As per the GST provisions, the taxable entities must avail GSTIN if their yearly turnover surpasses the threshold limit, i.e., Rs. 40 lakh. required to complete the GST process.

The GST portal is the medium where the registration formalities are performed and approved. A taxpayer needs to log in to this portal, complete the required form, and submit the same along with necessary documents. If an entity continues to conduct its business activities in the absence of GSTIN, he/she will force to confront specific penalties. In short, it’s an offense to engage with the supply of non-exempted goods and services in the absence of GST registration.

Steps involved in the GST Registration certificate

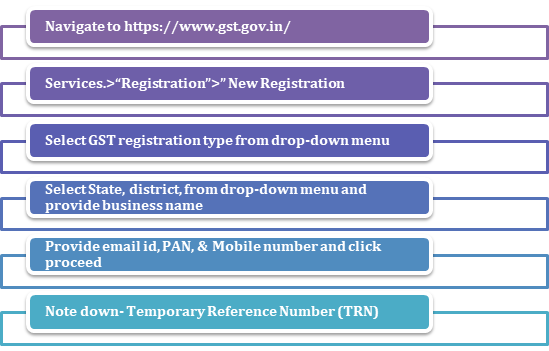

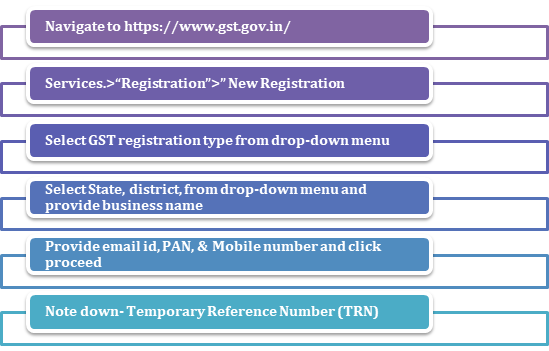

PART 1

- First of all, open your browser and visit – https://www.gst.gov.in/.

- Move your cursor to the top menu to select “Services.”

- Next, select “Registration”>” New Registration.”

- On the next window, you will come across the various blank fields.

- To get started, explore the drop-down menu given under “I am a” and select one option from the given alternatives.

- Taxpayer

- Tax deductor

- Tax collector (e-commerce)

- GST practitioner.

- Non-Resident Taxable Person

- United Nation body

- Consulate or embassy of a foreign country.

- Other Notified Persons.

- Non-resident online service providers.

- Next, select your state from the drop-down menu for which you want GSTIN.

- Select “district” from the drop-down menu.

- Provide your legal name of the business in the relevant field.

- Next, enter your email id, PAN, & Mobile number.

- Click “Proceed” to continue.

- On the following window, enter the OTP in the respective box for account verification.

- Select ‘Proceed.’

- The Temporary Reference Number (TRN) shall pop up on the screen. Note this number.

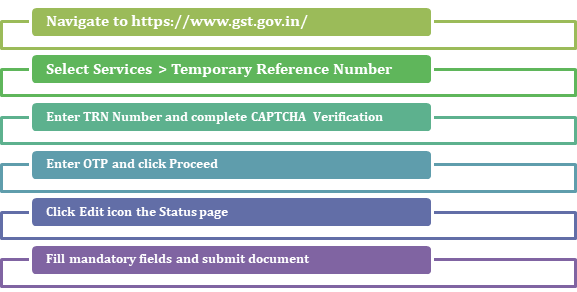

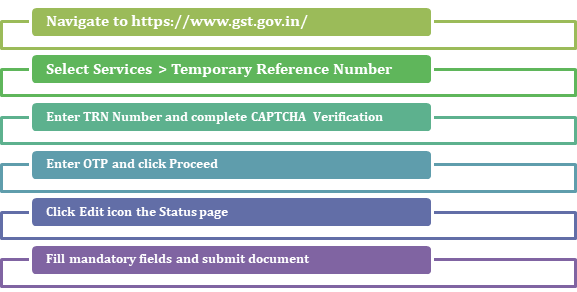

PART 2

- Revisit this portal and select Temporary Reference Number from the “Services” option.

- Enter your TRN in the given field.

- Provide the captcha details and click “search.”

- Now within a matter of minute, you will receive an OTP on your phone and email ID. All you need to enter this OTP on the next page and tap “Proceed.”

- Now the portal will automatically generate the application status on the following page.

- Head over to the right side, click the Edit icon.

- A page will appear on your screen that will ask you to fill some mandatory fields and submit the following documents.

- Photographs

- Proof regarding Business address

- Bank details, such as IFSC code and account number.

- Authorization form

- The taxpayer’s constitutions

- Reach out for the ‘Verification’ page and determine the declaration. Then use one of the following methods for the submission of the application.

- e-Sign method

- EVC

- Digital Signature Certificate (DSC), in the case of the company, is applying for registration.

- Once completed, the feedback message will be furnished by the portal on your screen.

- The Application Reference Number will be forwarded to the email id and the phone number. The ARN is typically used to check the GST registration certificate status.

Read our article: Revocation of Cancellation of GST Registration

Class of taxpayers under GST Registration certificate

If you are not accustomed to GST provisions, then you might get confused with the categories of GST registration. To ease out this complexity, check out the following list to become familiar with different types of GST Registration.

Normal Taxpayer

It is a standard category that encompasses most businesses pan India. You do not have to address any financial obligation to become normal taxpayers. This category defies any provision of expiration date pertaining to the taxpayer.

Casual Taxable Person

Individuals who are willing to reap some income through seasonal-based businesses can opt for this category. Here, a deposit has to be submitted in the form of an advance, equivalent to GST liability at the time the business is activated. The tenure of 3 months is given under this category, which can be renewed or extended.

Composition Taxpayer

Opt this category, if you are willing to be a part of the GST Composition Scheme. The access to this scheme is limited to those who deal with the supply of exempted goods and not makes inter-state supplies. Also, keep in mind that this scheme does not have any provision for the input tax credit.

Non-Resident Taxable Person

If you are residing at an overseas location and supplying goods to Indian customers, opt for this category. Just like the Casual Taxable Person type, this category also demands a deposit equivalent to the GST liability during the active state of GST registration. The tenure offered by this category to the taxpayer is three months. Once expired, the taxpayer can renew this category without any hassle.

GST Registration Certificate is Mandatory

- Individuals registered previous tax reforms such as VAT or excise duty.

- The taxable person leaving in overseas location and Casual Taxable Person

- Individuals addressing tax liabilities under the reverse charge mechanism

- All e-commerce aggregators

- Businesses are generating turnover above the threshold limit, i.e., Rs.40 lakh. In the case of special states, the threshold limit of Rs.10 lakh.

- ISD and agents of a supplier

- Individuals using e-commerce aggregator to supply exempted goods and services.

- Overseas individuals are providing value-added courses & information via an online portal to Indian customers.

Documentation for GST Registration

Here is the checklist of the documents for GST Registration certificate. Those are as follows:-

- PAN card.

- Aadhaar card.

- Address proof of the business

- Bank details such as account statements

- Canceled cheque.

- Registration proof of the business or Incorporation Certificate.

- Digital Signature.

- ID, address proof of the company’s members such as prompter or directors.

- Letter of Authorization from Authorized Signatory.

Penalty on violating GST Registration

- If the taxpayers fail to pay tax in a timely manner, then penalties of 10% of the due amount will be levied on the defaulters. Moreover, the minimum penalty threshold, in this case, is Rs, 10,000.

- A penalty of 100% of the due tax amount will be levied on the person who is not being registered and intentionally strives to bypass the GST tax provision.

Conclusion

GST offers better coverage and ensures no tax leakage as compared to the old tax regime. With an online portal in place, it’s easy for the taxpayer to apply for GST in no time. The online GST registration seeks negligible paperwork, and it advances on the cutting-edge verification system. If you have any issues concerning to apply for GST registration certificate online, then CorpBiz legal experts shall be happy to help you with this.

Read our article:A Complete Guide on Eligibility Criteria for GST Registration