Ministry of Corporate Affairs introduced E-Form INC 22A on February 21, 2019. Under the Companies Act 2013, the MCA demands companies such as Private companies, Public Companies , Nidhi Companies, and other companies to fill out the MCA E-Form INC-22A for the validation of the address of all the after Company Registration. In the past, the department of MCA (Ministry of Corporate Affairs) has introduced the new MSME- Form 1, which must get filed by specified companies whereof outstanding payment to MSME supplier will be more than 45 days.

E- Form INC 22A – An Introduction

Let’s have a look at the introduction of E-Form INC 22A. All registered companies under the roof of the Companies Act of 2013 should get their address validated by using this Form introduced by MCA. This e-ACTIVE (Active Company Tagging Identities and Verification) Form will be keeping Company Secretaries and Chartered Accountants active. This Form is a result of government wise step towards identification as well as the elimination of shell companies in the forthcoming years.

The intent behind the introduction of the KYC Form was to give companies the faith that they can accurately e-file their details for the maintenance of a proper check facility. The initial due date for filing this Form was April 25, 2019. However, after the representations made to the Ministry of Corporate Affairs for due date extension regarding ACTIVE E-Form INC 22A and the due date extended and up to June 15, 2019.`

Applicability of E-Form INC 22A

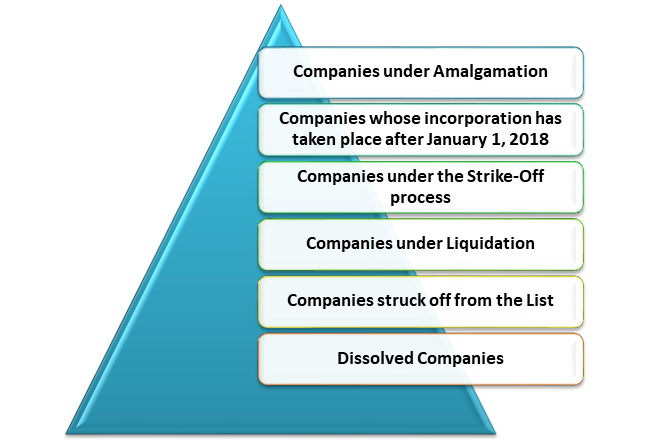

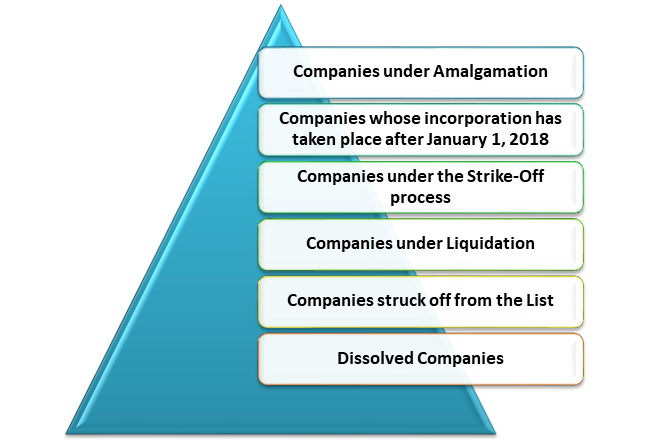

All those companies which get incorporated either on or before December 31, 2017, need to file the company particulars along with the address validation of registered office in MCA E-Form INC 22A either on or before June 15, 2019, with the registrar. Some companies got exempted from filing this ACTIVE Form.

The exempted companies’ are as follows:-

Information Furnishable in the E-Form INC 22A

Companies must complete all the compliances with respect to the Financial Statements filing as per section 137 and filing of Annual Returns as per Section 92 for the financial year 2017-2018 before filing E-Form INC 22A. In the E-Form ACTIVE 22A, the following information must get presented-

- Company Name

- CIN (Expanded as- Company Identification Number) – This must get acquired from the Certificate of Incorporation allotted to the company.

- Registered Office Location on Map representing Latitude or Longitude- These details may get attained from maps.

- Registered Office Address along with PIN Code (On CIN submission, the company address would get auto-filled)

- Mobile Number as well as Email in order to receive One Time Password for verification purpose- After the Form gets filled up and seems to be free from any error, the activation of the “Send OTP button” would take place.

Additional Information Provided by the Company

Along with the details provided above, there are some additional details to get furnished by the company-

- The company needs to provide information related to auditor. With this regard, the company should file the Form ADT-1 for the financial year 2018-19 with respect to the appointment of the auditor. The details that would get presented are-

- Name of the Firm

- PAN

- Appointment Period

- Registration Number of the Firm

- The company should provide relevant information with regard to all of the associate directors. Concerning this point, it is mandatory to make sure that DIN of all the associate directors is not disqualified and has received the approved tag. The information about the associate directors that would get furnished are-

- DIN

- Status of DIN

- Number of Directors

- The company needs to provide details about the cost auditor in case of applicability. The company should file Form CRA-2 with reference to the purpose of the cost auditor appointment. Here, the details that would get exhibited are-

- The financial year would get covered

- Name of LLP/Individual/Firm

- As per the case, Registration number of the firm or Membership number

- The company needs to provide the Company Secretary details in case of applicability. The information about Company Secretary that might get furnished are-

- PAN or DIN

- Name

- Membership number

- The company should provide details concerning the Certifying Authority (CA/CS). The details that would get furnished by the company are-

- Membership number

- DSC of Certifying Authority

- Cost Accountant/CA/CS

- The company must furnish information about the Chief Financial Officer in case of the applicability. The information regarding CFO that would must get provided, those are PAN and Name.

- The company should look after providing the details of the CEO/CFO/Manager/Managerial Personnel MD/Whole Time Director. The details that must get furnished are-

- PAN/DIN

- Name

- Designation

- SRN for MGT-7, along with AOC-4, needs to get furnished together with this Form. It’s mandatory to get both the Forms filed in the specified period in order to get an SRN. Enter the latitude as well as longitude with respect to the location of the registered office that would get obtained by using maps.

- A photo of the company’s registered office wherein one of the company’s directors is the present (Internal as well as External photo) needs to get attached along with the form.

Fees for Filing E-Form INC 22A (ACTIVE)

| Particulars | Fees |

| INC 22A filed either on or before June 15, 2019 | Nil |

| Companies with ACTIVE non-compliant status | Rs. 10,000 |

Who is not permitted to File E-Form INC 22A?

If a company has failed to file its due financial statements as under section 137 or has not filed due annual returns under section 92 or even both in the office of the Registrar won’t get the permission to file the ACTIVE Form.

On the other hand, if the entity/company is facing disputes concerning the management and the Registrar has recorded the same thing, then it would get allowed for filing E-Form INC 22A.

Consequences of Non-Filing of ACTIVE E-Form INC 22A

If an individual or a person fails to file the ACTIVE Form by the 15th of June 2019, the company status will get noted as ACTIVE Non-compliant. Also, it will be liable for action according to the Companies Act of 2013[1].

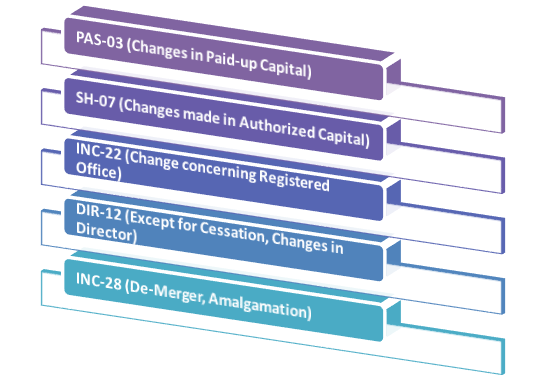

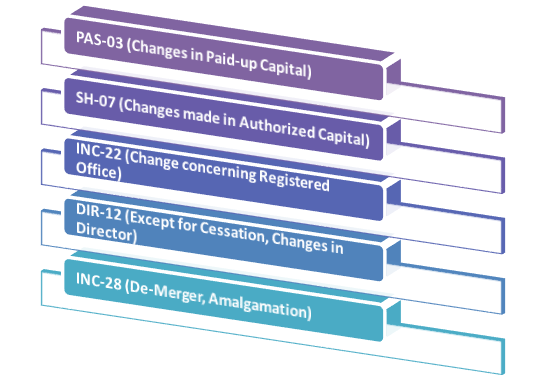

Till the filing of ACTIVE E-Form INC 22A, the following events or changes won’t get recorded by the Registrar-

Latest Updates on E-Form INC 22A

- The time period for DIN holders as ‘Deactivated‘ got extended up to September 30, 2020, in order to file DIR-3 KYC or DIR-3 KYC- Web without 5000 INR fees.

- ACTIVE Non-compliant companies got extended duration by September 30, 2020, for filing E-Form ACTIVE without Rs. 10,000 fees.

Take Away

The Indian government came up with ACTIVE E-Form INC 22A with an objective to identify as well as eliminate shell companies. This welcome move has brought transparency as well as accountability in corporate authority and ownership. We have covered the detailed information regarding ACTIVE E-Form INC 22A. You can consult Corpbiz experts for quick solutions concerning filing the Form and any other help as well.

Read our article: Maintenance and Inspection of Documents in Electronic Form