In this write-up, we will be focusing on various provisions related to NBFC and Housing Finance Company, its exemptions, filing procedure, and amendments. Section 186 of the Companies Act, 2013, mainly emphasizes on the company’s right to make investment, loan, and security. To understand the concept of this section, let explore the term “investment” cited in the Act.

Meaning of “Investment” in Context of NBFC and Housing Finance Company

As per Section 186(1) of the Act, the following will be deemed as an investment with a few differences.

- The subscription or purchase of shares;

- The subscription or purchase of warrants; &

- The subscription or purchase of debenture bonds or identical debt securities.

Exceptions

- The disbursement of loans or advances; &

- Any financial transactions like receivables’ purchase, lease, or other credit facilities.

Read our article:Know the Possible Traits of Ideal NBFC Software

Reasons Behind the Enactment of Companies (Amendment) Act, 2017

Owing to the disparities in the previous Act, Government amended the Act by incorporating the necessary provisions. The MCA (Ministry of Corporate affairs) delegates the rectification task of the Companies Act, 2013 to a CLC (Companies Law Committee). Thus, the Companies (Amendment) Act, 2017 came into existence after taking the consideration made by the CLC.

Sections 186 of the 2013 Act went through significant changes amongst all the changes made in the Act.

What is the Amendment Analysis of Section 186?

Section 186 of the 2013 Act was incorporated with certain relaxations given below:-

Section 186 (2):- It confirms that no organization can (directly or indirectly) provide any

- Loan to any individual or body corporate (BC);

- Guarantee or security vis-à-vis loan to any individual or body corporate; and

- Acquire by way of subscription, purchase, or otherwise, the securities of any other BC.

Exceeding 60% of its paid-up share capital along with free reserves & the securities premium account, or 100% of its free reserve and securities premium account, whichever is more.

The Board’s permission is mandatory for the disbursement of the loan, guarantee, or security under section 186(2). The same requirement applies to investment activities. Please note that a board resolution reflecting member’s consent is compulsory for serve these purposes.

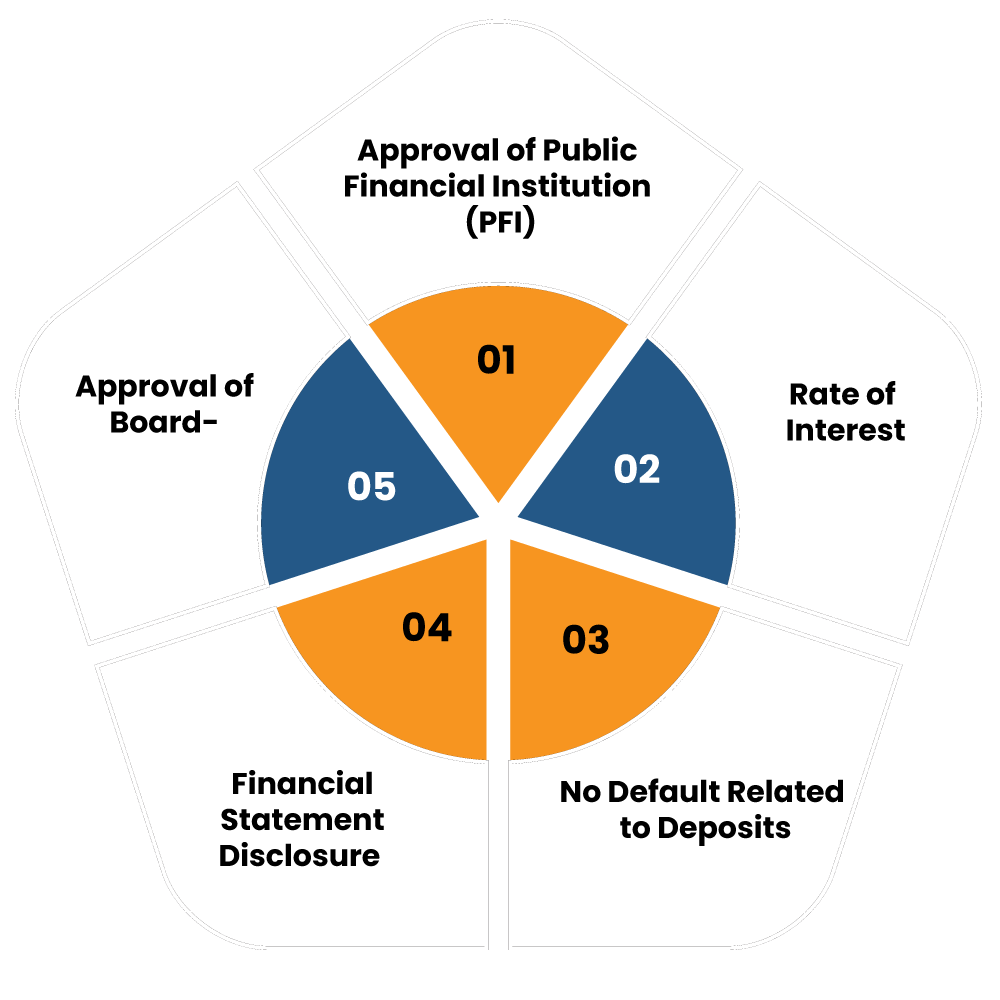

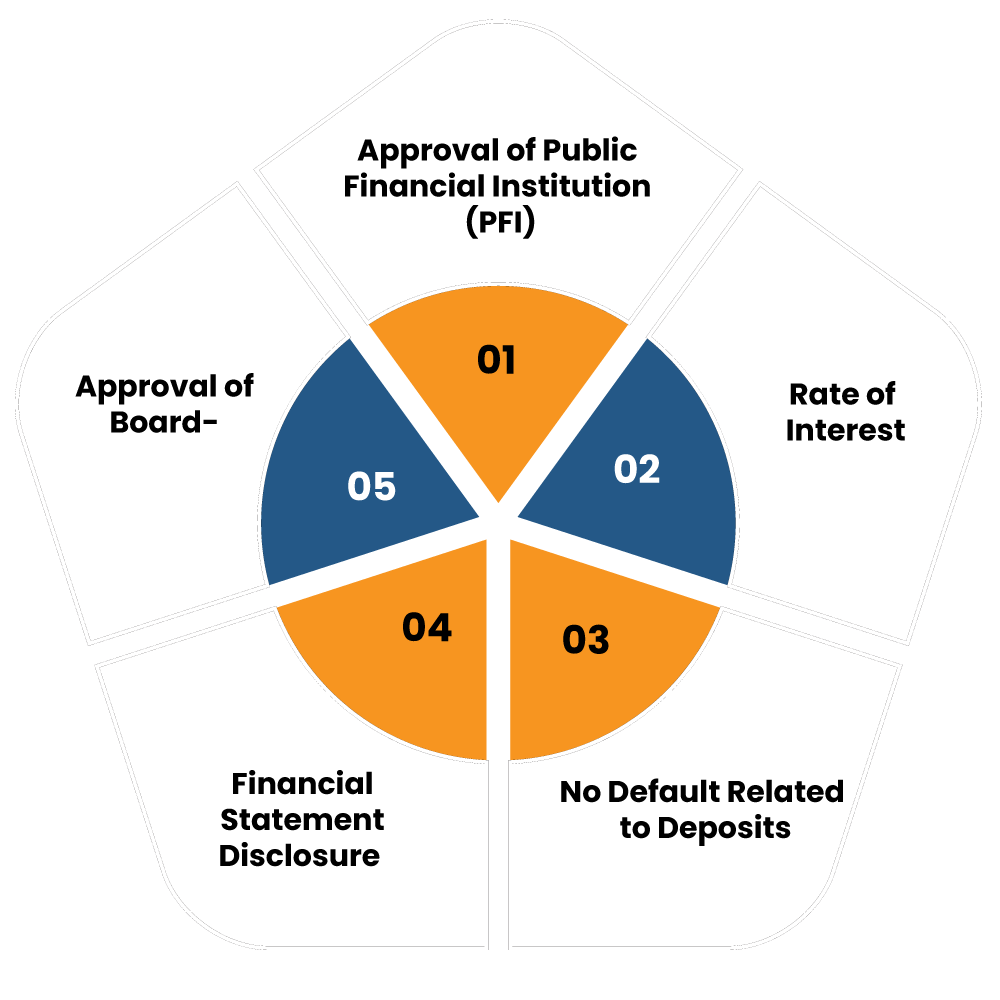

Underlining Requirements Under Section 186

Approval of Board- Members’ Approval Via Special Resolution

- Prior approval by special resolution is mandatory in case if the amount of loan, security, investment, or guarantee surpasses the threshold cited under section 186(2). The limit ought to be higher than

- 60% of the paid-up capital (aka PUC) & free reserves & premium securities account; or

- 100 % of free reserves & premium securities account.

- The special resolution should reflect the overall amount up to which Board can authenticate the said investment, loan, security, or guarantee.

- Exceptions:-

- The company provides loans to its joint venture or a wholly subsidiary company;

- The company provide security or guarantee to its joint venture or a wholly subsidiary company; and

- The holding company purchase securities via subscription or otherwise of its wholly subsidiary company (WOS)

Approval of Public Financial Institution (PFI)

- Prior approval from PFI is mandatory, from which it has availed a loan.

- Exceptions:-

- The aggregate of loan, security, investments, or guaranteed stays under the given limit.

- The default in repayment of the loan is unacceptable.

Rate of Interest

The interest rate ought to be more than the existing Government Security’s revenue closest to the loan period.

No Default Related to Deposits

The disbursement of loans, investments, security, or guarantee is not possible under the influence of past repayment defaults. Companies with clean track record of repayment are eligible to undertake such activities.

Financial Statement Disclosure

The company’s financial statement must reflect all the data of preceding investment, loan, security, or guarantee along with the purpose for which these finances are made to the concerned person.

Section 186(11): Non Applicability of Section 186:- As per Section 186(11), the Non Applicability of Section 186 is only possible, where

A loan or the guarantee or any security or investment is made by:

- Banking company;

- Insurance company;

- Housing finance company;

- A company involved with the business of providing Infrastructural Companies or of Financing of Companies

Section 186(1) will not come into effect if the investment made by the given firms:-

- A company whose core business is the acquisition of stock, share, debenture or other Securities

- An NBFC

- It’s mandatory to take erstwhile investment into account while making investments in Right Share u/s 62(1)(a) of companies act, 2013.

“The investment company” refers to a company that is involved with a business of acquiring shares, securities, and debentures. If the assets of the company exist in the form of shares, debentures, or other securities equivalent to 50% of its total assets or if its earning is from the investment business comprises 50% of its gross income.

The segment below talks about the implication of Chapter IIIB of the Reserve Bank of India Act 1934 on the NBFC and Housing Finance Company.

Exemptions Conferred by RBI to NBFC and Housing Finance Company

Reserve Bank[1] has got rid of certain exemptions for Housing Finance Companies and routed them to the level equivalent to NBFCs (Non-Banking Financial Companies). It seems that new development in Finance Act, 2019 has encouraged them to undertake such measures. It’s worth noting that the said Act governs the HFCs (Housing Finance Companies) in India.

Reserve Bank of India has also confirmed that the Chapter IIIB of the Reserve Bank of India Act, 1934 would no longer applicable to the NBFC and Housing Finance Company. On 13th August 2019, this apex institution conferred housing finance companies (HFCs) with the status of non-banks.

Conclusion

The 2017 Amendment Act consolidates all the necessary provisions that were not included in the erstwhile Act. In consultation with CLC, MCA has made this Act more practical for the NBFC and Housing Finance Company. Apart from that, Reserve Bank has also declared the withdrawal of certain exemptions pertaining to Housing Finance Companies and included it in the category of non – banks.

Read our article:Underlining Growth Prospects for NBFCs in Real Estate Realm