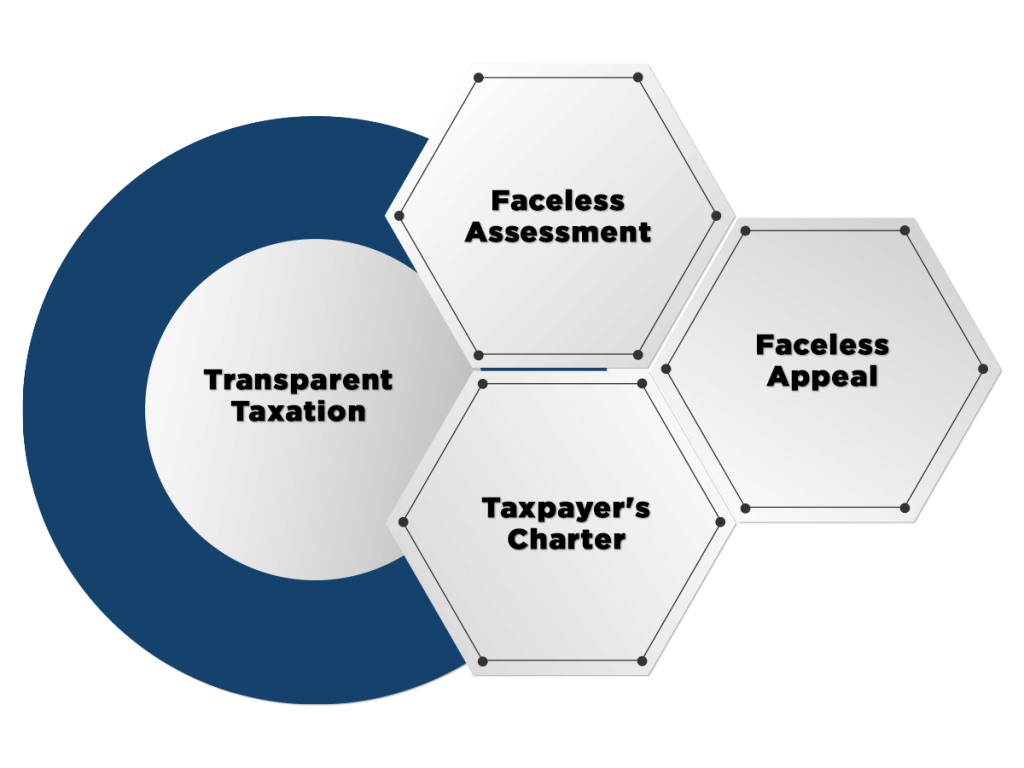

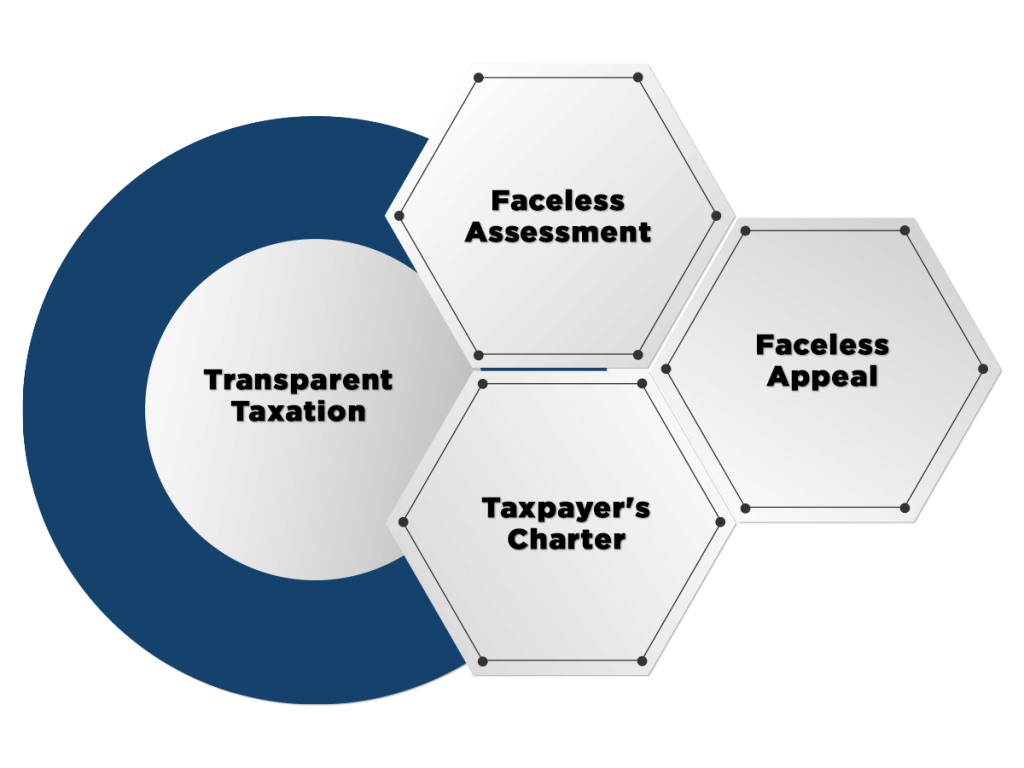

The Prime Minister has launched a Historic platform for “Transparent Taxation – Honoring the Honest” through video conferencing today – on the 13th August 2020 for Faceless assessment, faceless appeal which will begin from 25th September 2020, and the taxpayer charter starts from today.

Objectives and Features of Faceless Appeal and Assessment for Transparent Taxation

It conveys transparency, better efficiency, and accountability, eliminating physical interface and proximity between the Taxpayer and tax officers for better Transparent Taxation.

- The selection will be done only through the system via data analytics and AI

- It will involve Dynamic Jurisdiction – which will automatically abolish the territorial Jurisdiction

- The cases will be allocated -Automated random

- It will include the Central issuance of notices with DIN (Documents Identification No).

- There will be no Physical Interference and no need to visit the Income Tax Office

- There will be “Team-based assessment” and “Team-based review” for Transparent Taxation.

- This implies that – Draft assessment order in one city, – review in another city, and finalization in another third city

- Its objective is to fair and just in order for Transparent Taxation

- Moreover, the 2/3rd of the workforce is employed for faceless operations and contributing balance in other functions.

Read our article:A Comprehensive guide on Works Contract under GST

Taxpayers Charter is committed to the following Agendas.

Provide courteous, fair, and rational treatment

The Income Tax Department shall provide courteous, prompt, and professional assistance in all communications and transactions with the taxpayers for Transparent Taxation.

Treat the Taxpayer as “honest.”

The Income Tax Department shall treat every Taxpayer as honest until and unless there is a reason to believe otherwise.

Provide appliance for appeal and review

The Income Tax Department shall provide fair & impartial appeal and review mechanisms determining Transparent Taxation.

Provide accurate and complete information

The Income Tax Department shall provide accurate information for fulfilling compliance obligations under the prescribed law.

Provide timely resolution

The Income Tax Department shall take decisions in every income-tax proceeding within the time prescribed under law.

Collect the accurate amount of tax

The Income Tax Department shall collect only the amount due as per the law appreciating Transparent Taxation.

Respect privacy and secrecy of Taxpayer Details

The Income Tax Department shall follow due process of law. They will be no more intrusive than required in any examination, inquiry, or enforcement action.

Preserve Confidentiality

The Income Tax Department shall not disclose any information provided by taxpayers to the department until and unless authorized by law.

Hold its Authorities Responsible

The Income Tax Department shall hold its authorities accountable for their actions towards any case if needed.

Allow representatives of Choice.

The Income Tax Department shall allow every Taxpayer to select an authorized representative of his choice valuing Transparent Taxation.

Provide a mechanism to lodge a complaint

The Income Tax Department shall provide a mechanism for lodging a complaint and prompt addressable of issues thereof.

Provide a fair & just order in the system

The Income Tax Department shall provide a fair and impartial order in the system and resolve the tax issue in a time-bound routine.

Publish Report and Service Standards Periodically

The Income Tax Department shall publish standards for service delivery in a period custom.

Ease and reduced in cost of Compliance

The Income Tax Department shall duly take into account the cost of Compliance when directing Tax Legislation.

Taxpayers Charter expects taxpayers to the following Agendas.

Be compliant and honest.

The Taxpayer is expected to disclose his full compliance obligations and complete information honestly respecting Transparent Taxation.

Be well-versed and updated.

The taxpayer is expected to be well-versed and Updated of his compliance obligations under tax law. They can seek the help of the department if needed.

Possess accurate records

The taxpayer is expected to possess accurate records as required, as per law.

Identify and be aware of what the representative does on his behalf.

The taxpayer is expected to know what his chosen/authorized representative makes all information and submission, cherishing the Transparent Taxation.

Respond in time and regular interval

The taxpayer is expected to make a submission on time as per tax law.

Pay dues in time

The taxpayer is expected to pay in a timely manner the dues amount, as per law.

Focus Area: – Communication through the computer-generated unique document identification number (DIN)

The tax reforms focus has been on simplifying direct tax laws and reducing tax rates esteeming the projected value of Transparent Taxation. The CBDT has taken quite a lot of initiatives to bring in transparency and efficiency in the Income Tax Department’s functioning. This includes conveying more transparency in official communication over and done with the newly introduced Document Identification Number (DIN), in which every interaction of the Department would carry a computer generated unique DIN (document identification number).

In the same way, the IT Department has moved forward with “pre-filling of income tax returns” to make compliance more convenient for individual taxpayers to increase the ease of compliance for taxpayers. Moreover, the Compliance norms for start-ups have also been shortened up and simplify evaluating the norms of Transparent Taxation reforms.

Direct Tax – “Vivad se Vishwas Act, 2020” for Transparent Taxation

The IT Department also brought out the Direct Tax “Vivad se Vishwas Act, 2020” for Transparent Taxation intending to deliver for resolution of pending tax disputes, under which declarations for settling disputes are being filed. Moreover, the monetary thresholds for filing departmental appeals in various appellate Courts have been raised to successfully reduce taxpayer grievances and litigation in the High Court & Supreme Court.

Numerous measures have been taken to promote electronic modes of payment and digital transactions. It has been evident that the IT department is dedicated to taking the initiatives forward and has also done hard work to ease taxpayers’ compliance during the Covid-19 times. It is worth mentioning that they have extended statutory timeliness for filing returns by releasing refunds expeditiously to intensify liquidity in the hands of taxpayers.

Transparent Taxation for “Honoring the Honest” by PM Modi – LIVE EXPRESSIONS

The launched platform for “Transparent Taxation – Honoring the Honest by the PM Modi will further carry forward the passage of direct tax reforms in India. The event has witnessed by various Chambers of Commerce, Chartered Accountants’ associations, Trade Associations, and eminent taxpayers, apart from the Income Tax Department officials and officers. ShrimatiNirmalaSitharaman, Union Minister of Finance and Corporate Affairs, and Shri Anurag Singh Thakur, Minister of State for Finance & Corporate Affairs, was also present on the historic occasion.

It will strengthen efforts of “simplifying and reforming India’s tax system” determining the Transparent Taxation. The Prime Minister has unveiled the next phase of direct tax reforms intended for easing compliance and gratifying honest taxpayers to reconstruct the Indian economy, which has been hit by the COVID-19 – coronavirus pandemic and the subsequent lockdown. There are few live pronouncements mentioned below – expressed by Prime Minister Narendra Modi. Those are as follows:-

Said by Prime Minister, Modi:-

- “The platform is intended at bringing more transparency in official communication through the newly-introduced computer generated Document Identification Number (DIN)” – Transparent Taxation

- “Those who can pay Tax, however they are not in the tax net yet, they must come forward with self-motivation, and this is my request and hope. Let us work together towards the resolution of new India, self-reliant India,”

- “Amidst all the reforms presented and introduced by Centre, the number of people who have filed income tax returns has augmented by about two-and-a-half crores in the last six to seven years. However, it is also true that in a country of 130 crores, it is still very less n amount”.

- “Of all the tax returns filed in 2012-13, inspection, and scrutiny of 0.94 % cases was done. However, in the year 2018-19, this figure came down to 0.26%. It means that the inspection scrutiny of the case has reduced by almost four times. This also proves how far-reaching the change is. In the last 6 years, India has seen a new model/ideal of governance developing in tax law and its administration”.

- “With the help of faceless assessment, the taxpayer is assured of fair, courteous, and rational behavior. It means the income tax department now has to take care of the taxpayer’s dignity, delicately, and sensitively. Now you have to trust the taxpayer; the department cannot doubt any person randomly without any basis. Taxpayer’s charter is a big step in the country’s development taxation journey”.

- “Presently, the tax department of the city we live in buttons up and handle everything related. From now, this will end after this launch. With the help of computerization and technology, the matters of scrutiny will be assigned to IT department officials – randomly and indiscriminately. Now, the “Algorithms” will decide who will handle the case (Automated). Apart from issues related to Taxation, appeals will also be faceless under the Taxpayer’s Charter”.

- “Our tax system should be painless, seamless, as well as faceless. Seamless means that the tax law and its administration should solve the problem as a replacement for confusing taxpayers”.

- “It is worth mentioning that the taxes have reduced in the country along with the complexities of techniques and processes. Yes, Tax is now zero on the income of up to 5 lakh rupees. The tax rates have also been reduced in other remaining slabs as well. We are one of the lowest Tax consuming over Countries in the world in terms of Corporate Tax Collection.”

- “We believe that Compliance is difficult where there is complexity. If the law is clear, then taxpayers will be happy, as well as the country itself. This work was in the line of the process some time ago. Similarly, as GST has come in place of lots of taxes”.

- “There was a time when we used to discuss about reforms and its administrations. Decisions were taken in under pressure or desperation, and they were known to be reforms. Every law, rule, and policy is taken out of the power centric method and is being turned into ‘Public Friendly and’ ‘People-Centric’. This is the benefit of the new governance ideal of modern India”.

- “For us, reform means it is policy-based, not just a piece of the meal. Holistic reform develops and turns the basis of another reform, making way for the new reforms. And we cannot take a break after one reform; this is a constant process”.

- “Structural and Fundamental Reforms were required in India’s tax system because our system was created in the period of oppression and slavery. Later independence, a lot of variations were made here and there, but the large system’s character continued to be the same”.

- “Earlier, our focus area has been securing the unsecured, banking the unbanked, funding the unfunded. Today, we are stepping quite head, and we are launching “Honouring the Honest” “Now, the situation is becoming in the country to emphasis the work keeping supreme duty supreme. The question is, how is the change coming from? Does it just come with stringent rules? Does it come just from punishment or fines? I don’t believe”

- “My dear friends, the on-going structural reform has touched new heights today. Transparent Taxation – “Honoring the Honest” will have faceless appeal, faceless assessments, and taxpayer charter. The faceless appeal will come into force from 25th September 2020, while faceless assessment and taxpayer charter will come into effect from today itself”

Conclusion

We understand that the CBDT has carried out several major tax reforms indirect taxes in the latest contemporary years. Last year the “Corporate Tax rates” got reduced from 30 percent to 22 percent, and for new “manufacturing units”, the rates were reduced to 15 percent. Moreover, the “Dividend Distribution Tax” was also eliminated.

We strongly believe that the new reform will install a sense of fearlessness among the “honest taxpayers” who play a significant role in national economic development. It strengthens our resolve of maximum governance as well as the minimum government. The emphasis is on creating every rule-law, policy public-friendly, and people-centric. It has also focused on a straightforward interpretation of direct tax laws and increasing transparency in overall communication. CorpBiz shall be happy to assist you in any support you need for your complete compliance works and assure fruitful results respecting the growth of Transparent Taxation.

Read our article:Submitting of Audit Report with Income Tax Return is not Compulsory – ITAT