It can be shocking to receive an Income Tax Notice from the Income Tax Department even after filing of Income Tax Return before the due date. An encounter with the Income Tax Department is usually filled with stress. You can be confused regarding why you got the notice and how to respond to it. But receiving Income Tax Notice may not always bring bad news. Sometimes it can surprise you with the news of extra cash being refunded to you. However, when you receive an Income Tax Notice, you need to act on it.

What is Income Tax Notice?

After the taxpayer files their Income Tax Return, it is processed by the Income Tax Department. If any mistake or discrepancy or error is noticed in the Income Tax Return filed, then the same is intimated to the assessee or taxpayer. The Central Board of Direct Taxes or CBDT introduced a new scheme known as Centralized Communication Scheme (CCS). According to this scheme, all communications will take place in electronic mode. The various Income Notice issued by the Income Tax Department is mentioned in the article.

Why is Income Tax Notice Issued?

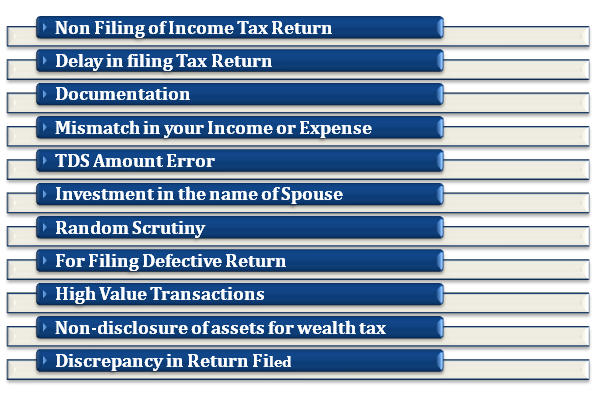

File your Income Tax Return in an appropriate manner to avoid any Notice of defective Return. Tax notices can be received for many reasons.

Some of the common reasons for issuance of Income Tax Notice are mentioned below:

Read our article:How to rectify ITR Filing online?

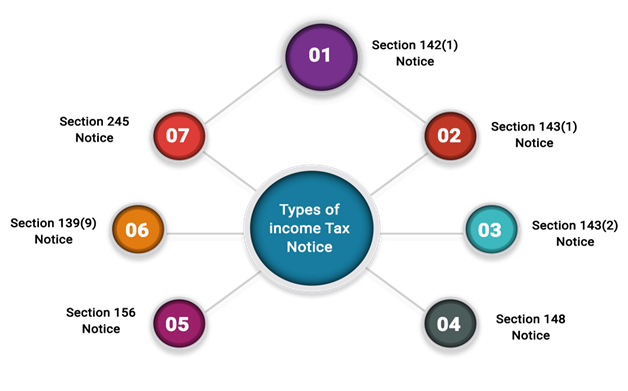

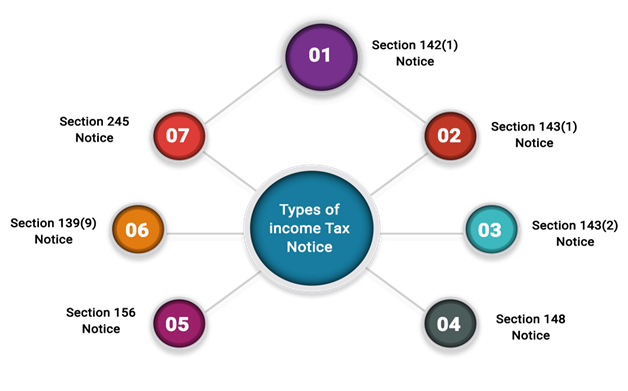

Types of Income Tax Notice

The Income Tax Department issues Income Tax Notice for various purposes mentioned under the Income Tax Act, 1961[1]. These are explained in detail :

Notice under Section 142(1)

A notice under Section 142(1) is issued under the following two circumstances:

- If after the filing Income Tax Returns the assessing officer requires additional information and documents; Or

- In case of non-filing of return, the assessing officer may intimate the taxpayer to file it.

- For example, the statement of assets and liabilities of the taxpayer on a particular date.

Notice under Section 143(1)

It is also known as Letter of Intimation. The Income Tax Department provides 30 days to file the dues indicated in the notice. The Income Tax Department can issue notices to the taxpayer under Section 143(1) in the circumstances listed below:

- Any arithmetical error in the return filed like excessive or less amount paid.

- An incorrect claim is apparent from the information filled.

- Any extra income not included in the return filed.

- Rejection of any loss or expenditure claimed incorrectly.

- The time limit set to intimate the assessee is one year from the end of the financial year in which the return is made.

- As per the notice, the tax due should be paid within 30 days.

Notice under Section 143(2)

Notice under Section 143(2) is considered as scrutiny notice. The notice under this section is sent after the notice under Section 142(1). Whether the return is accepted or not by the assessing officer is specified by this notice. Via this notice, the assessing officer intends to be assured of the following points:

- Understated income

- Claimed excessive loss

- Not paid less tax.

Notice under Section 148

This notice is termed as Income Escaping Assessment. The reason for issuing notice under this section is mentioned below:

- When an assessing officer after assessment feels that the income is not disclosed properly.

- Before making any such assessment or reassessment, the assessing officer must serve a notice to the assessee asking him/her to furnish his return of income.

Notice under section 156

Notice under Section 156 is said to be Notice of Demand. The assessing officer shall serve notice of demand in the following consequence:

- In the case where any tax, interest, penalty, fine or any other sum is payable by the assessee.

- The tax demanded is payable within 30 days of the service of notice. It can be reduced with prior approval of JCIT.

Notice under Section 139(9)

It is also known as Defective Return Notice. The Income Tax officer issues this notice in case of the income tax return filed is defective. For example, if the Income Tax Return is filed before the self-assessment tax.

Notice under Section 245

This notice is sent to a set of refunds against tax remaining payable. Income Tax Notice prescribed in Section 245 is more of intimation letter and less of demand notice. Communication is made regarding the adjustment of Income-tax refund against Income tax refund through this notice. Penalty for non-compliance of Income Tax Notice

| S.No | Types of Notice | Penalty |

| 1. | Notice under Section 142(1) |

|

| 2. | Notice under Section 143(2) |

|

| 3. | Notice under Section 156 |

|

How to check the status of Income Tax Notice Issued?

Here is the stepwise method to check whether the Income Tax Notice is issued:

| S. No | Steps |

| 1. | Login or Signup on the portal. |

| 2. | Go to “My Account” from the top of the menu and select ‘View e-Filed Returns or forms from the drop-down options. |

| 3. | Click on “Acc. No” for the concerned assessment year. |

| 4. | If there are any of the following messages, the return is subject to correction.

|

Documents required to reply an Income Tax Notice

The documents required vary with the types of Income Tax Notice. However, the basic documents that are needed to reply an Income Tax Notice are;

- Copy of Income Tax Notice

- Source of proof of income such as Form-16, Salary Receipts, etc.,

- TDS Certificates

- If applicable, the investment proofs.

- Any other document demanded by the assessing officer.

Avail Income Tax Notice Assistance Service in Corpbiz!

It is better to take assistance for replying to Income Tax Notice. Therefore, once you have uploaded the Income Tax notice copy, our Tax Experts comprising of well qualified CAs will review the same and provide you with the best solution available. Based on this, our professionals will ask you to provide the necessary documents.

Conclusion

Income Tax Department issues Income Tax Notices in case of non-compliance with the income tax law. The reason can be anything from error in filing original return, none or short payment of tax, non-filing of tax or late filing, among others. It is not possible to follow up with all the requisite procedures in today’s busy life. So contact Corpbiz for further assistance. We will allocate you a dedicated tax expert who shall help you sail through the process.

Read our article:An overview on Tax Residency Certificate & Double Taxation Avoidance Agreement: How To Get It?