In India, mandatory provision was inserted under the Companies Act, 2013, which requires every registered company to maintain statutory records of company in form of books of account, records, minutes etc. In erstwhile companies Act, companies were required to maintain physical copies of its financial records. But with the Companies (Amendment) Act, 2006 emphasis was given to electronic filing of documents. But still, there was major missing about methodology in order to maintain electronic documents. With the inception of the Companies act 2013[1], specific provisions were provided in order to define records in electronic forms

Where provisions w.r.t. Maintenance and inspection of electronic documents are defined?

Even in erstwhile companies Act, there was a reference of maintenance of records in electronic form, but clear picture was given under the Companies Act, 2013 under Section 120 of the companies act, 2013. Section 120 has been defined as:

“120. Without prejudice to any other provisions of this Act, any document, record, register, minutes, etc.,—

(a) required to be kept by a company; or

(b) allowed to be inspected or copies to be given to any person by a company under this Act, may be kept or inspected, or copies were given, as the case may be, in electronic form in such form and manner as may be prescribed.”

So as per the said section, companies are required to maintain the records of company in electronic form and further allow inspection or give copies of the same as per prescribed manner. Further, certain guidelines also have been provided under the Companies (Management and Administration) Rules of 2014 for preservation and inspection of records in electronic form.

What is the definition of records?

Here term ‘Records’ comprises of any ‘Books & Papers’ or ‘Documents’ as defined under section 2(12) and section 2(36) of the companies act, 2013 respectively. Further, the term ‘Records’ can be defined as registers, minutes, records, indexes, memorandum, agreements or any other documents as required by companies act to be maintained by a company as defined under Rule 27 of the Companies (Management and Administration) Rules of 2014.

Does this maintenance in electronic form is applicable for all companies?

Maintenance of records in electronic form is a mandatory provision for all listed companies and for companies which have shareholders, debenture holders or security holder’s number not less than One Thousand (1000). These companies are required to maintain records as per prescribed rules and guidelines prescribed for maintenance of electronic records. For other companies, it is an optional provision.

And any existing company was required to convert the data from physical form to electronic form within a time period of 6 months as per prescribed guidelines, i.e. on or before 01.10.2014.

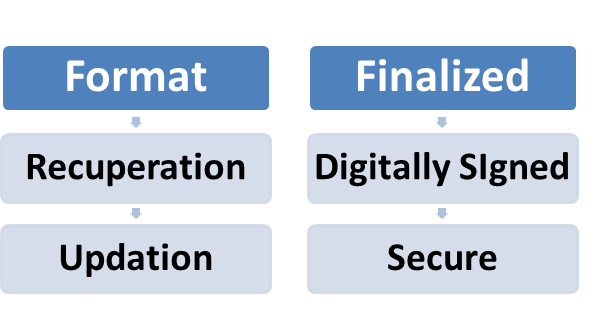

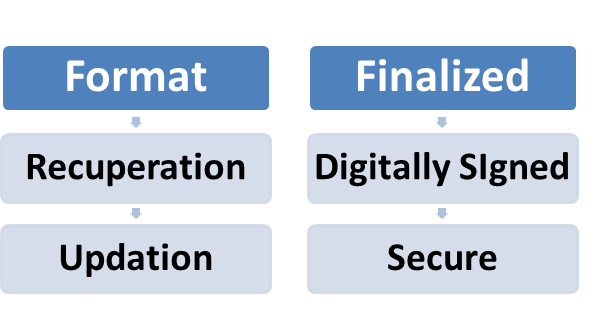

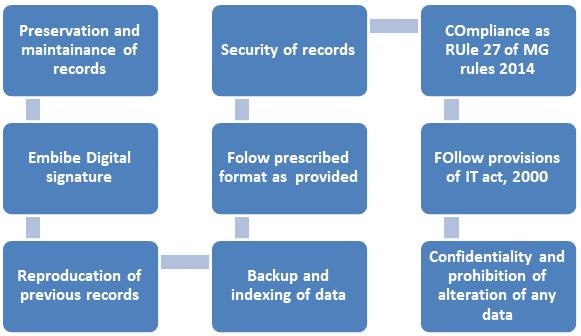

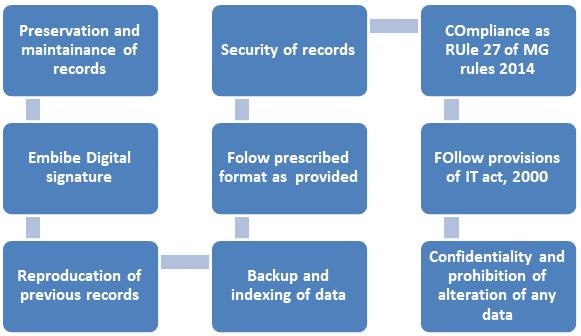

What points need to take care while maintaining electronic records?

Physical, as well as electronic records, are to be maintained by companies as directors or other key personnel’s of the company may deem fit. But certain pointed need to take care while maintaining, such as:

- Companies are required to maintain records as per guidelines and formats prescribed under the companies act or rules prescribed. Certain guidelines, as prescribed under the IT Act, 2000 also need to be followed while maintaining records.

- All the information to be recorded in such a way so that it can also be referred for future purpose. It needs to be in such form and in line with section 4 of the IT act, 2000 so that in case required can be present before court of law as evidence.

- All the information must be in readable form and in case required can be retrieved and reproduce in physical form too.

- All the records should be dated and digitally signed wherever it is required. Companies Act has not prescribed any specific guidelines w.r.t. to digital signature, so in this case, section 15 of the IT act, 2000 can be referred.

- All the records need to be in such form so that can be updated in case require. Date of updating need to be mentioned in such case and guidelines w.r.t. Rule 27(2)(f) of the Companies (Management and Administration) Rules of 2014 to be followed.

- Once statutory records are dated and digitally signed, it should not be altered or edited. This is in order to avoid any alteration in information.

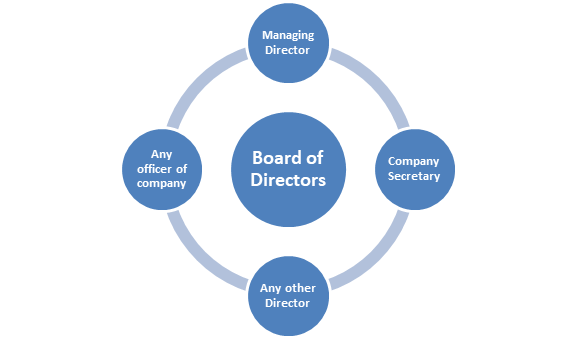

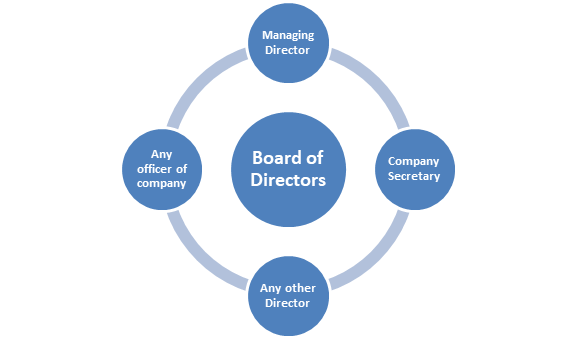

Who is responsible for maintenance of such records in electronic form?

Any person who is authorized by board of director can be given the responsibility of maintaining such records.

That authorized person as chosen by board of directors is required to maintain such records as per provisions given under Rule 28 the Companies (Management and Administration) Rules of 2014. Many guidelines have been imposed that authorized person needs to maintain in order to ensure the security of such records. Any one person from board of directors such as Managing director or any other officer of the company or company secretary of the company can be authorized to maintain such records as per Rule 28 the Companies (Management and Administration) Rules of 2014. The main intention behind this is to ensure only limited persons have the authorization to do alteration in records of company in order to maintain transparency.

What are the various responsibilities of the person authorized with such powers?

Such person as authorized by board of directors has below-mentioned responsibilities:

- To protect record from any unauthorized access or any kind of tampering or alteration

- To ensure proper maintenance of records in case of damage etc

- Ensure security of computer, system, any software etc. for accuracy and reliability of the records

- To ensure that authorized signatory of records does not repudiate the signed records as not to be genuine

- ensure against loss of the records as a result of damage to, or failure of the media on which the records are maintained;

- To detect in case of any unauthorized alteration is made in records

- Proper updation of data timely along with mention of the date of updation

- TO ensure the reproduction of records in future in such a way so that it can be produced legally in future in case required

- To keep data in the form of PDF or other such versions to ensure that it is non-editable or non-erasable.

- Ensure backup of such data and compliance with various rules and guidelines prescribed as per Rule 27 of MG rules 2014 and IT Act, 2000.

- Arrange and indexing of data in such form so that can be retrieved easily in case required

Provisions regarding maintenance and inspection of records in electronic form

Every company maintains electronic records of data have duty to maintain data in such form so that:

- Any person who wants to access such information about company can do that

- To provide copies of such records in whole or partly available for inspection at a nominal rate

Such provisions have been given under the Companies (Management & Administration) Rules, 2014 for inspection and taking extract of such records. As per that any person can do online inspection of records of company or get such records as required on payment of the prescribed nominal fee that should not exceed Rs. 10 per page.

Penalty in case of Non-Compliance

In case a company or its authorized person fails to comply with such provisions w.r.t. Maintenance and inspection of documents in electronic form then, in such scenario such company or authorized person can be penalized for amount up to Rs. 5000. In case of continuing default Rs. 500 per day can be imposed.

Conclusion

However, certain provisions were provided under erstwhile companies act, 1956 and amendments under the same but the new company’s Act of 2013 have provided statutory provisions to maintain records in electronic form. Although only listed companies are under obligation to maintain electronic records but other companies which have voluntarily resolve to maintain such records need to comply with Rule 27 and Rule 28 of MGT Rules of 2014 along with IT act 2000. Even penal provisions have been made for companies which fail to follow guidelines and provisions made by regulator or central government. Maintaining electronic record plays an important role in order to maintain transparency and corporate governance. So all companies should follow the said provisions.

Read our article:What is Quorum For Board Meeting in Regards to Companies Act, 2013?