The advent of Goods and Services tax has revamped the notion of indirect taxation in India. Unlike the previous tax regime, it is completely transparent and free from complexities. The deployment of the GST has made it easy for the tax authority to get rid of tax-evasion and bribery. GST not only accelerated the growth of the Indian economy but also help the government to escalate its revenue. It practically obliterated the cascading effect of tax that exists in the previous system. In this write-up, we would look into the deeper concept of the GST applicability on NBFCs. But before we get started with the main topic, let’s get familiar with some basics of Goods and Service Tax.

What is the Goods and Services Tax (GST)?

GST is the form of indirect tax that has overcome other indirect taxations in the country. It is a transparent and destination-oriented tax that was approved by the parliament in the year 2017. Since it is a value-added tax, it is applicable at every level of a supply chain.

Read our article:GST Registration Documents: A Complete Checklist

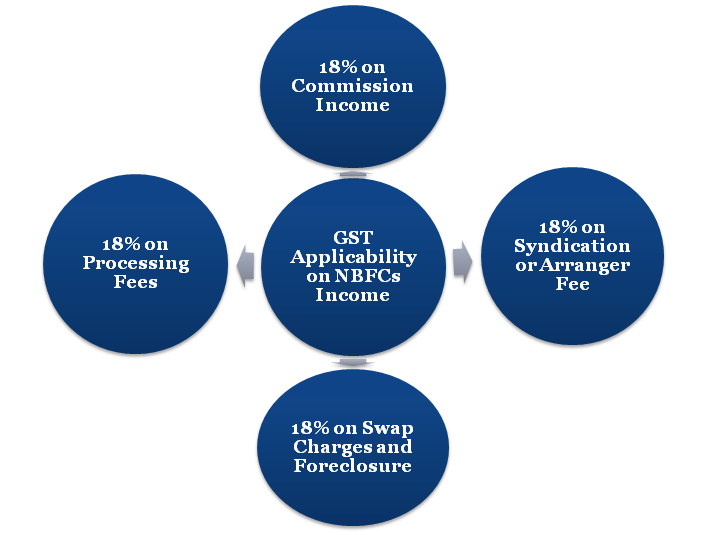

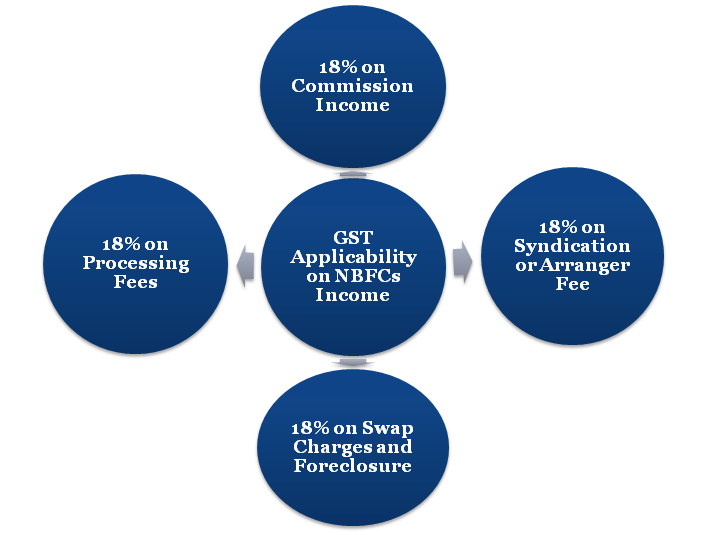

GST Applicability on NBFCs

Some of the pivotal requirements and taxability are mentioned below:-

- Post GST, the services rendered are taxable @ 18% which previously was capped at 15%.

- Before GST, taxpayers used to avail of central wise GST registration, but now the taxpayer used to obtain state-wise GST registration.

- ISGT will be applicable to inter-state supplies of services same that occur between the branches of the same entity.

- The GST registered entity has to address 3 returns/month i.e. GSTR-1, GSTR-2. GSTR-3 along with annual return in each state where they carry out their business. That’s means GST registered entity has to file 37 return/annum in each state. In the case of ISD and TDS, the entity has to file 61 returns (5 returns / month + 1 annual return).

Essential Aspects of Goods and Services Tax on NBFCs

1. Place of Supply- the place of supply of financial services such as stockbroking services to any individual should be at the premises of the recipient of services. According to section 12(12) of the IGST Act 2017 if the place of the recipient does not exist in the supplier’s record, then the place of supply can be the premises of suppliers.

2. Input Credit Tax: Section 17 of the CGST Act provides the following options for the input credit tax.

- Every month obtain an amount equivalent to fifty percent of the input tax credit on capital goods and services in that month. The remaining shall be lapsed as per Rule 3 of Input Tax Credit.

- According to section 17 (2) of CGST Act & Rule 7 of the ITC, the input tax is available for the taxable supplies as per section 17 (2) CGST (Central Goods and Service Tax) Act and rule 7 of the ITC (Input Tax Credit), take input tax as is regarded as being caused by taxable supply only and not for exempted supply.

Input Tax Credit Rule -3

NBFCs carrying out business in the supply of services by receiving deposit or disbursing credit cannot obtain the credit of paid tax-related input services that being utilized for non-business purposes.

Furthermore, these entities cannot avail credit attributable to supplies as per the sub-section (5) of section 17.

Apart from that, in the purview of sub-section (4) of section 17, NBFCs will avail credit of tax paid concerning inputs and services. The rest of the amount, fifty percent shall be the input tax credit allowable for the company. To avail of such a credit, taxpayers need to take advantage of the Form GSTR-2.

Reference of Section 17 (2) of CGST Act 2017, for understanding GST on NBFCs

In case the goods and services are used by the registered taxpayer partly to effect taxable supplies that include zero-rated supplies as well under the CGST Act[1] or ISGT Act and partly to effect exempted supplies under both the Acts, the credit’s amount would be limited to so much of the input tax as is attributable to taxable supplies that includes zero-rated supplies as well.

Reference of Section 17 (4) of CGST Act 2017, for understanding GST on NBFCs

A financial entity such as NBFCs will have an option to adheres to the provisions of sub-section (2) or obtain fifty percent of input tax credits available for inputs, input services, and capital good in the month.

The remaining will be lapsed provided:-

- The option used once shall not be withdrawn during the rest of the financial year;

- The restriction of fifty percent shall not impose on the tax, which is already paid on the supplies by a registered individual to another having an identical Permanent Account Number.

Beneficial Aspects of GST Applicability on NBFCs

Beneficial aspects of Goods and Services Tax are as follows:-

- The GST has accumulated all indirect taxes under a single ambit. Now the taxpayer does not have to address indirect taxes like state cess, excise duty, purchase tax, sales tax, etc individually.

- Since GST entails return filing and digital compliance, henceforth, the NBFCs can make sure that their GST return filing is addressed without an issue.

- The notion of GST requires only such entities whose yearly income is equal to or more than 25 lakhs rupees for GST registration in India. Henceforth, it permits small lending entities to avail an exemption from obtaining tax registration and further reduce the cost of operations to a great extent.

Conclusion- GST applicability on NBFCs

The existing tax regime under Goods and Services Tax has affected the functionality of the NBFCs in one way or another. It’s safe to say that NBFC has availed numerous benefits from GST but at the same time, it encounters some challenges as well. Intricate taxation policy is a serious matter of concern for the NBFCs operating pan India. These entities were expecting the government to take some productive measures in this direction to alleviate the tax burden.

Read our article:How to apply for GST registration certificate online?