Substantial consciousness about meditation and yoga has been expanded and gained a remarkable momentum in the past few years. It reflects in people suffering from varied diseases of body and mind as a result of various day-to-day anxieties. It gets more effective because of demonstrations of yoga and meditation exercises in numerous programs telecast through television focal points and channels. The question that got examined in this context is whether charitable institutions involved in such teachings and making these widespread would be entitled to tax benefits delivered to charitable Trust/bodies under the Income Tax Act of 1961.

What is the meaning of ‘charitable’ defined by Courts?

At the very outset, there cannot be an open and shut description of the term ‘charitable purpose.’ In seeking specific guidance in this regard, it can be derived from court decisions.

Few are as follows:-

- Case No. 1 – In the case of ‘Umar Baksh v CIT, AIR 1931 Lah 578 (SB)’, it was observed that for interpreting the words’ charitable purpose,’ it is essential to investigate the meaning of these words in the particular structure of jurisprudence that may be followed by the assessee. In the context of Hindu Law, ‘charity,’ it is a part of the content of the word ‘dharma.’ Therefore if the term used in the context of gifts of belongings, it means acts of devotion and kindness. It is considerably broader than what is understood by the use of the mere word ‘charity.’

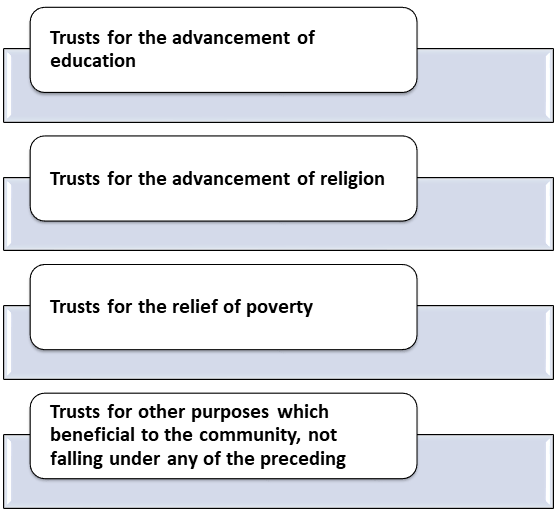

- Case No. 2 – In the case ‘The Commissioners for Special Purposes of Income Tax vs. Pemsel (1891) AC 531′, ‘charity’ in its broadest senses symbolized all good affection and regarded men ought to bear for each other. It has additionally held that “Charity in its legal mind includes four primary divisions: which are-

What is the meaning of ‘charitable’ under the Income Tax Act?

The Income Tax Act defines charitable purpose in a wide-ranging manner under clause (15) of section 2, saying that ‘charitable purpose’ comprises a) relief to the poor, b) education, medical relief, and c) the advancement of any other purpose in terms of General Public Utility.

Do the Yoga Teachings qualify to be an object under General Public Utility?

- Yes. In the view of Court decisions, it shows that the object of providing people an structure of ‘educated public’ opinion like a newspaper has been held to be covered by the expression ‘object of general public utility‘ in the classic case of ‘Re. Trustees of Tribune (1939) 7 ITR 415 (PC’).

- Moreover, under the case-“CIT v Octacamand Gymkhana Club (1977) 110 ITR 392 (Mad)” the object of inspiring and managing games and sports has been held to be sheltered by this phrase as its operation leads to the physical wellbeing, which is equivalent of a healthy society. What has stated about games and sports that must equally apply to meditation and yoga teachings?

What are the Jurisprudential views on meditation and yoga teachings?

- About this issue, it got under consideration, which has been decided by the Bombay High Court in the case of ‘CIT v Rajneesh Foundation (2006) 280 ITR 553 (Bom)’.

- It has assumed that in India, yoga has been an essential source for the physical, mental, and spiritual comfort of human beings. Understanding this has to be taken, that meditation and yoga are getting more and more popular among Conscious Indians for their physical, mental, and spiritual fitness. Even, it is not only in India, meditation and yoga teachings are being accepted in western countries also regarding the same.

- As soon as a large number of people feel that yoga teaching is an excellent source for physical, mental, and spiritual comfort, it got held to be an activity for the expansion of general public utility.

- Therefore, the High Court concluded that meditation and even preaching and propagation of the values is an activity for the general public utility even when money gets collected by way of fee and charges.

Does an Individual Person can get benefits under exemption from income tax liability in respect of carrying yoga undertakings?

- Yoga teachings and undertaking have indeed brought under the description of “charitable purposes” under Trust. It should, however, keep in mind that it does not get exempted from an ‘Individual – Person’ from paying income tax liability in respect of carrying yoga teachings and undertakings such as i.e., yoga instructions, etc.

- Following the existing provisions to take advantage of the said amendment “yoga,” it must be the activity of an institution such as trust, society, or section 8 companies. That institution must apply and get registration under section 11 of the Income-tax Act of 1961.

In what circumstances, the object of General Public Utility shall not be a part of a charitable purpose?

- That advancement of any other object of ‘general public utility’ shall not be a ‘charitable purpose’, if it includes the carrying on of any goings-on activities in the natural surroundings of trade, commerce or business. It should not work for a profit or fee or any other deliberation, irrespective of the manner of use or application, or retention, of the income derived from such Trust activity.

- Nevertheless, this restriction shall not apply if the aggregate value of the income receipts from the activities mentioned above is twenty-five lakh rupees or less in the preceding year.

- The Trust, as part of honest and charitable activities, take on activities like publishing books or holding platform events on yoga or other programs as part of actual carrying out of the objects as per first and second proviso to under section 2(15).

What do you mean by Carrying of activities like trade, commerce, or business against Charitable Purposes?

It has projected to amend the description of ‘charitable purpose’ to provide that the expansion of any other object of general public utility, which shall not be a charitable purpose of the Trust. It will adversely affected if it involves the carrying on of any activity like trade, commerce or business, or any exercise of interpreting any service concerning any trade, commerce or business, for-profit or fee or any other consideration, except when:-

What does Tribunals put up with – ‘Yoga gives Medical Relief and also Impart Education as per definition of charitable purpose’?

- The Applicable Question, which got raised by the Tribunals that, whether propagation of yoga by the assessee qualifies as a Medical Relief or imparting of education or not or does it fall in the residuary grouping of “advancement of any other object of trust for general public utility.”

- Explaining with the help of a case law, ‘Patanjali Yogpeeth’ was a public charitable trust duly registered under section 12A of the Income-tax Act, 1961. Moreover, it was also duly permitted under section 80G (5) (VI) of the concerned Act. The pre-dominant objects of the Trust were- a) Giving medical relief through yoga; b) Imparting education in the ground of yoga; c) &offering relief to the poor. For the applicable valuation year, the Assessing Officer framed the assessment u/s 143(3) of the concerned Act and denied exemption under section 11/12 of the same Act.

- However, the contentions of the revenue were multi-folded. The Tribunal held that insertion of “Yoga” in the definition of “charitable purpose” under section 2(15) of the Act via Finance Act, 2015, with effect from 1.04.2016. It had eradicated all the doubts that transmission of yoga itself is a ‘charitable purpose’ to make the assessee qualified for demanding exemption under sections 11/12 of the Income Tax Act.

- Moreover, the Tribunal placing dependence on the judgment brought in the case of ‘DivyaYogMandir Trust’ too. It held that the circulation of yoga as a pre-dominant objective in the case of present assessee very much falls within the connotation of “charitable purpose” provided under section 2(15) of the concerned Act as it is likewise “imparting of education.”

What are the Basic Procedural Documents Required to create a Charitable Trust for Yoga Teachings?

Kindly Refer to the other blogs to get the proper idea of the procedural aspect of Trust Creation, and click on this link[1] to get Annexures as per your requirement: Documents required are-

- Submit the Document concerning the Legacy of Yoga tradition as per the Annexure to be marked as A.1, A.2, etc.

- Submit Registration Certificate as per the Annexure to be marked as B.1, B.2, etc.

- Submit Documentary proof of year of establishment of the institution as per the Annexure to mark as C.1, C.2, etc.

- Submit Memorandum of Association/constitution as per the Annexure to be marked as D.1, D.2, etc.

- Submit Policy documents specifying aim, objectives, vision & mission, a logo, an organogram, etc. Other policy-related materials as per the Annexure to marked as E.1, E.2, etc.

- Submit Organisation documents defining organizational structure, duties, responsibilities, and authorities of the management, personnel, and committees as per the Annexure to mark as F.1, F.2, etc.

- Submit Details of the 1st Yoga course conducted by the Institutions as per the Annexure to mark as G.1, G.2, etc.

- Submit Document of ownership of the land/ lease deed/ rent agreement as per the Annexure to mark as H.1, H.2, etc.

- Submit Campus plan/Building layout as per the Annexure to marked as I.1, I.2, etc

- Submit Photographs of rooms, canteen facility, conference room, and other infrastructure facilities as per the Annexure to mark as J.1, J.2, etc.

- Submit Documentary evidence of staff hired with their details like qualification, experience, and role as per the Annexure to mark as K.1, K.2, etc.

- Submit Details of the teaching staff as per the Annexure to mark as L.1, L.2…)

- Submit Details of non-teaching staff as per the Annexure to be marked as M.1, M.2, etc.

- Submit Details of courses offered (Brochure, work plan, time table, and other details) as per the Annexure to mark as N.1, N.2, etc.

- Submit Details of management / administrative staff (Annexure to mark as O.1, O.2…)

- Submit Details of feedback receiving process as per the Annexure to be marked as P.1, P.2, etc.

- Submit Details of Compliant handling mechanism as per the Annexure to be marked as Q.1, Q.2, etc.

- Submit Policy documents regarding conducting assessment, evaluation, and declaration of results as per the Annexure to be marked as R.1, R.2, etc.

- Submit Policy documents regarding retention and accounting of students’ records as per the Annexure to be marked as S.1, S.2, etc.

- Submit Application Fee as per the Annexure to be marked as T.1, T.2, etc.

- Submit Annual report including an audit report for the last three years as per the Annexure to be marked as U.1, U.2, etc.

- Submit any other document as per the Annexure to be marked as V.1, V.2, etc.

Read our article:What are Public and Private Temples under the Indian Trusts Act, 1882? Get All the Updates you need to know!

What are the Tax Incentives for Yoga, referred to in the Budget 2020 all about?

- Precautionary health and wellness is the need of the hour for the whole world. In the last five years, the government has shown a keen interest in the restoration of yoga. As per current 2020 statistics, India anticipated to be one of the newest and youngest major financial prudence in the world.

- According to the data given by the World Economic Forum, it shows that over 77% of Indians will be below the age of 45 by the next decade. Appreciations to increased awareness over the past decade, there has been a slow but sure shift in this inclination, as health& wellness are becoming progressively main-stream these days.

- Prime Minister Narendra Modi has individually taken a lot of interest in placing yoga as a world-wide exercise that can help people stay apt, look good, and be in good physical shape. Through these challenges, numerous new initiatives have been presented by the government to help& inspire this general practice.

- Yoga has been too prepared as a compulsory topic that is being trained and taught to help young India stay proper and healthy.

- Ever since 2015, Yoga classes, Yoga teachers, and training institutes successively running as charitable trusts have been released and exempted from paying goods and service tax (GST). It is applicable even is the gross revenue exceeds the threshold perimeter of Rs 10 lakh.

- In the year of 2018, the government tossed the “Hum Fit Toh India Fit” campaign, cheering people to take up yoga and other forms of fitness actions to stay in good physical shape.

- According to under section 80D of the Income Tax Act of 1961, taxpayers get the right to claim tax deductions on health check-ups and health premiums. However, preventive wellness still positioned under a very high tax bracket.

- In the meanwhile of Union Budget for 2020, it is hopeful that it may go beyond providing tax deductions to those getting back to good health after falling sick, and also supports. It must also incentivize those who take care of their aptness and fitness.

- Moreover, the Budget 2020 could include exemption on availing of fitness services such as affiliations to gyms, fitness studios, commercially-run Yoga points, institutions etc.

Conclusion

Campaigning of meditation and yoga teaching activities are for the public good and thus improves the object of General public utility. Consequently, the trusts supporting these purposes can claim an income tax exemption under section 11 of the Income Tax Act, 1961. Moreover, the services and fee or consideration charged provided by an entity registered under Section 12A of the Income Tax Act, 1961[2] by way of improvement of yoga educations gets exempted.

However, if these charitable trusts merely or primarily provide housing or serve food and drinks against reflection in any form, including donation, then such activities will be taxable. In the same way, events such as holding of fitness camps or courses such as those in aerobics, dance, music composition, etc. will be taxable under the same”. Together with this, we at CorpBiz have skilled professionals to help you with the process of registering yoga teaching institutions, ensuring the successful and timely accomplishment of your work.

Read our article:Know all the Restrictions on the Charitable Trust