The Goods and Service Tax Network (GSTN) has unveiled exhaustive guidelines on 05/11/2020 for the taxpayers regarding prominent GST errors on GSTN portal. The guide also enclosed the solution for the probable errors that taxpayers encounter now and then.

These problems are generally associated with refunds, registration, appeals, DRC-03, appeal, and payment. GSTN is a non-government, non-profit organization which manages and controls the IT system of the GST portal.

The GSTN while addressing issues in the new registration mentioned about the GST errors that occur in the form of a message (‘pending for Clarification’) during the generation of ARN status. Fortunately, the concerned authority has responded to the problem by providing Show Cause Notice against the application for GST registration. This notice is needed to be reviewed, filled, and submitted by the taxpayer accordingly.

What are the Core Issues addressed in the Guide?

While tackling the issues with registration, the network has come across new registrations, cancellation of registration, application issue, GSTN-MCA integration, and changes in basic the non-core fields. The GSTN has encountered anomalies with GSTR 1, GSTR 3B, GSTR 2A, GSTR 9, GSTR 9A, GSTR 6, and ITC. Apart from that network also came across an issue related to GST and filing refund application.

The network while sorting out the solution for the refund problem dealt with refund-related issues that usually become inevitable while submitting or saving the application.

Common GST Errors and Solutions

| S.no | Category | Sub-Category | Error | Solution |

| Registration | New Registration | “Pending for clarification” a message prompt whenever the tax authority rolled out the SCN (Show cause notice) | Go through show cause notice carefully and submit the requested information. | |

| Registration | New Registration | “Updating Jurisdiction in the application.” | Contact Jurisdictional Authority to obtain the required solution. | |

| Registration | New Registration | “Add new “option is not working | Increase the number of places in the text box in the Part-b of the registration | |

| 4. | Registration | New Registration | E-commerce operators cannot opt for composition scheme. | This option isn’t available for the e-commerce operators. |

| Application | AD-VPAU-9001 | Raise the ticket on the portal and the screenshot on the portal | ||

| Appeal | CM-CSC9020 | Raise the ticket on the portal and the screenshot on the portal | ||

| GSTR3B offline | Create a JSON file and upload it without any changes |

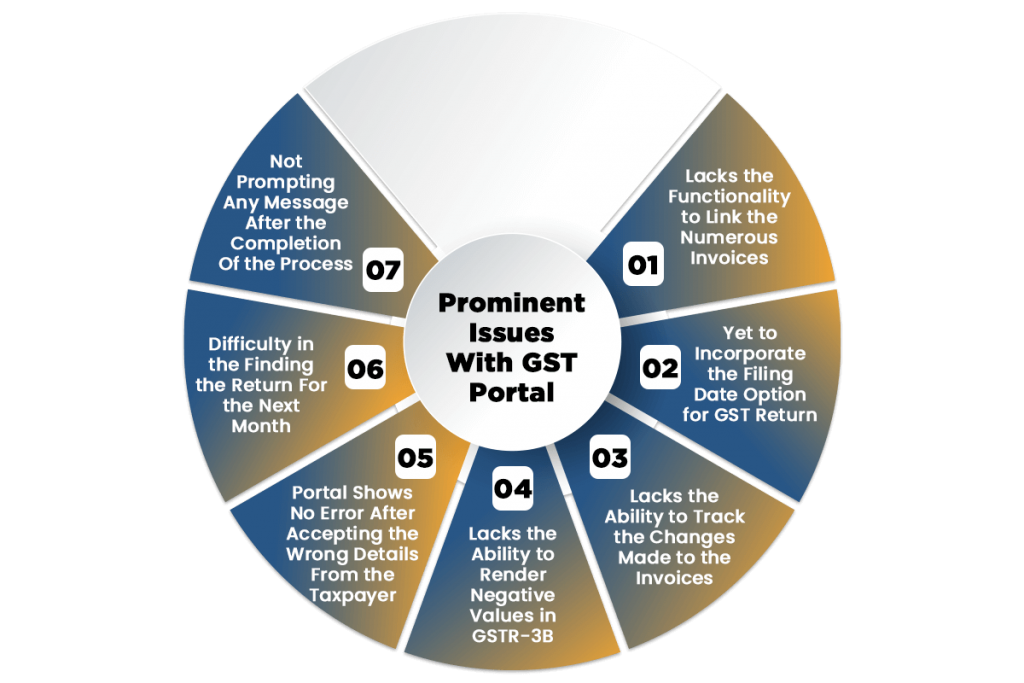

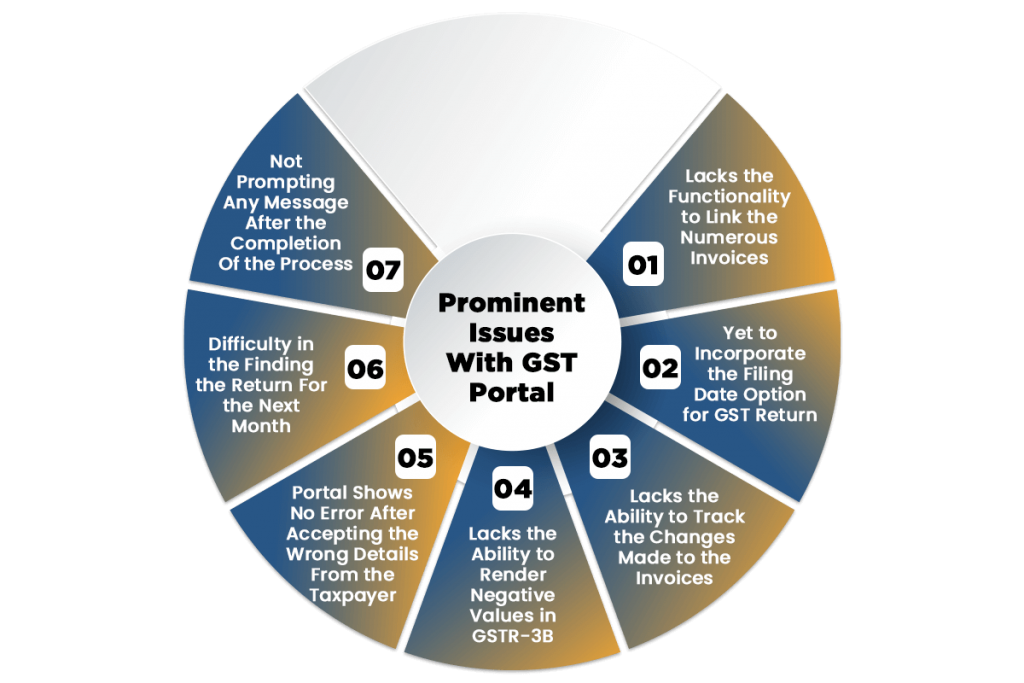

Despite the state of the art infrastructure and technology, the GSTN network is plagued with plenty of technical errors. In addition to the above anomalies, there are few more issues as well that hinders the functionality of the portal. The list below shows the same.

Conclusion

It seems GST portal is dealing a bunch of severe anomalies right now which seeks prompt resolution. From a taxpayer point in view, these issues could dent their credibility if the returns were not filed on time. On the other hand, government, in association with relevant authorities, is taking every possible measure to control the situation but seems they are still far away from a concrete solution for the GST errors.

If you are not accustomed to the GST errors and having issues with filing your return, then you can avail help from CorpBiz experts.

gstissuesandsuggestedsolutionsRead our article: List of Goods and Services where GST is Applicable: Latest Rates