When there are changes made in the existing share capital structure of the firm, it is known as Alteration in Share Capital. The Articles of Association (AoA) must authorize for the Alteration in Share Capital Clause. In the case of a public company, the shares are subscribed to the public at large. So, the limited company has to alter the Memorandum of Articles (MoA). The MoA contains the capital clause, which can be altered during the lifetime of the company. In this article, the procedure followed for Alteration in Share Capital will be discussed.

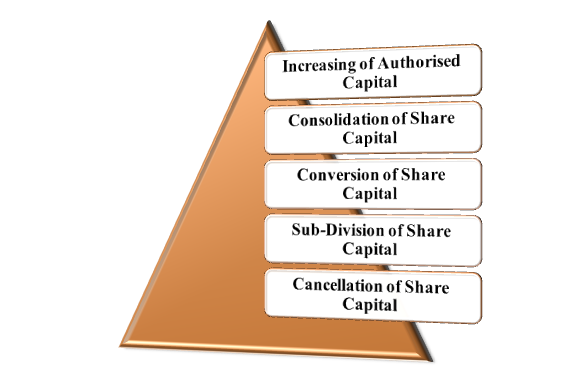

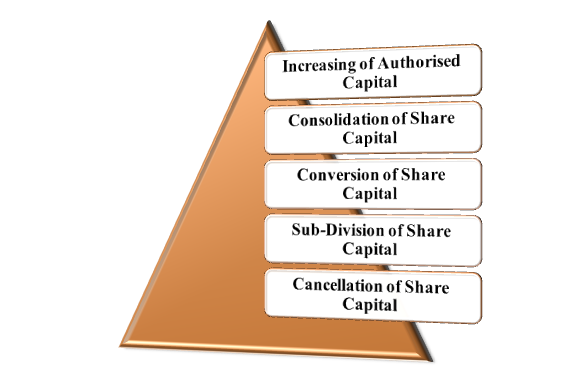

What are the Different Types of Alteration in Share Capital?

Section 61 of the Companies Act, 2013 mentions the different types of Alteration in Share Capital:

Increasing of Authorized Share Capital

Authorized Share Capital means the registered and the nominal capital, with which the company was incorporated following the whole procedure of company registration. The company can raise its share capital by doing Alteration in Capital Clause in the MoA.

Consolidation of Share Capital

The company can also do Alteration in Capital by consolidating the smaller denominations shares into larger denominations shares.

Conversion of Share Capital

The company can do Alteration in Capital by converting the fully paid-up shares into the Stock. The re-conversion of the stocks into fully paid up shares can also be done.

Sub-division of Share Capital

In this type, the company sub-divides its shares of smaller amount than that what was fixed by the MoA.

Cancellation of Share Capital

There are some shares which are not taken by any person and diminish that amount of share capital by the number of shares so cancelled.

Read our article:Appointment of Alternate Director: Procedures

What is the Procedure followed for Alteration in Share Capital?

The steps followed for the Alteration in Share Capital are as follows:

- Issue a Board notice with the agenda of the meeting at least 7 days before the date of the meeting.

- Hold a Board Meeting

- Pass the Resolution for the Alteration of Share Capital in the Board meeting.

- The Resolution passed is subject to the approval of Shareholders Meeting.

- For holding a Shareholders Meeting, fix the date, time and venue for the meeting.

- Director is authorized to send notice of the Shareholders meeting to the Shareholders.

- The notice for a Shareholders meeting should be issued at least before 21 days of the meeting

- Hold a Shareholders meeting

- Pass the Resolution with the consent of the majority shareholders.

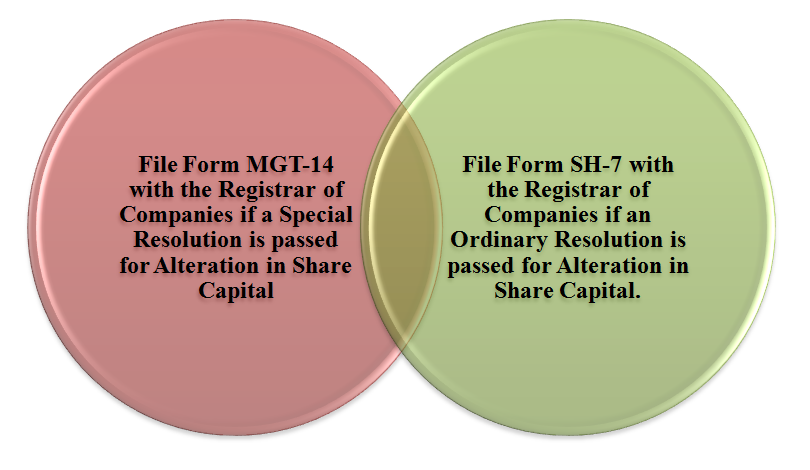

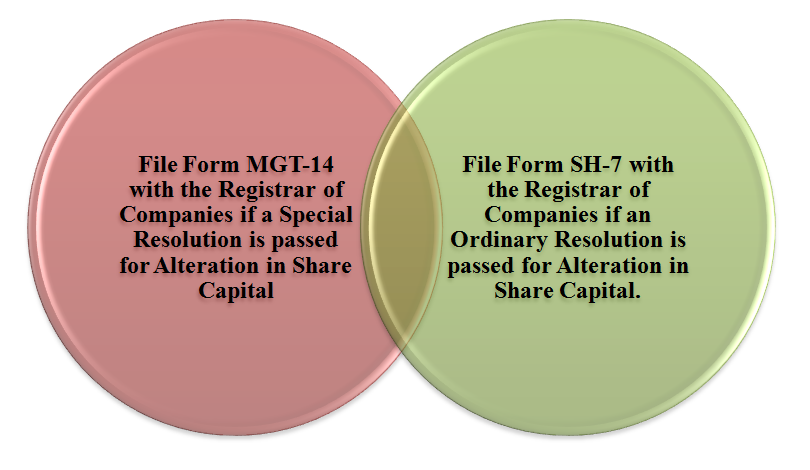

- After passing of the Resolution, the Registrar of the Companies (RoC) should be notified about the Alteration in Capital within 30 days of the passing of Resolution. If the Registrar is not notified about the Alteration within 30 days, then the company or its officers will be liable to pay a fine up to 10,000 Rupees for each day of delay and which can be extended to 5 lakh Rupees.

The above forms are to be filed with the prescribed fees by the Ministry of Corporate Affairs. If the Forms mentioned above are not filed with the Registrar of Companies, then according to Section 117 of the Companies Act, 2013[1], the company shall be liable for a fine which shall not be less than five lakh rupees and may extend up to 25 lakhs of rupees. Every officer who is in default will be liable to pay 1 lakh rupee and which can be extended to 5 lakhs of Rupees.

- The Stamp Duty can be paid electronically through the Ministry of Corporate Affairs, and the following documents are to be attached:

- Notice of Meeting

- A true certified copy of the Resolution

- Altered Memorandum of Articles (MoA) or Articles of Articles (AoA), if any

Conclusion

The procedural part of the Companies Act, 2013 states for the Alteration in Share Capital. The Alteration in Share Capital can only be done by altering the MoA and AoA of the Company. The increase in the total capital of the company is always a benefit for the investors in the company. We at Corpbiz have experienced professionals to help you in the procedure of Alteration in Share Capital. Our professionals will plan ideally and will make sure the successful completion of the process.

Read our article: Process for Shares Issue through Employee Stock Option Plan