Owning a house is indeed one of the vital decisions because it involves a lot of costs, including years of saving. Purchasing a property is a kind of investment whose value grows with time, and it offers a sense of security. But, not everyone has adequate financial backup to buy out a property in one go. This is when the requirement for availing of a loan arises. While banks are the one-stop destination for a home loan, they fail to make a sanction in some cases. This is where Non-Banking Financial Companies come into the picture. In this article we will see the growth prospects for NBFCs in Real Estate Sector.

What is NBFC?

NBFC is a financial avenue that offers a wide range of financial and banking services to consumers without meeting the bank’s legal classification. These establishments come under the Companies Act, 1956.

These institutions’ primary function is rendering banking services such as the acquisition of shares, as the advancement of loans, credit facilities, securities, retirement plans, debentures, stocks, etc. NBFCs in Real Estate sector play a vital role when it comes to financing prevailing and future project.

Significance of Non-Banking Financial Companies in the Indian Economy

Non-Banking Financial Companies meet the fiscal needs of a diverse client base that fails to avail the banks’ services.

NBFCs seem identical to banks owing to their operating models and overall functionality. Although they don’t fit with the bank’s legal definition as per law, they are emerging as a prominent financial supporter for the needy ones. They usually cater to the need of the unorganized sector and small businesses. These institutions are bound to run in accordance with the rules and regulations of other banks.

With a growing demand for property and a large sector consisting of the middle-class, NBFCs have now emerged as a prevalent financial avenue for real estate lending.

Read our article:Know the Possible Traits of Ideal NBFC Software

What is the Significance of NBFCs in Real Estate Development?

NBFC is one of the prominent contributors to the real estate sector of our country. They help in luring overseas investment, increase resources’ mobilization and capital formation. This implies that savings can transform into investments, leading to increased investments in the real estate sector. This implies that demand pertaining to real estate will grow over time, and therefore, property investments can offer a higher return on investment (ROI) in the future.

Since the fundamental role of NBFCs is to finance infrastructural projects, they are one of the biggest contributors to the real estate industry. In the past few years, these institutions have been sought for real estate loans instead of the banks.

Therefore, they continue to disburse credit to borrowers looking to invest in real estate or housing and are the finest alternative to banks.

Real Estate Future and its effect on NBFCs

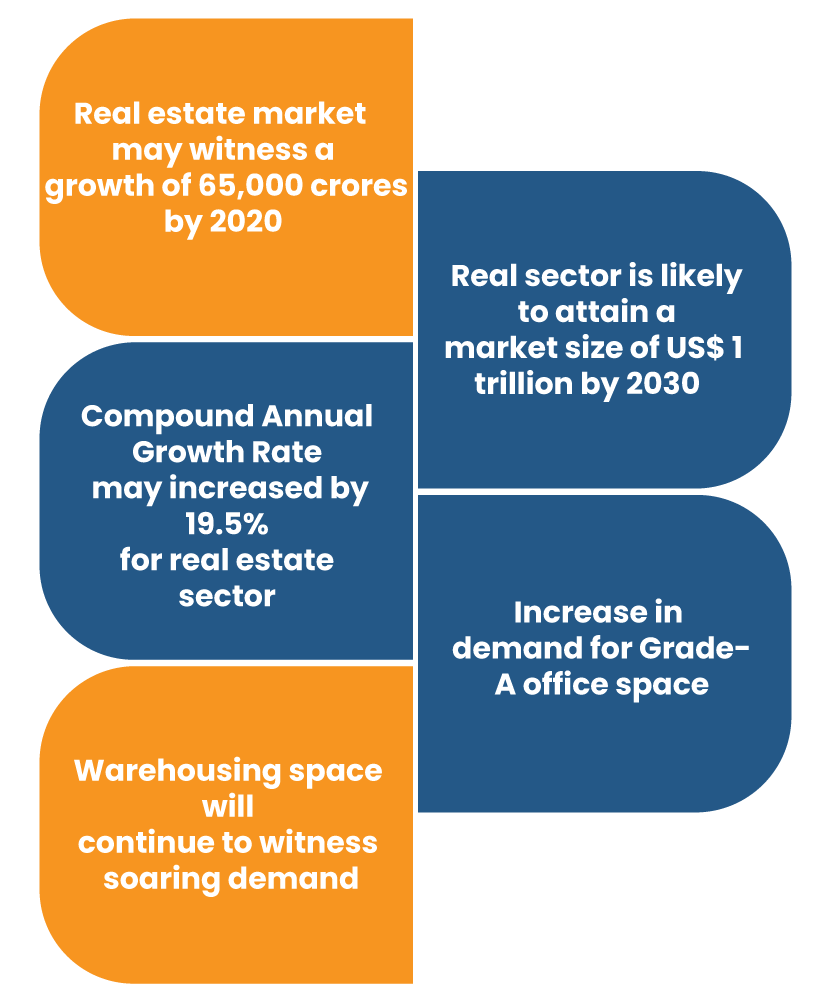

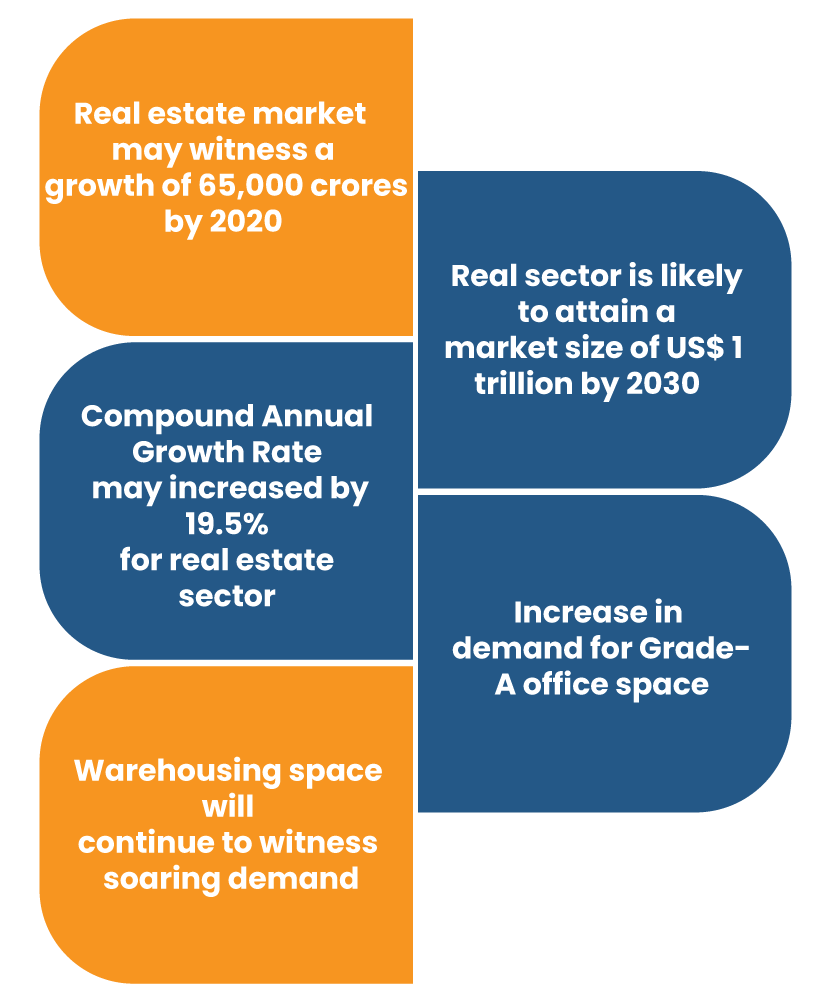

- By 2040, the real estate market is expected to grow to 65,000 crores from Rs. 12,000 crores in 2019. The real estate sector is anticipated to attain a market size of US$ 1 trillion by 2030 and contribute 13% to the nation’s GDP by 2025. Commercial real estate, hospitality, and Retail are thriving considerably, given the rising infrastructure demand. Indian real estate shall be increased by 19.5% CAGR by 2028. These figures are nothing short of potential growth indicator for NBFCs in real estate sector.

- The sectors such as IT, manufacturing, and consulting largely depend on office space to execute their operations. During 2019, the office leasing space hit an all-time high record, posting 60.6 million square feet (msf) across eight major cities, recording a growth of 27% on year on year basis.

- Warehousing space grew 247 million square feet (msf) in 2020 and witness investment worth Rs. 50,000 crore during FY 2018-20. Grade –A office space demand is likely to reach 700 msf by 2022, with NCR contributing the most.

- 2.61 lakh units of the house were sold in 2019 across seven major cities. Home sales volume in eight major cities collectively reached 33,403 units in Sep 2020 compared to 9,632 units in the preceding quarter, indicating healthy recovery after the lockdown imposed due to the spread of COVID-19.

Facts to be noted

With limited funding from conventional banks, which came down to 2% as of March 2018, NBFCs stood at 61% of commercial borrowing in the nation. Given the ever-increasing population, there has been a consistent demand for the need of infrastructures such as commercial spaces and offices. The borrowing had increased up to 50% in the FY 2016 – 2018. Unfortunately, in the year 2020, the overall lending in India reduced by 46% owing to the Coronavirus outbreak.

A take on Government’s initiatives to steer NBFCs through tough times

The RBI has taken some critical decisions in the past to improve the efficiency and security of NBFCs in India[1]. In 2018, the Reserve Bank came up with an Information Technology Framework for NBFC to augment security, safety, and efficiency to ensure seamless operation and improved turnaround time.

The Role of NBFCs in capital formation & sustaining consumptions in MSMEs is quite significant. Therefore, the Government of India[1] has facilitated a single-use partial credit guarantee to PSBs to purchase high-rated assets worth Rs 10, 00, 00 crores from NBFCs. This initiative was of great help because it allows NBFCs to garner much-needed liquidity to support their operation.

Even when most private lenders and NBFCs were encountering tough times amid the COVID-19 era, the government stands strong and releases much-needed financial support to these firms through different initiatives. The schemes like Partial Credit Guarantee Scheme and Special Liquidity Scheme collectively provide Rs 75,000 crores of financial support so that these institutions can effectively counter the unprecedented liquidity crunch.

Conclusion

The presence of NBFCs in our country ensures trouble-free accessibility of finances to the more significant part of the unbanked population. The absence of banking status doesn’t make them unreliable or unproductive and they are as precise as any full-fledged bank. As far as their growth is concerned in real estate realm, it is expected that as the economy stabilizes overtime, these institutions will see the improved credit demand. The increasing significance of NBFCs in Real Estate sector will pave down roadmap of growth for Indian economy.

Read our article:RBI Proposed to Revamp NBFCs Regulatory Framework