Merger or Acquisition is a tedious and complicated procedure owing to the presence of vast legal implications. Small companies often have tough time in addressing the legalities associated with such processes. To counter such a situation, the Ministry of Corporate Affairs (MCA), on 15 Dec 2015, introduced fast-track mergers u/s 233 of the Companies Act, 2013 read with Rule 25 of the Companies.

Section 233 of the Companies Act, 2013 brought the notion of the Fast Track Merger process, which simplifies the complicated procedure of mergers and amalgamations for almost all companies.

Fast Track Merger seeks to empower these entities to perform M&A procedures promptly and precisely within a fixed time frame.

In contrast with the process of a conventional merger, the new Act has overcome the complications by mitigating the requirement of confronting the judicial process with the National Company Law Tribunal.

Now the companies are mandated to avail consent from only three regulatory institutions mentioned as follow

- Regional Director

- Registrar of Companies

- Official Liquidator

Read our article:Merger or Amalgamation of Company with Foreign Company: Complete Overview

Applicability of Fast track merger or Amalgamation

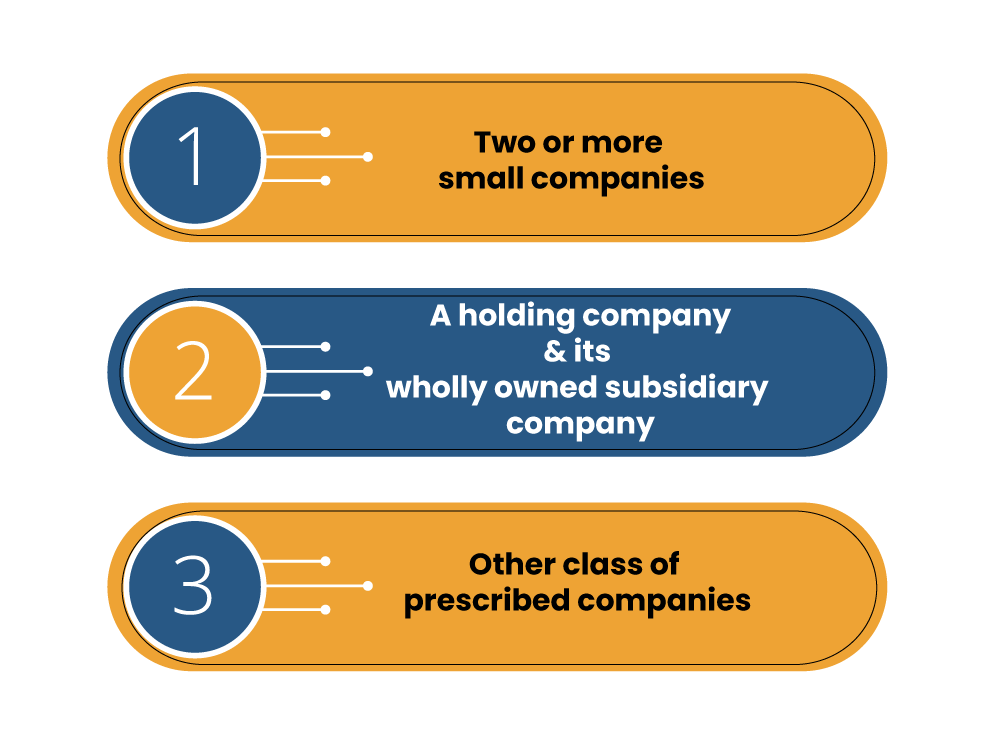

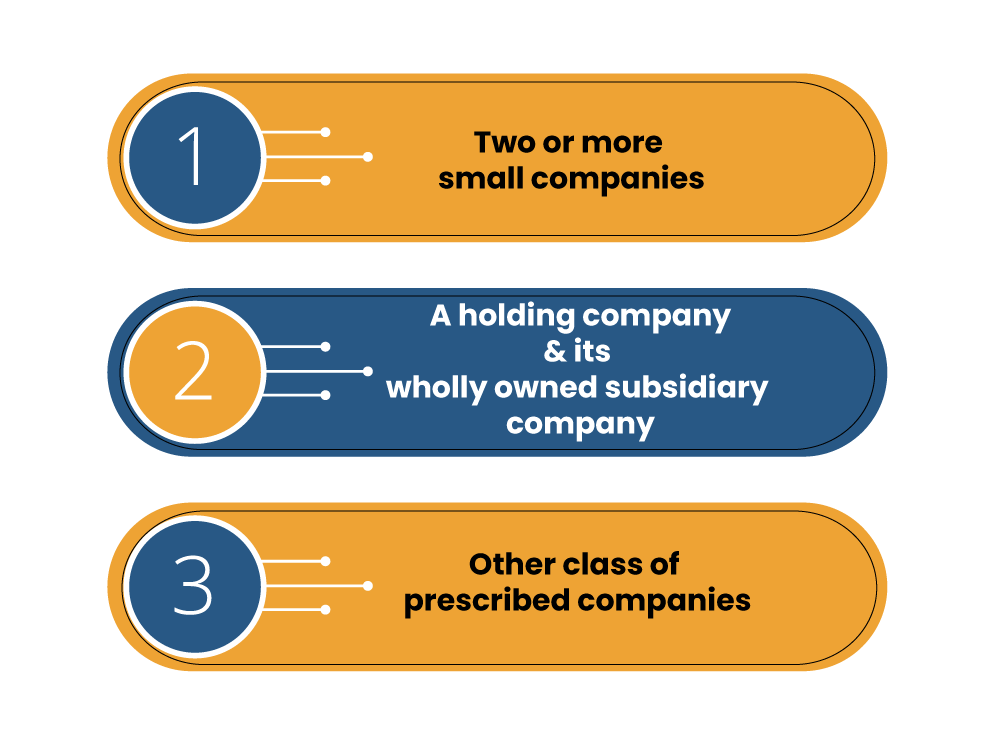

In the purview of Section 233(1) of Companies Act, 2013, a scheme pertaining to merger or Amalgamation under the said provided may occur between:

Who can engage with the Fast track merger and Amalgamation?

The above-listed class of entities shall stand eligible for out of the Court/Tribunal process of arrangement or compromise in the purview of Section 233 (12) of the Companies Act, 2013[1]. Such arrangement or compromise could be:

- Between an entity & its creditors or any class of them; or

- Between an entity & its members or any class of them

Legal Procedure for Fast Track Merger & Amalgamation

The procedure relating to Fast Track Mergers & Amalgamation may be described in the following manner:

- Make sure the company’s MOA entails the provision for Amalgamation. If such provision is not present, incorporate the same via a legit procedure before indulging in said process.

- The next step is to file the Provisional Financials statements as on the date. The Transferor & transferee entities are obligated to serve such a purpose.

- Next, Transferor & transferee entities are supposed to draft the Scheme of the merger.

- Board approval is mandatory in such a scenario, i.e. Merger Scheme needs to get the board approval without exception. The same meeting is liable to authorize the form CAA, a legal consent to invite any rejections/Suggestions against the proposed Scheme in the purview of Rule 25 Sub-rule (1).

- ROC will take around 30 days to respond against the form CAA 9. On the other hand, the Official Liquidator will also take the same amount of time to serve this purpose.

- In the purview of Rule 25 Sub Rule (2), the Transferor & transferee entities are required to file the Declaration of Solvency CAA-10 before ROC prior to sending notice for convening the meeting of creditors & members.

- No-Objection Certificate from creditors (Secured & Unsecured) – NOC to be dated post-filing of the said form and before EGM for final approval.

- Transferor & transferee entities shall convene the Board Meeting to arrange the EGM.

- In light of Rule 25 Sub Rule (3), Notice pertaining to General Meeting- Notice of the meeting must be attested with Declaration of Solvency & Detailed statement, CAA-10

- General meeting for scheme approval: The Scheme of M&A or suggestions availed from ROC & OL, if any, will be taken into account in this meeting, and the Scheme will be authenticated.

- In the purview of Section 233 (4), the Scheme‘s approval by creditors 9/10th in value of entities either in meeting or otherwise authenticated in written consent to be availed from the creditors in place of convening the meeting.

- Filing of form, namely MGT-14 for availing ROC’s approval for Shareholders resolution.

- Intimation of the approved Scheme has to be shared with all the regulatory authorities.

- In the purview of Rule 25 Sub-rule 4(a), submit the form CAA-11 in Form GNL-11 to Registrar of Companies within seven days after meeting’s decision and should entail a complete statement in GNL-1 (This must be shared by Transferee Company for both the companies).

- Submission of Form CAA-11 manually to ROC and OL within seven days after the general meeting. (The said firm must be submitted by the transferee company for both the companies).

- Regional Director will share their concern in the form of a questionnaire to the transferee company. The recipient must respond within seven days from the date of receiving the said questionnaire. The regional director may cancel the Scheme based on the response submitted by the recipient.

- In the purview of Rule 25 Sub Rule (6), the approval order of the Scheme will be received in CAA-12. The recipient can receive such order within 60 days as the timeframe for filing an application with Tribunal for application’s rejection is 60 days

- In the purview of 233(7), filing of INC-28 for the order availed- Within one month of order availed for the consent of the Scheme.

Post-Merger Effects & Compliances

The Scheme of the Scheme could have the given effects as mentioned below

- Transfer of asset or liabilities of the transferor entity to the transferee entity;

- The charges, if any, on the property of the transferor entity will be applicable and legally enforceable as if the charges were imposed on the property of the transferee company;

- Legal proceedings by or against the transferor entity pending before any legal forum shall be continued by or against the transferee entity;

- The transferor company is no longer entitled to possess PAN, IEC, GST, ESI, and PF and submitted the same to the concerned authorities.

Conclusion

The fast track merger enlisted u/s 233 of Companies Act, 2013 seeks mandatory approval from creditors, shareholders, ROC, OL, and regional director. As it is clear from above, companies intending to be involved with mergers and Amalgamation process require addressing loads of legal implications that seek precise paperwork and a legit approach.

Read our article:Mergers and Acquisitions: SWOT Analysis