The indirect tax inference on Motor Vehicle Renting Services has always driven the attraction because of its complicated abatement/ exemption treatment in the other law. In recent years, the Motor Vehicle Renting Services (also known as rent-a-cab facility) has increased in bounds and boundaries. Nowadays, even a common man is aware and is frequently using the cab service provided. In this article, we will comprehend the GST on Motor Vehicle Renting Services.

Understanding GST on Motor Vehicle Renting Services

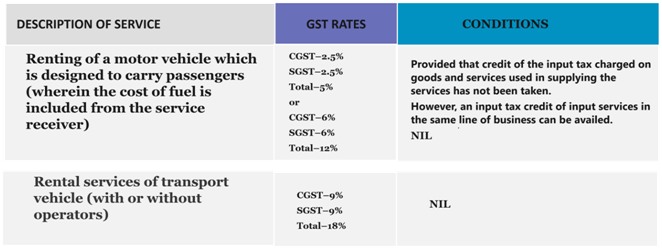

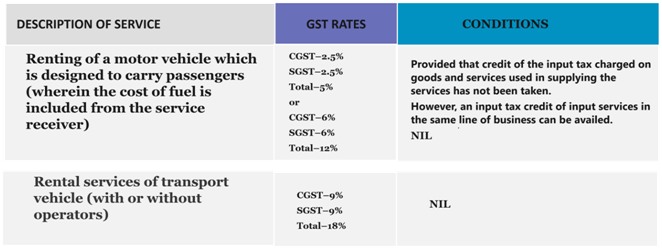

GST rates on Motor Vehicle Renting Services have been agreed under notification no.11/2017-Central Tax (Rate) dated 28.06.2017, it has been explained below:-

According to the above-referred notification, the motorcar service provider has the following two options, in terms of GST rates:-

- To pay GST @5%, where the input tax credit should not be available (an input tax credit of only input service of the same business line can be availed);

- To pay GST @12%, where the input tax credit is available.

Reverse Charge Mechanism

The Reverse Charge Mechanism has been presented by the Government of India for the vehicle rental services. The Government of India observed that the common people operating the vehicle rental services belongs to an unorganized sector of the society. Similarly, the small initiatives operating in the field of vehicle rental service are not able to obtain GST registration or files for GST return. To address any related issue the Central Board of Indirect Taxes and Customs have introduced

Circular No.130/49/2019 on 31st December 2019.

The circular issued is based on the recommendations from the 37th GST Council meeting[1] held. The circular has made RCM compulsory for assessee in the vehicle rental service on the fulfilment of special circumstances. After introduction of the circular, the Government of India aims at providing relief to assessee in the vehicle rental services since they are having exemptionfrom paying GST.

RCM is a broad concept that is applicable on the assessees covered under Section 9(3) of the Central Goods and Services Tax Act, 2017. Usually, the supplier of the products is liable to pay GST. However, under the RCM, the customer is responsible to pay GST. The Reverse Charge Mechanism is applicable routinely in the case of imports and purchases made from any unregistered buyers. It is also applicable on the list of goods and services provided by the Ministry of Finance.

Conditions for Applicability of Reverse Charge Mechanism

- The assessee must not be a company or LLP;

- The individual must be involved in the profitable business of providing motor vehicles on rent;

- The motor vehicle renting services should be a commercial vehicle designed exclusively to carry passengers

Read our article:What is Input Tax Credit under GST?

Effect of the Circular on the Assessees

Individuals who are not covered by the RCM have the option to choose a five percent GST rate with limited Input Tax Credit. Otherwise, the assessee can opt for a twelve percent GST rate with the availability of full ITC benefit. In both cases, there should be no breakage in the tax cable. Henceforth, the individual can sell the products to clients at competitive prices. The effect of the options is clarified below:

Five percent GST

The assessee can opt for a five percent GST rate charges. In these cases the selections available to the individual to claim Input Tax Credit will be limited.

In such a scenario, the individual will be able to avail of ITC exclusively from invoices that have been raised by individual in the same line of occupational. Additional, the assessee will be able to claim Input Tax Creditsolely for invoices relating to companies.

The individual is allowed to be compensated for the input items on which ITC is not permitted. The reimbursement is available because the tax rate is five percent. The individual recovers the ITC partly by set off and partly by the concessional tax rate of five percent. Henceforth, there is a minimal breakage in the tax chain, which is compensated by a concessional GST rate charge.

Twelve percent GST

The individual also have option for a twelve percent GST rate charge. There is no restraint on the accessibility of the Input Tax Credit. In such scenario, the individual has to avail of ITC for all statements received for input tax credit. Input Tax Credit would be allowed if the input goods and services are linked to the vehicle rental service.

There can items used indirectly in the course of the business. Indirect topics can include packing items, electrical spares, consultancy fees for workforce services, and other things. The individual is allowed to claim ITC for related issues.

Input Tax Credit is accessible for all items used as input in the persistence of the business. Henceforth, there is no breakage in the tax chain.

Conclusion

The indirect tax inference on Motor Vehicle Renting Services has always driven the attraction because of its complicated abatement/ exemption treatment in the other law. In recent years, the Motor Vehicle Renting Services (also known as rent-a-cab facility) has increased in bounds and boundaries. Nowadays, even a common man is aware and are frequently using the cab service provided.

Our CorpBiz group shall be at your disposal if you seek expert advice on any aspect related with GST Registration along with complete compliance. We will help you ensure full compliance concerning all the requirements based on your anticipated activities, ensuring the productive and well-timed completion of your expectation.

Read our article:Procedure for Appeals under GST