In early times, the financial sector of India was dependent and completely dominated by private financial institutions. Even there was a time in India when financial Institutions and banks hesitated to grant loans to the small business, considering it a risky proportion. However, the current financial scenario is completely different and is being balanced equally by both public and private sector financial institutions. RBI is the chief regulator for NBFC and have framed Pre- commencement NBFC compliance.

It was also a time in India when small and medium business enterprises were getting rejected from the banks have turned as a great opportunity for NBFCs with localized presence and complete market Information. Since the NBFCs are associated with the small firm’s financial sector; the NBFCs have evolved in there in terms of operations, a variety of products, instruments, and technology. NBFCs are required to comply all the RBI prescribed regulations during the Pre – Commencement of business.

Here in this blog, we will try to touch every aspect related to NBFC in India, the current situation of NBFC; besides this, we also discuss the pre-commencement formalities for NBFC.

Pre – Incorporation Compliance for NBFC

RBI is responsible for regulating the Financial Institutions like NBFCs in India. NBFCs in India are the credit providers, which are much preferred than banks, due to their quick and less complicated formalities. However, for newly incorporated NBFCs, there are following types of Compliances which are needed to follow strictly for further operations.

Compliances for Pre-Commencement of Business after obtaining License

a. Adoption of Fair Practice Code

1) Application for Loan and their Processing:

- Language: Information which has to be provided by the lender to the borrower should be in such a manner which can be easily understandable by the borrower.

- Loan application forms should be included necessary information in the interest of the borrower.

2) Loan appraisal and conditions:

- Information about the amount of the limit sanctioned to the borrower shall be conveyed to the borrower along with the terms and conditions, including annual rate of interest, in written form.

- Penal interest charged by the NBFC for late repayment shall be in bold in Loan Agreement.

3) Disbursement of loans (terms and condition)

- Notice to the Borrower should be provided in regards to any amendment in the terms and conditions which includes disbursement schedule, interest rates, service charges, prepayment charges, etc., by the NBFC.

- The decision to recall or accelerate payment or performance under the agreement should conform with the loan agreement.

- NBFCs shall securities shall be released, on the repayment of remaining dues on the outstanding amount of loan.

4) General:

- NBFCs have refrained from any interference in the affairs of the borrower except in the terms & condition in Loan Agreement.

- Request from the borrower related to the transfer of borrowal account or any rejection by the NBFC shall be conveyed within the 21 days from the date of receipt of such request.

- In the case of recovery of loans, the NBFCs are obliged not to do any undue harassment.

- NBFCs cannot charge any foreclosure charges/ or any prepayment penalties on the rate of terms loans sectioned to the borrower, with immediate effect.

5) Responsibility of the Board of Directors:

- There should be an appropriate grievance redressal mechanism in NBFC, which shall be laid down by the board of director.

- The board of directors shall provide a review report on how the NBFC has followed the Fair Practice Code Compliances, and how their grievance redressal mechanism at various level of management is working.

b. CIC Registration

As per the Credit Information Companies (Regulation) Act, 2005 (CICRA), makes a mandatory rule for the Banks and NBFCs to report every retail loan to all the four credit information bureaus which are namely –

- Tran Union CIBIL – This was the first Credit Information Company founded in the year 2000, known as Credit Information Bureau of India. CIBIL plays an important role during the approval of any loan being granted through a bank either through NBFC.

- Equifax – Equifax is one of the oldest CIC founded in 1899 in Atlanta. It received its ‘Certificate of Registration’ in India in the year 2010 through RBI. Equifax has a separate bureau dedicated to addressing the growing lending and regulatory needs of the Microfinance Institutions.

- Experian – This Credit information company was founded as a joint venture with many banks and several financial Institutions in India in 2006. One of the renowned magazine Forbes declared Experian as the ‘World’s Most Innovative Company’, in the year 2014. The company prepares the credit report based on the information provided by banks and other financial institutions, of the past financial history of the individual.

- Credit Information High Mark Services – This type of CIC not only provide a credit report but also furnish to borrower segments such as SME, commercial borrower and the retail borrower. The company was founded in 2005 in Mumbai.

c. FIU-IND

Government of India in the year March 2018, asked Non – Banking Financial Institution to register with the Financial Intelligence Unit (FIU). The objective behind this is to report the details of the client as per the requirement under the Prevention of Money Laundering Act, 2002.

Every single reporting entity under Prevention of Money Laundering Act,2002, required to furnish the information to the Director, Financial Intelligence unit – India. FIU- IND is a central agency, which is working on collecting and sharing the information related to suspicious financial transactions with the enforcement agencies. Reporting entities need to furnish this information through a secure online FINnet gateway.

The NBFC registration process requires the furnishing of basic details of the user or reporting entity. The three steps registration process to register as the new user are:

- Reporting Entity (RE) selection

- Principal Officer (PO) registration

- Other User (OU) registration

Following mentioned entities are required to be registered with FIU- IND;

- Financial Institutions

- Banking Company

- Chit – Fund Company

- Intermediary

- Co-operative Bank

- Housing Finance Institution

- Non – Banking Institution

d. Central KYC(CKYC)

NBFCs are offering a variety of banking and non-banking services. Majority NBFCs deals in Loans and advances, stock and share, hire and purchase, leasing and insurance etc. Reserve Bank of India chief regulator of NBFC and is responsible for lay down the rules and regulations for the smooth working of NBFCs.Hence, NBFCs are regulated and supervised on the basis of provisions laid down by RBI.

RBI being as the chief regulatory authority, keep on updating and amending its certain provisions from time to time. These new amendments are essential for the health of the institutions.

Know your Customer (KYC) direction, 2016, is also one of such move published on 25 February 2016 by RBI. Directions are mandatory to be followed by the regulatory entities like;

- Scheduled Commercial Banks

- Financial Institutions

- Non – Banking Finance Companies

- Payment System Provider

- Agent of Money Transfer Scheme

- Domestic and cross- border wire transfer.

Objective behind CKYC

The purpose behind creating central KYC is to;

- The KYC record can be used across the sector

- This will reduce the burden of furnishing KYC documents, whenever any customer creates a new relationship with a financial entity.

- There will be a reduction in substantial cost, by not registering customer again and again.

e. CERSAI

RBI vide its notification dated November 12, 2013, notified all the NBFCs to register the details of all such equitable mortgages created by them on after March 31, 2011, with Central Registry of Securitisation Asset Reconstruction and Security Interest in India (CERSAI)[1].

Under the SERFAESI Act, banks and financial institutions are required to furnish the details of all the mortgage created in their favour by way of title deeds on the portal of the Central Registry (CERSAI).

Read our article:Are you running an NBFC? Get updated about the list of Annual Compliances Prescribed by the RBI

Entities Required to Register the Security interest with CERSAI;

Banks

- A banking company

- A corresponding new bank

- State Bank of India

- Subsidiary Bank

- Multi-state co-operative banks

Financial Institutions

- A Public financial institution, under section 4A of companies act,1956

- A central government specified financial institution, under sub-clause(ii) of clause (h) of section 2 of Recovery of Debts Due to Banks and Financial Institutions act, 1993

- International Financial Corporation formed under the International Finance Corporation (Status, Immunities and privileges) act,1958

- Non – Banking Financial Company or any other Institution defined under clause (f) of section 450-I of RBI act,1934.

- Debenture Trustee is appointed by the bank or any financial institution

- Secularization company

- Any other trustee holding securities on behalf of a bank or financial institution

Submission of Financial Information to Information Utilities

RBI vide its circular No. RBI/2017-18/110, dated December 19, 2017, provided directions to all the NBFCs to submit the Financial information to the information utilities.

Further, financial information shall be submitted in relation to a person, means, one or more categories.

Following are the categories of information that needs to be furnished;

- A complete record of debt of a person;

- Liabilities record of the time when a person was solvent;

- Record of such securities upon which security interest has been created of a person;

- Record of instances of default by a person against any debt (if any);

- Balance sheet record and cash flow of statement;

- Any other related information may be specified.

Documentation during Commencement of Business

After obtaining the Licence from RBI, NBFC needs draft documents for loan disbursal. The documentation will change completely according to the business plan submitted during the licensing process, to RBI.

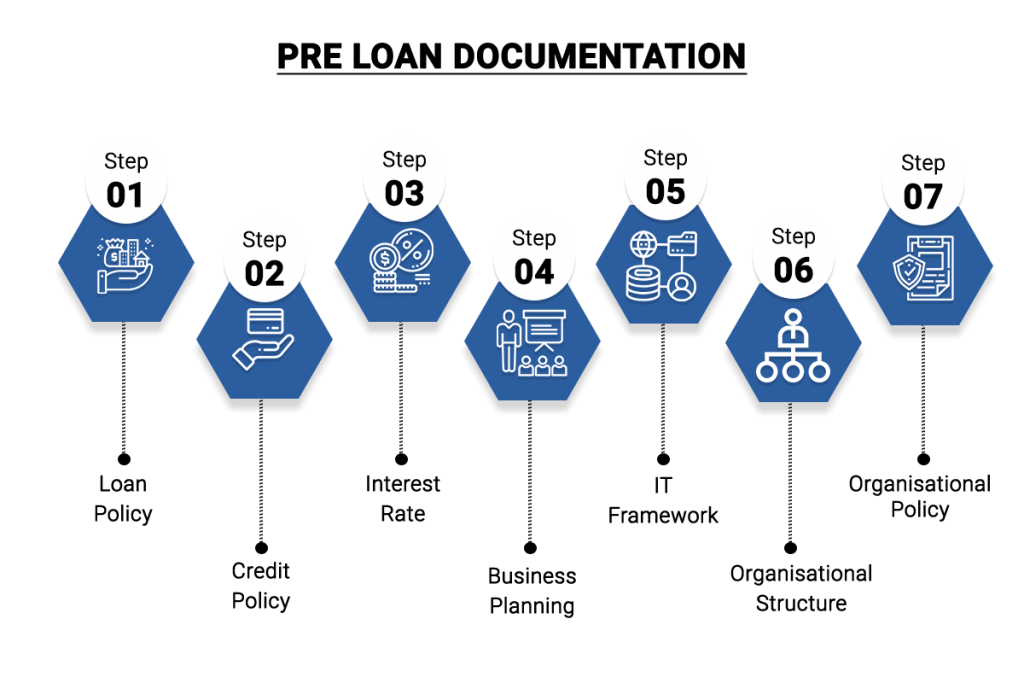

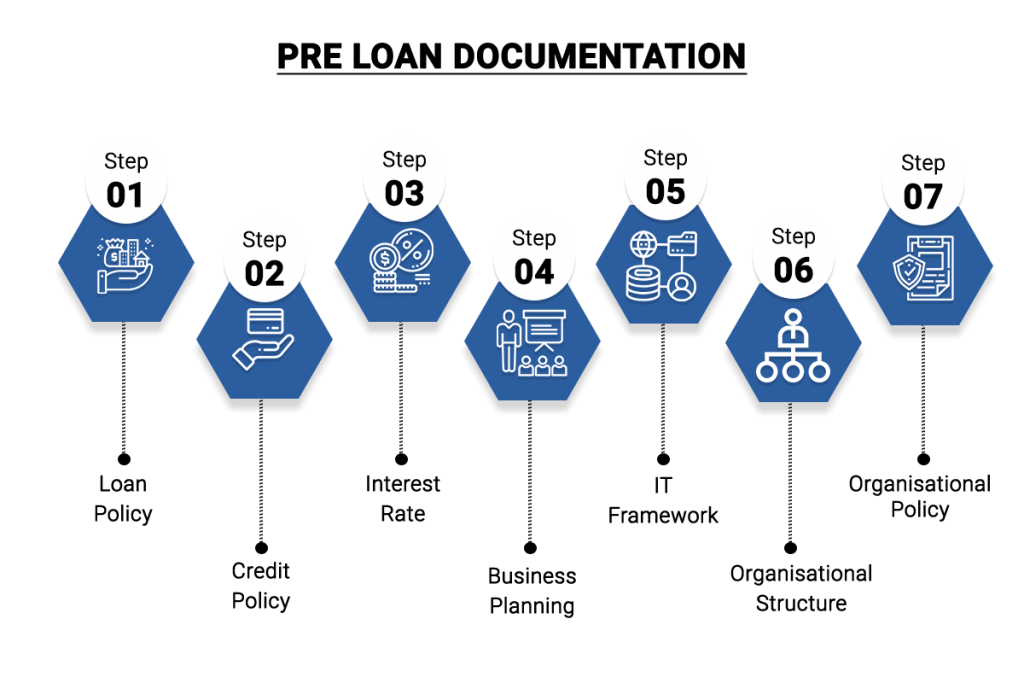

Pre Loan Documentation

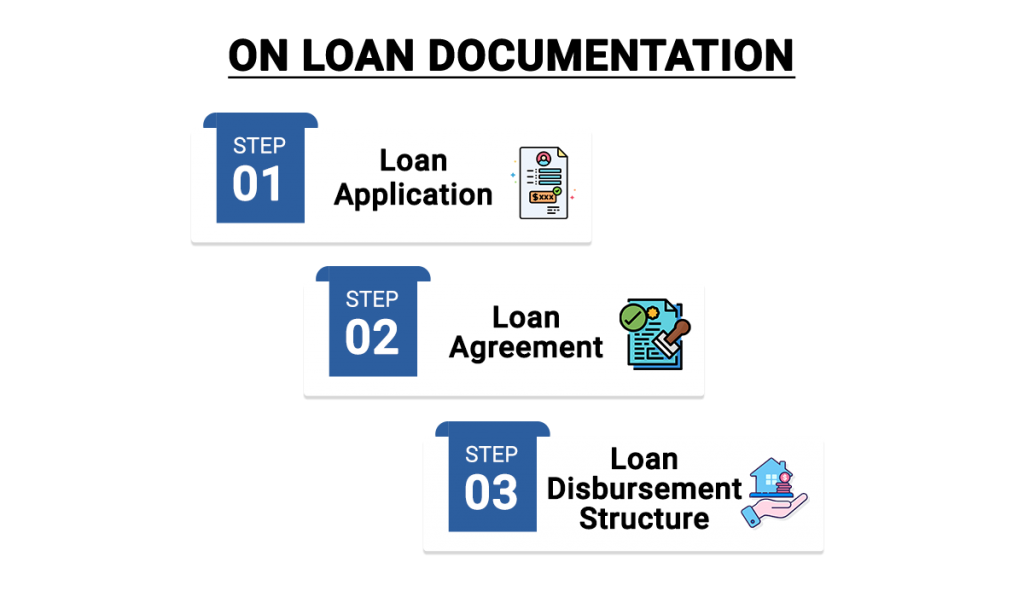

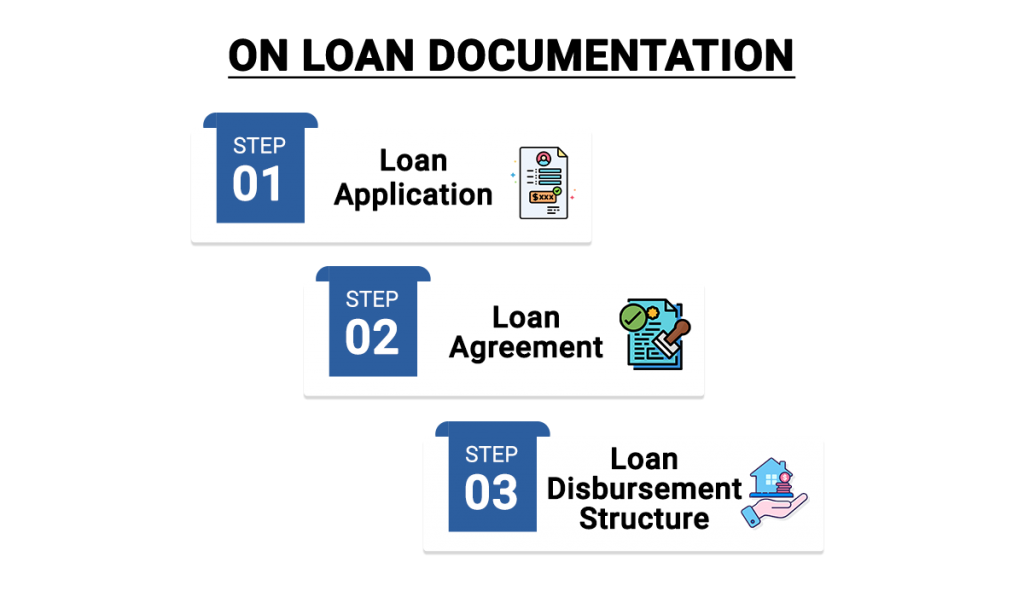

On Loan Documentation

Post Loan Documentation

However, there are two types of NBFCs

- Systematically Important NBFC – Asset Size more than 500 Cr

- Non- Systematically Important NBFC- Asset Size Below 500 Cr

Systematically Important NBFC has to follow the policies prescribed by RBI mandatorily.

Progressive Era for NBFC

The contribution of NBFC in the Indian economy has risen from 8.4% in 2006 to more than 14% in March 2015. Undoubtedly, the NBFC has conceived a great success story, which will bring fruitful results near future. NBFC have registered a compound annual growth rate (CAGR) of 19% over the past few years.

NBFCs stands supported with the help of several factors like low costs, broader and effective reach, superior product lines, and capabilities to check and control bad debts.

Whereas banking sector is struggling to get rid of their bad debts, other non-banking financial sector (NBFCs) has improved its performance on most metrics in the fiscal year 2015. Financial Stability Report (FSR), of June 2016 have mentioned in their report, NBFC loan rate has been expended 16.6% annually which was twice of credit growth across the banking sector on an aggregate level.

However, it is very much evident that the development in the NBFC sector is giving a challenge to the other financial sector of India – like Banks. Banks need to improve their quality and Competence, and they even should more work upon innovations in the banking sector.

Read our article:NBFC Registration: Step by Step Procedure