Ever-evolving rivalry in the lending market & high borrowing cost has escalated the need for more businesses to follow agile methodologies. A lending business that excels on customer-centric policies by augmenting existing infrastructure via technological leverage is more likely to have an enlarged customer base than others. Therefore, the time has come for NBFCs to leverage smart technology. In this write-up, we will talk about Possible Traits of Ideal NBFC Software.

Why Private Lenders Seek Ideal NBFC Software for Present Generation Borrowers?

Borrowers of the current generation are well informed and smart. They are aware of their options when it comes to availing credit from a financial institution. The age of digitization has them tweak their demand for credit accordingly due to the availability of vast data on the internet.

With that said, they aren’t anymore bothered about NBFCs whose lending protocol is stubborn and adheres to old practices. This change in customer’s perception and decision making has forced private lenders to leverage smart technology, including robust NBFC software.

The adoption of such technology can help NBFCs minimize overall workforce cost and increase client satisfaction rate. Indeed, automation is the next big thing in the financial domain. There is a number of companies who already showcased their NBFCs programs that claimed to offers unparalleled performance without any compromise.

Now, this leads us to one query, how to select ideal NBFC software that instantly syncs with a firm’s workloads and offers quick around time? The section below will answer this query in brief by offering substantial reasons.

Read our article:NBFC Vs MFI: Know the Differences

Grounds for Selecting an Ideal NBFC Software

The rapidly changing demand of the borrowers required NBFCs to offer a wide portfolio of services through a legit and agile framework. Leveraging the latest technologies can help NBFCs ensure widespread reach and hone their existing practices to increase customer satisfaction & reduce operational costs.

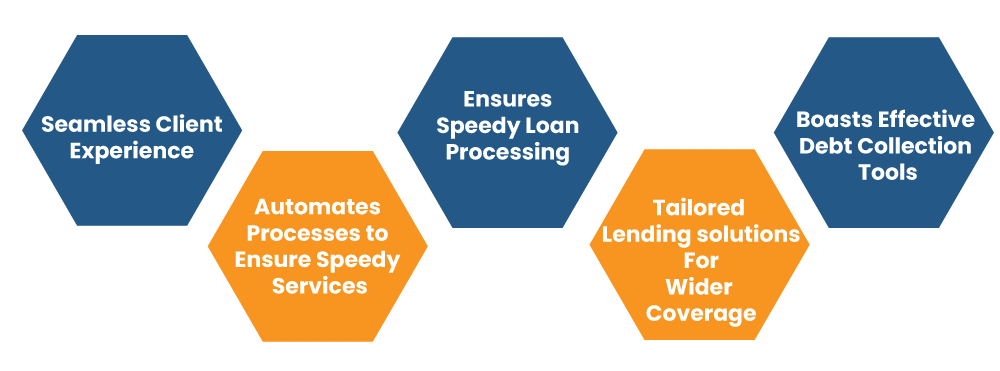

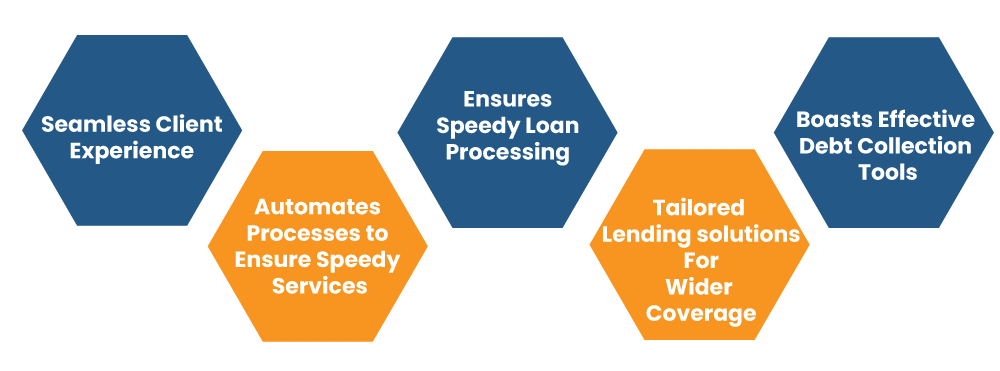

According to the prevailing NBFCs scenario, the ideal NBFC software is one that offers:-

Seamless Client Experience

NFBCs has been a savior for clients who often fail to qualify for a credit of the conventional lending avenue. In search of an untapped market share, they render flexible credit options to clients that don’t fit the eligibility criteria of traditional lending institutions. Under the influence of enormous loan application, most private lenders’ services fall apart because of inadequate resources, including manpower and technology.

Ideal NBFC software is capable of overcoming such hindrances by simplifying the tedious borrowing procedure. These software are very good at reducing loan processing and loan servicing time as well. An ideal NBFC software ensures spontaneous credit access to borrowers, thereby reducing the time for loan approval.

The best NBFC software even automates the lender-client correspondence via data-driven information available at the backup. It also mitigates the requirement of manually sending frequent reminders or messages to clients mentioned in the priority list. Thus, NBFC software ensures superior customer experiences by filling up the most fundamental gaps that often undermine the company’s growth.

Automates Processes to Ensure Quick Turnaround Time

It is a well-known fact that the lending process revolves around complexity, and it is time-consuming. Most private lenders access of heap of documentation before approving the client’s request for credit. This is not only time-consuming but also vulnerable to errors. With a sharp growth in credit demand, NBFCs need to maintain growing manpower, which inherently lures more expenditure.

Using ideal NBFC software laid the foundation for technological innovations, making operation incredibly synchronized at an NBFC. Therefore, NBFC software can mitigate gaps, including massive operational costs that hinder organizational growth. Scaling up of business is very much possible with such software.

Ensures Scaling Up and Growth via Efficient Loan Processing

While conventional banks embraced reduced risk appetite, it triggered the growth of NBFCs in the country. NBFCs often search clients that encounter disapproval from conventional bankers.

NBFCs can scale up their business only when they ensure an adequate grip over their target audience. A better insight into the lending landscape will let them meet business goals and ensure improved revenue.

The right technology can empower NBFCs to dig down the market and ensure a firm grip over a larger market share—an ideal NBFC software leverage data-driven insights about prevailing and new customers to scale up. The use of analytic and data allow NBFCs access untapped market zone. The good NBFC software can offer better insight into customers so that businesses can make informed decisions.

Tailored Lending Solutions to Please Borrowers

NBFCs usually encounter trouble in enabling customized services to meet the requirement of particular borrowers. The increased competition in the financial market often encourages NBFCs to leverage unique strategies to an untapped new market. Borrowers in present scenarios seek more than just standard credit dispensing norms.

Only highly tailored and innovative credit offerings can lure clients today. An ideal NBFC software enables NBFCs to achieve an optimum level of customization and personalization that clients often anticipate. Software leveraging AI and ML-powered algorithms offers solutions as per the client needs, thereby keeping lender’s NPAs as low as possible.

Boasts Effective Debt Collection Tools

NBFCs face constant scrutiny from regulatory authorities and follow strict norms for the collection process. All NBFCs are in desperate need of ensuring much-need changes in debt recovery protocols to earn consistent revenues. The prevailing regulations are making their debt recovery framework more rigid and less client-friendly.

An ideal NBFC software boasts versatile debt collection tools that simplify the conventional debt collection process. It inherently overcomes the requirement of maintaining heavy paperwork, which is costly and time-consuming. Intimating clients with regular update keep confusion at bay and ensures improved transparency.

Such tools simplify the process of follow up and location tracking, thereby minimizing the burden on the field collection agent. NBFC software that boasts such a tool can improve repayment scenarios and reduce the likelihood of error via human intervention.

Conclusion

Considering the competition at present, the technologically backwards NBFCs will find it hard to cement their place in years to come. The rapidly changing taste of customers and increased dominance of technology is now demanding NBFCs to step into the world of digitization and automate most of their services as quickly as possible. With the information above, we can conclude that an ideal NBFC software is highly imperative for the growth[1] of these entities.

Read our article:NBFC Software: Empowering NBFCs to Streamline Workflow