Powers related to detention and confiscation of vehicles and goods under GST must get appropriately exercised. Post the implementation of the GST regime, the generation of Eway Bill must take place in case of the movement of goods beyond the worth of Rs 50,000 by a registered person. The person who is carrying the goods of exceeding the figure of Rs 50,000 must-have documents like an invoice and an e-way bill. The propel officer has got the authority by central or state government to intercept goods in transit. The interception process involves the inspection of documents as well as goods by the right officer.

This article on detention and confiscation of vehicles and goods under GST encompasses all the mandatory sections and rules which carry the law for detention and confiscation of vehicles and goods under GST and also includes tax and penalty according to section 129.

Along with Section 68 of the CGST Act, 2017, Section 129 of the same Act, in addition to Rules 138B of CGST Rules, 2017[1], provides the respective Officer with the right to intercept the vehicle. Also, it provides them with the power to verify the documents related to the carrying of goods in the vehicle.

- As per Section 68(3), if at a particular place proper Officer intercepts any vehicle, he may ask the person who is in charge of the vehicle to bring the documents on the table as given in the said sub-section as well as devices for the further verification process. Besides this, it would be the responsibility of the said person to produce the devices along with documents and also give a green signal to the inspection of goods.

- As per Section 129 in CGST Act, 2017, if an individual stores or transports any goods at the time of transit in non-compliance with the provisions and rules of this Act-

Goods and conveyance of such type utilized as a transport mode for carrying the said goods along with documents concerning goods and conveyance must be liable to detention as well as seizure.

- Rule 138B(1) of CGST Rules, 2017 revealed that empowered commissioner or Officer might give the required power to the proper Officer to intercept any particular conveyance for verification of the e-way bill in either physical or in electronic form for passage of goods in inter-state as well as intra-state.

Confiscation of Vehicles and Goods under GST

Confiscation of vehicles and goods under GST would take place if an individual-

- Supplies or receives goods non-observance of GST provisions to steer clear of taxes

- Defies the rules to dodge tax

- Supplies goods without going through the GST registration process (Although he meets all the criteria of registration)

- Cannot take the responsibility of seized goods

- Uses any conveyance or vehicle for the transportation of goods in contradiction to the provisions of goods and service tax

There is no provision for confiscation of vehicles and goods under GST in case the vehicle owner proves by any means that no information was available to him regarding the use of the vehicle. The tax officer shall give the option of making the payment of the fine in place of confiscation.

Provisional Interpretation

- If the Officer has got the impression that goods are being carried for the purpose of tax evasion, then the Officer has got the authority to appeal to Section 130 and issue notice for the confiscation of vehicles and goods under GST.

- The notice must get issued to the owner of the goods, specifying the quantum of tax, fine along with the penalty. Additionally, one different notice shall be issued to conveyance/vehicle owner specifying the quantum of fine imposed on him. The points under the quantum of fine have been covered ahead in the write-up.

- Both of the notices mentioned in the previous point concerning confiscation in GST MOV-10 must define the penalty, tax, and fine charged because of the confiscation u/s 130 (subsection-2) of CGST Act, 2017.

- Order for penalty imposition or the confiscation of vehicles and goods under GST shall not get passed without providing any opportunity of being heard.

- If there is any passing of the order under GST MOV-11, then the previously passed order under goods and service tax MOV-09 shall move on the verge of withdrawal.

- In GST MOV-11, the amount determined in the order shall get paid within the specified time period in the order. The specified time should not be more than three months. If in case there is no payment within the specified time, the Officer can use its right to auction the goods, as well as conveyance (vehicles) by public auction, and whatever the sale proceeds got accumulated, shall get forwarded into the accounts of the government.

Quantum of Fine Imposed on Owners of Goods and Conveyance

- In addition to tax along with penalty levied on the owner of goods u/s 129 of CGST Act, 2017, owner of goods would have to pay the fine, in case of confiscation of vehicles and goods under GST. The Officer has the option to levy such fine, with the proviso that-

- The aggregate of penalty and fine must exceed the penalty levied u/s 129, subsection-1.

- Quantum of fine shall not be more than the value of goods less tax imposed on such goods.

- If goods get confiscated, the owner of conveyance must get charged with fine apart from the owner of goods. Such type of fine charged must be equal to the tax payable amount on goods of a similar kind.

Difference between Detention, Seizure, and Confiscation

- Detention is the act of not providing access to the owner of the goods by a legal order or notice. It must get remarked that the ownership of the detained goods stays with the owner. The government passes the detention order during the hours of suspicion that the goods are liable to confiscation.

- Gaining control of the actual ownership of goods by the department via the legal process is known as seizure. It can happen only after investigation or inquiry that the goods are liable to confiscation.

- After proper arbitration, the confiscation of goods is the final act. The ownership and possession of goods move out of the hands of the original owner and reach into the government authority hands after confiscation takes place.

Read our article:GST on Legal Services in India: Taxability of Legal Services under GST

Procedures Ahead of Detention of Vehicles or Goods

According to the Reference Source- Circular No – 41/15/2018 dated- 13th of April, 2018- Amendment by Circular No. – 88/07/2019 dated- 1st of February, 2019:-

- The Officer must present a summary report in FORM GST EWB-03 – Part A of all concerned inspections in the time frame of 24 hours of the inspection.

- Besides this, the Officer needs to make the submission of the final report in FORM GST EWB-03 – Part B in the time limit of three days within the inspection. As per Rule- 138 C, the counting of 24 hrs or three days will begin from the midnight of that date on which the vehicle got intercepted.

- If the vehicle got detained for more than half an hour, the Officer would upload the details in Form EWB-04 on the portal as prescribed in the Rule- 138D.

In cases where the Officer intercepts the vehicle and the person(Driver) having the conveyance unable to provide the relevant documents in front of the Officer or the Officer who is waiting to continue with the inspection process, the Officer can take the following actions (As shown in Circular No. – 41/15/2018 dated- 13th of April, 2018) given in the table provided below-

| Prescribed Forms | Actions that Officer will Take |

| GST MOV-01 | Take the statement from the driver and record it |

| GST MOV-02 | Issuance of an order for physical verification of the documents, goods, and conveyance and to stop as well as park the vehicle at the place specified in the order |

| GST EWB-03- Part A | Report preparation within 24 hrs. of GST MOV-02 issuance and upload it on the portal |

| GST MOV-03 | Physical verification must get accomplished in the time limit of 3 days of GST MOV-02 issuance. In the case of non-completion of the same, written permission must get acquired from commissioner to extend the three days limit |

| GST MOV-4 | Physical verification completion report must get issued to the driver |

| GST EWB-03- Part B | An officer will be updating the final report on the common portal in the time limit of 3 days |

| GST MOV-05 | In case, no discrepancies are discovered, release order would get issued, and the vehicle would get released |

| GST MOV-06 | Order of detention shall get issued in case officer is interested in detaining goods as well as the vehicle |

| GST MOV-07 | Notice as well as the above order shall get issued for the detention |

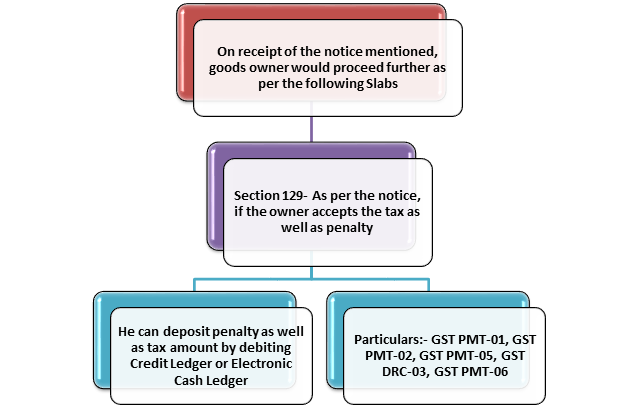

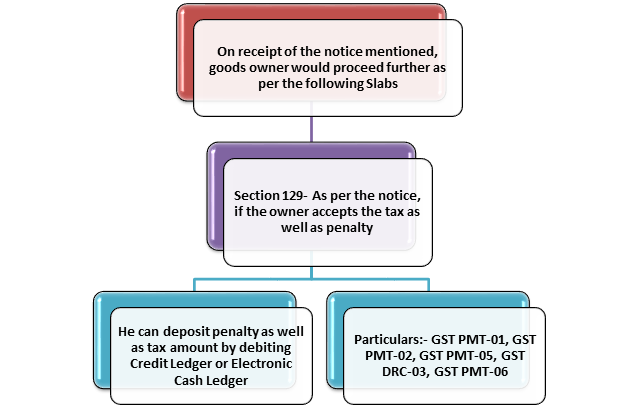

- Or he can go for the submission of the bond as well as security in the form of bank assured in the GST MOV-08 order for goods along with conveyance release must get passed in FORM GST MOV-05. If the owner doesn’t accept the penalty as well as tax as per Section 129, the reply will get filed along with objections.

- If the owner doesn’t accept the tax as well as a penalty as per Section 129, the Speaking order needs to get passed by the Officer and must get uploaded on the common portal –FORM GST MOV-09.

- After the tax along with penalty gets paid, releasing order of conveyance as well as goods shall get passed- FORM GST MOV-05, in case the owner doesn’t accept the tax besides penalty as per Section 129.

- As per Section 130, if the tax penalties mentioned above are not deposited within 14 days of issue of the detention order, notice for goods and conveyance confiscation must get issued – FORM GST MOV-10. The owner of goods and conveyance must submit the reply to the notice.

- FORM GST MOV-11– Final order of confiscation of vehicles and goods under GST must get passed and served upon the goods and conveyance owners and also should get uploaded on the common portal. The Officer would pass the common order to the owner of conveyance as well as goods.

Tax and Penalty as per Section 129

The following shall get levied in case of the owner of goods comes forward-

- Applicable Tax

- A penalty equal to tax

- A penalty equal to 2% of the worth of goods or Rs 25000– (whichever is less) in case of exempted goods.

The following shall get levied in case of the owner of goods does not proceed ahead-

- Applicable Tax

- A penalty equal to 50% of the value of the goods (lessened by the amount of tax)

- A penalty equal to 5% of the value of the goods or Rs 25000, whatsoever is less in case of exempted goods.

Latest Approach: 2020

- On 15 May 2020, With respect to the amendment of the Essential Commodities Act, Finance Minister Nirmala Sitharaman stated that the imposition of stock limit could be under the circumstances like famine, natural disasters, etc. which lead to an irregular surge in prices.

- Moreover, she added that agriculture food items like pulses, cereals, potato as well as onion would get deregulated after the amendment in the Essential Commodities Act.

- Amendment in ECA will eradicate measures like detention, confiscation of vehicles under GST, and attachment of properties of black marketers.

- Notification No. 40/2020 got issued to extend the validity of the e-way bill till 31st of May, 2020, for those e-way bills that got generated either on the 24th of March, 2020, or before this date and had expiry amid the time range of 20-03-2020 to 15-04-2020. CBIC has also mentioned this in a tweet.

Winding Up

There are several laws and procedures related to detention and confiscation of vehicles and goods under GST. In this write-up, we have covered most of the legal aspects related to detention and confiscation of vehicles and goods under GST. Our highly skilled professionals at Coprbiz would assist you and help you in sorting out all the issues and complexities related to the laws and procedures related to detention and confiscation.

Read our article: Composition Scheme under GST- The Next Big Thing