A major concern for enterprises incorporated under the regime of GST is to ensure that they are not lost on the tax benefits and input credits of the old regime. These taxes can be paid on purchases, inputs, raw materials, semi-finished goods, finished goods or materials sent to worker. For most enterprises, these taxes are available as input credits on July 30. And to take advantage of these, it is important to transfer them to GST regime. CBEC has issued transition rules and Tran 1 form & Tran 2 Form, and with their help, businesses can attribute the old system to GST.

What is Old ITC & GST Regime?

Any business that is or does not have a stock-whether registered before Goods and services tax will be entitled to claim the tax credit paid under the pre-GST regime. This claim of ITC also depends on certain conditions which we will discuss further.

Types of Forms Available

To help businesses transition smoothly and advance their ITC, CBEC has issued two transition forms called TRAN 1 form and TRAN 2.

| Form No. | Person who is Eligible to File | Person who is not Eligible to File |

| TRAN 1 Form | Individuals registered under GST, may be registered or unregistered under the old regime | Those registered under GST as composition dealers |

| TRAN 2 Form | Registered persons under GST but unregistered or under the old regime A dealer/ trader who does not have documentation of fees paid | A manufacturer is registered under Excise Department A service provider registered under service tax |

Broad Aspects of Transition to GST

Following are the aspects of transition to GST, which are given below:-

- ITC of the old regime which you want to claim in the new regime (Report in TRAN 1 form)

- Avoid any interference in the material being sent to the employees working (Reported in TRAN1 form).

- Report Agent-Principal Dealing and Shipping Agreement (Report in TRAN1 form)

- Claims & tax refunds under the old system (not reported in TRAN 1 form/TRAN 2 form)

Read our article:An Outlook on Effect of VAT Return after GST Implementation

Important Points for Understanding regarding Transition to GST

- Separate transition forms must be filed for each GSTIN.

- Any credit that individual want to carry forward from the old rule should be an eligible credit under GST.

- Accumulated credit of old regime can be taken in GST. This is allowed only if you have filed the return for the last six months under the old rule. Therefore, you will have to properly file the old returns of VAT/ /Service Tax[1]/Excise.

- Any tax which imposed by the central govt. & duties such as excise & service tax will be carried forward in terms of CGST

- Any state tax like VAT will be carried forward as SGST

Details Required in TRAN 1 Form

Following are the details required at the time of filing Tran 1 form

- To mention GSTIN is mandatory in TRAN 1 form

- To mention legal name of the individual is mandatory in TRAN 1 form.

- If you are using any trade name for your business, then mention trade name on TRAN 1 form

- Make sure that you have provided all the returns essential under the current law for the last 6 months – the answer is in the form of Yes / No.

- The closing balance of the CENVAT / VAT credit of previous returns can be taken as a credit in your GST electronic ledger, when you have filed returns for the last six months under the old rule.

Details Required in Form TRAN 2

- It can be filed by a dealer / trader who have registered for GST, but was unregistered under the old rule.

- A manufacturer/service provider cannot file Form GST-TRAN 2.

- TRAN 2 must be filed by a dealer or trader at the end of every month, when the stock is sold, reporting the details to claim the ITC.

Conditions that Must Meet by Individual

- Such goods were not fully exempted from excise duty / VAT or zero rated goods under excise duty / VAT.

- The scheme operates for only 6 months from 1 July which means the stock have to be cleared by the end of December in order to claim the credit.

- Individual must have a document which shows the purchase of such goods.

- Stock of goods on which credit is being claimed is stored in such a way that it is easily identifiable.

Information to be filled in TRAN 2 Form

- GSTIN

- Name of Taxable Person

- Tax period (mention the month and year for which this form is being filed)

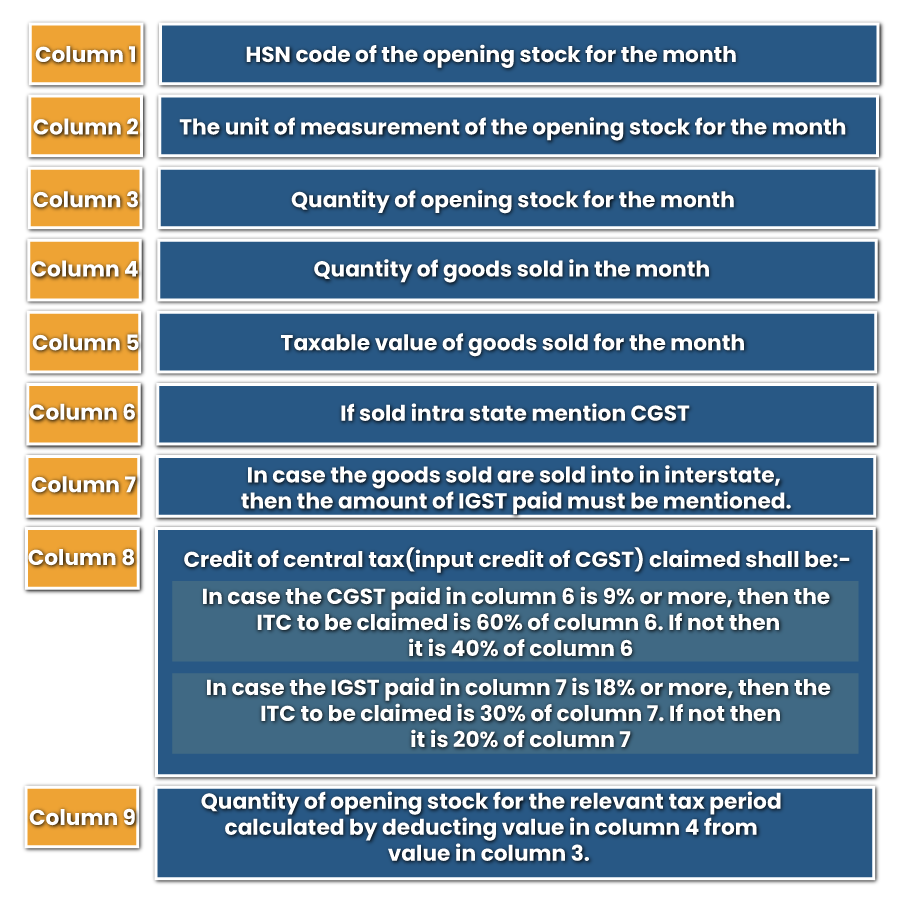

- Details of inputs placed on stock on July 1 for which you do not have any invoice / document for payment of tax made for the electronic credit leader.

- Stock held with no Supporting Documents Showing Payment of Excise (central tax)

What to do when Documents are not available to Show the Payment of Excise Duty?

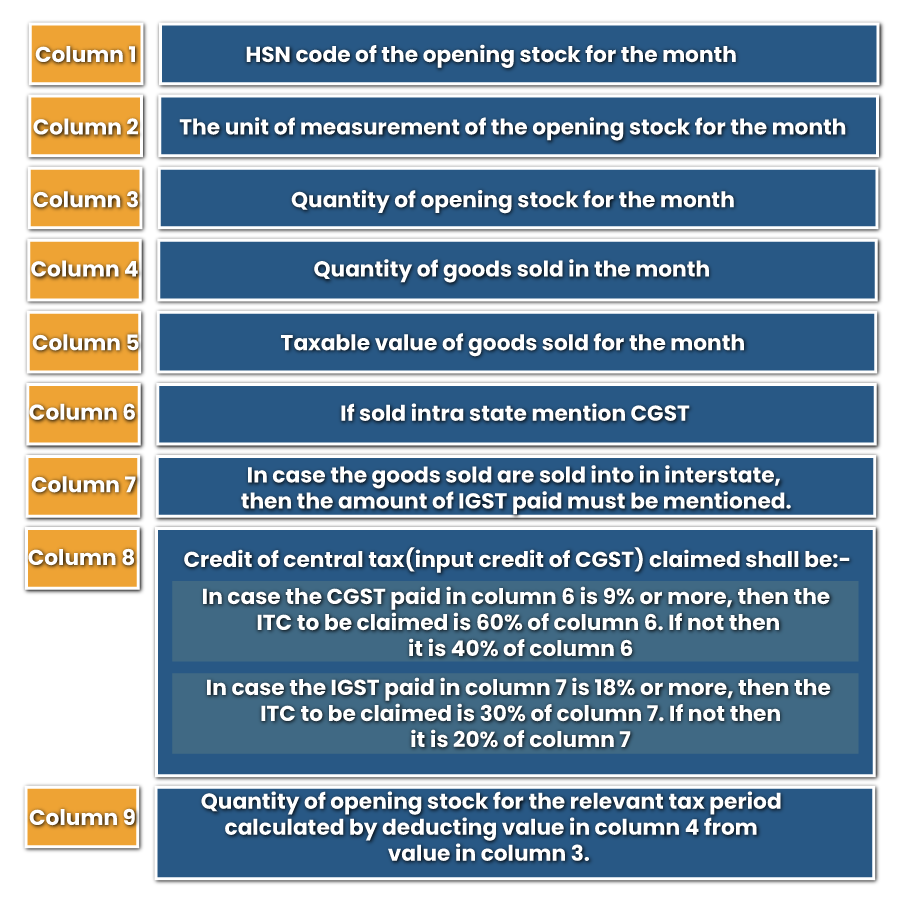

In case individual does not have a document showing the payment of Excise Duty, then he is supposed to fill the following details –

Conditions to be fulfilled to Claim Credit

- CGST or SGST payable on such supplies has been paid.

- Such goods were not fully exempted under excise or NIL rated or under the respective State VAT Act.

- Documents for the purchase of such goods are available with the registered person.

- Shows the details of the stock held at the end of each of the tax periods, in which Form TRAN-2 details the supply of such goods affected during the tax period.

- The allowed credit amount will be credited in the electronic credit ledger.

- The stock of goods on which credit is availed is stored so that it can be easily identified by the registered person.

Concluding Remarks

To facilitate uninterrupted transfer of ITC under GST to existing physical shares which have already suffered incidence of taxes under various existing laws and are still lying with registered dealers on the due date, Transitional provisions have been included in GST new regime.

Sections 140 to 142 of the GST Act, 2017, and the regulations specifically accorded with the provisions of input tax credit to further the new GST regime. Kindly associate with the CorpBiz expert to know more about the format of TRAN 1 & TRAN 2 form

Read our article:Understanding on Place of Supply of Imports of Goods or Services under the Regime of GST