According to the GST Act 2017, all supplies of goods/services imported into India will be treated as an inter-state supply and therefore attract the Goods and Services Tax (IGST) integrated with custom duty.

RCM (Reverse Charge Mechanism) applies to imports of Goods, in which the importer is liable to pay IGST. However, there is an exception to which the RCM is not applicable to services related to OIDAR (Online Information Data Access and Retrieval), the supplier must register and pay taxes.

What is Supply of Imports of Goods or Services

- Imports of goods are defined in the IGST Act, 2017, which means bringing goods into India from a place outside India.

- All imports shall be treated as inter-state supplies

- Integrated tax shall be imposed in addition to the applicable customs duty.

- The unified tax shall be levied on the value as per the provisions of the Customs Tariff Act, 1975[1] when levied on the duties of customs under the Customs Act, 1962 and on duties of customs under the Customs Act 1962.

- In addition to the unified tax, applicable on goods Customs Act BCD (Basic Custom Duty) is imposed as per the Customs Act.

- In addition, under the Goods and Services Tax (Compensation to States) Cess Act, 2017, Goods and Service Tax compensation cess can also be imposed on some luxury and depreciable goods.

Read our article:Overall Guide on Section 7 Schedule 1 of the CGST Act

Purpose of the Place of Supply Imports of Goods or Services

The purpose of the place of supply imports of goods or services have two folds, which are:-

- In of case of cross-border transactions, it is to determine whether a particular transaction is to be taxed or not,

- In case of domestic transactions, it is to determine whether a particular transaction is an inter-state supply or not.

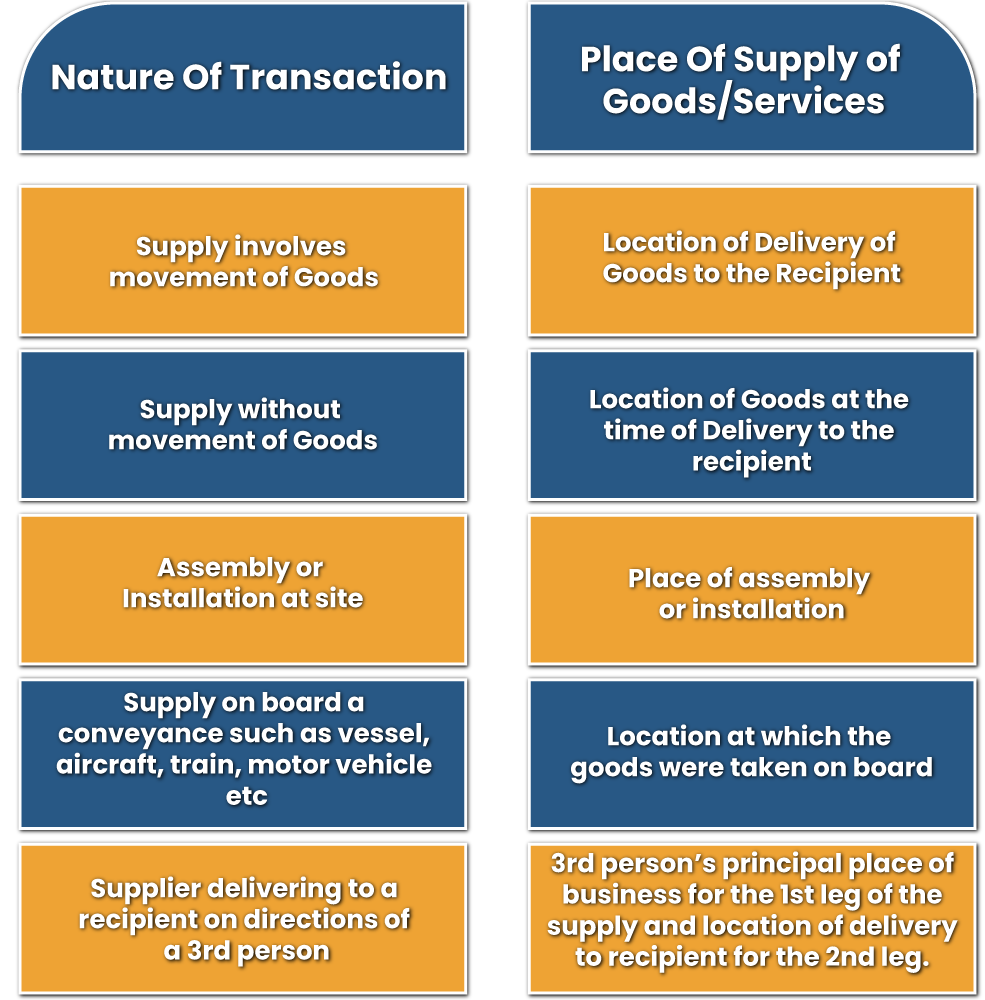

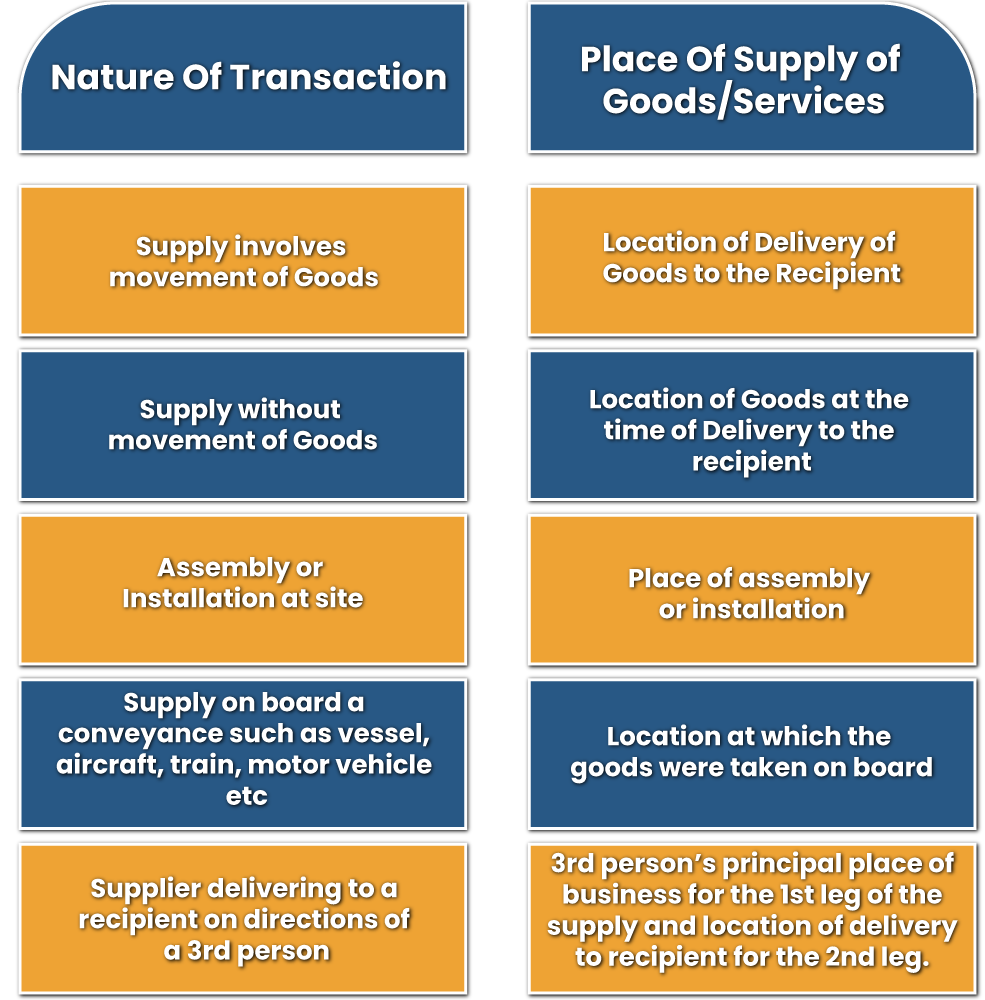

Place of Supply of Imports of Goods or Services

GST is a destination-based tax, that is, services/goods shall imposed tax where they are consumed and not at the origin. Hence, the state where they are consumed will have the right to impose GST. This, in turn, makes the concept of place of movement under GST important as all the provisions of GST revolve around it.

Movements of goods under Goods and Service Tax defines whether the transaction will be counted as intra-state or inter-state and levy of SGST, CGST and IGST will be determined accordingly.

Provision of Supply of Goods/Services in the course of Inter-State Trade Provided u/s 3 of the ACT

- Supplier and recipient location must be in different states

- Import of goods/services into India will be treated as interstate trade

- Supply of goods or services from outside India shall be treated as inter-state trade.

- Supply of goods or services to a Special Economic Zone (SEZ) developer or SEZ entity shall be treated as inter-state trade.

- Any movement of goods or services which is not an Intra State supply shall be treated as Inter State business.

Provision of Supply of Goods / Services in the course of Intra State Trade Provided u/s 4 of the Act

- Intra state movement goods means the movement of goods where the location of the supplier and the place of supply are in the same state.

- Goods are supplied to India during imports until they cross the Indian Customs border.

- Intra state supply of services means supply of services where the supplier’s location and place of supply are in the same state, but excludes supply to the special economic zone (SEZ) developer or SEZ unit.

Concluding Remark

Under the GST regime, Article 269A constitutionally provides for the supply of goods, or services, or both the supply of goods, or the supply of services during the importation into the territory of India, or between the two-state trade or commerce. Therefore imports of goods or services will be considered inter-state supplies and will be subject to integrated tax.

Although IGST can be levied under IGST Act on import of services, IGST duty on import of goods will be levied under the Customs Act, 1975 along with the Customs Act, 1975.The importer of goods/services will have to pay tax on the basis of reverse charges. Moreover, concerning to the import of OIDAR by unregistered, non-taxable person, the supplier based outside India will be responsible to pay tax (IGST). Either the supplier has to take registration or appoint a person in India to pay taxes. Kindly associate with the Corpbiz expert to know more about the place of supply of imports of goods or services under the regime of GST

Read our article:Transactions Treated as Supply under GST