Non-Banking Financial Companies has attained unparalleled value in financial sector in recent times due to hassle-free lending. These entities are usually touted for delivering easy fiscal aid to individuals and businesses without imposing stringent stipulates, unlike a traditional bank. RBI is continuously striving to tighten the norms for NBFC to ensure better control. This leads to the increased borrowing rate and it is forcing NBFCs to look out for other niche markets. NBFCs are also focusing on the development of new products that cater to the need of the low-income group and urban sectors residing in the unorganized sectors. In this article, we will look into the contribution of Emerging technologies towards NBFCs.

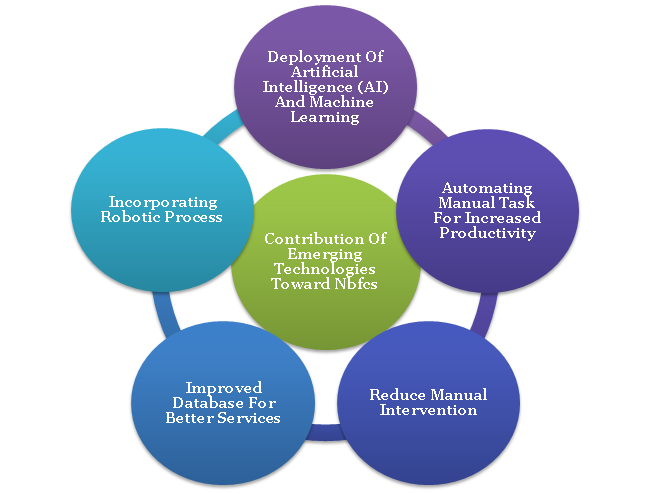

Emerging Technologies towards NBFCs

In this circumstance, NBFCs are opting for business models underpinned by emerging technologies that seamlessly facilitate the design, deployment, and execution of services. Investment in newer and upcoming technologies and collaboration with financial institutions also led NBFCs to avert cost constraint when it comes to escalating their market size and providing services to customers. It also helps them to conquer the dominance of traditional lending in an expanding economy.

Read our article:A Comprehensive Analysis on Terrorist Financing & Money Laundering for NBFCs

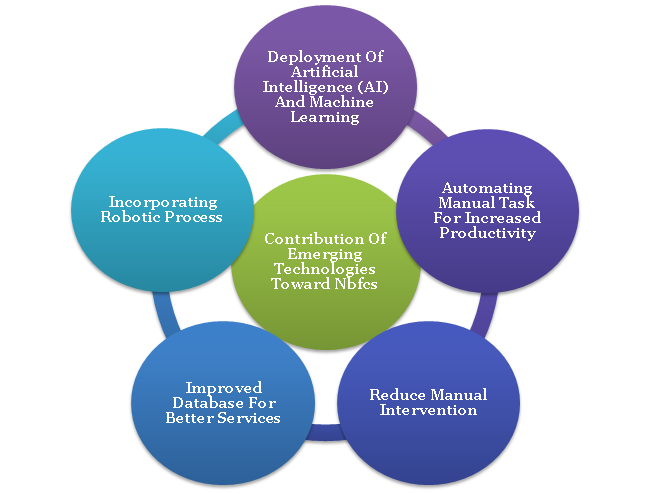

Deployment of Artificial Intelligence (AI) and Machine Learning

The newer NBFC’s are taking advantage of the latest technology to improve every dimension of their services. It also let them set up collaboration with multiple counterparts to create a productive ecosystem to ensure seamless management of existing services.

Things like AI and machine learning led the lender to analyze customer’s insight and set up an effective model for optional credit scoring. The current era of digitalization has permitted the NBFCs to establish a prompt connection with low-income customers who rely on smart devices to engage with banking-related services. With more and more startups opting for NBFC registration, it become essential for existing rivals to deploy digital technology within their system to gain the competitive edge.

Incorporating Robotic Process

The robotic process helps in optimizing the operational workflows and escalating accuracy within the system which consequently leads to increased cost saving. NBFCs are rigorously testing distributed ledger technologies on multiple grounds such as e-KYC, data exchange, cybersecurity, and loan disbursement. Application programming interfaces (also known as API) are also set up and experimented for a dynamic connected eco-system for multiple stakeholders and institutions.

Conventional Operating Model and its Quandaries

There are several obstacles linked with the conventional operating model which are as follows:-

- Unexpected delays in lead generation and processing time;

- Increase operating expenditure;

- Limited scope for credit appraisal and risk profiling;

- Manual intervention is required to execute the workflow;

- Rely on human judgment in decision-making;

- Provide shorter credit for a longer tenure;

- Stuffed with branches and people;

- Runs on outdated IT infrastructure;

- Absence of productive data.

How are Growing Technologies setting up newer Standards for NBFCs?

The following explains the exposure of emerging technology available to NBFCs.

FinTech Companies Facilitating the Latest Technologies

FinTech has been creating a lot of buzz around value chains in the financial sector[1]. Due to its immense potential of disrupting the existing banking system, the FinTech footprints are extending in the areas of asset management, deposits, and lending. In the current scenario, the FinTech companies facilitating the latest technologies to dominant the obstacles and built services related to delivery, regulatory compliance, accounting automation, regulatory compliance, and fraud detection.

Conventionally lenders have utilized a standardized method, thereby analyzing customers from different backgrounds against a single credit policy which has led to the exclusion of creditworthy customers. The FinTech is now adopting a business model underpinned by AI and Machine learning. Of course, this would help them to create a system that can easily coordinate with required data sources so that lenders can make informed decisions to tweak their services and workflow accordingly.

The approach would allow the lender to increase its existing market size and escalates the sales figure. The inclusion of AI in the existing model would empower the lenders to provide optimized services to the right pool of customers and avert overhead costs.

NBFCs Coordinating with FinTech for Automation

Some NBFCs are willing to experiment and implement solutions in co-ordination with FinTech software to automate the workflows that seek manual intervention. These entities also seek to deploy middleware software which would be responsible for processing inputs from the customers and produced well-structured data for further usages.

Technology to Boost Turnaround Time and Productivity

Technology boosted NBFC would strike the right balance between work efficiency and quality services. The incorporation of the latest tech in the system which increases cost-effectiveness and ensures prompt turnaround time as contrasted with the conventional lending models of the bank.

Instead of having resources for determining the credibility and risk in lending, the latest tech like robotic automatic can tweak such resources for better outcomes.

Automating Manual Task

Prompt and subtle decision-making is yet another key benefit of emerging technology. Technologically advanced NBFCs can automate pain-staking manual tasks in no time so that they can focus on their core competencies. Artificial Intelligence and machine learning can consistently tweak risk models for the betterment of the services. Automation is certainly the most part of emerging technologies towards NBFCs.

Discard Inefficacy and Improve Collection Ability

A periodic assessment helps in detecting the pain points within the system when tested in real scenarios. It can also render optimize the solution for maximum efficiency. Advanced analytics and AI empowers NBFCs to gather payments and analyze decisions robustly.

Increased Database for Better Analysis

For years the majority of NBFC’s take advantage of customer account balance & credit scores to prioritize suspicious or non-performing accounts and outlines methods for its collection. With such disparity at disposal, the lenders have to increase the data sets and capabilities of data processing to extract and blend insight current and old data sets of the suspicious account by focusing on big sets of information.

Conclusion

NBFC has changed the dimension of the financial sector by incorporating strategies that support easy lending. People who tend to approach the bank in the first place for credit is now favoring NBFCs due to ease of services. With so many individual rushing toward NBFCs to avail credit, it becomes vital for them to automate the system from the ground up.

The advent of AI and machine learning will certainly help NBFCs to take a huge leap toward digitization. Now, this would improve the overall efficacy of their system and maximize their profit in the longer run. Contact CorpBiz team in order to get precise info on emerging technologies towards NBFCs.

Read our article:Future of NBFCs in India – A Reality Check