The Finance Minister has presented changes in the E-Way Bill system, containing auto calculation of distance based on PIN codes for generation of bill and blocking of multiple bills on one invoice, as it seeks to crack down on GST evaders.

The bill is like an excise gate pass that a factory had to give as evidence that excise-paid products were payable. The pass included the number of the truck so that the trucker was in the clear and not suspected of moving goods on the sly, i.e. without tax payment.

The Goods and Services Tax (GST) bill is intended for the same reason, with an exception that it must be created by logging into the official E-Way Bill portal. Any bill ultimately has to be connected to a GST invoice. Of course, only for sales in excess of INR 50,000 must be in one-to-one relationship between movement and be established.

Documents Required to Generate E-Way Bill

This type of bill is required for movement of goods. One movement requires one bill. There is no requirement to generate multiple bills for change in a mode of conveyance

In case the bill is generated by mentioning a vehicle number, subsequently, the goods are transshipped to another vehicle or there is a change in the mode of conveyance, such Change in the vehicle or mode of transport can be updated on the bill in the common portal, or through SMS.

In order to generate a bill, a consigner should be prepared with the following information-

- The Invoice

- Bill of supply,

- Delivery challan,

- Transporter’s ID (if transporting by road),

- Vehicle number,

- Transport document number

- Date of document (if transporting by rail, water vessel or air)

While transportation of goods, the transporter is essential to have the following information:-

- The invoice

- Bill of supply

- Delivery challan,

- A copy of the bill form

- Bill number.

Read our article:Step by step guide on how to check GST Registration Status

Non-Applicability of an E-Way Bill

A business entity is not essential to generate a bill in the following conditions:-

- When transporting goods by a non-motorized conveyance;

- When transportation of goods from a customs port, air cargo complex, airport or land customs station to an Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by custom officer;

- When transportation of goods under customs supervision or under customs seal;

- Goods that are transported under a customs bond from Inland Container Depot to a customs port, or from one custom station to another;

- Transit Cargo transported to or from Bhutan or Nepal[1];

- When the Ministry of Defense moves goods as a consignor or consignee for defense formation;

- When a consignor transports goods between a place of business and a weighting bridge for weighment, up to a distance of 20 kms and convoyed by a delivery challan;

- In case the consignor of goods is the central government, state government, or any local authority for transportation of goods by railways;

- When goods are specified as exempted from the bill supplies in the respective state or union territory GST Rules;

- When transporting empty cargo vessels;

- When transportation of alcoholic liquor for human consumption, petroleum crude oil, motor spirit, high-speed diesel, natural gas, as well as aviation turbine fuel;

- In case of specified goods such as jewellery, personal or household products that are mentioned in the list.

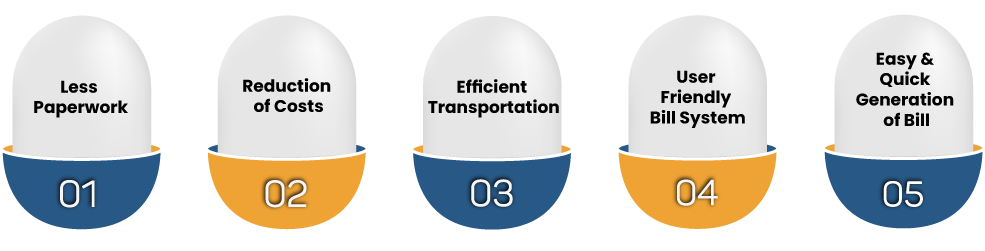

Advantage of E-way Bill

The advantages of E-way Bill are as follows-

Less Paperwork

It will never again need all the outgoing state-wise documentation needed for the movement of goods. The establishment of RFID equipment in the vehicle used for transporting consignment on a standard premises is another benefit that is available for the transporters. As the computer is connected to the car, the person in control of the vehicle never again has to send physical copies and the bill can be mapped and checked through the device.

Reduction of Costs

This type of bill would reduce the expense of logistics. The bill would improve proper invoicing and would decrease the practice of tax avoidance along these lines.

Efficient Transportation

It will improve transportation efficiency & speed. In India, a truck travels an annual average distance of 85,000 km, compared to 1, 50,000 to 2, 50,000 km in developed countries, which is a strong indication that some changes are required in our transport systems. The bill will help change the business. No waiting time at the check post and quicker movement of goods, resulting in maximum vehicle/resource use.

User Friendly Bill System

It is very user-friendly and easy to use E-Way bill systems as well as portal. Even dealers can quickly download the bill for themselves.

Easy and Quick Generation of Bill

E-way bill would be generate easily and quick, there is not big task to generate e-way bill. In upcoming time it will be make very easy because government is working very lightly.

What are the Disadvantages of an E-way Bill?

The disadvantages of the bill are as follows-

Weak Internet Facilities

Poor internet access or unavailability can be a major problem in most areas.

Different Views from Various States

Most states are concerned with E-Way bill schemes. Many states tend to introduce their own bill schemes, which could be a major huddle in the future.

Glitches in Producing E-Way Bills

Since the last time, the date was postponed due to technical glitches; it is a major problem at the portal. Industries involved in different modes of transport would end up creating a large number of bills for each shipment.

Conclusion

All in all, this type of bill proclaims the return of the inspectors on the highways. The system has to enable the flag off on the tax evasion, as the human interference is both negligent and exploitation prone. In American stores, there is no corporeal frisking or moving and patting of shoppers but muggers are caught by an alarm that is planned to go-off when any package goes out without payment for the same. The alarm as well as the bar code on the package are associated.

A comparable self-effacing system needs to be put in place under the GST rule this time round to make sure that there is no nuisance or delay in the course of movement of goods and services. While it does have its advantages, the E-Way Bill is yet another GST intricacy for companies to manage. Automation in the GST helps dismiss some of the pressure. For hassle free GST Registration, contact our professional team at Corpbiz.

Read our article:How to apply for GST registration certificate online?