Liquor license is issued only after scrutiny to all the details of the license holder because selling Liquor without a license is an offense under various state laws. The Delhi Liquor License Rules, 1976, pronounces types of licenses that serve liquor in a State. Besides this, the Act ensures to supply quality and safe Liquor to its consumers. The legal age for consuming alcohol has been specified in every State. Under Section 23 of Delhi Excise Act, 2010 and Delhi Liquor License Rules, 1976, the legal age for alcohol consumption is 25 years.

Types of Liquor Licenses in Delhi

Grant of Liquor License in Delhi

- The licensee must apply for the issue of transport pass, and the same must be issued in such a manner as specified by the Excise Commissioner from time to time. Each application must be accompanied by a receipted treasury challan showing deposit of duty and fees, payable on a quantity of liquor for which transport pass is required unless duty & fee have been paid at the time of import.

- The Assistant Commissioner must cause the application to be scrutinized to see that the quantity applied is within the limit of the licensee, and after satisfying himself that the duty has been paid and the application form is otherwise in order, he must issue the transport pass.

- The transport pass must be in triplicate; the first copy will be issued to the applicant. The second copy must be given to the licensee of the warehouse. The third copy will remain on record in an office in the form of a compact disc or paper print. The quantity issued must be indicated legibly both in figures and words on all the copies of the pass.

- No over-writing or cutting is permissible on this. If any reason, some erroneous entries have been made in the past, the Assistant Commissioner will issue a fresh pass and will cancel all the three copies of the defective pass.

- The signature of an excise official, by whom the pass is issued, must be in ink, and his name and designation have to be written in capital letters on all the copies, whenever prepared manually.

- The liquor must be issued from a warehouse on the basis of transport passes. The record of these transactions covered by such passes must be maintained in form-2.

- The record of such passes must be maintained by the licensee or the excise officer, as the case may be, in a register in form-2.

- Before issuing, the licensee or the excise officer, as the case may be, must make appropriate endorsements on the copies of pass:-

- pass-holder

- warehouse licensee

- copies to be retained by him in personal custody

A monthly statement of all such passes must be submitted to the Assistant Commissioner, who must cause entries made in the said statement has to be compared with relevant records in the office. The Assistant Commissioner, must after such comparison, submits his report to the Deputy Commissioner and will make an endorsement to this effect on a statement aforesaid.

- The Assistant Commissioner has to maintain records showing the particulars of all such passes issued by him with the summary showing the total number of passes issued, names of the licensees to whom issued, the total quantity of liquor, and also the total number of duty involved. The Assistant Commissioner must append his signature below the summary.

A person licensed to import, export and transport of liquor

No person except a licensed vendor can import, export or transport liquor, provided that-

- Any person holding a license for the possession of liquor can import and transport any quantity, but not exceeding the quantity which he is permitted to possess under a permit on the payment of prescribed duty and fee.

- Defense Laboratory, Quarter Master General branch, can import, transport, or possess Indian liquor on the basis of an import license for purposes of analysis without paying a fee.

Conditions applicable on an individual’s possession limit

No person must have in his possession any quantity of intoxicant, except the permissible limit of possession and retail sale as prescribed. Also, further on the condition that it must not be –

- Consumed in any public place;

- They were kept in any premises used as a place to which has admitted for the consumption of food or a drink for consideration unless such premises have been licensed for consumption of liquor under the Act or the rules. It has been exempted by an order by the Government in writing from the provisions of these rules.

Conditions applicable to grant of a liquor license in Delhi

All passes and the Liquor license granted to cover import, export, and transport of intoxicants must be subject to the conditions-

- That bulk must not be broken in transit;

- That copies of permits or passes must be sent to an Excise Officer of the district of origin or destination, in the case of imports and exports:

It is provided that a pass shall be sufficient to cover the transport of intoxicants to the premises where an importer is either licensed to sell and to possess intoxicants in Delhi.

The export pass must show in all cases the quantity and strength of intoxicants to be exported and duty at the rates prevailing in Delhi has been paid, or exemption has been granted, or the bond has been executed to safeguard excise revenue.

Power of refusal to grant a liquor license in Delhi.

The Excise Commissioner, the Assistant Commissioner or the Deputy Commissioner might refuse to grant any licenses for any sufficient reason, which is to be recorded and must not grant any such licenses if he had a reason to believe that an applicant has not paid any dues demanded from him.

Authority empowered to issue Permit or pass.

Passes for an import, export, or transport of liquor and permit for possession of liquor can be granted by a Deputy Commissioner, or he can delegate his powers to any excise officer who is subordinate to him.

Extension of validity of liquor license in Delhi

- No pass or license must be valid after the date of its expiry provided that a Deputy Commissioner, granting the license or the authority to authorize a dispatch of any consignment under these rules, can extend the period of currency thereof. If an extension is applied for the delay in transit of a consignment or for any other sufficient reason on the payment of composition money, it must not exceed 25% of the duty of consignment, or otherwise, and reasons to be recorded.

- Where during the course of an import of liquor, the delay occurs for reasons beyond the control of the licensee, he must submit an application for revalidation of import license to a Deputy Commissioner within 3 working days of the occurrence of the event and the Deputy Commissioner may re-validate the same.

- For transport permit, the application for such revalidation must be made on the next working day from the date of expiry of validity.

- Where the application is not submitted within a stipulated period or the delay is for any other reason, the revalidation can be done on payment of composition money, which must not exceed 10% of the duty involved.

The validity of liquor license in Delhi

- Unless the Government otherwise directs, the license must ordinarily be granted for a period of one year.

- A temporary license can be given to provide for a sale of liquor on special occasions in such cases, as the Deputy Commissioner can determine.

- All licenses other than temporary licenses must unless otherwise provided, determine on 31st March following the grant or renewal.

Read our article: Suspension and Revocation of Liquor License in India

Restriction on grant of liquor license to certain persons

Persons to who licenses cannot be granted.In addition to the provisions provided in Section 13, license for vend of intoxicant shall not be given to:

- Any person who does not have his Permanent Account Number(PAN) the Income Tax Department or has not been assessed to income tax

- Any person who is not registered under Delhi (VAT) Act, 2004[1]

- Any person who has held a license in Delhi for the sale of any intoxicant and has failed to pay due to excise revenue and not exempted by order of the Government from payment of duty

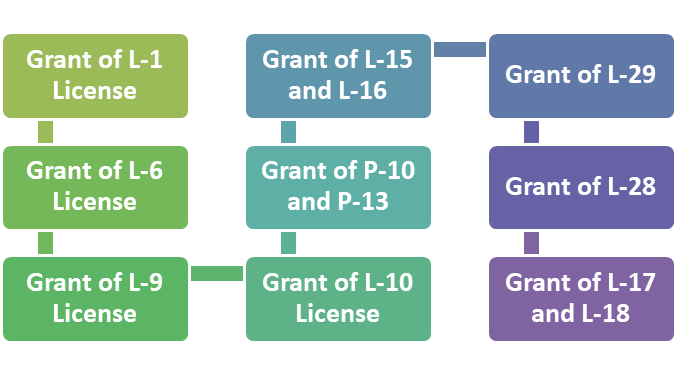

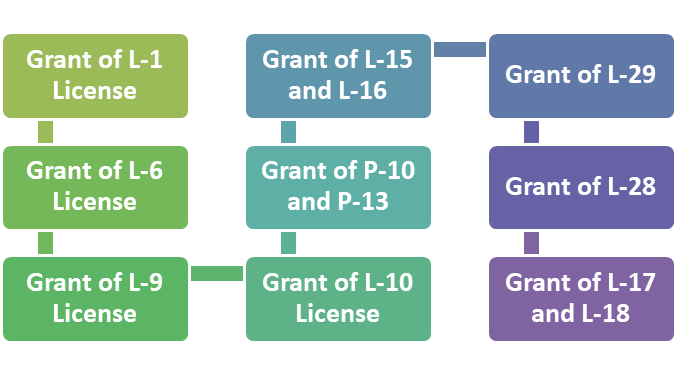

Granting of liquor Licenses in Delhi

Licenses in this domain are of different kinds. The granting provisions for a few of them are as below:

Grant of L-1 License

The L-1 licenses are for wholesale vending to companies, partnership firms, societies, or proprietorship firms subject to the condition that the applicant has distillery/manufacturing units/breweries/bottling plants. Moreover, they have to abide by the terms and conditions ordered by the concerned authority.

Grant of L-6 License

The L-6 licenses are for the retail sales of foreign liquor. Issuance of this license requires to choose undertakings of the Delhi government, DTTDC, DSCSC, DSIDC, and DCCWS.

Grant of L-9 License

The L-9 licenses are for the retail sale of various brands of Indian Liquor and Foreign Liquor. This license was earlier known as L-52 D. To attain this license. The applicant requires to abide by the terms and conditions ordered by concerned authority.

Grant of L-10 License

The L-10 licenses are for the retail sale of various brands of Indian Liquor and Foreign Liquor. However, the terms and conditions for the L-9 license do not apply to the L-10 licenses.

Grant of P-10 and P-13

These licenses are temporary licenses for serving liquor in the parties, functions, and conferences. The terms & conditions ordained for these licenses vary from residents, clubs, hotels, restaurants, and other premises.

Grant of L-15 and L-16

These licenses are for star hotels that are approved by the Department of Tourism to accommodate the tourists. The hotel management is to abide by the terms and conditions ordered by the authorities.

Grant of L-17 and L-18

These licenses are for the star hotels which are approved by the Department of Tourism. These establishments must be located in a commercial area with adequate space for parking.

Grant of L-28

The L-28 license is for clubs that have been registered with the registrar of firms or registrar of cooperative societies to provide services of foreign liquor to its club members. All clubs which agree to specified terms and conditions can apply for this license.

Grant of L-29

The L-29 license is for clubs or mess which provides liquor or beer exclusively to Government Servants, and that are not subject to commercial rates and rules. The application procedure and required documents for an L-29 license are similar to that of the L-28 license.

Permits of Liquor License

At Residence

No Licence is required by an individual for serving liquor to his guests, and family members at his residence provided the liquor served is within permissible possession limit

For Licensees allowed for onside Consumption Hotels/Clubs/Restaurants,) required Permit (P-13)

- P-13 Permit is granted to licensed hotels, restaurants, and clubs for service of foreign liquor inside/outside their licensed premises on a temporary basis for hosting a function on a specific day.

- Any eligible hotel, restaurant, and the club can apply for a grant of P-13 Permit in the prescribed proforma after depositing Rs 5000/- as permit fee.

At any other premises – License (P-10)

- P-10 license can be obtained on payment of Rs. 5,000 (except for Motels, Banquet Hall and Form Houses where P-10 License fee is 15000) for service of liquor in any marriage, party, function, etc. at specific premises in Delhi excluding public parks subject to following conditions: –

- The area is screened off from the public view;

- Liquor is served to the adults above 25 years of age;

- Liquor is procured from an authorized source in Delhi (the license holder must have the bill in original issued by retail liquor vend in Delhi from where liquor has been procured).

- An individual/organization can apply for a grant of a P-10 license in the prescribed Performa. This license can be obtained from online or the window at the Excise Department or from the specified liquor vends.

Conclusion- Manner of blacklisting

Any licensee, bidder, tenderer, manufacturer or supplier, whose products are sold in Delhi can be blacklisted by a Deputy Commissioner for violation of the provisions of Act and the rules framed or for any other reason which can be considered detrimental to the interest of revenue or public health. No such order must be passed without giving reasonable opportunity of hearing to the person concerned.

Any person whose name has been mentioned in the blacklist must be debarred from applying for or holding any excise license within Delhi for such period, not exceeding five years, as may be specifically indicated in the blacklisting order. The name of the blacklisted persons must be circulated by the Deputy Commissioner to the Excise Authorities of the neighboring States.

Read our article: How much does Liquor License cost in India?