The Central Board of Direct Taxes has already extended a time limit for compulsory selection of returns for a Complete scrutiny of cases during Financial Year (FY) 2020-21 from 30 Sept 2020 to 31 Oct 2020. The new statutory time limit in accordance to the Taxation and other laws (Relaxations and amendment of certain provisions) Act, 2020 for Compulsory Scrutiny under selection of cases on the basis of prescribed parameters was extended to 31 March 2021.

Highlights of the Notification

Details Analysis of Notification

It has been clarified that a new statutory time limit in accordance with the Taxation and other laws (Relaxations & amendment of certain provisions) Act, 2020 for compulsory scrutiny under selection of cases on the basis of prescribed parameters has extended to 31st March 2021. Still for a purpose of timely allocation of cases to a NeAC, the above time limit must have to be strictly adhered to otherwise; the allocation of cases to a NeAC will get delayed considerably.

Considering all the difficulties faced by in a field formation due to the COVID-19 pandemic and PAN migration-related issues, this matter have been reconsidered. It has decided to extend the prescribed date for selection of cases for the Compulsory Scrutiny on a basis of prescribed parameters, as duly communicated vide Board’s letter dated 17 September 2020, from 30 Sept 2020 to 31 Oct 2020.

Furthermore, the same reasons as mentioned in the above paragraph, the cases covered under scenarios mentioned in Para 2 (b) & 2(c) of the letter must be transferred to the Central Charges by issuing of orders under section 127 of the Act, immediately after the service of notice under section 143(2) of a Act.

Read our article:An Overall Assessment of Income Tax Notice

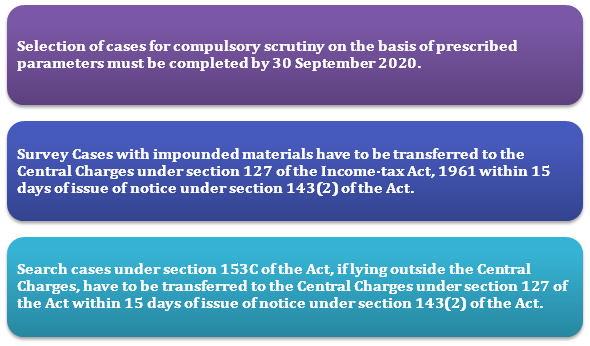

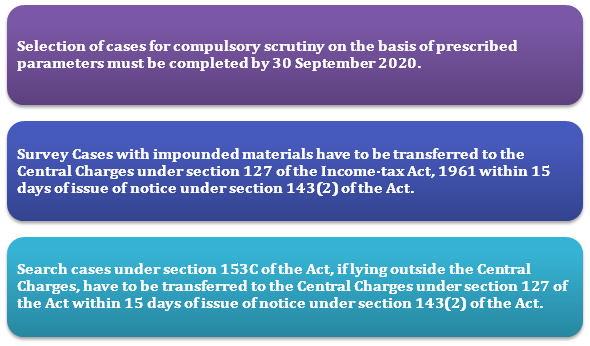

The Letter has Various Time Limits Prescribed for Completion of Certain Actions

- Firstly, for compulsory scrutiny under selection of cases on the basis of the prescribed parameters shall be completed by 30 Sept 2020.

- Secondly, the Survey Cases with impounded materials must be transferred to the Central Charges U/s 127 of the Income-tax Act, 1961 within 15 days of issue of notice U/s 143(2) of Income Tax Act[1].

- Lastly, search cases U/s 153C of the Act, if lying outside the Central Charges, must be transferred to the Central Charges U/s 127 of the Act within 15 days of issue of notice U/s 143(2) of Income Tax Act.

Conclusion

There has been granted an extension of time limit for compulsory selection of returns for Complete Scrutiny during the Financial Year 2020-21. The compulsory scrutiny has to be completed by 30 Sept 2020 to 31 Oct 2020. The survey cases have to be transferred to Central Charges within 15 days of issue of notice. Also the search cases have to be transferred to Central Charges within 15 days of issue of notice. The complete compulsory scrutiny on the basis of prescribed parameters was extended to 31 March 2021.

Read our article:CBDT Amends the Tax Audit Report Form 3CD, ITR 6, Form No 10-IE and 10-IF

22922-extension-of-time-limit-for-compulsory-selection-of-returns-for-complete-scrutiny-during-fy-2020-21-1