All companies need to file annual return at the end of each financial year with the Ministry of Corporate Affairs. In this article we are going to gain knowledge about the steps involved in the filing of annual return, what forms you need to fill and what are the other requisites regarding filing the same.

What is Annual Return?

The annual return is the yearly statement containing essential information about an entity’s composition, activities and financial position. Not to mention, every active company registered with an appropriate authority need to file Annual Return at the end of every fiscal year. As per the provisions of general corporate legislation, it ought to consist of the following;

- A particular of shareholders or stockholders, debenture holders, firm’s secretary and the directors.

- List of charges against the entity (if any)

- Address of the registered office with location of the register of members

- Copy of latest financial statements

Who Needs to File Annual Return?

There are three categories of companies that need to comply with the provision of filing an annual return;

- Class I: Every company registered under the Companies Act, 2013 or the Companies Act, 1956 need to file Annual Return in Form MGT 7 within 60 days from the wrapping up of its Annual General Meeting {AGM}. Also, such companies have to file their Financial Statements in e-Form AOC-4 within 30 days from the conclusion of their AGM.

- Class II: Every company whose name has been published for not complying with the Annual Compliance and Filing, in the Strike-off Public Notice No-ROC-DEL/248/STK-5/2018/2912, Dated 18/6/2018. As a matter of fact, 31250 companies received this notice.

- Class III: All companies whose directors have been disqualified under Section 164(20) for not filing an annual return.

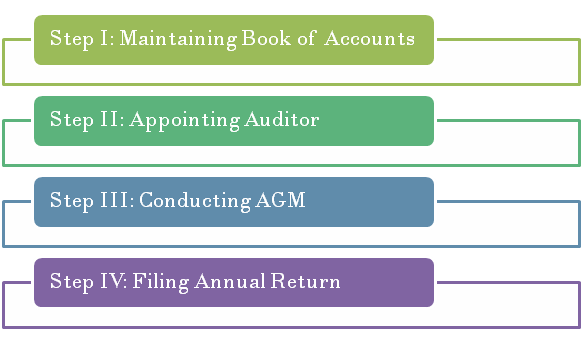

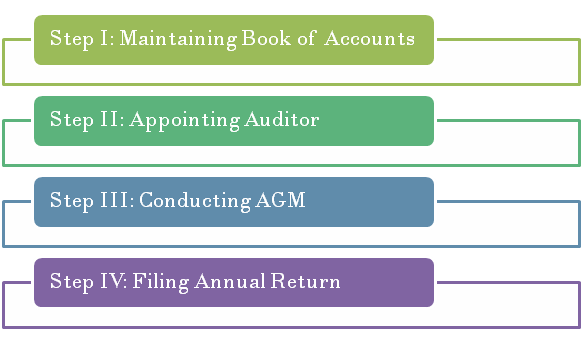

Steps Involved in the Filing of Annual Return

The following steps are involved in the filing of annual return;

Maintenance of Book of Accounts

It is obligatory for every company to maintain a Book of Accounts. Not only it serves as compliance with the law but also, it helps in keeping track of the inflow/ outflow of finances of the company. Moreover, as per the Companies Act, 2013[1], it is mandatory for all companies to maintain a Book of Accounts in a specified format.

Furthermore, the following should be included in it, namely;

- Detail of monies received or spent by the company

- Also, the assets and liabilities of the company

- Furthermore, the details of sales and purchases of the company and

- Lastly, other financial or business transactions

Preparing a Company’s Financial Statements

A financial statement of a company is prepared based on the Book of Accounts. Furthermore, the financial statement is a statement that contains the information about the financial position, performance and changes in the financial position of an assessee of the company. Additionally, it comprises of the balance sheet, profit and loss account and other statements/ explanatory notes of the company.

Conducting Audit of Financial Statements

Every Company needs to appoint its first Auditor within one month of the registration of the company. Furthermore, any individual who is a qualified Chartered Accountant in practice, or an entity of Chartered Accountants may be selected the Auditor of a Company.

After his appointment, the Auditor of the Company needs to audit the financial statements of the Company and submit his/ her report on the accounts of the Company to the members. The Auditor also has to state in his report whether the accounts of the Company give an accurate and fair picture of the state of affairs of the Company.

Commencing Annual General Meeting

An Annual General Meeting is the congregation of the shareholders of a Company conducted every year. Furthermore, the Companies Act, 2013 mandates that all companies except One Person Company need to hold Annual General Meeting each year. Moreover, the date of any Annual General Meeting has to be kept within 15 months from the date of commencement of the preceding Annual General Meeting. On the other hand, for a newly incorporated company, the first Annual General Meeting must be held within 18 months from the date of incorporation of the Company.

Annual Return Filing

After the commencement of the Annual General Meeting, you have to file it to the Registrar of Companies (ROC). Also, it is necessary to submit the audited financial statements of the company in the prescribed format to the Ministry of Corporate Affairs (MCA). Furthermore, the company should file the financial statements within 30 days, and annual return within 60 days after the winding up of the Annual General Meeting (AGM).

Forms used to file Annual Return

Company’s set-up under the Companies Act, 2013 need to fill the following forms with the Registrar of Companies as a part of annual return filing;

- AOC 4 Form: Form used for the purpose of filing the financial statements and required documents

- Form AOC 4- CSF : Form for submitting containing salient features of consolidated financial statement of a group

- AOC 4- XBRL Form : Form used in order to file the XBRL documents in respect of financial statement and other document

- MGT 7 Form : Form used for the purpose of filing Annual Return by companies having share capital

Signing: The Director and Company Secretary, of the company should sign the Annual Return Form. Also, a practicing Company Secretary can sign it in case there is no CS in the company. However, in One Person Company, it has to be signed by the director of the company.

Documents and Information that needs to be submitted in Form MGT 7

The following documents and information are required to be submitted along with the Form MGT 7;

- Balance Sheet of the Company, Profit & Loss Account

- Compliance Certificate, Registered Office Address

- Also, a list of shareholders and shareholding structure of the company

- Furthermore, the details of transfers &/or Transmission of securities

- Additionally, the details of Shares and Debentures

- Lastly, information related to any changes in the Directorship

General Points while Doing the Annual ROC Filing

- Before 7 days from the date of Board Meeting the notice shall be sent to all the directors and acknowledgement of the notice must be taken.

- The financial statement together with the consolidated financial statement according to Section 134 of the Companies Act, 2013, on behalf of the Board shall be signed by the company’s chairperson where he is sanctioned by the Board or any two directors from which one shall be the Chief Executive Officer and the managing director. In case of a director in the company, the company secretary of the company and the Chief Financial Officer, wherever they are appointed, or only by one director in the case of a One Person Company.

- According to Section 101 of the Companies Act, 2013, the general meeting notice for 21 days shall be given to all the members, legal representatives of person who are dead, every director of the company and auditor by both electronic and physical mode. The notice should include the location map of the place of the general meeting in accordance with the Secretarial Standards and should be updated on the website if any.

- The company shall make its own books of accounts and the same shall be in the registered office. If the company decides to locate at some different place, then the company shall have to pass a board resolution by filing AOC-5.

- During the process of uploading the forms, proper caution should be taken that the form is correct and is the updated version as given on the MCA portal.

Conclusion

Annual Return is a mandatory compliance for all companies registered under the Companies Act, 2013 or as specified by law under specific circumstances. Also, you can file NIL annual return; if your company does not have any transactions in the preceding year.

Read our article: Appointment and Removal of Auditor in a Privately-held Organization