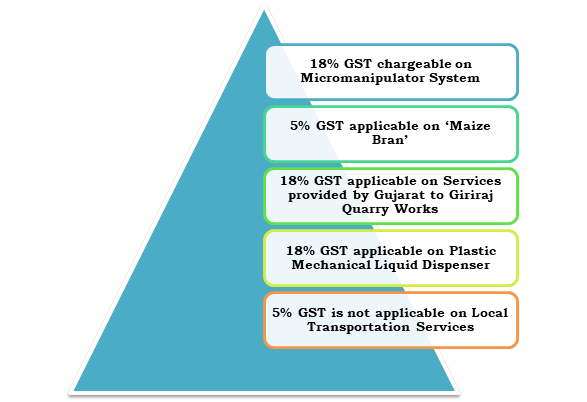

The Authority of Advance Ruling has specified various goods and services where GST is Applicable or not. Following are the Goods and Services-

18% GST chargeable on Micro-manipulator System

The Gujarat Authority of Advance Ruling (AAR) ruled on 2nd July 2020 that 18% GST is Applicable on the Micromanipulator system with retrospective effect from November 15, 2017.

The applicant, M/s. Shivani Scientific Industries Pvt. Ltd. who is engaged in the supply of medical equipment in relation to ‘Micromanipulator System’ which is basically Intracytoplasmic Sperm Injection used in Assisted Reproductive Technology Process. The applicant has declared that they have received the orders for supply of ‘Micromanipulator System’ from several customers and is selling the same to them. The applicant wanted advance ruling on the issue whether Micromanipulator system is classified under tariff heading 9018 or 9011, which means, what is the tax rate on Micromanipulator System.

Ruling

The product ‘Micromanipulator system’ manufactured and supplied by M/s. Shivani Scientific Industries pvt.ltd. is classified under Tariff item no.9011 of the First Schedule of the Customs Tariff Act, 1975 (51 of 1975). Moreover, the product is covered under Entry No.184 of Schedule-IV of Notification No.01/2017-Central Tax (Rate) dated 28th June 2017 (upto 14th November 2017) and under Entry No.411F of Schedule-III of Notification No.01/2017-Central Tax (Rate) dated 28th June 2017 (as amended) (with effect from 15th November 2017) issued under the CGST Act, 2017[1]. Applicability of the GST rate on the above-mentioned product would be 28% (14% SGST + 14% CGST) upto 14th November 2017 and 18% GST (9% SGST + 9% CGST) with effect from 15th November 2017.

5% GST applicable on ‘Maize Bran’

The Gujarat Authority of Advance Ruling ruled out that 5% GST is applicable on ‘Maize Bran’ on 2nd July 2020 with retrospective effect from 28th June 2017.

In the Central Excise rule, the classification and rate of duty was determined on the basis of the Central Excise Tariff Act, 1985. As per Central Excise Tariff Act, 1985, the rate of duty of the said product was NIL.

Whereas in the GST regime, categorization of the goods is established on the basis of the Customs Tariff Act, 1975 and GST rate is determined on the basis of Notification No. 01/2017-CT dated June 28, 2017.

Then, the rate of duty determined in Central Excise Rule does not have any legal value as such, after initiation of the GST Act with effect from 1st July 2017 GST rate and categorization of any product is to be determined under the said GST Act.

Ruling

The bench of Sanjay Saxena and Mohit Agarwal ruled out that the product ‘Maize Bran’ produced and delivered by M/s. Sayaji Industries Ltd. It Comes under Entry Sr.No.103A of Notification No.1/2017- Central Tax dated 28th June 2017 of the CGST Act, 2017 on which GST rate applicable is 5% (2.5% SGST and 2.5% CGST).

18% GST applicable on Services provided by Gujarat to Giriraj Quarry Works

The Gujarat Authority of Advance Ruling ruled out that 18% GST is applicable for services provided by Gujarat to Giriraj Quarry Works for which royalty is paid on 2nd July 2020 with retrospective effect from 28th June 2020.

The Applicant, M/s. Giriraj Quarry Works is involved in the business of excavation of “Black Trap” in Gujarat. The product is classified under Tariff Heading 2517 and GST is applicable at the rate of 5% in Schedule-I.

The applicant required the Advance Ruling on the issue of what is the categorization of service provided according to Notification No. 11/2017-CT dated 28th June 2017 – read with annexure attached to it, for which royalty is paid. The other issue raised was what the rate of GST is on given services provided by Gujarat to M/s Giriraj Quarry Works.

Ruling

The bench of Sanjay Saxena and Mohit Agarwal ruled out that the activity undertaken by the applicant is classified under Heading 9973 that is leasing or rental services, with or without operator, as mentioned Serial No. 257 in the annexure. “The activity undertaken by the applicant has to pay 18% GST (9% CGST+ 9% SGST),” as ruled by the AAR.

18% GST Applicable on Plastic Mechanical Liquid Dispenser

The Authority of Advance Ruling ruled that 18% GST is applicable to Plastic Mechanical Liquid Dispenser on 3rd July 2020 with retrospective effects from 15th November 2020.

The Applicant imports “Plastic Mechanical Liquid Dispensers” and selling them in the local market. These dispensers are used as the bottle caps used for dispensing liquid.

The applicant submitted that they were not sure about the HSN of the imported goods, and other competitors were supplying the same product under HSN 8424 and 9616. So, it led to confusion, and they applied for Advance Ruling on the classification of the imported goods.

Ruling

The bench of Sanjay Saxena and Mohit Agarwal ruled that that the imported Plastic Mechanical Liquid Dispenser should be classified under Chapter sub-heading 3926.90.

5% GST is not applicable on Local Transportation Services

The Rajasthan Authority of Advance Ruling ruled that 5% GST is not applicable on local transportation services on 2nd July 2020 with effect from 28th June 2017. The applicant is involved in the business of providing tourism services identified by the Main Tour Operator.

The Applicant raised a single invoice in which all the services are shown as separate items for accounting purposes. Yet, the final amount charged by the Applicant from the Main Tour Operator is the full amount of all the services provided by the Applicant to the Tourist together. The applicant wanted the advance ruling on the issue of whether 5% GST is applicable under heading 9985(i) applicable on transaction which the Applicant intended to undertake a single invoice raised in local transportation services.

Ruling

The applicant is representing only transportation with some subsidiary services and not accommodation; it does not satisfy the conditions stated under Serial No. 23 Chapter heading 9985 of Notification No. 11/2017 Central Tax dated 28th June 2017, therefore, 5% GST is not applicable.

Conclusion

The Authority of Advance Ruling has laid down certain changes related to where GST is Applicable in case of various goods and services that is Micromanipulator System, Local transportation services, Plastic Mechanical Liquid dispenser, Maize bran and services provided to quarry workers by the state. To know more in details, you may please contact CorpBiz professional for better understanding of the same.

Read our article: Latest Orders by AAR on Different Segments Related to GST