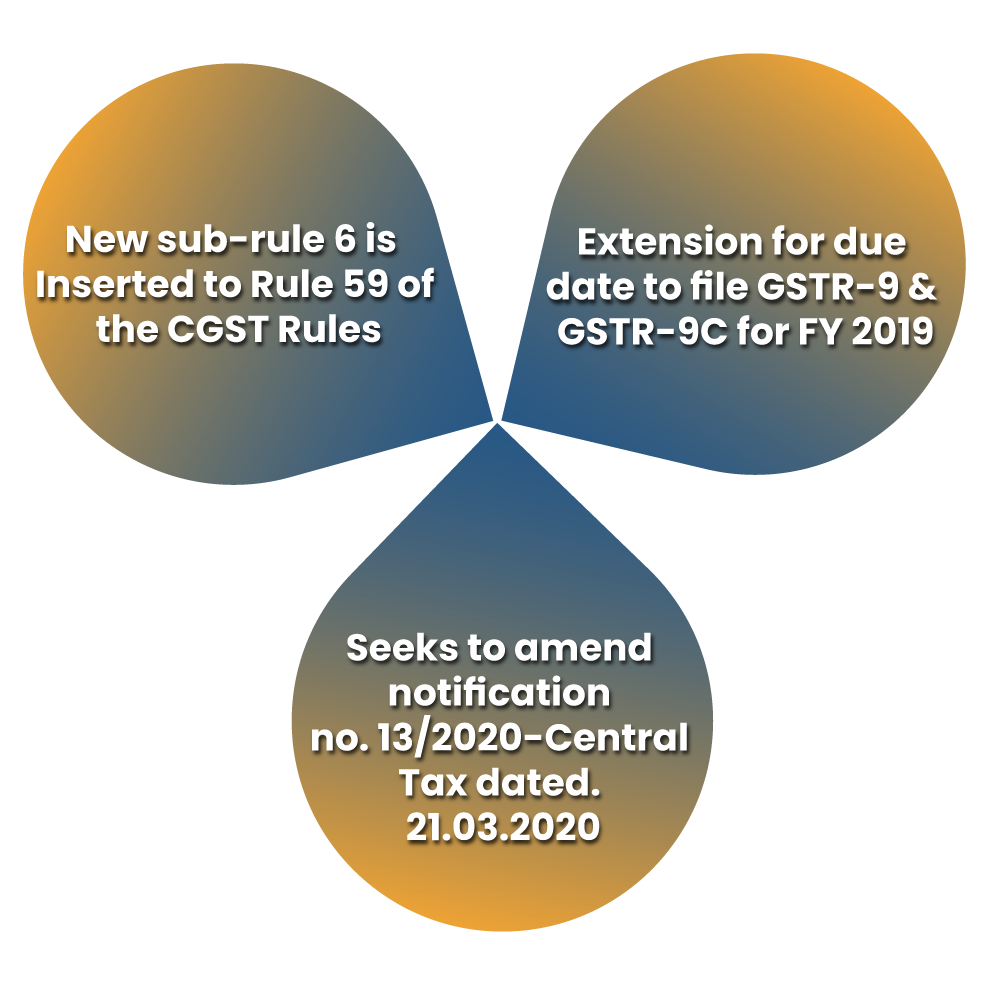

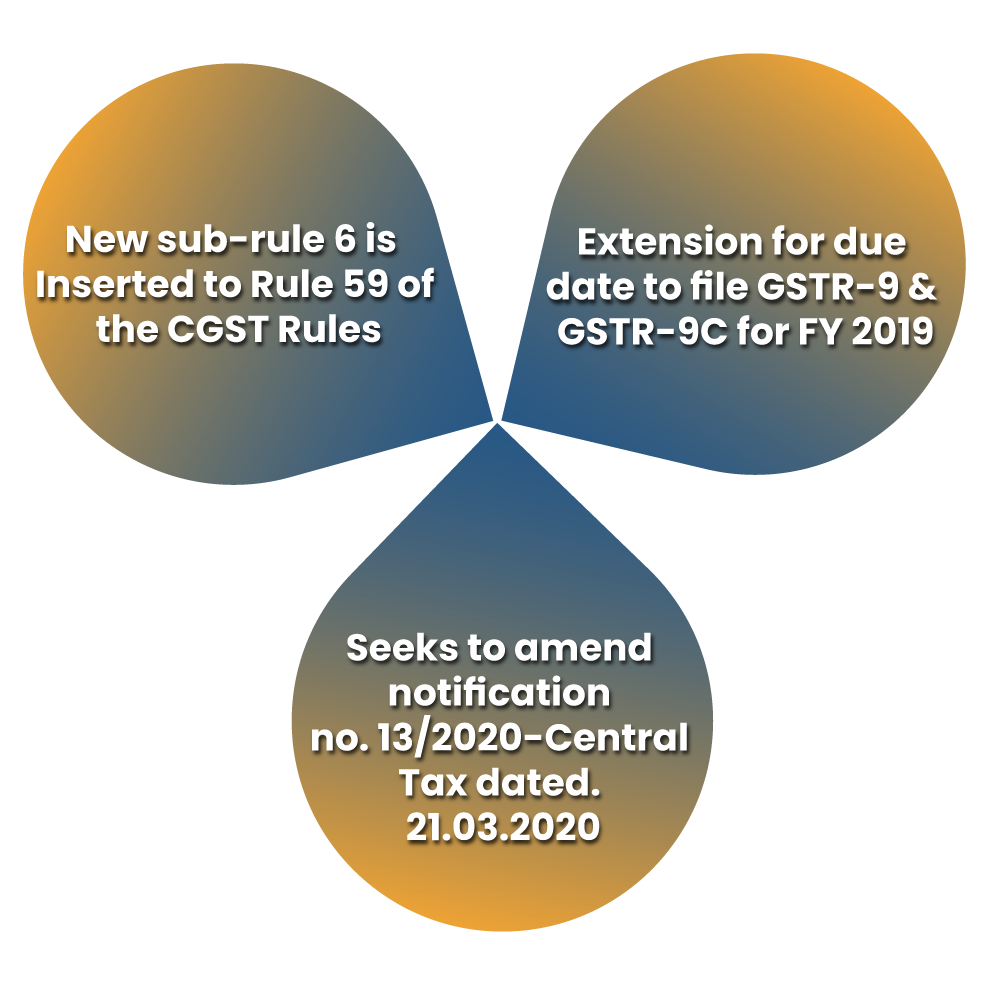

New sub-rule 6 is Inserted to Rule 59 of the CGST Rules

Wide Notification 1/2021, dated on 01/01/2021, the department seeks to amend the CGST Rules, 2017 to CGST Amendment Rules, 2021-. Its Subject is to amend the CGST Rules, 2017 to CGST Amendment Rules, 2021. A new sub-rule 6 is inserted to rule 59 of the CGST Rules, 2017, limiting or closing the filing of GSTR-1 as follows:-

- For filing of GSTR-1 on monthly basis – GSTR-1 for the current month is not allowed, where GSTR-3B filing for the preceding 2 months is pending.

- For filing of GSTR-1 on Quarterly Basis, where GSTR-3B filing for the preceding tax period is pending, then neither the Invoice furnishing facility (IFF) nor the GSTR-1 for the current quarter is allowed.

- Where more than 99% of tax liability is carried out through electronic credit ledger under Rule 86B, then the taxpayer cannot use-

- The Invoice furnishing facility or

- file GSTR-1,

if the previous tax period’s GSTR-3B is not filed.

Extension for due date to file GSTR-9 & GSTR-9C for FY 2019

On 30thDecember2020, the Department has extended the due date to file GSTR-9 & GSTR-9C for FY 2019 from 31st December 2020 up to 28th February 2021.

Seeks to amend notification no. 13/2020-Central Tax dated. 21.03.2020

- For the applicability of e-Invoicing, in place of “a financial year”, substituting the words and figures “any preceding financial year from 2017-18 onwards.”

- Positioning the words “or for exports”, after the words “goods or services or both to a registered person”.

GST Update as on 4th January 2021

- To meet the GST compensation shortfall, the central government has released the 10th installment of INR 6000 crores (As a loan) to the states.

- Also, a new facility of interaction between taxpayers has been provided on the GST Portal[1].

GST Update as on 6th January 2021

GSTN has initiated a new Invoice Furnishing Facility (IFF) under quarterly return filing & monthly payment scheme for taxpayers. IFF is an optional facility provided to the taxpayer under the QRMP scheme.

GST Update as on 7th January 2021

For existing taxpayers, the authority has added a new feature of Aadhaar authentication & electronic KYC (E-KYC). The feature is available on the GST portal.

Highlights of Budget 2021 Expectation in GST

Intending to simplify the GST and Labour laws, the department has issued the various notifications, which are as follows:-

Regulating the Payment of Taxes through Input Tax Credit

As per the recent notification issued by the department, if the monthly taxable sales are more than Rs 50 lakhs, it has been made compulsory to pay 1 % of GST liability in cash. However, there are few exceptions to it, and is not allowed to be set-off against input tax credit.

Exception-The restrictions for the payment of taxes through ITC would not be applied to the following where-

1. Income Tax paid by-

- An individual or the proprietor or,

- Karta or,

- The Managing Director or any of its 2 partners,

- Whole-time Directors,

- Members of Managing Committee of Associations or,

- Board of Trustees

of Rs 1 lakh or more in each of last 2 financial year.

2. Claimed refund of the Input tax credit on zero-rated supplies of 1 lakh or more in the previous financial year,

3. Claimed refund of the Input tax credit on an Inverted duty structure of 1 lakh or more in the previous financial year.

4. The person registered under GST has carried out his liability towards output tax through the electronic cash ledger for an amount which is over 1% of the total output tax liability, applied collectively, up to the said month in the current financial year; or

5. The registered person is a Government division, a Public sector Unit, a local official, ora statutory body.

- With a requirement of physical verification of office address, the GST officer has increased the time limit of permitting the GST registration.

- As per recent GST Updates, GST officers have been assigned more powers to cancel GST registration in several cases.

- Respective state governments are anticipating GST department audits and scrutiny’s as per respective State GST laws to comply with the GST Update of 2021.

Impact on MSMEs and Startups as per recent GST Updates

The above GST Updates in Budget expectations shall not only shoot up time and compliance costs for MSMEs and startups but will also bring out manipulation and badgering. MSMEs and new startups anticipating untangled and programmed tax laws are not such complicated and officer-determined laws.

Conclusion

The department keeps on changing and amending the provisions related to GST and other taxes. The reason behind such change is to avoid future contingencies and for the ease of the taxpayers.

Once a person gets registered as a Goods and Services taxpayer, he has to follow all the compliances and GST updates issued by the GST Council from time to time. For any queries related to the Goods and Service Tax, GST updates, and related notification feel free to contact our experienced and trained professionals at Corpbiz.

Read our article: GST Exemption on Satellite launches for Encouraging the Domestic Launch