You can incur hefty fines and penalties that can go up to 100% of your owed tax amount if you fail to register for GST as goods or service provider. Consequently, you must register for GST to avoid any conflict with the law. Moreover, you can also collect GST from your customers if you register for GST.

GST Registration for Charitable Medical Stores

The Gujarat Authority of Advance (AAR) in the “ADVANCE RULING number GUJ/GAAR/R/2020/08/ APPLICATION NO Advance Ruling /SGST&CGST/2018/AR/39) held that GST Registration is required for medical stores run by Charitable Trust which provides medicines at a lower rate amounts to the supply of goods in the market.

Facts of the Case

M/s Nagri Eye Research Foundation is the applicant in the case of a Charitable Trust and runs a medical store. Those medicines are given at a lower rate to the supply of goods in the market. Moreover, the motive of the trust is not for profit or its orientation.

Issues before AAR

M/s Nagri Eye Research Foundation, the applicant has sought the advance ruling on the issues which are as follows:-

- Whether GST Registration is obligatory for medical stores run by Charitable Trust

- Whether medical stores given those medicines at a lower rate amounts to the supply of goods comparing to the market.

Held by AAR

Sanjay Saxena and Mohit Agarwal were the consisting authority of the Gujarat Authority of Advance (AAR), who ruled that the medical Store supplying medicines at a lower rate extent to the supply of goods in the marketplace. Moreover, it was also held that GST Registration is obligatory for medical stores run by Charitable Trust with the motive of non-profit.

Rational of the Judgment

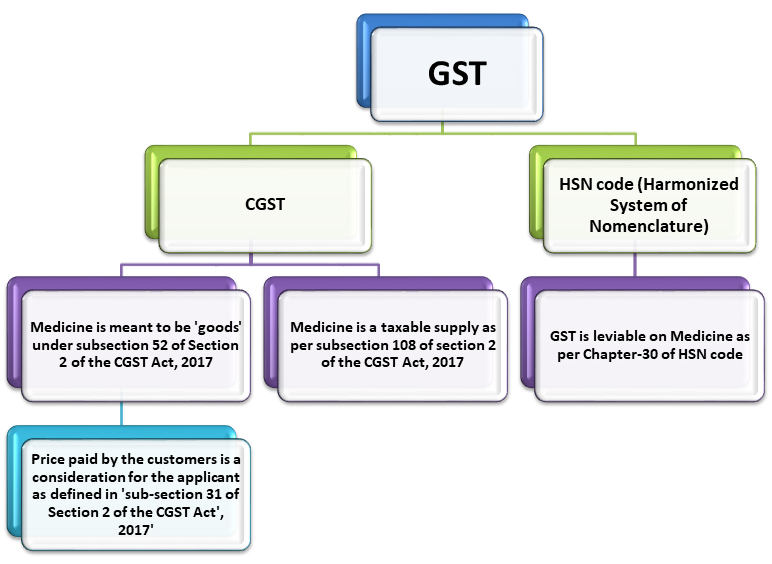

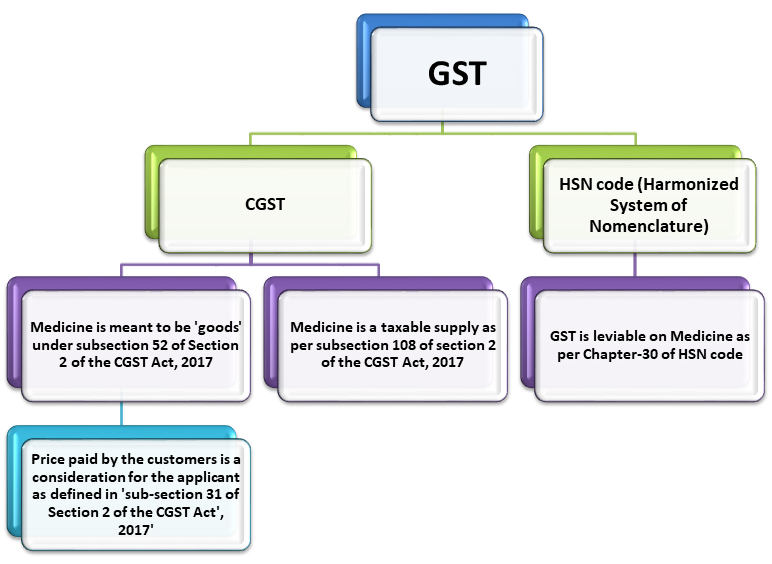

The applicant is selling medicines from its medical Store. However, the question arises that why the GST Registration is obligatory for medical stores run by Charitable Trust with the motive of non-profit? The reason denotes as; Medicine is a taxable supply as per subsection 108 of section 2 of the CGST Act, 2017. Moreover, GST is leviable on Medicine as per Chapter-30 of HSN code (Harmonized System of Nomenclature). The point to be noted that Medicine is meant to be ‘goods’ under subsection 52 of Section 2 of the CGST Act, 2017.

Overall understanding in Brief

For that reason, the sale of Medicine by the applicant is a taxable supply of goods considering the above illustration. The price paid by the customers is a consideration for the applicant as defined in ‘sub-section 31 of Section 2 of the CGST Act’, 2017[1]‘ as the applicant giving medicines from its medical Store at a lower rate.

Overall Observation

It is evident from the fair discussion of The Gujarat Authority of Advance (AAR) that the applicant has to get registration under the relevant provisions of the CGST Act, 2017. The applicant is making taxable supply from its medical Store, and where the aggregate turnover medical store (medicines) of applicant goes beyond the threshold limit as specified in sub-section(1) of Section 22 of the CGST Act, 2017.

Read our article:Concept of Input Service Distributor under GST

GST not Applicable on Manpower Supply/ Security Service

The Gujarat Authority of Advance (AAR) in the “ADVANCE RULING number GUJ/GAAR/R/2020/18/ APPLICATION NO Advance Ruling /SGST&CGST/2018/AR/40) held that the applicant is qualified to claim exemption benefit for the supply of manpower/workforce and security service provided to Central, State, Local, Governmental Authorities & Entities.

It is subjected to conditions that, services provided should be entrusted to a ‘Municipality under Article 243W of the Constitution of India’ or function entrusted to a ‘Panchayat under Article 243G of the Constitution of India’.

Facts of the Case

M/s. A. B. Enterprise is the applicant in this case, which is a partnership firm listed under GST. This partnership firm has been engaged in the business of providing manpower services to Non-Government entities as well as Government entities/Departments. All these services have been providing includes manpower supply for housekeeping, security, cleaning, operators, data entry, etc.

This supply service, as mentioned above, has been continuing at various positions in such Government departments for the past several years. On the successful bidding of tenders floated by respective Government departments/organizations, this firm has been given a contract from numerous Government entities/branches that deliver works contract service, which is offered along with goods.

However, supply is only for service in case of manpower supply service. In the implementation of such manpower supply service contract, it has been observed that there is no supply of goods along with it after the introduction of GST.

Issues before AAR

M/s. A. B. Enterprise, the applicant has sought the advance ruling on the issues which are as follows:-

- Whether the applicant is eligible to seek exemption benefit under “Sr.Number 3 of Notification No.12/2017-Central Tax (Rate) dated 28.06.2017”?

- Whether the applicant, as submitted in Annexure-A to the application, is eligible to claim exemption benefit for Pure services (security service, the supply of manpower, ) provided to Central, State, Local & Governmental Authorities, Government Entities.

Held by AAR: Rational of the Judgment

Sanjay Saxena and Mohit Agarwal was the consisting authority of the Gujarat Authority of Advance (AAR). They ruled that the applicant is eligible to claim exemption benefit under “Sr. No.3 dated June 28, 2017, of Notification No.12/2017-Central Tax (Rate)”.

The applicant is eligible to claim exemption as they have submitted in Annexure-A to the application benefit for pure services (supply of manpower, security service) provided to Central, State, Local & Governmental Authorities & Entities.

However, it is subjected to the condition that the services provided concerning any function entrusted to a ‘Municipality under Article 243W of the Constitution of India’ or in relation to any function entrusted to a ‘Panchayat under Article 243G of the Constitution of India’.

Conclusion: Overall Observation

As a result, the AAR further ruled with respective service recipients that the exemption sought by the applicant will depend upon the quality & nature of services delivered by them in terms of specific contracts across the threshold.

These are just an evaluation, and we always inspire our readers to examine the issue in-depth based on the mentioned case laws and amended rules/decided judicial decisions accordingly. Our CorpBiz legal experts shall be at your disposal to help you with guidance concerning the GST Registration Procedure and its compliance for the smooth functioning of your business in India.

Read our article: Clarifications made by CBIC regarding GST on Director’s Remuneration