This Notification has come into force on a date of publication in an Official Gazette which was on 1st Oct, 2020. If the ITR-6 or the Tax Audit Report in Form No. 3CD or Form No. 3CEB has been filed before that date then there is no need to revise the ITR-6 or the tax audit report in view of changes so notified in a notification. However, if any of such return or report is not yet filed, it has to be filed according to an amended provision.

Highlights of the Amendment

Income Tax dated on 1 Oct, 2020 issued the Income tax (22nd Amendment) Rules, 2020 to bring and notify changes in Form No 3CEB, Form 3CD, and ITR6. The amendment in Rule 5 of Income Tax Rules, 1962 and have been inserted new Rules & Forms which are:-

Amendment in the Rule 5 of the Income Tax Rules, 1962

Rule 5 has prescribed a computation of depreciation allowance under section 32(1)(ii) in respect of any block of assets. Currently, the proviso to Rule 5(1) has restricted the rate of depreciation to 40% on the written down value of block of assets, in case a prescribed rate of depreciation is higher than 40% for that block of assets for a purpose of claiming depreciation allowance under section 32(1)(ii) in case of the domestic company which has exercised an option under section 115BA(4).

The proviso is amended and new proviso has been substituted to include the new beneficial lower tax regime provisions under section 115BAB, section 115BAA, section 115BAC and section 115BAD apart from existing section 115BA to restrict a rate of depreciation to 40% for claiming depreciation allowance under section 32(1)(ii). Hence, a person opts a lower tax regime under 115BAA, section 115BA, section 115BAB, section 115BAC and section 115BAD cannot claim the depreciation allowance more than at a rate of 40% for block of assets.

- Section 115BAA, Section 115BA, and section 115BAB are applicable for the domestic company. Section 115BAA and section 115BAB will be applicable from Assessment year 2020-21.

- Section 115BAC will be applicable for an Individual and HUF whereas section 115BAD is applicable for the co-operative society. Section 115BAD and section 115BAC is applicable from the Assessment year 2021-22.

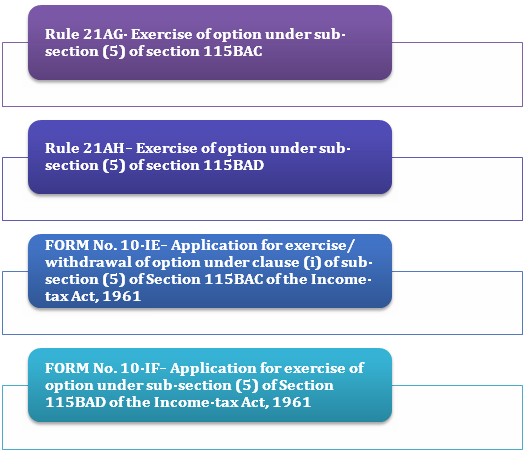

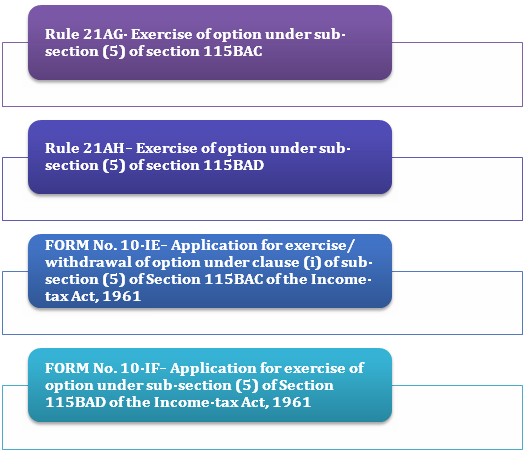

Insertion of new Rule 21AG

Rule 21AG states that the Individual or HUF[1] must exercise an option of a lower tax regime under section 115BAC (5) in the Form No. 10-IE from Assessment year 2021-22. The option in Form No. 10-IE must be furnished electronically either under electronic verification code or digital signature. A Principal Director General of Income-tax Systems or the Director General of Income-tax Systems, must specify the procedure for the filing of the Form No. 10-IE.

Insertion of new Rule 21AH

Rule 21AH states that the cooperative society resident in India must exercise an option of a lower tax regime under section 115BAD (5) in Form No. 10-IF from Assessment year 2021-22. The option in Form No. 10-IF must be furnished electronically either under the digital signature or electronic verification code. A Principal Director General of Income-tax Systems or the Director General of Income-tax Systems must specify a procedure for filing of Form No. 10-IF.

Read our article:An overview on Tax Residency Certificate & Double Taxation Avoidance Agreement: How To Get It?

Changes in Tax Audit Report in the Form No 3CD

- Suitable changes must be made in Form No 3CD and the new serial 8a has been inserted to provide information on whether an assessee has opted for taxation under section 115BA/115BAB/115BAA.Further an information is required has to be given for adjustment made to written down value under section 115BAA (for AY 2020-21 only) and the Adjusted written down value. For the purpose, serial 18(ca) and 18(cb) is inserted in a Part-B of Form No. 3CD.

- Details of brought forward for loss or depreciation allowance in serial no 32(a) in the Part-B of the Form No. 3CD is modified to incorporate an adjustment for losses and allowances under section 115BAA.

Changes in Tax Audit Report in the Form No 3CEB

Changes have been made in serial no. 22, 23 and 24 in Part-C of the Form 3CEB notified.

Format of Form 10-IE

This Notification has to insert Form 10-IE in accordance with Rule 21AG pertaining to Application for a exercise of option under section 115BAC sub-section (5).

Format of Form 10-IF

Format of the Form 10-IF in accordance with Rule 21AH – Application for exercise of option under section 115BAD sub-section (5) notified.

Changes in ITR-6

- Amendments in the Schedule – DPM of ITR-6 have made to incorporate the adjustments of depreciation amount under section 115BAA.

- Amendments in Schedule-CFL of ITR-6 have made to incorporate an adjustment for losses and allowances under section 115BAA.

- Amendments in Schedule-UD of ITR-6 have made to incorporate an adjustment for depreciation allowances for opting section 115BAA.

Conclusion

CBDT has notified amendments in Tax Audit Report Form No. 3CEB, Form No. 3CD, and ITR-6. The Notification has brought amendment in the Rule 5 of the Income Tax Rules, 1962 and inserted 2 new Rules – Rule 21AG and Rule 21AH for exercising the concessional tax regime under section 115BAC(5) in the Form No. 10-IE and under section 115BAD(5) in the Form No- 10-IF respectively. New two Forms – Form No. 10-IE and Form No. 10-IF has also been inserted.

Read our article:Income Tax Return Filing without Form 16

CENTRAL-BOARD-OF-DIRECT-TAXES