Imposing taxes on the services is perhaps the most convenient way for the government to generate revenue and “doctrine of divide & rule” help them a lot. The modern taxation system is refined and has a very little margin of error or vagueness in it which eventually led the authorities and governments to overcome conflicts with ease. But what if no transaction or less transaction occurs in this state of affairs? How the government will respond to these uncertainties or fewer Goods and Services Tax (GST) Collection and what step the government will take to meet the expenditure?

Read our article:GST Can’t be Imposed on Services Provided By Court Receiver

Poor GST collection And Raising Conflict between Governments

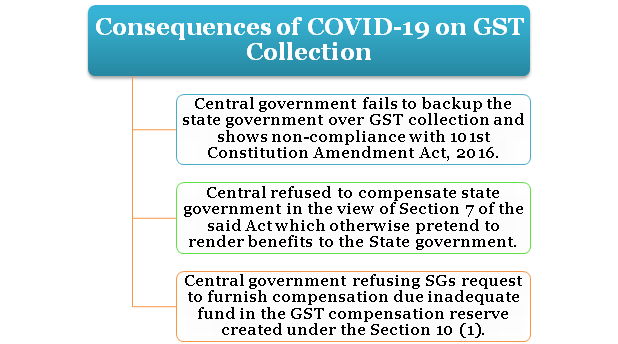

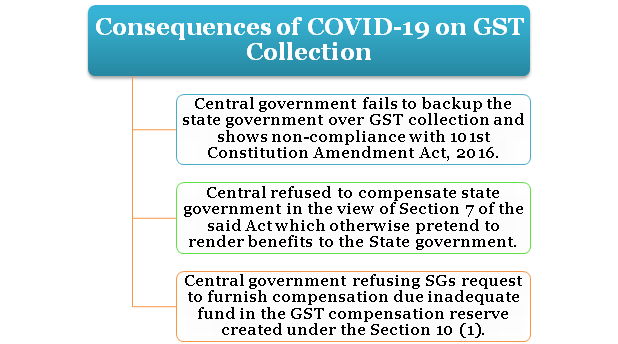

As lower GST collection shocked the States government, they were expecting to receive compensation as per the GST Compensation Act, 2017. Unfortunately, the said act was misunderstood by the state government which in turn raise the conflict of interest. Every GST council meeting that was held after March 2020, enclose the agenda concerning this very act. Even some State governments accused Central Government of working in an unconventional manner. Let’s dive into the constitutional provision related to GST which is raising conflict between state and central government.

101st Constitution Amendment Act, 2016: -States Agreed to Dissolve their Power on Specific Tax

Unlike local and federal laws, Goods and Service Tax is a perfect example of bonding with the State and Central Government wherein all stakeholders confer their rights mentioned under the Constitution of India. Before the Goods and Services Tax (GST) implementation, the second list of the seventh Schedule of the Constitution of India delegate state authorities to impose taxes on the supply chain of goods within the prescribed restriction. States agreed to confer this right to levy a tax against the promise of CG that their revenue will not be compromised at any cost.

Section 7 of the Act: – Hampering State’s Reserve amid COVID 19

Among all the provisions in the Act, Section 7 is perhaps the most confusing one due to its contradictory nature. This is the reason why most of the State Governments misunderstood this Act and eventually ends up in a state of chaos. Section 7 is all about the methodology for calculating the compensation. It pretends to give the benefit on the surface, but if you look deeply it has some contradictory elements that allow the Central government[1] to bypass the compensation that they are supposed to offer to state government.

Section 10 of the Act: – Right to Refuse the Request of State Government

The Act states that compensation under Section 7 will be rolled out from Goods and Services Tax (GST) Compensation Fund made under Section 10(1) which means the funds can be rolled out only in the event if the Central Government have fund under this section. Thus; the Central government has every right to refuse the request of State Government regarding fund allotment in the purview of the said Act. The provisions inherently prevent Central Government to pay any fund to State Government in this context which in turn creates the conflicts among the State Government.

Conclusion

COVID-19 hits the economic structure so hard that at one point there was a complete halt on transactions as the majority of the population was forced to remain at homẹ. The anxiety and threat that this pandemic created were unprecedented in nature. While it keeps the income churning population at home, it’s also pushing the government on the back foot by hindering their major source of revenue that comes from the collection of taxes.

Read our article:WB Authority of Advance Ruling on the applicability of GST rate in Various Sectors