Before GST implementation, taxpayers have to confront strings of indirect taxes in India. Every state in the Indian province has its specific indirect tax structure. After the arrival of GST, all the indirect taxes have been integrated into one tax.

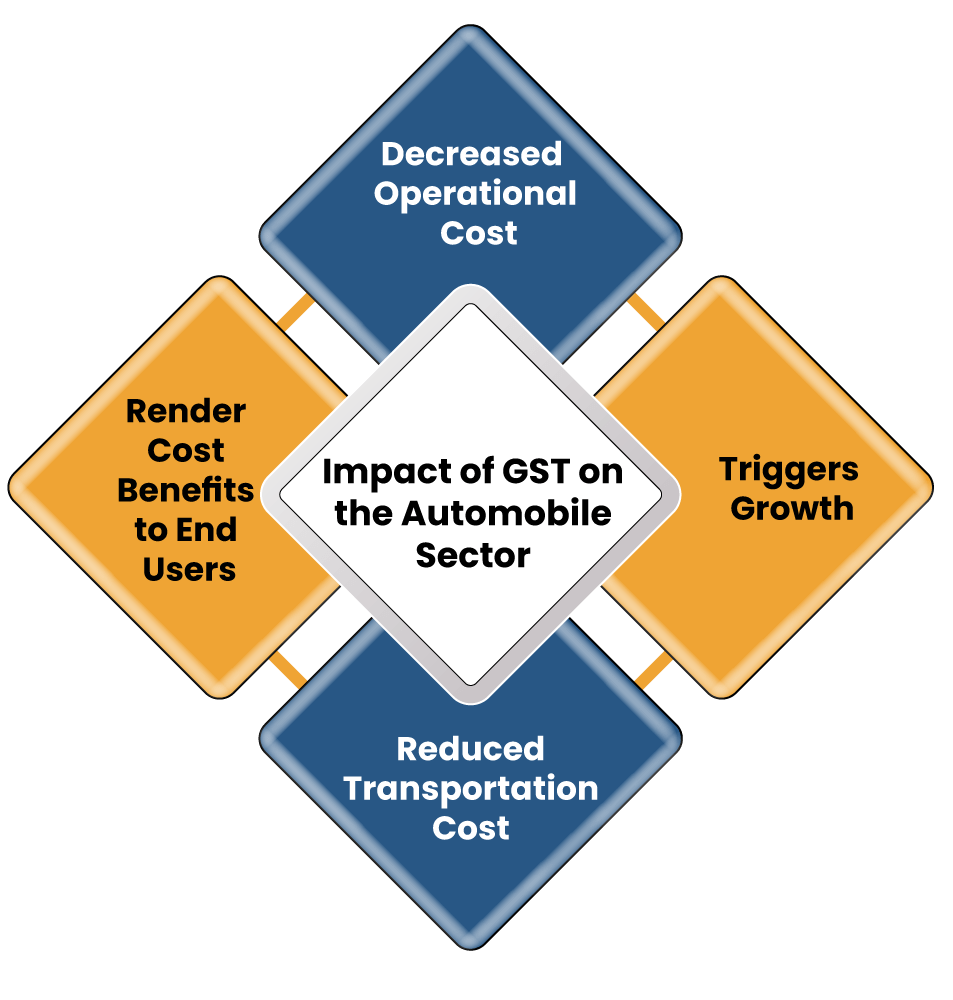

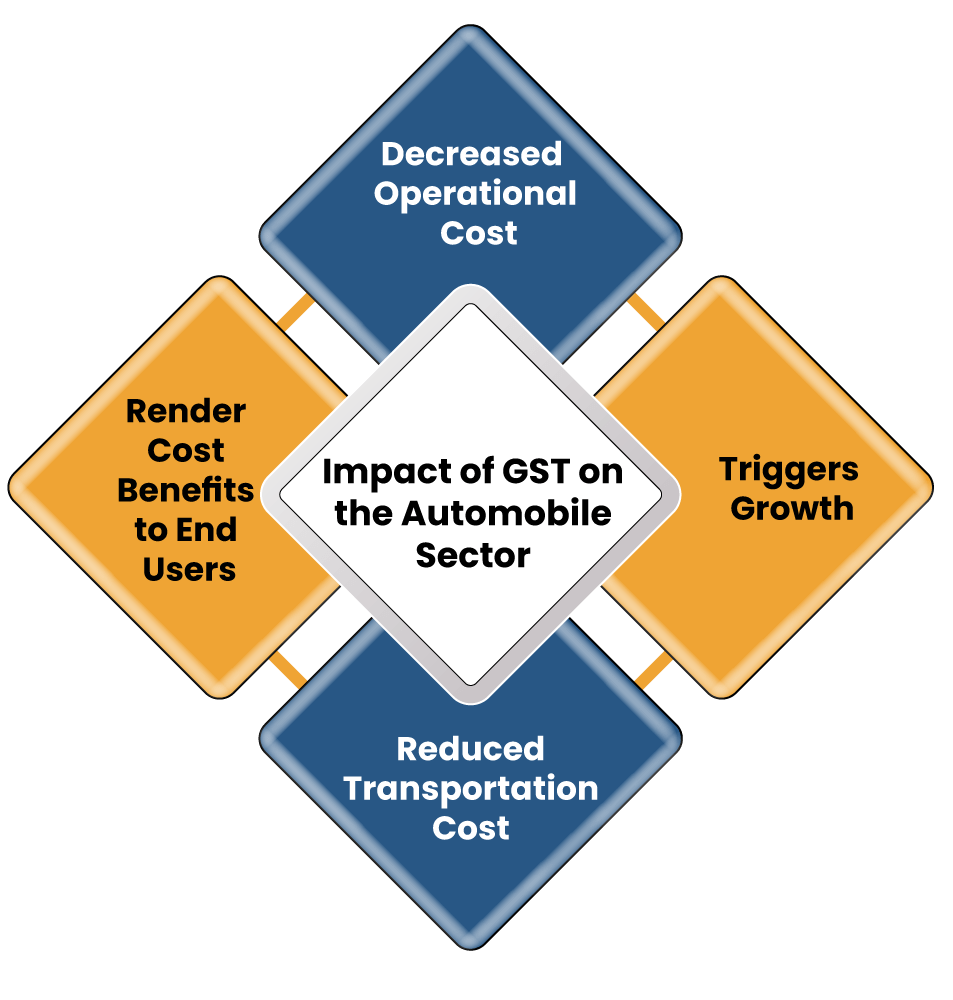

Positive Impact of GST on the automobile sector

As expected, the Impact of GST on the automobile sector is considered positive as the automobile makers were bound to address fewer tax liabilities which ultimately benefits the end-users. Before GST was implemented in India, various taxes like road tax, sales tax, VAT[1], sector tax, registration duty, motor vehicle tax were imposed. Fortunately, all these taxes are now integrated under the GST regime.

GST on vehicles has drastically reduced the transportation cost of goods. This is done by eliminating all irrelevant taxes accountable for raising the transportation cost.

Eventually, the subsumed tax leads to the price reduction of the automobile in India when contrasted with former prices before GST.

Decreased Operational Cost

The most complex central state tax has been eliminated after the implementation of GST. Now automobile makers can stock up their produce in fewer warehouses and can rejoice in low operating costs. Moreover, taxes paid on promotion or advertising cover under the ITC i.e. input tax credit, which will eventually lead to low operating costs.

Effect on Working Capital

Every entities including automobile manufactures and dealer under GST Registration needs to address the certain tax liabilities depending the slab tax. Even after the reduction in operating costs, the surge in the GST tax rate on the automobile has been witnessed. This of course has become a serious matter of concern for dealers. Here are the reasons behind this setback.

- Whenever any vehicle is dispatched from one place to another, GST is paid and capital is locked since such supply attracts GST. Now, the dealer is liable to pay GST on the same day. However, this will also enforce the dealer to adopt a deliberate approach to avert disrupting their outflow.

- Cash lock on free services is another loophole that might affect dealers under the GST regime. The majorities of automobile makers render free services or warranty cards while selling vehicles to benefit the customers. GST will apply to such services at the time of their issuance. However, customers are free to redeem these services whenever they want or as per their convenience.

Read our article:GST on Motor Vehicle Renting Services

What are the GST Rate on Automobiles?

The calculation of GST on the automobile is essentially done by taking a fixed base rate and additional cess into account. Currently, the fixed base rate is capped at 28%. The cess slab rate ranges from 1% to 22% depending on the type of vehicles.

Two-Wheelers

Two-wheelers equipped with 350cc engine would attract 28% GST, whereas the vehicle with the engine above 350CC has to confront GST @ 31%.

Commercial Vehicles

The majority of the commercial vehicles shall be charged with a 28% tax, which was previously capped at 30.2%. But, minibuses, in particular, have been largely affected as these lures cess charge of 15%, which makes the total to 43%. While the majority of commercial automobiles have witnessed a negligible effect post-GST implementation, GST on thirteen passenger minibuses has raised concerns.

Luxury Car

Luxury car taxed at 42-45% under the GST regime. Under the erstwhile tax regime, these cars are taxable at 50% or more which seems quite steep considering the base price of the car.

Small Cars

Well, the tax structure for the small car under the GST regime is more or less the same. Currently, small cars are taxed at 28%+1% cess under GST. The previous rate at which these cars are taxed was capped at 29%. This is a marginal hike in the tax rate.

Hybrid Cars

Hybrid cars are taxed heavily under GST. As per the existing slab rate, the hybrid cars are supposed to be taxed at 28% + 15% cess. Under the former tax regime, these cars attract 30% of the tax rate only.

Spare Parts

The spare parts market could be disrupted after the introduction of the new tax rate under GST. Previously, spare parts are taxed at 12% only but after the implementation of GST, spare parts are taxable @ 28%. But this rate does not apply to all categories of spare parts. As per the tax authority, spare parts under the code 8708 will attract the tax rate of 28%, which will be divided equally between the center and the state. The parts like rubber hoses with code 4008/4009 would be taxed at 18% GST.

Tabular representation of GST rate on different class of automobile

| Category | Before GST | After GST |

| Two wheelers | 30.2% | 28-31% |

| Small cars | 24-25% | 29-31% |

| Luxury cars | 50% | 42-45% |

| Spare parts | 12% | 28% |

| Hybrid cars | 30% | 43% |

| Commercial vehicles | 30.2% | 28% |

Conclusion

To be specific, the existing slab tax under GST for the automobile industry might look steep on the surface, but in reality, it will reduce the tax liabilities on the supplier to a considerable extend. However, Spare part manufacture could face tough times in confronting the existing tax obligation because of the higher rate.

So we can conclude by saying that the impact of GST on the automobile sector, on a whole, is the positive one. Consider connecting with CorpBiz’s experts to avail in-depth insight into this matter. We also assist our clients to obtain GST registration in a seamless way.

Read our article:What is the Impact of GST on Loans?