Mergers and Acquisitions or M&A is a type of business alliance that helps companies to expand or grow their business. Mergers and Acquisitions are altogether a different thing. A typical Merger and Acquisition covers a lot of complex issues like tax, legal and synergy. Its process covers ways of selling, buying, dividing and combining different companies. A merger and acquisition occur between two existing companies by way of purchasing or amalgamating two companies.

What are Mergers and Acquisitions? – Definition

Mergers and Acquisitions are defined as companies consolidation. Mergers and Acquisition have been explained below:

What is the difference between Merger and Acquisitions?

Mergers and Acquisitions are generally considered identical. However, the two combinations are moderately different. The basis of comparison is specified below:

| Basis of Comparison | Merger | Acquisition | |

| 1. | Definition | When more than one companies come forward to work as one, it is considered a merger. | When one company takes control of another company, it is acquisition. |

| 2. | Terms | Mergers are planned and friendly. | Acquisitions are, at times, involuntary and also hostile. It is not always involuntary. |

| 3. | Title | A new name is given to the company. | The acquired company works under the name of acquiring company. |

| 4. | Scenario | Two or more companies who work in like manner or consider each other on equal terms usually merge. | It should be noted that the acquiring company is larger than the acquired company. |

| 5. | Power | There is no power difference between the two companies. | The acquiring company dictates terms to the acquired company. |

| 6. | Stocks | New stocks are being issued due to merger. | There are no new stocks issued in case of Acquisition. |

| 7. | Legal Formalities | There are more legal formalities. | There are less legal formalities. |

| 8. | Purpose | Firstly, to decrease competition and secondly, to increase operational efficiency. | Only, for instantaneous growth. |

| 9. | Example | The merger of Bank of Baroda and Vijaya Bank. | Tata Steel acquiring European Steel major Corus. |

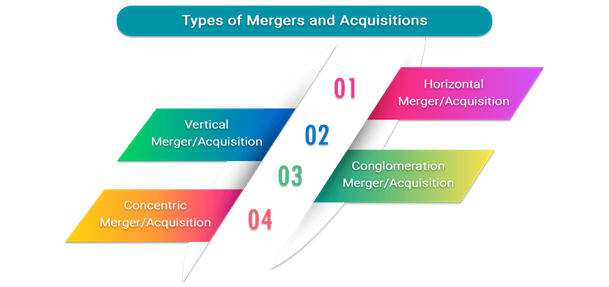

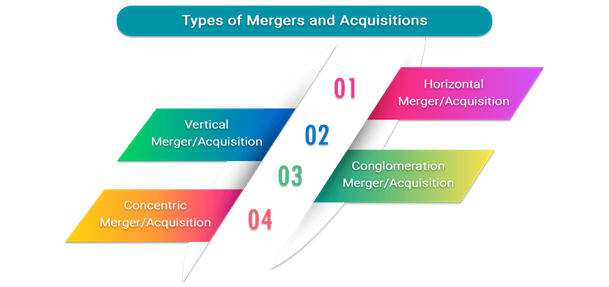

Know the Types of Mergers and Acquisitions!

Companies merge together and acquire each other for various reasons. The basic four ways why the companies join forces are mentioned below:

Vertical merger/Acquisition

- The aim of a vertical merger is to amalgamate two companies with similar products or services.

- But the only difference is the stages of production at which they are operating.

- For instance, Hewlett Packard[1] took over/ acquired Compaq Computers for $24.3 billion. The only aim was to create dominance of personal computer by combing the PC products of both the companies.

Concentric Mergers/Acquisition

- Concentric mergers take place between firms serving the same customers.

- Though the customers are the same still, they don’t offer the same products and services.

- Their products are complements of each other.

- But technically they are different products.

- For instance, A combination of a computer system manufacturer with a UPS manufacturer. Or a cloth retailer buying cloth manufacturing company.

Horizontal Merger

- Two companies having the same products or services join together.

- By merging, they are not doing anything new. But are expanding their services.

- For example, acquisition of Times Bank by HDFC Bank or acquisition of Electrolux’s Indian Operations by Videocon International limited.

- The main objective of the Horizontal merger is to achieve monopoly status in the market and reduce competition.

Conglomerate Merger / Acquisition

- Conglomerate merger is combining two different or unrelated industries by way of merger or acquisition.

- The business target of both companies here is entirely different.

- For instance, watch manufacture acquiring a cement manufacturer.

- The main objective is to grow the size of the business.

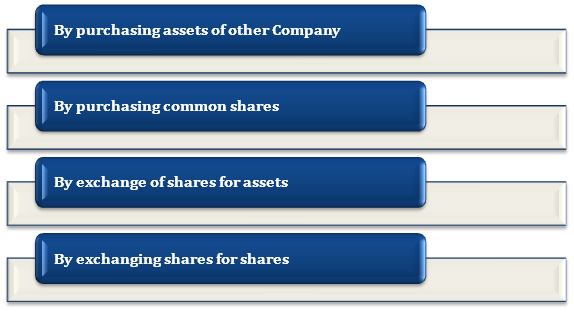

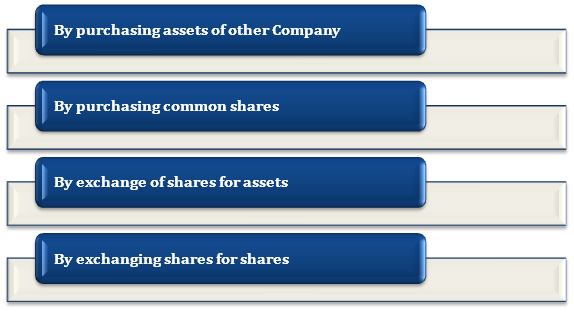

How mergers and acquisitions can take place?

Mergers and acquisitions take place in the ways mentioned below:

Read our article:What are Alternative Investment Funds and why they are becoming increasingly popular across the Globe?

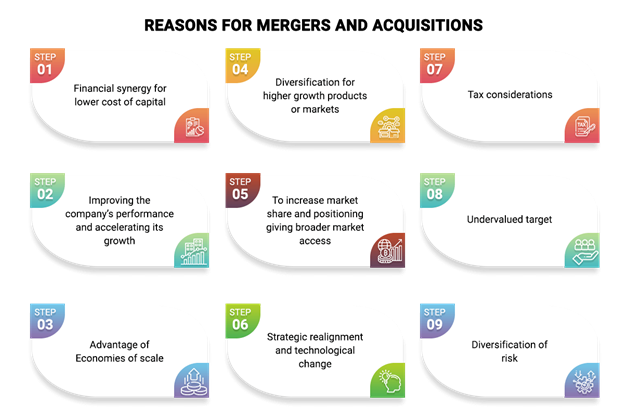

What are the reasons for Mergers and Acquisitions?

Many critical business reasons give birth to Mergers and Acquisitions. But the economic reason is the most common reason. The below shown graphic mentions some of the reasons:

What are the benefits of Mergers and Acquisitions?

There are many benefits of expanding business through acquisition or merger. The benefits include:

Synergy

The synergy generated by the merger of two companies is powerful enough to increase business performance, financial gains and, overall shareholders’ value.

Competitive Edge

The combined resources of the new company help it gain and maintain a competitive edge.

Cost Efficiency

The merger results in reducing the costs and overheads through shared marketing budgets and lower costs. The reduction in staff or other resources reduces the salary costs and increases the budget of the company.

New Market

A Combination of two businesses results in better sales opportunities. The market reach grows or is improved due to a merger or acquisition.

What are the Disadvantages of Mergers and Acquisitions?

The disadvantages of Mergers and Acquisitions are mentioned below:

Increase in prices

A merger or acquisition reduces competition in the market and thus gives the acquiring company all the monopoly in the market. Due to less competition and greater market share, the new firm can increase the prices of the products. Here the consumers are the ultimate sufferers due to the increase in the prices of the products.

Decrease in jobs/Job Losses

A merger or acquisition can result in job losses. Usually, the companies tend to remove those assets which are not profitable for the company.

Diseconomies of Scale

After the amalgamation process, the new company may experience diseconomies of scale due to its increased size. There may be a lack of the degree of control, and thus they may struggle to persuade their workers to work efficiently.

Loss in Productivity

In cases where the small companies are taken over or amalgamated, the employees may require re-skilling. Thus during re-skilling, the company may suffer non-productivity of those employees. Hence it will cast a capital burden on the economy.

What are the steps involved in Mergers and Acquisitions?

For the successful execution of mergers and acquisitions following sequential steps should be followed:

What are the Reasons for Failure of Mergers and Acquisitions?

Many of the mergers and Acquisitions face failure because they are not aware of the exact process. Some common reasons are listed below:

Summing up

Businesses, whether it be large or small, cannot get a 100 per cent success guarantee from Merger and Acquisitions. Looking at the pitfalls or failures, consult a firm to conduct the process for you. We at Corpbiz have experienced and expert professionals to help you in the process. Our professional will guide you and will help you in getting through the Mergers and Acquisition process. Our professionals will plan ideally and will ensure the successful completion of the process.

Read our article:How does a Company Issue Debentures to the Public?