The process of applying for a refund under GST law varies under different outlines. Through this write-up, we are going to throw light on the steps to apply for a refund under GST, GST RFD-01, and GST RFD-01A, the applicability of RFD-01, and RFD-01A, and more.

Let’s Begin with RFD-01 and RFD-01A

In Form RFD-01/RFD-01A, all the taxpayers can file for the refund. The issuance of refund under GST is only possible when refund crosses the figure of Rs. 1000. RFD-01 is an application that must get e-filed on the GST portal for claiming the refund of cess, taxes, as well as interest paid in the matter of zero-rated supplies and claiming the refund of unutilized ITC stored in your Electronic Credit Ledger because of the Inverted Duty Structure.

Another reason behind the e-filing of RFD-01 on the GST portal is for claiming the refund of the balance of cash paid in excess into the Electronic Cash Ledger. The significant usage of RFD-01 is in the direction of online processing of refund under GST law.

The applicability of RFD-01 is in some instances of refund, especially for manual processing. RFD-01A came into existence as a temporary solution until such time the online facility is in process for claiming refunds. RFD-01A get considered as a knock-off of RFD-01.

Steps to Apply for Refund under GST

The steps to apply for a refund under GST is quoted below-

- In the first step, you need to login to the GST portal[1].

- After that, you have to select the Refund tab, and you will get the option of Application for Refund.

- Pick the refund type and fill the required details and proceed ahead for submission. ARN number would get generated thereon.

- In the fourth step, you need to take a print out as well as the generated ARN number.

- Here, you can go ahead for the submission of print out and ARN number as well as application annexures to the concerned Jurisdictional goods and service tax officer.

The officer can be UT or state tax authority or central tax authority as stated for refund processing and eventually get intimated via the declaration in RFD-02.

Read our article:All you need to know about GST Refund on Exports

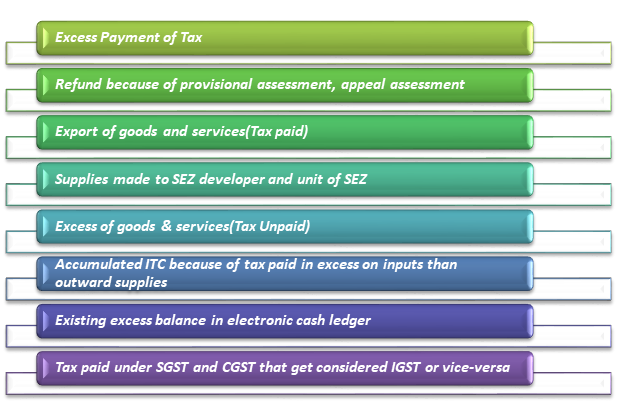

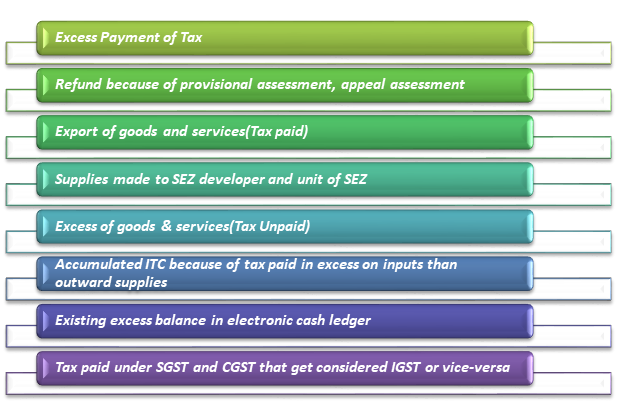

Applicability of RFD-01/01A for Types of Refunds

Applicability of RFD-01 for the several types of refund under GST got represented in the table shown below-

Types of Manually Processed Refunds under GST

- Claims for the matters of deemed exports

- IGST paid on zero-rated supplies

- Balance in excess in electronic cash ledger

- Input tax credit on exports under bond or Letter of Undertaking

- Refund claims owing to Inverted Duty Structure

Till further stated, the file RFD-01A will be applicable instead of RFD-01 for the cases given above. As an alternative, the claims of balance in excess in electronic cash ledger might get made in the monthly returns filed by taxpayers. For instance, GSTR-3, GSTR-4, or GSTR-7 depending on the nature of the case.

Non-Applicability of RFD-01/01A

Filing of RFD-01 or RFD-01A is mandatory for most of the cases of refund claims.

However, few exceptions are mentioned below-

- Casual taxable persons or non-resident taxable individuals

- Export of goods comprising export duty payment

- UN or embassies along with specific individuals stated

- Cases in which the supplier goes on availing the drawback scheme of the IGST/SGST/CGST paid on supplies

- Export of goods or services wherein IGST get paid and shipping bill by default deemed the refund application

Who must File RFD-01 or RFD-01A?

- Either the supplier or the recipient can proceed ahead for making an application for refund of taxes paid in case of deemed exports.

- The supplier, as well as the recipient, cannot apply for claiming the refund for a distinct invoice of deemed exports.

- If the supplier moves ahead to apply for a refund under GST, he needs to receive a notification from the recipient that he won’t be claiming the refund against that supply.

Filing RFD-01/RFD-01A- Time Limit and Frequency

In the time limit of 2 yrs from the appropriate date in RFD-01 or RFD-01A, the refund claim should be made.

In the cases given below, filing of RFD-01A must take place on a monthly basis-

- Refund claims in Deemed exports case

- Refund claims in the matter of zero-rated supplies

- Refund of balance in excess in electronic cash ledger

- Refund claims in the matter of Inverted Duty Structure

- If in cases wherein the taxpayer is having turnover, not more than Rs. 1.5 crore and he has decided to file Quarterly returns, RFD-01A would get filed on a quarterly basis in place of a monthly basis.

- Once the zonal officer has validated the confirmation of evidence of receipt of service, a supplier should file Form RFD-01A in the matter of supply of services to units of Special Economic Zones or also in the matter of SEZ developer.

- Once the zonal officer has validated the confirmation of receipt of goods, a supplier should file Form RFD-01A in the matter of supply of goods to units of Special Economic Zones or also in the case of SEZ developer.

Take Away

Under different scenarios, changes would get witnessed in the procedure of applying for a refund under GST law. Taxpayers have got the Form RFD-01/RFD-01A for filing the refund. At Corpbiz, our well-versed experts with GST refunds procedure and other aspects would help you with GST registration, GST refund filing, or any additional help.

Read our article:A Brief Take on Special Economic Zone- SEZ under GST