The businesses in these modern economics days are very different from the businesses earlier. The increase in the adaption of the technology is challenging the business operating these days. Due to the increasing wave of globalization, the concept of Merger and Amalgamation with Foreign Company has now gained significant importance in recent times. Under the Companies Act, 2013[1], the provisions for Merger or Amalgamation of Company are provided in Section 234 of the Act.

What is a Merger or Amalgamation of Company with Foreign Company?

A Merger or Amalgamation of Company with Foreign Company or Cross Border Mergers and Acquisition is a concept when one Company acquires another Company that is based in a different country. The Merger or Amalgamation of a Company with Foreign Company helps the Companies to expand their businesses around the world. A Company must have a clear strategy or vision before the Merger or Amalgamation with Foreign Company. The company should also do the Due Diligence analysis to find the perfect match of a foreign company for the process of Merger or Amalgamation with Foreign Company to start.

Under Section 234 of Companies Act, 2013, provides for the provisions for Merger or Amalgamation of Company with Foreign Company. The prior approval of RBI is needed for Merger or Amalgamation with Foreign Company as per Rule 25A of Companies (Compromises, Arrangement, and Amalgamation) Rules, 2017, in consultation with the Reserve Bank of India (RBI). The RBI also introduced the Foreign Exchange Management (Cross Border Merger) Regulations, 2017, which states that the Merger or Amalgamation with Foreign Company must be approved by the Reserve Bank of India (RBI) if the Merger or Amalgamation is in accordance of the regulations.

What legal provisions are associated with the Merger or Amalgamation of Company with Foreign Company?

In India, the Merger or Amalgamation Foreign Company is majorly regulated under the following legal provisions:

- The Companies Act, 2013.

- SEBI (Listing Obligation & Disclosure Requirements), 2015

- SEBI (Substantial Acquisition of Share and Takeover) Regulations, 2011.

- The Competition Act, 2002.

- Indian Stamp Act, 1899, and all other Stamp Acts.

- Insolvency and Bankruptcy Code, 2016.

- Foreign Exchange Management (Cross Border Mergers) Regulations, 2018.

- Central Goods and Services Act, 2017, and other State GST Acts.

- Companies (Compromises, Arrangement, and Amalgamation) Rules, 2017.

What are the conditions for Merger or Amalgamation of Company with Foreign Company?

The conditions for Merger or Amalgamation of the Company with Foreign Company are as follows:

- Prior approval is needed by Reserve Bank of India (RBI)

- The provisions of Section 230-232 of Companies Act, 2013, should be followed for the Merger or Amalgamation with Foreign Company;

- Approval of National Company Law Tribunal (NCLT), Shareholders, Creditors, Securities and Exchange Board of India (SEBI), and Income Tax Authorities should be taken prior the Merger or Amalgamation with Foreign Company;

- Payment of consideration to shareholders of merging company should be provided in cash or depository receipts or partly in depository receipts and partly in cash;

- The Incorporation of Foreign Companies should be in a permitted jurisdiction.

- The Valuation of the surviving should be submitted to the Reserve Bank of India (RBI);

- The Valuation should be done in accordance with the internationally accepted principles on Accounting and Valuation. The Valuation report should be made by a valuer who is the member of a recognized body in its jurisdiction.

- The Resultant Company is involved in the Merger, or Amalgamation is required to furnish a report from time to time as per guidelines of Reserve Bank of India (RBI). The company should also consult the Government of India while preparing the report.

- The laws relating to the Merger or Amalgamation of the Foreign Company in which Foreign Company is incorporated should also be considered by the NCLT while approving the Merger or Amalgamation of Company with Foreign Company.

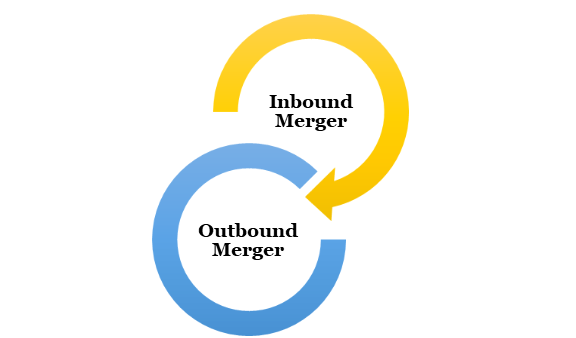

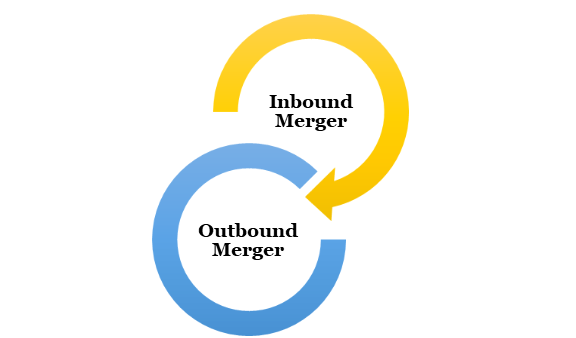

What are the different types of Merger or Amalgamation of the Company with Foreign Company?

The Merger or Amalgamation with Foreign Company are of two types:

Inbound Merger

The Inbound Merger is a concept where the resultant company is an Indian Company. The Resultant Company means that company that takeover the assets and liabilities of the other company involved in the Merger or Amalgamation of Company with Foreign Company.

Outbound Merger

The Outbound Merger is a concept where the Resultant Company is a foreign company. The Resultant Company means that company takeovers the assets and liabilities of the other company involved in the Merger of Company with Foreign Company.

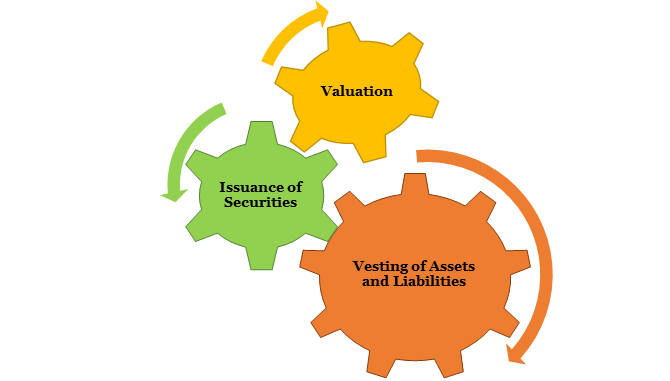

What are the key provisions of the Merger or Amalgamation for Inbound and Outbound Merger?

The key provisions of Merger or Amalgamation in case of Inbound Merger and Outbound Merger is as follows:

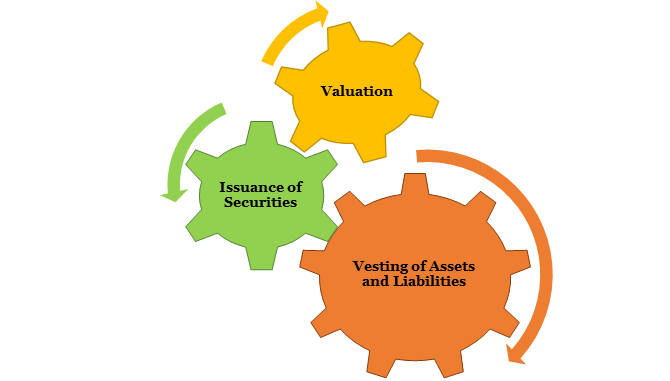

Issuance of Securities

The Resultant Company can do the Issue of Securities to a person resident outside India according to Foreign Exchange Management (Transfer or Issue of Securities by a Person Resident outside India) (Amendment) Regulations, 2019.

The Resultant Company, if holding any assets after the Merger, shall follow the Foreign Exchange Management (Transfer or Issue of any Foreign Security) Regulation, 2004.

Valuation

As per the Rule 25A of the Companies (Compromises, Arrangement, and Amalgamation) Rules, 2017, the Valuation should be done by registered valuers who are members of recognized bodies in the jurisdiction of the transferee Company. Furthermore, the Valuation should be done in accordance with the international standard accepted principles of Valuation and Accounting.

Vesting of Assets and Liabilities

In the case of Inbound Merger, the borrowings and guarantees of transferor Company should become the borrowings and guarantees of Resultant Company. On the other hand, the borrowings and guarantees of the Resultant Company undergoing Outbound Merger should be paid as per the NCLT Regulations.

In Inbound Merger, the Resultant Company can open a Bank Account in the jurisdiction of a foreign country for overseeing the transactions related to the Merger or Amalgamation of Company with Foreign Company. On the other hand, in case of Outbound Merger, the Resultant Company can open a Bank Account Special Non-Resident Rupee Account for the transactions related to Merger or Amalgamation of Company with Foreign Company.

What are the benefits of the Merger or Amalgamation of Company with Foreign Company?

The benefits are as follows:

- The Merger or Amalgamation helps in capital accumulation for a long term basis.

- There is employment creation in the long run when the business expands and becomes successful.

- There will be sharing of best management skills and practices when Companies across the world come together in business.

- There will be an expansion of technology when best skills and practices come together in business from around the different countries of the world.

- There will be an increase in the productivity of the host country.

- If the government policies are in favor of the Merger or Amalgamation, then it will lead to economic growth and development of the country.

Conclusion

Section 234 of the Companies Act, 2013, provides for the Merger or Amalgamation of Company with Foreign Company. The Companies Act, 2013, provides the much-needed procedure for upgrading the Merger or Amalgamation architecture in India. The Merger or Amalgamation with Foreign Company is done on a very vast scale these days in India. The complex issues in Merger or Amalgamation with Foreign Company depend largely and specifically upon the facts, scale, dynamics, and geographic scope of both the Companies. Hence, the process of Merger or Amalgamation of Company with Foreign Company is complicated and time-consuming. We at Corpbiz have expert professionals to help you with the process. Our professionals will assist and help you with the process of Merger of Company with Foreign Company. Our professionals will ensure successful and timely completion of the process.

Read our article:Mergers and Acquisitions: SWOT Analysis