As a business proprietor and a taxpayer, the tax payer has to declare in their GST returns in his income tax passbook regarding the earnings received from carrying out the business transactions.

GST return is a document that will comprise of all the details in the income tax passbook regarding sales, purchases, tax accrued on sales also called output tax and tax paid on purchase known as input tax. Once the GST is filed then the tax payer needs to pay the ensuing tax liability i.e. money owe to the government.

Form 26AS is generated by the Income Tax Department and it is an annual consolidated tax statement. This form functions like the ‘Annual Tax Credit Statement’ which releases the tax credit details of the existing taxpayer on Permanent Account Number (PAN) basis according to the database of the Income-tax Department.

What is Form 26 AS?

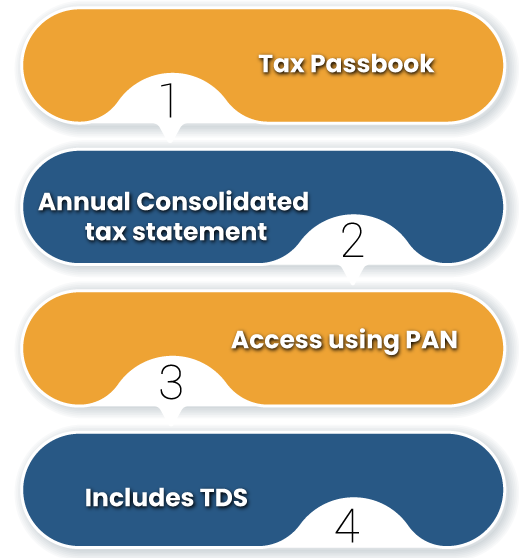

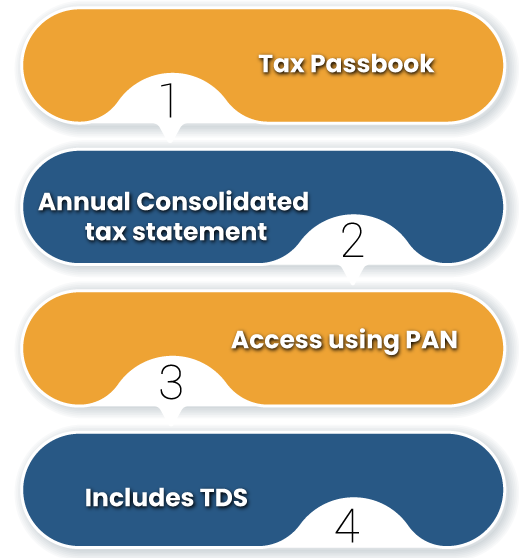

- Form 26AS is a ‘Tax Passbook” in the income tax passbook. Every individual or company must credit the amount that has deducted taxes to the government through banks.

- Form 26AS is generated by the Income Tax Department[1] also known as an annual consolidated tax statement.

- The taxpayers can easily access Form 26AS from the income-tax website by using their Permanent Account Number (PAN).

- A Form 26AS includes the amount of the tax deducted at source (TDS) of the salaried class and shall include the taxes paid during the financial year in case of businessmen or self-employed in the income tax passbook.

- The taxpayers can refer to their Form 26AS at the time of filing the Income Tax Return and tally it with their Form 16 which is provided by the employers or banks for the amount of taxes they pay to the treasury of the Central Government.

Purpose of Form 26AS

The purpose of Form 26 AS serves the following aspects, which are as follows:-

- The form is one of the most important Income Tax documents in the income tax passbook for a taxpayer, and under Section 203AA of Income Tax Act & 31AB of Income Tax rules the Form 26AS it is a consolidated statement issued to the PAN number holders.

- It gives a proof of deduction of tax in the income tax passbook and that it has been collected on taxpayer’s behalf.

- Form 26AS gives a record of the tax paid by the taxpayer in his annual Income tax return as shown in income tax passbook.

- Form 26AS ensures that the correct tax has been deducted by different entities and has been deposited into the government’s account.

- It confirms that the tax deposited to the bank has been properly furnished.

- A taxpayer while paying his Income tax return is not required for attaching his photocopy of TDS certificate in this form.

- To avoid demand notices and penalty from Income Tax Department it is important to check Form 26AS carefully before filing the Income Tax Return and

- This form also allows for a speedy processing of return.

Read our article:Last Date for Filing Annual GST Return for FY 2020 Extended To March 31

GST Returns Reflecting in Income Tax Passbook

It was detected by the revenue department that although the turnover of crores of rupees in GST is shown but those people are still not paying income tax. Therefore, it was decided that with effect from June 1, 2020, a new format for the Form 26AS will improve the flow of information between the tax authority and the taxpayer and also help the taxpayers to calculate the correct tax liability and file the Income Tax Return (ITR).

There will be no change for honest taxpayers in reporting requirement under Form 26AS in the income tax passbook with respect to the display of information of GST turnover data. Besides this change it will also refrain the taxpayers to intentionally conceal their financial transactions in their tax returns in the income tax passbook.

Few of the changes includes:-

- The CBDT (Central Board of Direct Taxes) has sanctioned the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) to upload information in the Annual Information Statement in Form 26AS which is in their possession and related to GST returns, the uploading must be done within three months from the end of the month in which the information is received by him.

- The purpose was to enlarge and change the format of Form 26AS to incorporate data received from different divisions/offices, including the GST authorities.

- This concludes that the GST turnover information will be covered well in the new form 26AS.

Amendments in Form 26AS- Income Tax Passbooks

The CBDT (Central Board of Direct Taxes) has introduced Form 26AS with few amendments in a new format.

- Under section 285BB of the Income-tax Act, 1961 the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) or any person authorized by him shall upload an annual information statement in the assessee’s registered account in Form No. 26AS containing the information which is in his possession within three months from the month end during which the information is received by him.

- The new format of Form 26AS will ask for Aadhaar number, date of birth, email ID, mobile number, and address in the income tax passbook.

- The Central Board of Direct Taxes (CBDT) has stated that earlier the Form 26AS used to provide information regarding TDS and TCS along with additional information which included details on other paid taxes, refunds and TDS defaults. But now the Form 26AS shall contain SFTs ( Statement of Financial Transactions) in the income tax passbook which will help the taxpayers in reminding all major financial transactions so that the taxpayer has a reckoner to file the ITR.

- The new ‘Annual Information Statement’ i.e. Form 26AS in the income tax passbook will contain all the information on taxes paid, details on pending taxes, proceedings of completed income tax, income tax refund status and demand together with the details of specific financial transactions like purchase of property or shares.

Conclusion

These amends for GST Returns to reflect in Income Tax Passbook will ease the GST turnover reporting in the Income Tax Return GST Schedule. Thus, it will also be seen as a significant step focusing on the “Transparent Taxation” thereby honouring the honest taxpayers.

Also there will not be any extra compliance burden on the taxpayers for GST turnover displayed in the Form 26AS in the income tax passbook. Now, this will be an annual consolidated tax statement that can be accessed by the taxpayers using their Permanent Account Number (PAN) from the income-tax website. Therefore, the information in the Form 26AS would afford an ease to the taxpayers in complying and filing the GST return in Income Tax Passbook.

Read our article:16 Types of GST Return your Business should be Aware of!