We all are aware that Section 12AA of the Act proposes methods of granting registration of charitable trust or institution. It aligns for the purpose of availing exemption by its income under section 11 of the Act, substantial to conditions contained under ‘sections 11, 12, 12AA and 13’. By the same, section 12AA also delivers all the manners of Cancellation of trust registration. This blog will provide you with updates on the Cancellation of registration of trust based on recent amendments, case laws, and circulars.

What are the Amended Powers of Commissioner to cancel your Trust Registration?

Commissioner may cancel the Trust registration when:-

- the activities of the exempt entity satisfies the Principal Commissioner or the Commissioner; are not genuine or are not being carried out following its objects; and

- the Principal Commissioner or the Commissioner notices that the trust is supporting the activities of the exempt entity in a manner that part of its income would terminate to be exempt.

To ensure the institutional genuineness, there are few proposed amended sections 12AA of the Income-tax Act. The proposals are as follows:-

- During the phase of granting registration to a trust, the Principal Commissioner or the Commissioner shall satisfy himself about the compliance of the trust. It shall be corresponding to all the requirements of any other law. That law should be the material fact to achieve its objects.

- During the time of granting registration under section 12A, it should get noticed whether the trust or institution has dishonoured requirements of any other law or not. It may be towards achieving its objectives, and the order, direction, or decree or by whatever name called.

- The Powers have been given to Commissioner of Income Tax with effect from 31st August 2020 to cancel trust registration, if the activities are not on agreement with the objects of the said trust.

- Point to be noted that as per section 115TD of the Act, such trust or institution shall be obliged to pay tax on the cumulative fair market value of the total assets/property of the trust as on 31st August, 2020.

- With this, a trust or institution will necessarily need to apply for re-registration at least six months before the expiration of the period of registration until five years.

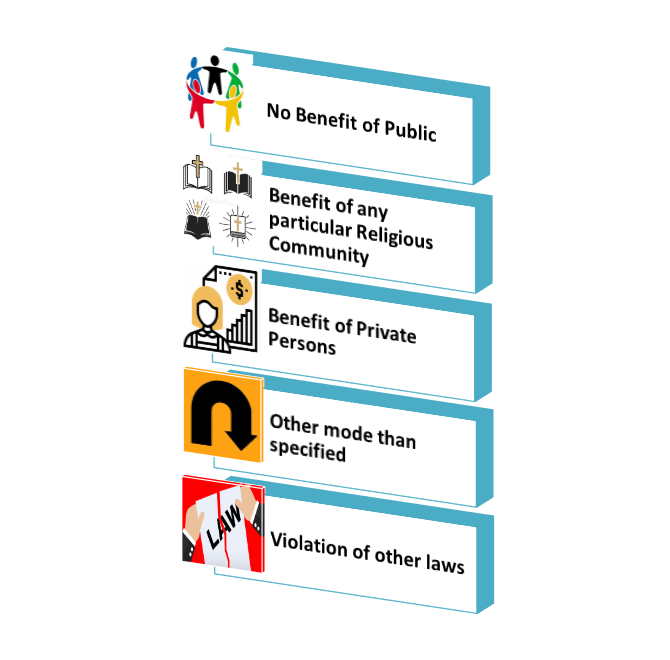

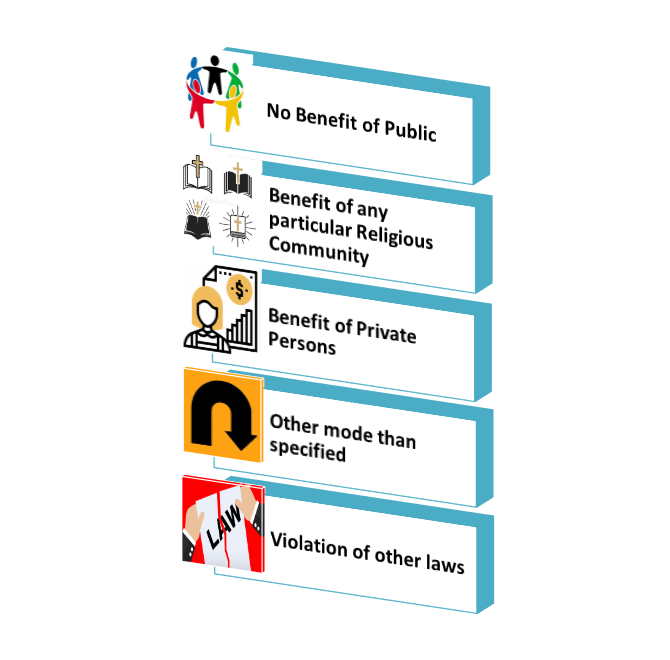

Grounds for Cancellation of Exemption Certificates are:

- Under the Sec 13(1)(a), if the income not gets applied for the benefit of public

- Under the Sec. 13(1)(b), if income used for the benefit of any particular religious community or caste

- Under the Sec. 13(1)(c), if income gets applied for the benefit of persons specified in Sec 13(3)

- Under the Sec 11(5), if the funds used in modes other than those specified

- If any violation of other laws

Grounds for Cancellation of Registration violation of other laws

- During the initiation of the registration

- Any time in between after registration if such violation is distinguished

- Any violation of the statutes is absolute or conquered its irrevocability

- Reasonable chance of being heard gets provided on conditions

What do you mean by the Cancellation of Trust Registration justified under section 12AA with retrospective effect?

Retrospective Effect means Looking backward. This word gets frequently applied to those acts of the legislature, which are made to function on contract or misconduct. These mainly occur before the passage of the acts, and they are therefore called retrospective laws. Let’s understand the Cancellation of Trust registration justified under section 12AA with retrospective effect with the help of a case law.

Case law: – Prathyusha Educational Trust v. Asstt CIT-27 May, 2019

Overview of the Case

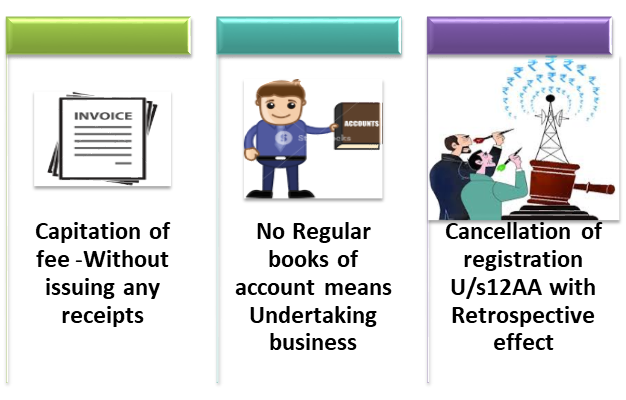

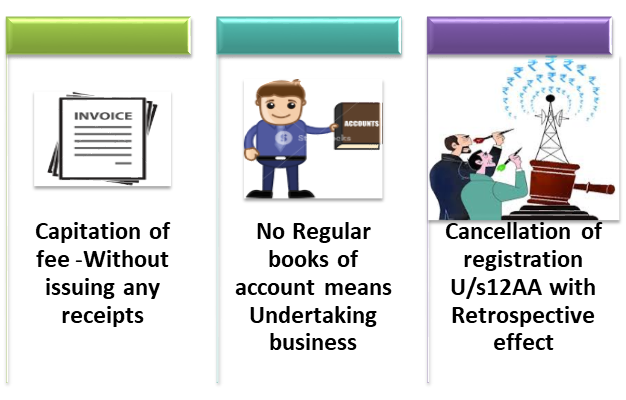

- The Cancellation of registration under section 12AA was justified as the Receipt of capitation fee by the educational institution was not recorded by the assessee in regular books of account.

- It was in total violation of section 13(1) (c) because it was found that the educational trust has collected a massive amount from students (in cash) without issuing any receipts.

- Subsequently, assessee was obliged to prove its exemption claim, but assessee had not placed any substantial viz. certified copies of concurrent audited or un-audited income and expenses statement.

- As a result of this, the assessee challenged this on the ground that revenue had not recognized the amount received from the student was ‘capitation fee.’ The registration under section 12AA could not be withdrawn retrospectively. For that reason, CIT has cancelled registration granted to assessee under section 12AA from assessment year straight on from 2010-12.

Decree of the case

- According to the tribunal, the assessee failed to show that the questioned amount collected by the assessee were not ‘capitation fee but a ‘regular fee’. CIT had no alternative available to interpret seized documents as the record of capitation fee.

- The cash collections by the assessee being kept outside regular books of account supported the view that assessee was undertaking business of running an Educational Institution for the determination of profit maximization.

- Undoubtedly, registration had canceled on the explanation of examination by conveying all the evidence in the form of incriminating documents. As a result, Cancellation of registration under section 12AA and the retrospective effect from assessment year 2010-11 onwards were reasonable.

- Related Jurisdictional are as follows:-

- Industrial Infrastructure Development Corporation (M.P Gwalior) Ltd. v. CIT, (para 27 2018)

- CBDT Circular No. 1/2011 dt. 6-4-2011- (Para 7.4) comprehending explanatory notes to the provisions of Finance Act, 2010,

- Oxford Academy for Career Development v. CCIT, 315 ITR 382 (2009)

- Mumbai Cricket Association v. DIT (2012) – the registration cannot be canceled beyond 1st October, 2010, on which the provision became valid).

- PCIT v. JIS Foundation, (2018) (para 9 Cal)

Read our article:Trustee Salary & Taxability: Guide on Reasonable Compensation

What are the pronouncements made by CBDT, Tribunals, Supreme Court, and Amendments Regarding Cancellation of Registration U/s I2AA (12AB)?

Central Board of Direct Taxes No. 21/2016 dated 27.05.2016:-Circular Regarding Cancellation of Trust Registration U/s I2AA of The Income-tax Act, 1961 Of Charitable Trusts.

- It has been clarified that it shall not be obligatory to cancel the Registration, which is already granted under section 11 to charitable institution just on mere grounds. It may conclude the ground of cut-off stated in the proviso section to section 2(15) of the Act, surpassing the income in a particular year without any change in the institution’s activities.

- Even if such happens, the tax exemption would be rejected by the institution in that year. In this picture, the cancellation of registration would not be mandatory, except such cancellation becomes essential on the ground(s) agreed under the Act.

- The CBDT has also advised that the process for cancellation of Trust Registration is to be introduced strictly following section 12 (3) and 12AA (4) after carefully inspecting the applicability of these provisions.

Case law: – M/s Ananda Social and Educational Trust vs. CIT (Supreme Court) Feb, 2020 (S. 12AA)

- It says that Registration can be applied for by a newly registered trust. There is no stipulation that the Trust should have undertaken any activities before making the application for Registration.

- Following the law, the term ‘activities’ in the U/s. 12AA includes ‘proposed activities’ too. CIT must consider only whether the objects of the Trust are genuine nature or not, and activities of Trust are in line with the objectives of the Trust. On the other hand, he cannot refuse Registration on the ground that no commencement of activities of Trust.

Case law: – ShriDharSabhaVaishno Devi vs. CIT (E) (ITAT Amritsar) (Third Member) Jan, 2020 (S. 11/ 12AA)

- The essential requirement for granting Registration is that the objects of the society must be charitable, and actions are purely genuine.

- Moreover, it has shown that trust may be of a public charitable nature even if the trust property controller is not vested in the hands of the public but retained by the settlers.

- The Registration under section 12A cannot be cancelled on the ground that the Trust Deed does not cover the “dissolution clause.” It is entirely irrelevant & outside the scope of question contemplated u/s 12A of Income Tax Act.

- As a result of this, the Registration cannot be cancelled for non-furnishing of registration details with the Registrar. Registration with the Registrar of Societies is not aprecondition for granting Registration u/s 12A.

Case Law:-DIT (E) vs. Gujarat Cricket Association (Gujarat High Court) Sep 2019 (S. 2(15)/11)

- According to the case, carrying on charitable activities, which results in a surplus, does not mean that assessee subsists for profit. “Profit” means that owners have the power to withdraw the surplus for any purpose comprising personal purpose.

- Nevertheless, if the surplus is tilled back into similar charitable activities, the assessee cannot supposed to be carrying out commercial activities like trade, commerce, or business. Therefore, the assessee has dealings with, & share of profits from BCCI does not distress its charitable status

Case Law: – CIT vs. ShreedharSewa Trust (Allahabad High Court) Sep 2017 (S. 12AA)

- The case says that at the time of registration of a charitable institution u/s 12AA, the CIT is not obligatory to look into the activities if such activities are in the process of its initiation or not.

- The Registration cannot be canceled on the ground that the Trust has not started the charitable or religious Activity yet. This stage will mainly be focussed on the genuineness of the objects only, unless the activities have commenced.

Case Law: – CIT vs. Society for the Promotion of Education, Adventure Sport & Conservation of Environment- 2016

- TheSupreme Court held that every single order granting or cancelling Registration should be accepted before the expiry of ‘six months’ from the end of the month in which the request was acknowledged.

Case Law: DIT (Exemptions) vs. Khar Gymkhana (Bombay High Court) June 2016 [S. 2(15)/12AA (3)]

- The Income Tax Department has no jurisdiction to cancel the registration of a charitable institution if it practices commercial activities, which violate the amended definition of “charitable purpose” in under section 2(15).

- The Registration can be cancelled when if the activities of the Trust are not genuine and not being carried complying with its objects.

Case Law: – ITO vs. Bhansali Trust (ITAT Mumbai) August 2015 (S. 11/ 12AA)

- This case says that mere non-intimation of amendments to trust deed cannot, by that very fact, result in cancellation of Registration if there is no change in manner and intention/nature of objects.

Case Law: – Kapurthala Improvement Trust vs. CIT (ITAT Amritsar) June 2015 [S. 11/ 12AA (3)]

- The particular provision under section 2(15) has no bearing on the grant of cancellation of Registration. This section’s applicability has to be evaluated every year, affecting the exemption grant under section 11.

Case Law: Kul Foundation vs. CIT (ITAT Pune) June 2015 [S. 12AA/80G (5)]

- During the grant of registration or renewal, CIT can only look at the nature of activities and is not apprehensive with a potential violation of under section 11(5) or 13. Therefore, the Registration cannot be cancelled concerning the commencement or non-commencement of such Activity.

Case Law: Jaipur Development Authority vs. CIT (ITAT Jaipur) Sep 2014

- This case says that the fact of mere surplus cannot cancel the charitable status. Ordinary levy of fees is not reflective of a business aptitude or indicative of profit concerned with intent.

Case Law: Nandi Infrastructure Corr. Ent. Ltd. v. Election Commission of India, (2010) 12 SCC 334

- This case suggests if no application released before the due date from the end of the applicant, then the Registration is considered to be cancelled. It specifies the term ‘Cancel,‘ which means ‘surrender, abandon, make void, destroy efficiency, to convey nothingness.’

Case Law:

- Medical Land v. CIT, (2014) 363 ITR 81 (Ker)]

- GovindImpex (P.) Ltd. v. Appropriate Authority, (2011),

- Dilip S. Dahanukar v. Kotak Mahindra Co. Ltd., (2007) 6 SCC 528

- The cases mentioned above speaks about the mandate of Cancellation results in tax under section 115TD (penal provision). It says that Section 115TD should be construed strictly in support of the Trust and against the Tax Department.

What are some Quick Advices to be considered in precaution against the Cancelation of Trust Registration?

For all intents and purposes, it is advisable to pass resolutions during the Board meeting of the trustees. It should connect all the following aspects and attribute such as Form No. 10A during application.

- The investment of surplus funds of Trust should be attributed only in manners and securities permitted by the Income-tax Act, 1961[1].

- If the instrument of the trust deed is silent upon the event of dissolution, in those cases, the funds of the Trust will be contributed or donated to some other trust with similar objectives.

- In cases of modifications or alterations to the trust deed, it must be communicated to the Commissioner straightaway. Nonetheless, most of the Commissioners insist that a resolution of the Board of trustees founded in Form No. 10A should be passed in this similar regard. On the other hand, some Commissioners hold that the Trust’s resolution should be to the effect that any modification to the trust deed will not be taken without any prior written consent of the Commissioner.

- It should be noted that Form No. 10A must be filed in duplicate. It should be along with a certified copy of the trust deed, and a copy may be filed adjacent to the resolution copies in the Commissioner’s office. Add all the documents along with a cover letter that lists out the attachments.

- In cases where the two copies of the letter are taken, the person in receipt of the clerk in the office will ‘sign,’ ‘affix date,’ and ‘seal’ in one copy of the letter given. Kindly keep this letter as proof of having applied for registration of your Trust.

Conclusion

The Trust and other charitable institutions are occupying a dynamic role in the social order right now in the corona outbreak. It is essential to allow them to remain socially involved in the dreadful causes rather than engaging in all sorts of formalities. Therefore, Central Board of Direct Taxes has stretched out the operation of the procedure for ‘approval/ registration or cancellation’ of individual entities’ u/s 10(23C), 12AA, 35 & 80G’ of the Income Tax Act, 1961 to ‘October 1, 2020′.

Our Corpbiz team will be at your disposal if you need expert advice on any aspect of cancellation of Trust Registration. We will help you to ensure complete full Compliances as per your desired activities, ensuring the successful and well-timed completion of your work.

Read our article:New Registration Procedure under 12A (1) a/aa/ab: Trust 2020